TSX Composite Index Hits Record High: What You Need To Know

Table of Contents

Understanding the TSX Composite Index and its Components

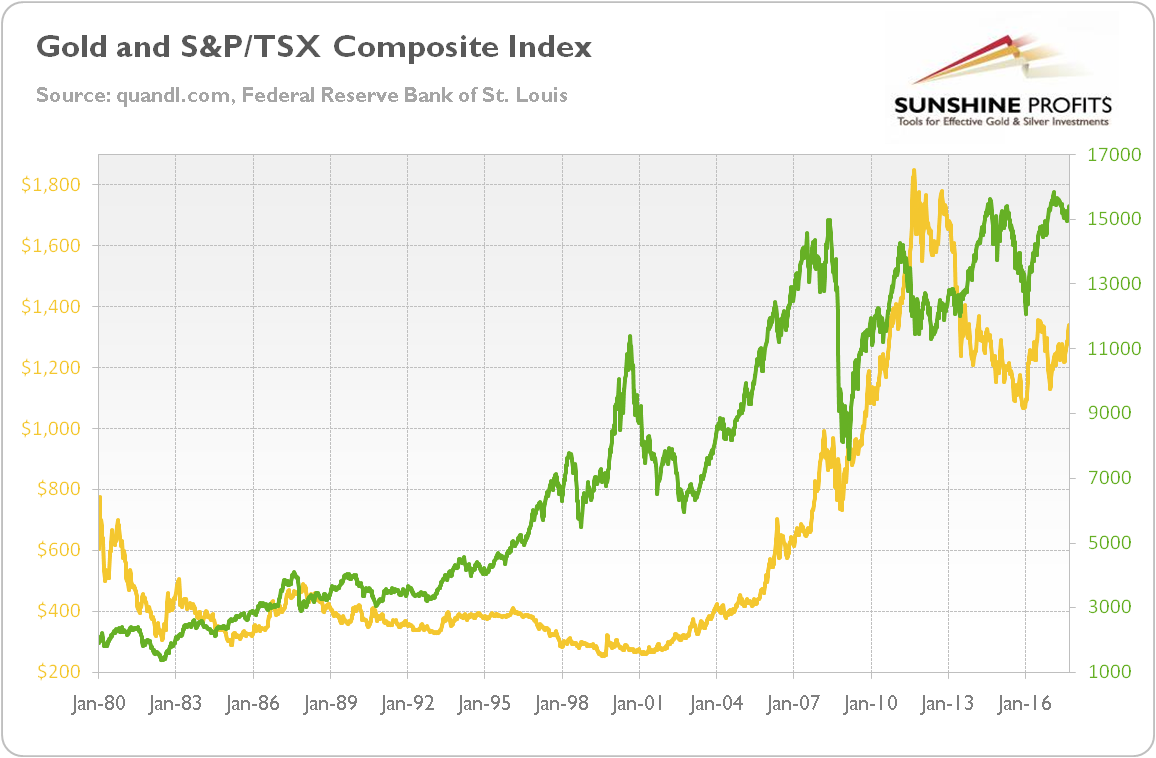

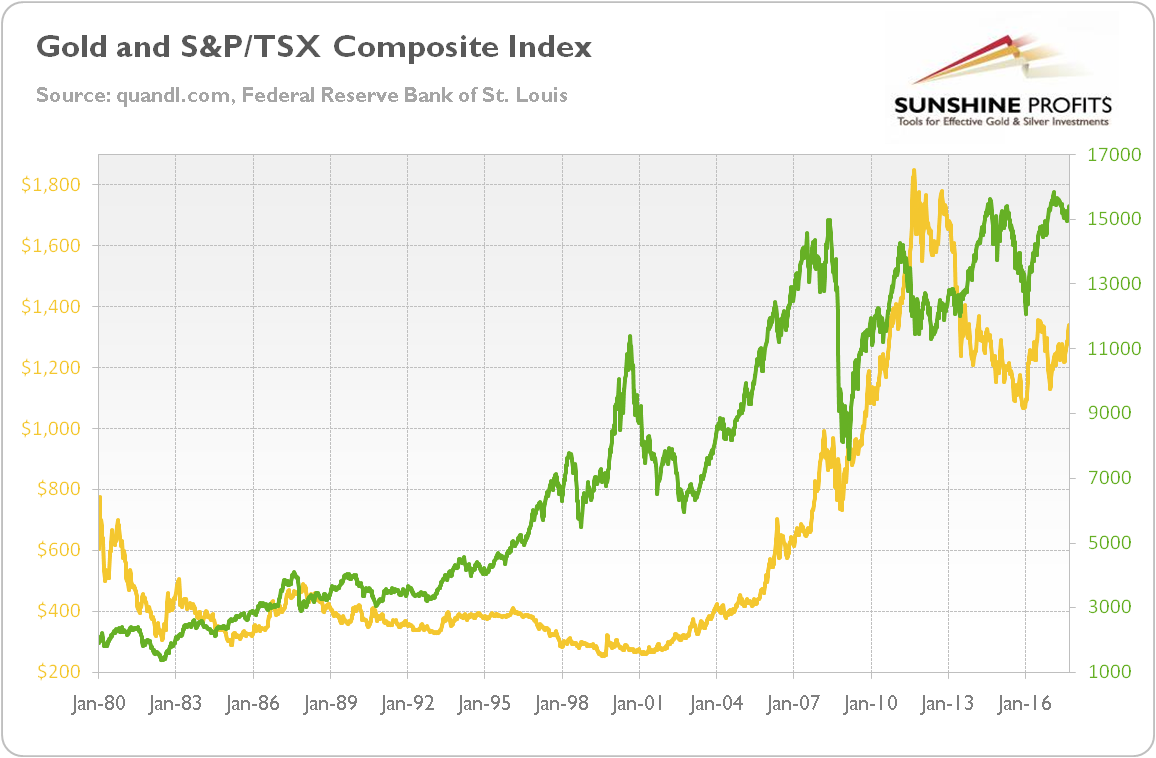

The TSX Composite Index is a benchmark stock market index that tracks the performance of the largest and most liquid companies listed on the Toronto Stock Exchange (TSX). It serves as a key indicator of the overall health of the Canadian economy and provides a broad representation of Canadian corporate performance. The index is weighted by market capitalization, meaning larger companies have a greater influence on its overall value.

Several key sectors contribute significantly to the TSX Composite Index's composition. These include:

- Financials: This sector, dominated by major Canadian banks like Royal Bank of Canada (RY), Toronto-Dominion Bank (TD), and Bank of Nova Scotia (BNS), typically holds a substantial weighting. Their performance is closely tied to overall economic conditions and interest rates.

- Energy: With significant players like Enbridge (ENB) and Suncor Energy (SU), this sector's performance fluctuates based on global oil and gas prices.

- Materials: This sector encompasses companies involved in mining and resource extraction, and its performance is influenced by commodity prices and global demand.

- Technology: While a smaller component historically, the tech sector, with companies like Shopify (SHOP) gaining prominence, is increasingly contributing to the TSX's performance.

The TSX Composite Index, like any market index, has experienced periods of both significant growth and volatility throughout its history. Understanding this historical context is crucial for informed investment decisions.

Factors Driving the TSX Composite Index to Record Highs

Several interconnected factors have contributed to the recent record highs witnessed by the TSX Composite Index.

Economic Growth and Strong Corporate Earnings

Positive economic indicators in Canada have played a significant role. Strong GDP growth, coupled with healthy employment figures, indicates a robust economy capable of supporting higher stock valuations. Furthermore, many major Canadian companies have reported strong corporate earnings, boosting investor confidence. Government initiatives aimed at economic diversification and infrastructure development further contribute to this positive outlook.

