Trump's Trade Threats Send Gold Prices Soaring

Table of Contents

The Safe-Haven Effect of Gold

Gold is traditionally viewed as a safe-haven asset; investors flock to it during times of economic uncertainty or geopolitical instability. This inherent characteristic makes it particularly sensitive to periods of heightened market volatility, such as those triggered by protectionist trade policies.

- Trade wars increase market volatility: The uncertainty surrounding tariffs, sanctions, and retaliatory measures creates a climate of fear and speculation, impacting investor confidence.

- Investors seek stability during trade disputes: When traditional asset classes like stocks and bonds experience significant price swings due to trade tensions, investors seek the relative stability of gold.

- Gold's value is typically unaffected by currency fluctuations (in the long term): Unlike other assets, gold's value is largely independent of currency fluctuations, making it an attractive hedge against currency devaluation.

- Increased demand for gold pushes prices higher: As more investors seek refuge in gold, the increased demand inevitably leads to higher prices, creating a positive feedback loop.

Trump's protectionist trade policies, including tariffs and trade disputes with major economies like China and the European Union, have created a climate of significant uncertainty. This uncertainty has triggered a surge in demand for gold as investors seek to preserve capital and hedge against potential losses in other asset classes. The price of gold, therefore, acts as a barometer for global trade anxieties.

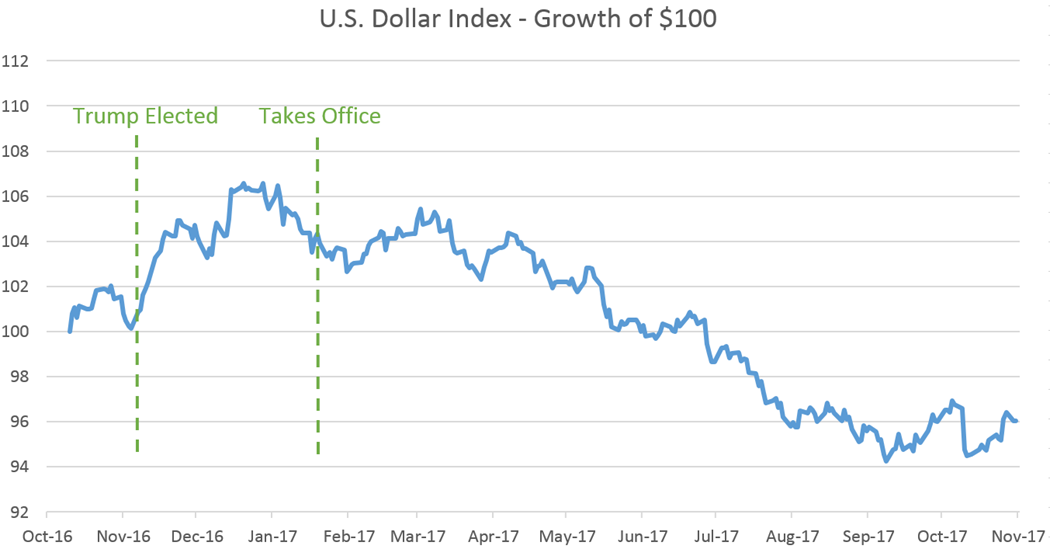

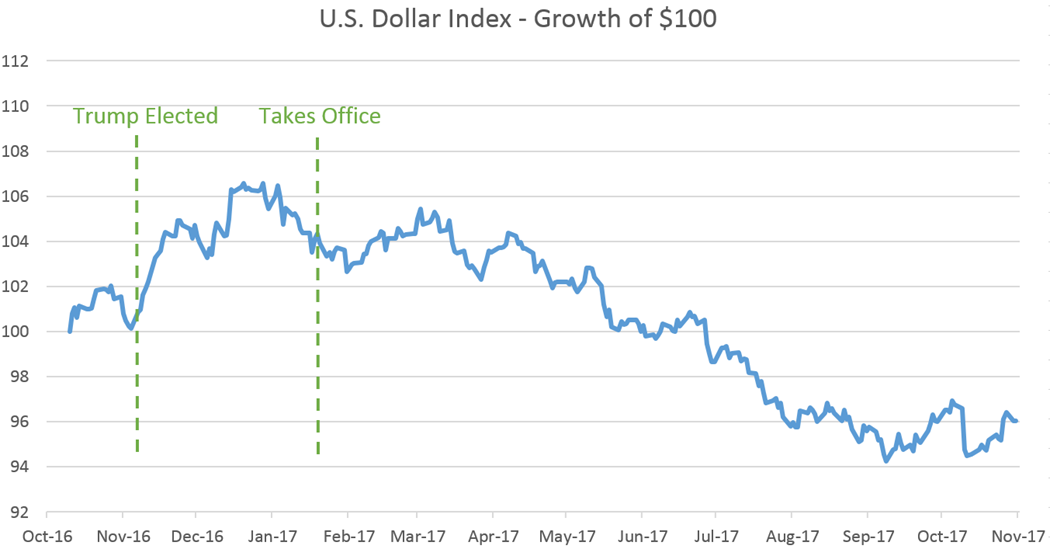

Weakening Dollar and Gold Price Correlation

The US dollar and gold prices share an inverse correlation; a weakening dollar typically leads to higher gold prices (as gold is priced in USD). Trump's trade policies have played a significant role in influencing this dynamic.

