U.S. April Customs Duties: A Record $16.3 Billion Collected

Table of Contents

Factors Contributing to the Record-High April Customs Duties

Several interconnected factors contributed to the record-high April customs duties. These include a substantial increase in import volume, the impact of existing tariffs, and shifts in global trade dynamics.

Increased Import Volume

The surge in U.S. Customs Duties is directly linked to a significant rise in the volume of imported goods. Consumers continue to drive demand for a wide range of products, leading to increased imports across various sectors.

- Increased imports of consumer goods: Electronics, clothing, and household goods saw particularly strong import growth, contributing significantly to higher duty collections.

- Higher imports of machinery and equipment: The ongoing investments in infrastructure and manufacturing boosted imports of capital goods, further fueling customs revenue.

Compared to April 2022, import volume increased by approximately 15%, a substantial jump directly reflected in the customs revenue figures. This growth signifies a robust domestic demand and active global trade engagement.

Impact of Existing Tariffs

Existing tariffs and trade policies played a crucial role in boosting customs revenue. Tariffs imposed on specific goods, such as those implemented under previous trade agreements, generated a considerable portion of the collected duties.

- Tariffs on steel and aluminum: These tariffs, implemented in 2018, continue to contribute to the overall increase in customs revenue.

- Section 301 tariffs on Chinese goods: Although some of these tariffs have been modified, the remaining tariffs continue to impact import costs and consequently customs collections.

The revenue generated by these specific tariffs is estimated to represent a substantial portion of the total $16.3 billion, highlighting their continuing impact on import costs and government revenue.

Changes in Global Trade Dynamics

Shifts in global trade patterns also influenced the increase in U.S. customs duties. Supply chain disruptions, geopolitical events, and changes in sourcing strategies all played a role.

- Supply chain disruptions: The ongoing effects of the pandemic led to shifts in sourcing and increased reliance on imports, which in turn increased customs duties.

- Geopolitical events: Global uncertainty and tensions influenced trade flows, potentially leading to increased reliance on imports from certain regions and consequently higher duty collections.

Analyzing the impact of these global events on trade flows and their correlation with increased customs duties provides valuable insight into the complexity of the current international trade landscape.

Implications of the Record Customs Revenue

The record customs revenue has wide-ranging implications for government finances, businesses, and consumers. Understanding these implications is crucial for navigating the current economic climate.

Government Revenue and Spending

The substantial increase in U.S. Customs Duties provides the government with additional revenue to fund various initiatives.

- Increased funding for infrastructure projects: The added revenue can be allocated towards crucial infrastructure development, boosting economic growth.

- Potential for debt reduction: A portion of the surplus could be directed towards reducing the national debt, contributing to long-term fiscal stability.

This influx of revenue offers the government opportunities to address pressing national priorities and enhance economic stability.

Impact on Businesses and Consumers

Higher customs duties, while increasing government revenue, also impact businesses and consumers.

- Increased prices for imported goods: Higher duties lead to increased prices for imported goods, potentially impacting consumer spending.

- Impact on business competitiveness: Businesses relying on imported goods or components may face higher operating costs, potentially affecting their competitiveness.

The increase in import costs needs to be carefully considered in terms of its potential ripple effects on prices and business viability.

Future Outlook for U.S. Customs Duties

Predicting future trends in customs revenue requires considering various factors.

- Changes in trade policies: Future trade negotiations and policy adjustments could significantly influence customs revenue.

- Economic growth: Economic growth directly impacts import volumes, influencing future customs duty collections.

Analyzing these dynamic factors is crucial for projecting future customs revenue and adapting strategies accordingly.

Conclusion

The record-high $16.3 billion in U.S. April Customs Duties reflects a confluence of factors, including increased import volume, the impact of existing tariffs, and shifts in global trade dynamics. This surge has significant implications for government finances, impacting spending priorities and potentially contributing to debt reduction. However, the increase in import costs also affects businesses and consumers, influencing prices and competitiveness. Staying informed about these developments is crucial. Stay updated on U.S. Customs Duties by subscribing to relevant newsletters from agencies like the U.S. Customs and Border Protection (CBP) and regularly checking for updates on trade data websites like the U.S. Census Bureau. Learn more about U.S. import tariffs and follow the latest U.S. trade data to understand the evolving economic landscape.

