Trump's Trade War Legacy: A Wall Street Bets Perspective.

Table of Contents

The Tariff Rollercoaster: Winners and Losers in the Stock Market

The imposition of tariffs under the Trump administration created a dramatic rollercoaster ride for the stock market. Specific sectors experienced wildly different outcomes, highlighting the uneven distribution of the trade war's impact. Industries heavily reliant on imports, like agriculture and manufacturing, faced significant challenges. For example, American soybean farmers, facing retaliatory tariffs from China, saw their export markets shrink drastically, impacting their stock valuations. Conversely, some domestic producers benefited from increased protection against foreign competition.

- Examples of stocks that surged due to protectionist measures: Companies producing goods previously subject to significant import competition might have seen their stock prices rise as imports became more expensive. This could include certain steel and aluminum producers.

- Examples of stocks that plummeted due to retaliatory tariffs: Companies heavily reliant on exports to China or other countries affected by retaliatory tariffs experienced significant stock price declines. Agricultural companies and manufacturers exporting goods to China are prime examples.

- Discussion of supply chain disruptions and their impact on stock prices: The trade war disrupted global supply chains, leading to delays, increased costs, and uncertainty for many businesses. This uncertainty negatively impacted stock prices across various sectors.

Geopolitical Fallout: Beyond Tariffs and Trade Deficits

The Trump trade war extended far beyond simple tariffs and trade deficits. The escalating tensions, particularly with China, significantly strained international relations and reshaped the global geopolitical landscape. This had a profound ripple effect on investment decisions and market volatility. The uncertainty surrounding trade relations led to increased risk aversion among investors, influencing investment strategies and portfolio allocations.

- Impact on US-China relations and its reflection in the stock market: The deterioration of US-China relations significantly impacted the stock market. Uncertainty surrounding trade negotiations and the possibility of further escalation created volatility and affected the valuations of companies with significant exposure to the Chinese market.

- Discussion of increased trade tensions with other nations: The Trump administration's trade policies extended beyond China, creating friction with other countries like the European Union and Mexico. This widespread tension further fueled market uncertainty and volatility.

- Analysis of the impact on global investment flows: The trade war led to a shift in global investment flows, with investors reassessing their portfolios and seeking more diversified investments to mitigate the increased risks.

The Long-Term Economic Ramifications: A Wall Street Bets View

The long-term economic ramifications of the Trump trade war are still unfolding, but several key impacts are already apparent. Inflation, driven partly by increased import costs due to tariffs, became a concern. Economic growth, while initially resilient, may have been hampered by trade uncertainties and supply chain disruptions in the long run. The Wall Street Bets community, known for its diverse and often contrarian viewpoints, displayed a range of opinions on the lasting impact.

- Long-term impact on inflation and economic growth: While the short-term impact of tariffs on inflation was relatively clear, the long-term effects are more complex and still being analyzed by economists. The impact on economic growth is equally uncertain, with ongoing debates about the trade-off between protectionism and global integration.

- The influence of the trade war on future investment strategies: The experience of the Trump trade war has led many investors, including those in the Wall Street Bets community, to adopt more cautious and diversified investment strategies to mitigate future trade-related risks.

- Opinions from various Wall Street Bets communities about long-term outcomes: The Wall Street Bets community encompasses a wide spectrum of views, with some believing the long-term damage to be minimal and others predicting more significant and lasting negative consequences.

Lessons Learned and Future Implications for Investors

The Trump trade war provided valuable lessons for investors. Understanding the interconnectedness of global markets and the unpredictable nature of trade policy is crucial. Investors need to develop strategies to navigate future trade disputes and protect their portfolios from the resulting volatility.

- Diversification strategies to mitigate trade war risks: Diversifying investments across different sectors, geographies, and asset classes is crucial to reduce exposure to the risks associated with trade disputes.

- How to identify companies resilient to trade disputes: Companies with diversified supply chains, strong domestic markets, and a focus on innovation are often better positioned to withstand trade wars.

- Future outlook for specific sectors affected by the trade war: Investors need to carefully assess the outlook for specific sectors and industries likely to be affected by future trade disputes. This requires diligent analysis of global trade trends and geopolitical factors.

Conclusion: Navigating the Aftermath of Trump's Trade War Legacy

Trump's trade war left a complex and multifaceted legacy. From the perspective of Wall Street Bets, the impact was far-reaching, affecting various sectors, impacting investor sentiment, and reshaping investment strategies. The long-term consequences, including inflation, economic growth, and the geopolitical landscape, continue to unfold. Understanding Trump's trade war legacy is crucial for navigating the complexities of the global market; stay informed about global trade developments and adopt robust investment strategies to thrive in this evolving landscape. Use keywords like Trump trade war analysis, trade war investing strategies, global trade outlook.