- Strong Performing Sectors: Financials have shown resilience, benefiting from rising interest rates. The energy sector has also thrived due to increased global demand.

- Examples of Strong Performing Companies: Royal Bank of Canada (RY) and Shopify (SHOP) have shown particularly strong performance recently.

Global Market Trends and Investor Sentiment

Global market trends have also influenced the TSX's performance. Positive performance in the US stock market often has a positive spillover effect on the TSX. Furthermore, rising commodity prices, particularly in energy and materials, have boosted the performance of relevant Canadian companies. Positive investor sentiment, driven by factors like economic optimism and expectations of continued growth, has further fuelled the rise.

- Global Events Impacting the TSX: Positive global economic data and reduced geopolitical tensions contribute to a positive investor sentiment, driving up the TSX.

- Impact of US Market Performance: A strong US market generally translates to a positive effect on the TSX.

Interest Rates and Monetary Policy

The Bank of Canada's monetary policy plays a critical role. While interest rate hikes can sometimes dampen economic activity, in the current context, they have helped to maintain financial stability and curb inflation, ultimately contributing to a positive environment for investment.

- Impact of Interest Rate Changes: Historically, moderate interest rate increases have generally been positive for the TSX, although excessive increases can lead to market corrections.

What the Record High Means for Investors

The record high presents both opportunities and risks for investors.

Opportunities and Risks

This market performance offers several potential investment opportunities across different sectors. However, it's crucial to remember that a record high doesn't guarantee continued growth. Market corrections are inevitable, and a potential downturn could lead to significant losses. Therefore, diversification and effective risk management are paramount.

- Investment Strategies: Consider investing in a diversified portfolio of ETFs or mutual funds to spread risk across different sectors.

- Sector-Specific Investments: Consider sectors like technology or renewable energy for long-term growth potential.

Strategies for Investing in the TSX

Investing in the TSX can be done through various vehicles, including exchange-traded funds (ETFs), mutual funds, and individual stocks. Careful research and understanding of individual company performance and overall market trends are essential before making any investment decisions. It is always advisable to consult with a qualified financial advisor before making investment choices.

- Tips for Beginners: Start with index funds or ETFs for diversification and low fees.

- Tips for Experienced Investors: Explore individual stocks based on thorough research and risk tolerance.

Conclusion: Navigating the TSX Composite Index's New Heights

The TSX Composite Index's record high is a result of a confluence of factors, including strong economic growth, positive corporate earnings, favorable global market trends, and a well-managed monetary policy. While this presents exciting investment opportunities, it's crucial to approach the market with caution, recognizing the inherent risks. Diversification, risk management, and thorough research are essential for navigating this dynamic market. Remember to consult with a financial advisor to develop an investment strategy tailored to your individual needs and risk tolerance. Stay informed about the TSX Composite Index and Canadian investment strategies to maximize your potential for success. Further resources on the TSX and Canadian investment strategies can be found at [link to relevant resources].

Featured Posts

-

Trump Tariffs And Rising Phone Battery Costs A Consumers Dilemma

May 17, 2025

Trump Tariffs And Rising Phone Battery Costs A Consumers Dilemma

May 17, 2025 -

Reddit Down For Thousands Investigating The Global Outage

May 17, 2025

Reddit Down For Thousands Investigating The Global Outage

May 17, 2025 -

100 Rotten Tomatoes Seth Rogens The Studio Makes History

May 17, 2025

100 Rotten Tomatoes Seth Rogens The Studio Makes History

May 17, 2025 -

Thibodeau And Bridges Clear The Air After Public Disagreement

May 17, 2025

Thibodeau And Bridges Clear The Air After Public Disagreement

May 17, 2025 -

Alkuvuoden 2024 Osakesijoitusten Tappiot Elaekeyhtioeissae

May 17, 2025

Alkuvuoden 2024 Osakesijoitusten Tappiot Elaekeyhtioeissae

May 17, 2025