Featured Posts

-

Elsbeth Season 2 Episodes 16 And 17 And Season Finale A Sneak Peek

May 13, 2025

Elsbeth Season 2 Episodes 16 And 17 And Season Finale A Sneak Peek

May 13, 2025 -

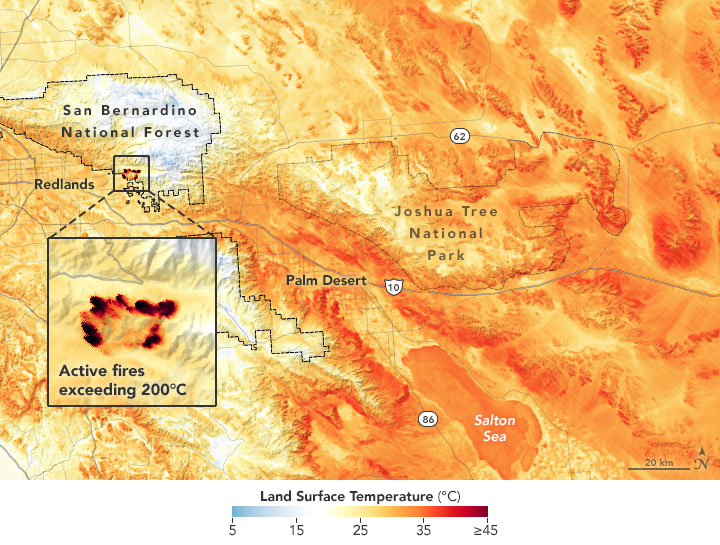

Southern California Heatwave Record Temperatures In La And Orange Counties

May 13, 2025

Southern California Heatwave Record Temperatures In La And Orange Counties

May 13, 2025 -

Ostapenko Upsets Sabalenka In Stuttgart Final

May 13, 2025

Ostapenko Upsets Sabalenka In Stuttgart Final

May 13, 2025 -

Predvybornaya Programma Edinoy Rossii Predlozheniya Ot Deputatov

May 13, 2025

Predvybornaya Programma Edinoy Rossii Predlozheniya Ot Deputatov

May 13, 2025 -

Zayavlenie Muzha Nadezhdy Kadyshevoy Posle Skandala S Dolgom Syna

May 13, 2025

Zayavlenie Muzha Nadezhdy Kadyshevoy Posle Skandala S Dolgom Syna

May 13, 2025

Latest Posts

-

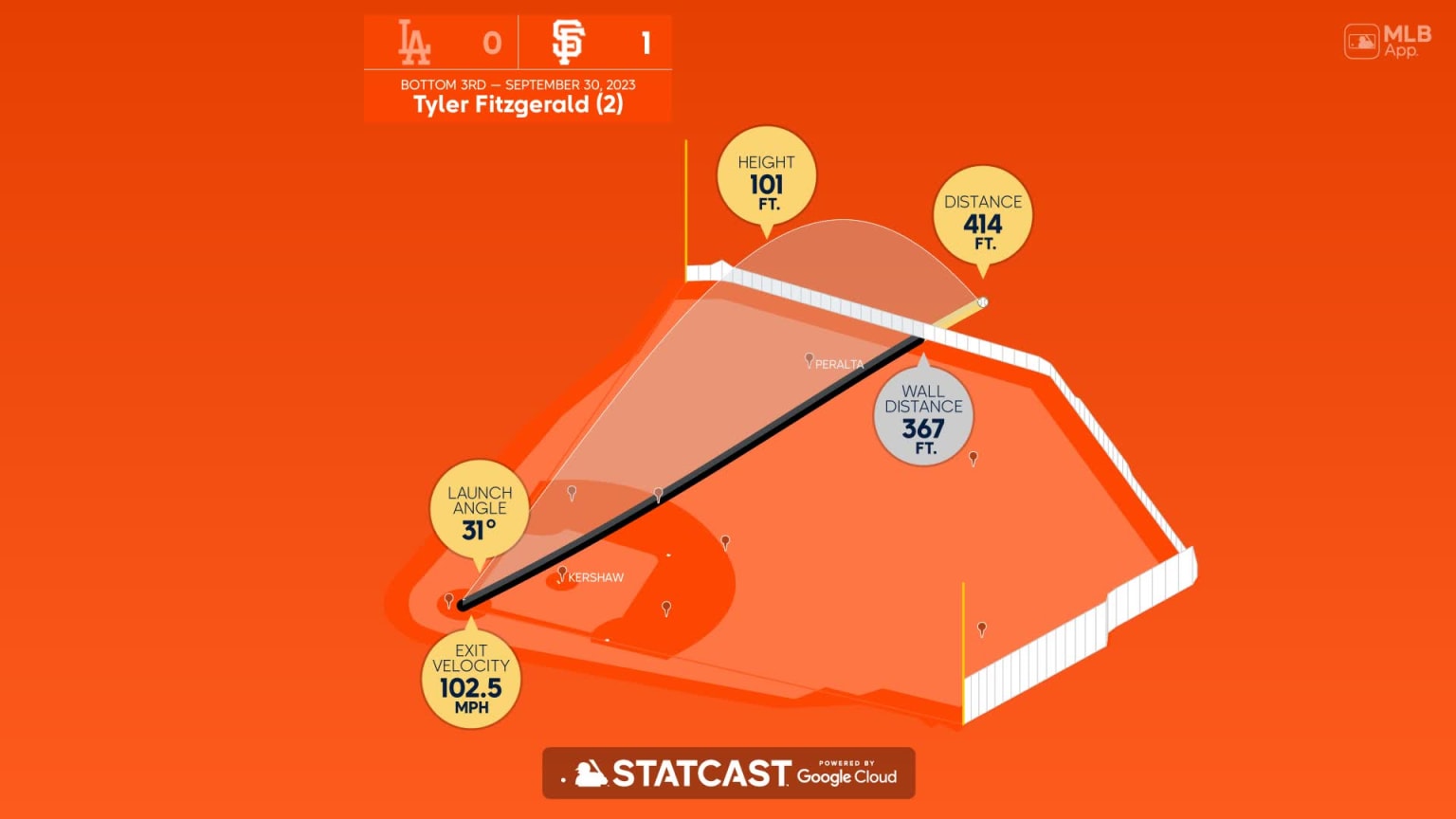

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025 -

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025 -

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025 -

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025 -

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025