Trump's Tariff Delay Sends Euronext Amsterdam Stocks Soaring 8%

Table of Contents

The Impact of Tariff Delays on Global Trade and Investment

Tariff uncertainty creates a chilling effect on global trade and investment. Businesses hesitate to commit to long-term projects, fearing unpredictable changes in import and export costs. The delay announced by the Trump administration brought a collective sigh of relief to European businesses, many of whom had been bracing for significant financial repercussions. Sectors like technology and manufacturing, heavily reliant on international trade, were particularly vulnerable. The delay’s positive impact can be summarized as follows:

- Reduced trade barriers lead to increased market confidence. Predictability is crucial for businesses to plan and invest.

- Improved investor sentiment translates to higher stock valuations. The lessening of trade war fears directly boosts investor confidence.

- Positive ripple effect across related industries. A boost in one sector often stimulates growth throughout connected industries.

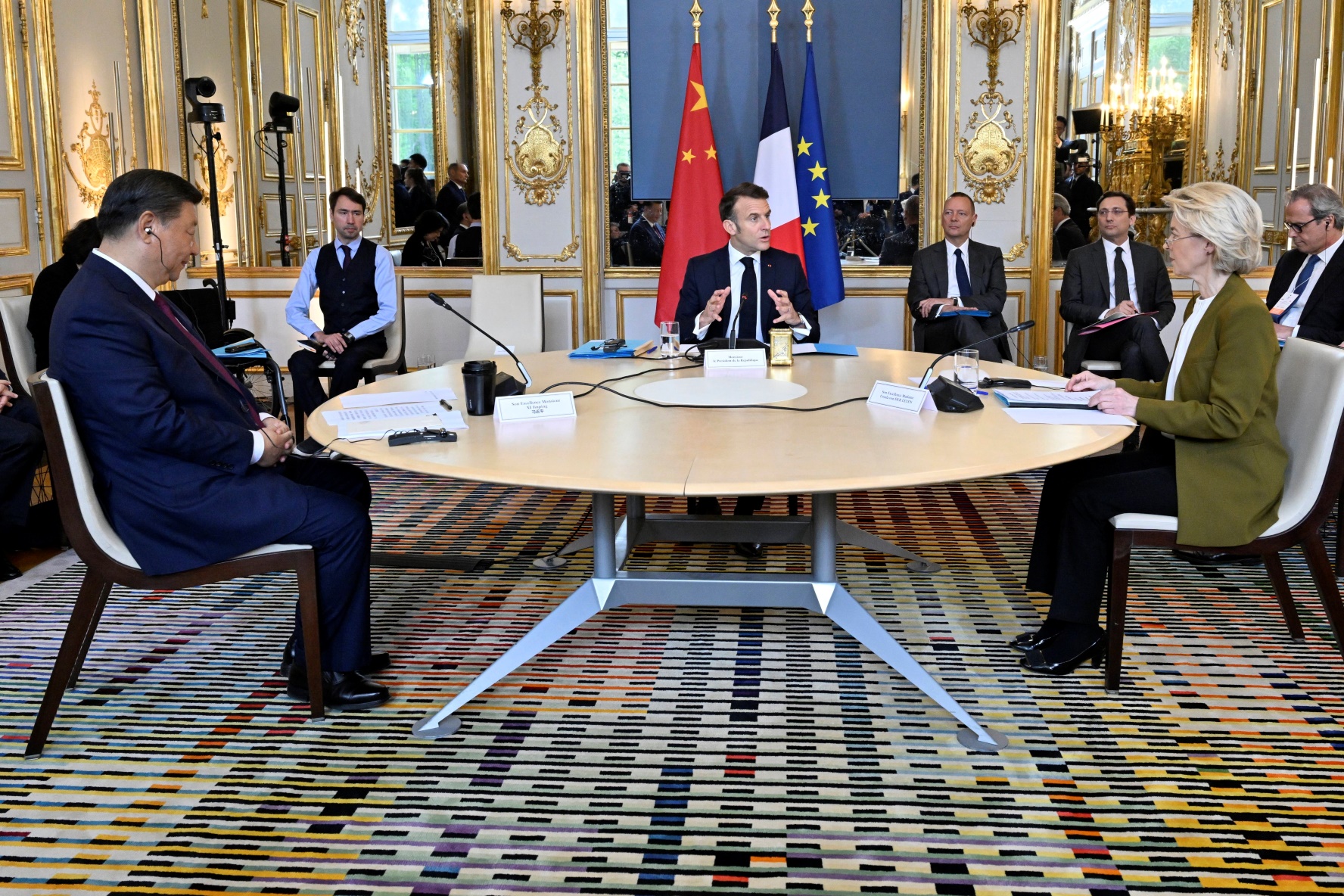

Euronext Amsterdam's Unique Position and Vulnerability to Tariffs

Euronext Amsterdam holds a significant position within the European financial landscape. Its location and the nature of its listed companies make it particularly susceptible to changes in US trade policy. Many companies listed on the exchange have strong ties with the US market, either through exports, imports, or direct investments. This dependence on international trade, especially with the US, amplified the impact of Trump's previous tariff threats.

- Geographic location and trade relationships with the US: Proximity to the US market makes Euronext Amsterdam particularly sensitive to US trade policy.

- Companies listed on Euronext with significant US exports/imports: Specific companies experienced a dramatic rebound following the tariff delay announcement. Further research into these individual companies' performance post-delay is crucial.

- Analysis of specific company performance post-delay announcement: A detailed study of individual stock performance would reveal the varying degrees of impact across different sectors.