Featured Posts

-

Lw Ansf Alqwmu Drws Mn Almady Lbnae Mstqbl Afdl

May 29, 2025

Lw Ansf Alqwmu Drws Mn Almady Lbnae Mstqbl Afdl

May 29, 2025 -

Suzuka Test Crash Leaves Hondas Luca Marini Injured Updates And Recovery

May 29, 2025

Suzuka Test Crash Leaves Hondas Luca Marini Injured Updates And Recovery

May 29, 2025 -

Starbase Official City Status For Space Xs Texas Hub

May 29, 2025

Starbase Official City Status For Space Xs Texas Hub

May 29, 2025 -

Seattle Police Investigate First Hill Homicide Publics Help Requested

May 29, 2025

Seattle Police Investigate First Hill Homicide Publics Help Requested

May 29, 2025 -

Real Madrids Pursuit Of Mbappe The Challenges And Opportunities

May 29, 2025

Real Madrids Pursuit Of Mbappe The Challenges And Opportunities

May 29, 2025

Latest Posts

-

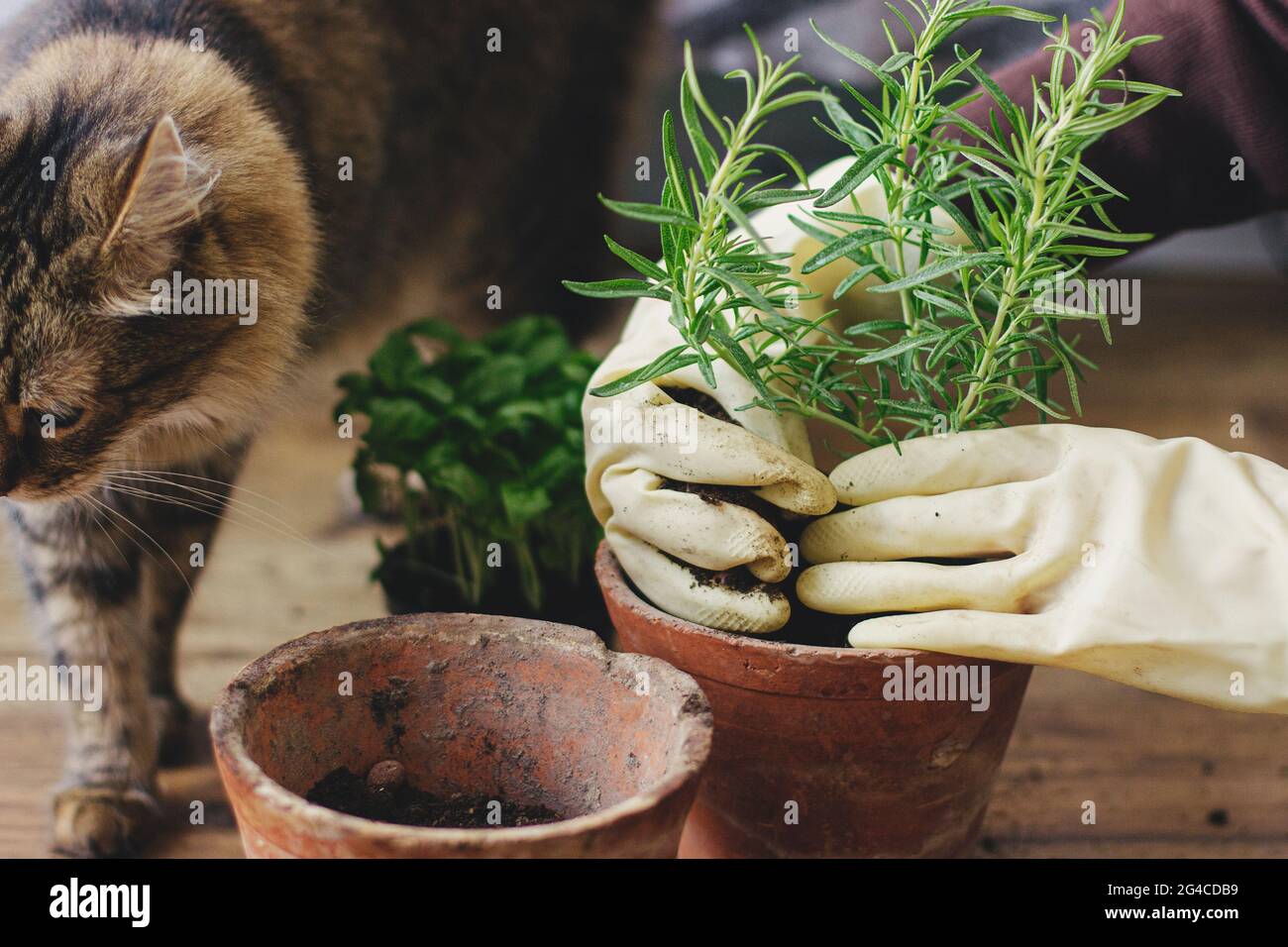

The History And Folklore Of Rosemary And Thyme

May 31, 2025

The History And Folklore Of Rosemary And Thyme

May 31, 2025 -

Rosemary And Thyme Your Guide To Cultivating These Powerful Herbs

May 31, 2025

Rosemary And Thyme Your Guide To Cultivating These Powerful Herbs

May 31, 2025 -

A Guide To Combining Rosemary And Thyme For Maximum Flavor

May 31, 2025

A Guide To Combining Rosemary And Thyme For Maximum Flavor

May 31, 2025 -

Exploring The Differences Between Rosemary And Thyme Flavor Profiles And Uses

May 31, 2025

Exploring The Differences Between Rosemary And Thyme Flavor Profiles And Uses

May 31, 2025 -

Rosemary And Thyme Recipes Simple Dishes With Big Flavor

May 31, 2025

Rosemary And Thyme Recipes Simple Dishes With Big Flavor

May 31, 2025