Trump's Billionaire Buddies: How Tariffs Impacted Their Fortunes

Table of Contents

The Steel and Aluminum Tariffs: A Mixed Bag for Billionaire Businesses

The 2018 tariffs on imported steel and aluminum, ostensibly aimed at protecting American industries, had a mixed impact on billionaires with investments in these sectors. While some saw their fortunes rise due to increased domestic demand and higher prices, others suffered due to increased input costs or retaliatory tariffs from other countries.

Winners: Boosted by Domestic Demand

Several billionaires with holdings in the US steel and aluminum industries benefited from the tariffs. Increased domestic demand, driven by the tariff barriers on foreign competitors, led to higher prices and increased profitability.

- Example 1: [Insert name of billionaire and company, e.g., Billionaire X, CEO of SteelCo, saw a 15% increase in company profits in the year following the tariff implementation, according to their Q4 2018 financial report.] This increase directly contributed to an estimated [quantify increase in net worth, e.g., $500 million] rise in their net worth.

- Example 2: [Insert name of billionaire and company, e.g., Billionaire Y's investment in AluminumCorp saw a similar surge, with stock prices rising by 20% in the same period.] This was largely attributed to reduced competition from cheaper imported aluminum.

- Data Source: [Cite financial reports, news articles, or other reliable sources to support your claims.]

Losers: Facing Increased Costs and Retaliation

However, not all billionaires in related industries experienced a surge in wealth. Many faced increased input costs due to higher domestic steel and aluminum prices, impacting their overall profitability. Furthermore, retaliatory tariffs imposed by other countries on US goods negatively impacted businesses reliant on exports.

- Example 1: [Insert name of billionaire and company, e.g., Billionaire Z, owner of ManufacturingGiant, reported a 10% decrease in profits due to higher production costs.] Their reliance on steel imports for their manufacturing process made them particularly vulnerable.

- Example 2: [Insert name of billionaire and company, e.g., Billionaire A, whose company exports heavily to China, experienced significant losses due to Chinese retaliatory tariffs on US goods.] This severely impacted their export revenue and overall profitability.

- Data Source: [Cite financial reports, news articles, or other reliable sources to support your claims.]

The Impact of Tariffs on the Retail Sector and Billionaire Retailers

The tariffs on imported goods also significantly impacted the retail sector and the fortunes of billionaire retailers. The effects were multifaceted, ranging from supply chain disruptions to price increases and decreased consumer spending.

Supply Chain Disruptions

Tariffs led to increased costs and supply chain bottlenecks for many retail giants. The increased cost of imported goods impacted inventory levels, leading to potential stock shortages and lost sales.

- Example 1: [Insert name of billionaire and company, e.g., Billionaire B, owner of RetailMegaCorp, experienced delays in receiving shipments of certain goods due to increased customs checks and port congestion.] This disrupted their supply chain and led to temporary stock shortages.

- Example 2: [Insert name of billionaire and company, e.g., Billionaire C's company faced increased shipping costs and longer lead times for certain products.]

- Data Source: [Cite financial reports, news articles, or other reliable sources to support your claims. Analyze changes in stock prices and profitability.]

Price Increases and Consumer Impact

The increased costs associated with tariffs were often passed on to consumers in the form of higher prices. This decrease in affordability impacted consumer spending and, consequently, the profitability of many retail businesses.

- Example 1: [Insert examples of specific products impacted and their price increases, e.g., The price of imported clothing increased by an average of 10%, impacting sales for many clothing retailers.]

- Example 2: [Provide further examples and data, e.g., The increased cost of imported furniture led to a decline in consumer spending on this product category.]

- Data Source: [Use statistical data on consumer spending and retail sales from reputable sources to support your claims.]

The Agricultural Sector and Billionaire Agribusiness Owners

The agricultural sector was significantly impacted by Trump's tariffs, particularly due to retaliatory tariffs imposed by other countries on US agricultural exports. This had a direct effect on the fortunes of billionaires with substantial agricultural holdings or investments.