Market Reaction and Investor Sentiment Following the News

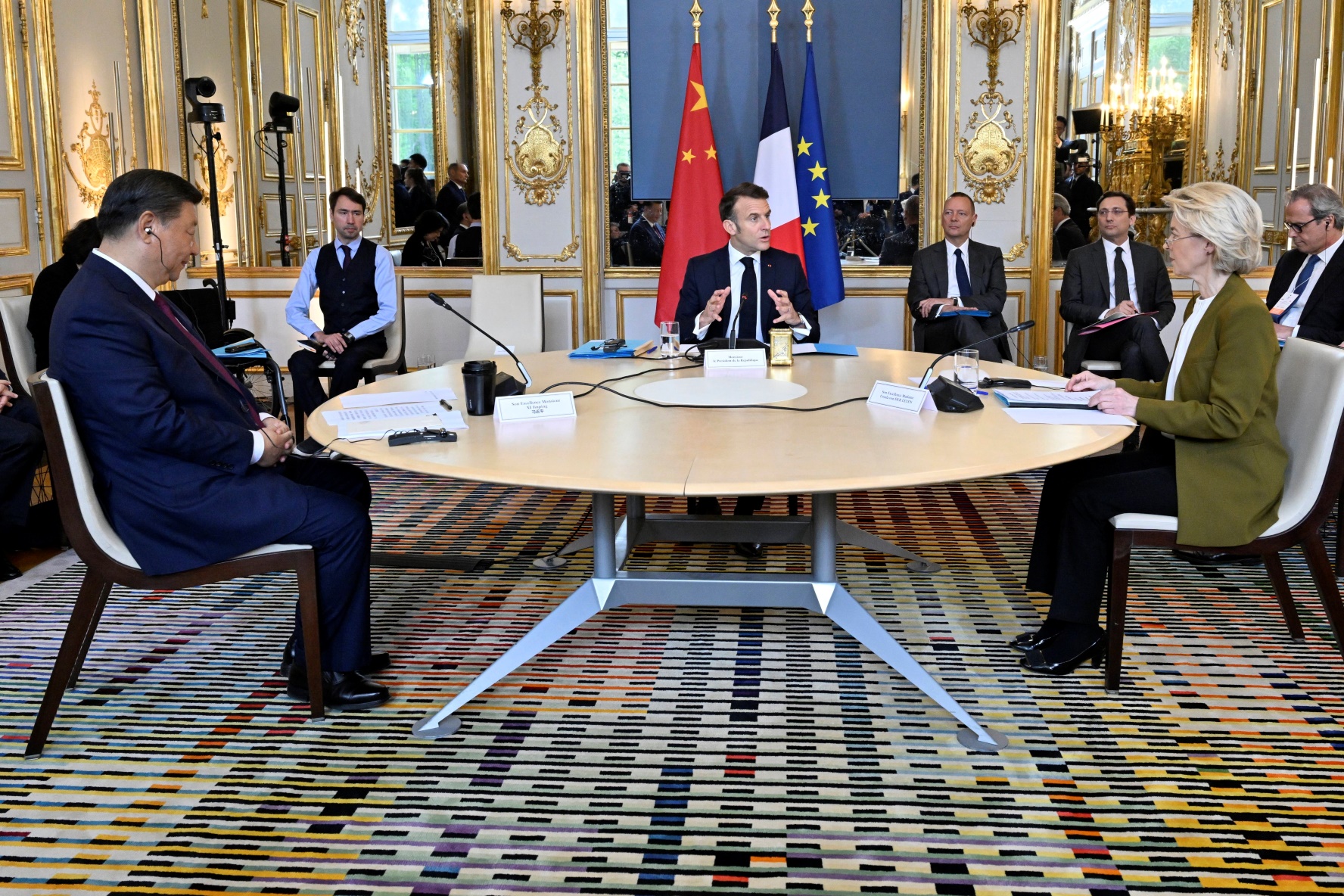

The market reacted instantly to the news of the tariff delay. The initial response was a wave of buying, leading to the aforementioned 8% surge in Euronext Amsterdam stocks. This rapid increase reflects investor speculation and anticipatory trading. Investors, having anticipated negative consequences from the tariffs, quickly adjusted their positions in response to the positive news.

- Charts and graphs showing stock price fluctuations: Visual representations of the market's immediate reaction are essential for understanding the impact.

- Expert opinions and analyst comments on market behavior: Gathering and presenting expert opinions adds credibility and depth to the analysis.

- Comparison with previous market reactions to tariff announcements: Analyzing past reactions provides context and allows for more informed predictions.

Long-Term Implications and Potential Risks

While the tariff delay brought immediate relief, the long-term implications remain uncertain. The possibility of future tariff changes casts a shadow of doubt on the sustainability of the current stock market rise. Renewed uncertainty and market volatility are potential risks that investors must consider.

- Risk assessment of long-term market stability: A careful assessment of potential future shocks to the market is crucial.

- Discussion of potential political factors influencing future tariffs: Political developments will inevitably impact future trade policies and their effects on Euronext Amsterdam.

- Expert predictions for the future of Euronext Amsterdam stocks: Incorporating forecasts from financial analysts provides valuable insight.

Conclusion

Trump's tariff delay provided significant short-term relief, boosting Euronext Amsterdam stocks by a remarkable 8%. This dramatic surge underscores the profound impact of tariff uncertainty on global markets and the performance of individual companies. The vulnerability of Euronext Amsterdam and its listed companies to US trade policy highlights the importance of carefully monitoring future developments related to trade policy. Stay informed about the evolving situation with Trump's Tariff Delay and its effects on Euronext Amsterdam and global markets by following [link to relevant news source/website]. Learn more about how trade policy affects global stock markets by reading our other articles on [link to related articles].