- Trump's trade policies can negatively impact the US dollar: Protectionist measures can damage the US economy's long-term prospects, leading to reduced investor confidence in the dollar.

- Trade disputes can weaken investor confidence in the US economy: Uncertainty about future trade relations undermines investor confidence, prompting them to seek alternative, safer investments.

- A weaker dollar makes gold more attractive to international investors: When the dollar weakens, gold becomes cheaper for investors holding other currencies, further increasing demand.

- This dynamic further contributes to the rise in gold prices: The combined effect of reduced demand for the dollar and increased international demand for gold leads to a significant price increase.

Trade wars frequently create uncertainty about the future strength of the US dollar. As investor confidence wanes, they may move away from the dollar, pushing up demand for alternative assets like gold, thereby increasing its price. This is a key factor explaining the surge in gold prices during periods of heightened trade tensions under the Trump administration.

Inflationary Pressures and Gold's Role as a Hedge

Trump's trade policies, particularly tariffs, can contribute to inflationary pressures within the US economy and globally.

- Tariffs increase the cost of imported goods: Tariffs make imported goods more expensive, increasing the overall price level.

- Increased costs are often passed on to consumers: Businesses often pass increased import costs onto consumers, leading to higher prices for goods and services.

- Inflation erodes the purchasing power of fiat currencies: Inflation reduces the real value of money, making it less valuable over time.

- Gold acts as a hedge against inflation, preserving purchasing power: Gold's value tends to rise during inflationary periods, preserving its purchasing power and acting as a store of value.

Rising inflation is a significant factor driving investment in gold. As the purchasing power of traditional currencies declines, investors often turn to gold to protect their wealth from inflationary pressures. Trump's trade actions, by potentially fueling inflation through tariffs and trade disputes, strengthen this demand for gold as a safe haven and inflation hedge.

Analyzing Specific Trade Threats and Their Impact on Gold Prices

Let's examine the impact of two major trade disputes on gold prices:

-

The trade war with China: The escalating tensions between the US and China, marked by tit-for-tat tariffs, created significant market uncertainty. This period saw a notable increase in gold prices, reflecting investor anxieties and a flight to safety. (Insert chart or graph illustrating the correlation between the escalation of US-China trade tensions and gold price movements.)

-

Steel and aluminum tariffs: The imposition of tariffs on steel and aluminum imports from various countries also contributed to market uncertainty and inflationary pressures. This led to a discernible rise in gold prices as investors sought protection from potential economic fallout. (Insert chart or graph illustrating the correlation between the steel and aluminum tariffs and gold price movements.)

Conclusion

Trump's trade threats have undeniably played a significant role in the soaring gold prices. The combination of a safe-haven effect, a weakening dollar, and inflationary pressures resulting from these policies has created a perfect storm for gold investors. By understanding the interplay between global trade dynamics and gold's inherent value, investors can better navigate the complexities of the current economic climate and make informed decisions about their portfolios. Are you ready to capitalize on the continued potential for growth in gold prices due to ongoing trade uncertainties? Consider diversifying your investments with gold to safeguard your financial future in light of ongoing trade threats and volatility in the Gold Prices market.

Featured Posts

-

Ranking Taylor Swifts Albums A Comprehensive Guide

May 27, 2025

Ranking Taylor Swifts Albums A Comprehensive Guide

May 27, 2025 -

Criminal Minds Evolution Season 18 Episode 4 Image Gallery Released

May 27, 2025

Criminal Minds Evolution Season 18 Episode 4 Image Gallery Released

May 27, 2025 -

Discussion Surrounding Renee Rapps Topless Video

May 27, 2025

Discussion Surrounding Renee Rapps Topless Video

May 27, 2025 -

Ice Cube To Write And Star In Latest Friday Installment

May 27, 2025

Ice Cube To Write And Star In Latest Friday Installment

May 27, 2025 -

Ramshtayn 11 Germaniya Usilivaet Podderzhku Ukrainy Obyavlenie V Bryussele

May 27, 2025

Ramshtayn 11 Germaniya Usilivaet Podderzhku Ukrainy Obyavlenie V Bryussele

May 27, 2025

Latest Posts

-

First Nations Child Welfare In Manitoba A 21 Year Analysis Of Cfs Intervention Rates

May 30, 2025

First Nations Child Welfare In Manitoba A 21 Year Analysis Of Cfs Intervention Rates

May 30, 2025 -

Strategic Energy Corridor Manitoba And Nunavut Partner On Kivalliq Hydro Fibre Link

May 30, 2025

Strategic Energy Corridor Manitoba And Nunavut Partner On Kivalliq Hydro Fibre Link

May 30, 2025 -

Manitoba Child And Family Services Impact On First Nations Families 1998 2019

May 30, 2025

Manitoba Child And Family Services Impact On First Nations Families 1998 2019

May 30, 2025 -

Kivalliq Hydro Fibre Link A Joint Manitoba Nunavut Energy And Infrastructure Project

May 30, 2025

Kivalliq Hydro Fibre Link A Joint Manitoba Nunavut Energy And Infrastructure Project

May 30, 2025 -

Study Reveals High Rate Of Child And Family Services Intervention Among Manitoba First Nations Parents

May 30, 2025

Study Reveals High Rate Of Child And Family Services Intervention Among Manitoba First Nations Parents

May 30, 2025