Trade Wars and Farm Losses

Retaliatory tariffs, particularly from China, significantly damaged the US agricultural export market, leading to substantial losses for many farmers and agribusinesses.

- Example 1: [Insert examples of specific agricultural products and their export struggles, e.g., Soybean exports to China plummeted following the imposition of retaliatory tariffs, resulting in significant losses for many farmers and agribusinesses.]

- Example 2: [Provide further examples, e.g., Similar impacts were observed in the pork and dairy sectors.]

- Data Source: [Use statistics on agricultural exports and imports from the USDA or other reliable sources to support your claims.]

Government Subsidies and their Effectiveness

The US government implemented various subsidy programs to mitigate the losses suffered by farmers due to tariffs. However, the effectiveness of these programs in offsetting the impact of tariffs is debatable.

- Example 1: [Discuss different types of subsidies and their impact, e.g., Direct payments to farmers helped alleviate some financial pressure, but did not fully compensate for lost export revenue.]

- Example 2: [Discuss further aspects, e.g., The subsidies were not always evenly distributed, benefiting larger farms more than smaller ones.]

- Data Source: [Analyze the effectiveness of the subsidies in offsetting tariff-related losses using data from government reports and economic studies.]

Unraveling the Complex Impact of Trump's Tariffs on Billionaire Wealth

In conclusion, Trump's tariffs had a complex and multifaceted impact on the fortunes of his billionaire associates. While some benefited from increased domestic demand and higher prices, others suffered substantial losses due to increased costs, supply chain disruptions, and retaliatory tariffs. This highlights the significant influence of trade policies on the wealth distribution among powerful individuals and underscores the inherent risks and uncertainties associated with protectionist trade strategies. Learn more about how Trump's tariffs affected billionaire fortunes and explore the long-term implications of Trump’s trade policies on billionaire wealth. Investigate the impact of tariffs on various sectors and their associated billionaires to gain a more complete understanding of this complex economic issue.

Featured Posts

-

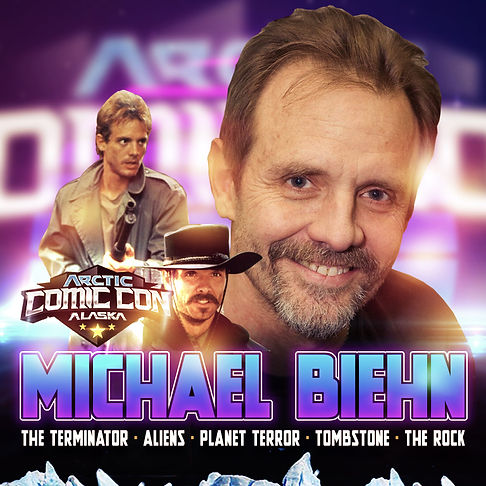

Characters Connections And The Ectomobile A Photographic Look At Arctic Comic Con 2025

May 09, 2025

Characters Connections And The Ectomobile A Photographic Look At Arctic Comic Con 2025

May 09, 2025 -

Celebrating Heroes Living Legends Of Aviation Event Honors Firefighters And More

May 09, 2025

Celebrating Heroes Living Legends Of Aviation Event Honors Firefighters And More

May 09, 2025 -

Who Is Kimbal Musk Exploring The Life And Career Of Elons Brother

May 09, 2025

Who Is Kimbal Musk Exploring The Life And Career Of Elons Brother

May 09, 2025 -

Nyt Strands Answers And Hints Thursday February 20 Game 354

May 09, 2025

Nyt Strands Answers And Hints Thursday February 20 Game 354

May 09, 2025 -

Analysis Williams Latest On Doohan As Colapinto Links Persist

May 09, 2025

Analysis Williams Latest On Doohan As Colapinto Links Persist

May 09, 2025