Featured Posts

-

Pobediteli Evrovideniya Poslednie 10 Let Gde Oni Seychas I Chem Zanimayutsya

May 24, 2025

Pobediteli Evrovideniya Poslednie 10 Let Gde Oni Seychas I Chem Zanimayutsya

May 24, 2025 -

Hamilton Faces Backlash Ferrari Chief Condemns Unfair Statements

May 24, 2025

Hamilton Faces Backlash Ferrari Chief Condemns Unfair Statements

May 24, 2025 -

Pengalaman Unik Porsche Di Indonesia Classic Art Week 2025

May 24, 2025

Pengalaman Unik Porsche Di Indonesia Classic Art Week 2025

May 24, 2025 -

Kerings Financial Report Sales Down Demnas Gucci Designs Coming In September

May 24, 2025

Kerings Financial Report Sales Down Demnas Gucci Designs Coming In September

May 24, 2025 -

Apples Q2 Earnings Looming Stock Price Analysis

May 24, 2025

Apples Q2 Earnings Looming Stock Price Analysis

May 24, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025 -

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025 -

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025 -

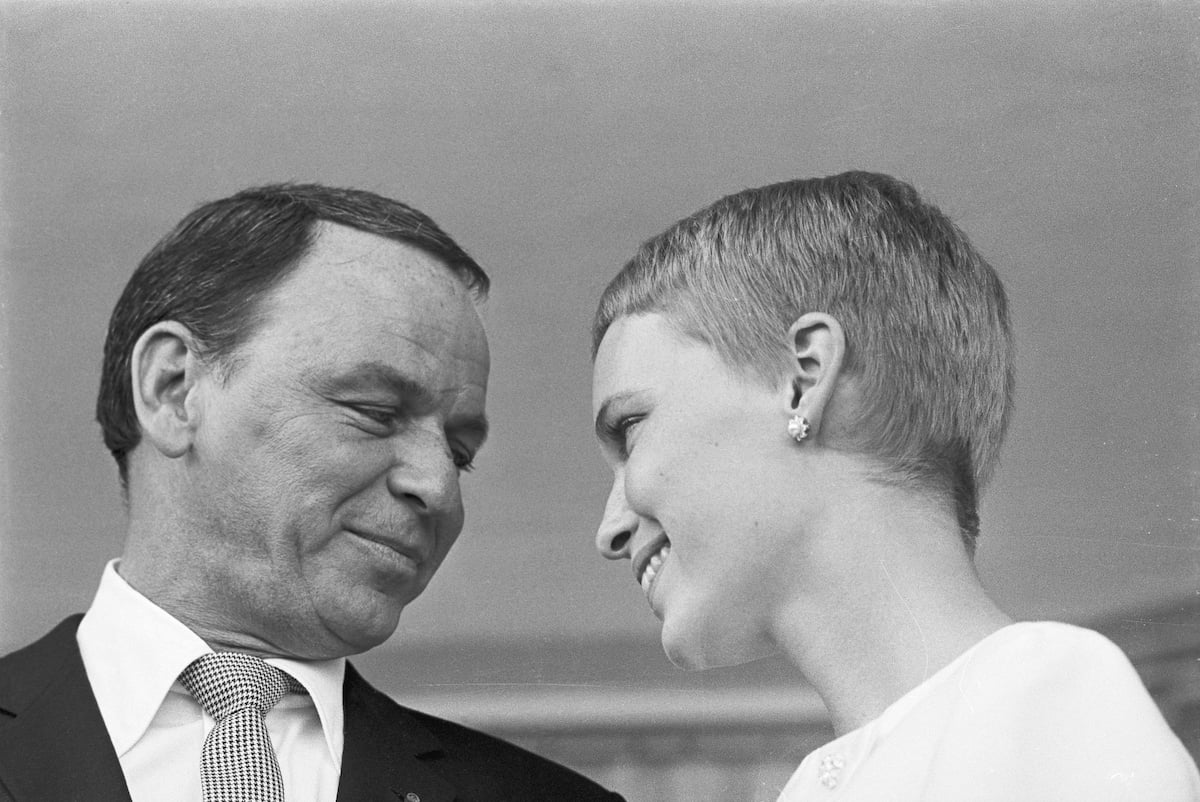

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025