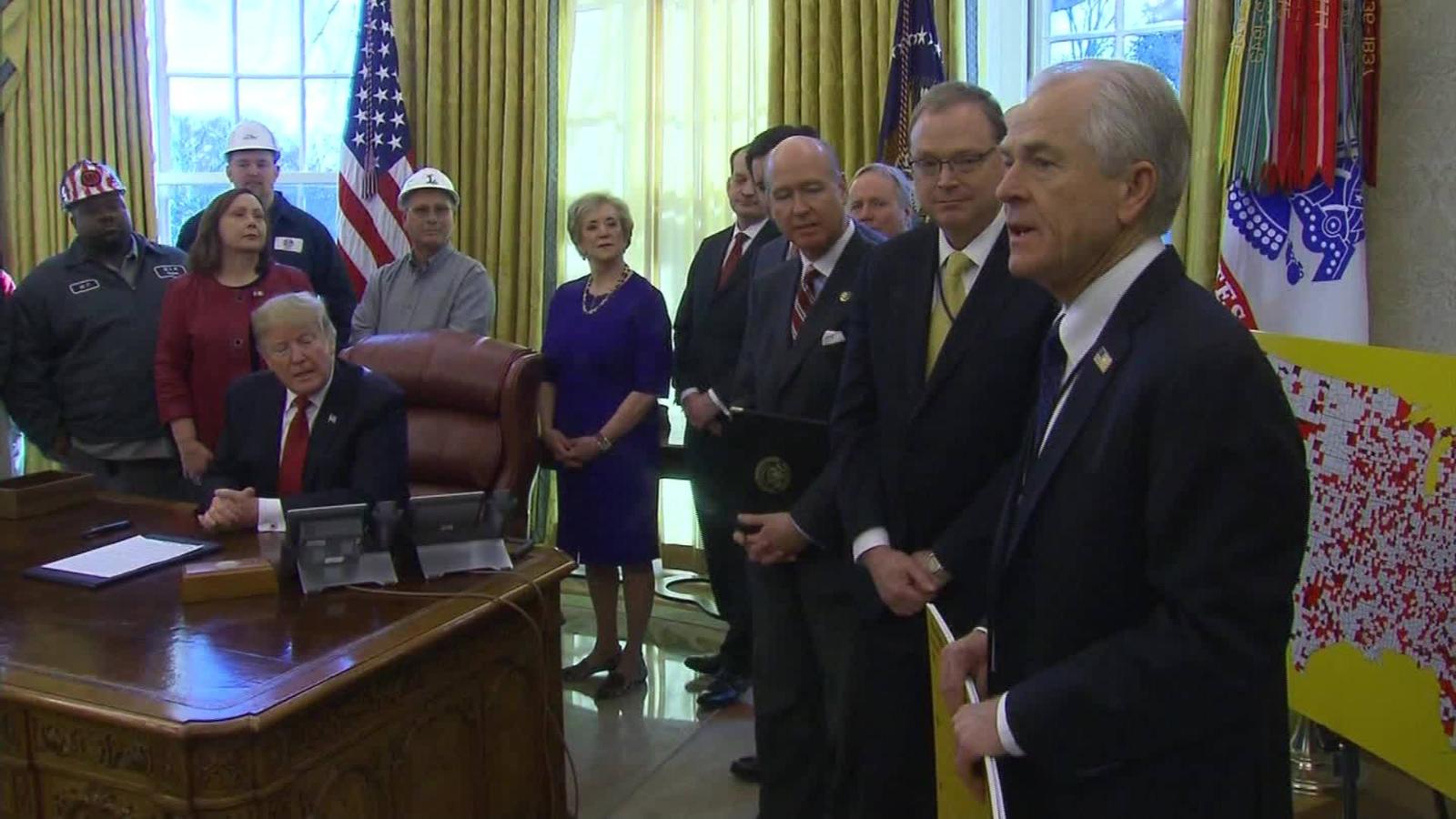

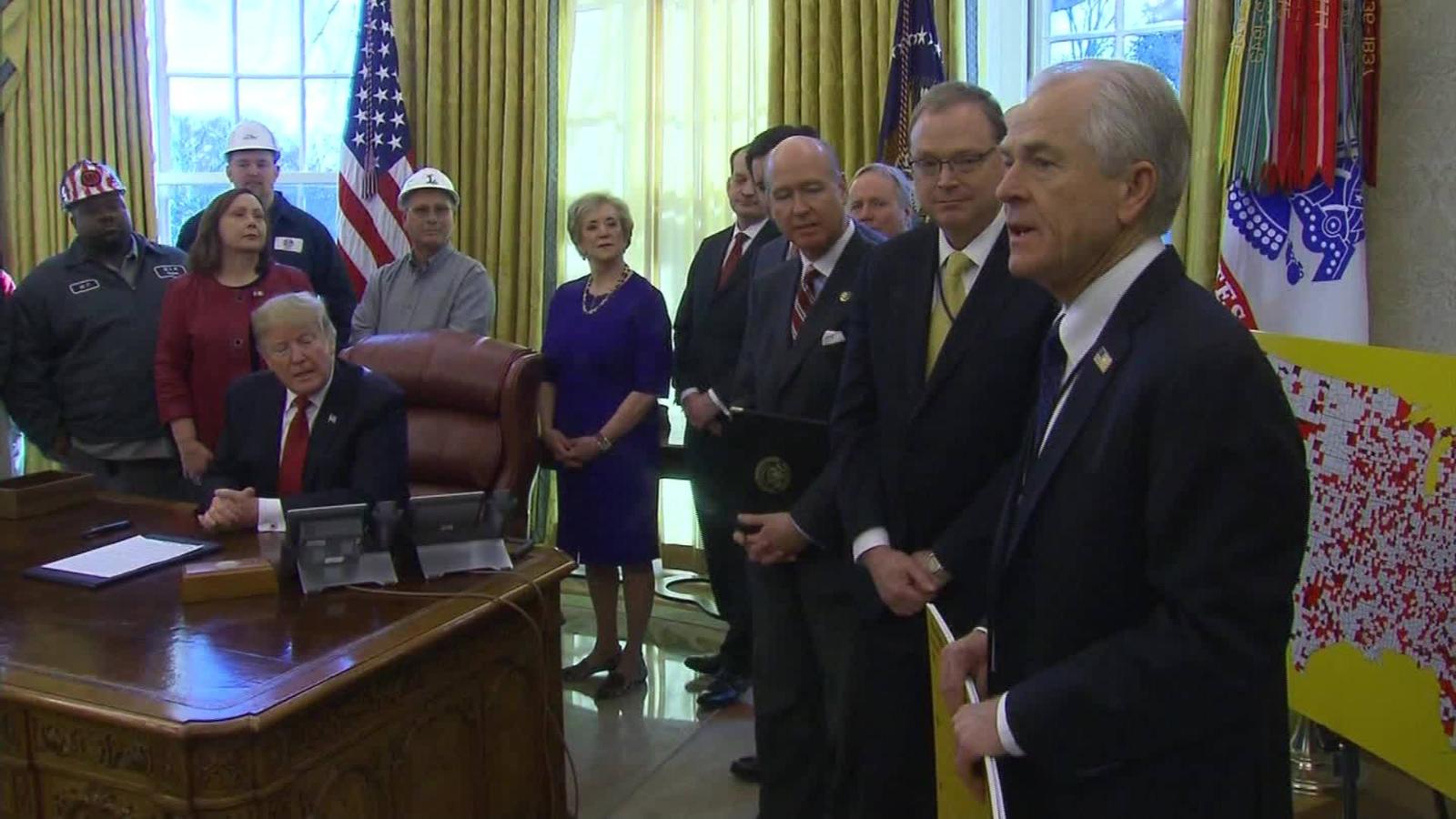

U.S.-China Truce Fuels Global Stock Market Rally

Table of Contents

Easing Trade Tensions and Their Impact on Global Markets

Recent announcements suggest a potential de-escalation in the long-running trade dispute between the U.S. and China. This easing of trade tensions is a primary driver of the current global stock market rally. Reduced tariffs or trade barriers, even if temporary, could significantly boost global trade and economic activity. The positive impact on investor confidence is undeniable, leading to higher stock valuations and increased investment.

- Reduced Tariffs: Lower tariffs directly benefit businesses involved in international trade, leading to increased profitability and boosting stock prices in affected sectors.

- Increased Economic Activity: Freer trade stimulates economic growth globally, creating a positive feedback loop that supports higher stock prices.

- Boosted Investor Confidence: The perception of reduced geopolitical risk increases investor confidence, leading them to allocate more capital to the stock market.

- Sector-Specific Benefits: Sectors heavily impacted by the trade war, such as technology and manufacturing, are experiencing particularly strong rallies. Companies involved in the supply chain of tech products, for example, are seeing significant gains as trade barriers ease.

- Increased Cross-Border Investments: A more stable US-China relationship fosters greater confidence in cross-border investments and collaborations, further fueling economic growth.

Impact on Specific Market Sectors

The global stock market rally following the U.S.-China truce isn't uniform across all sectors. Some sectors are experiencing more significant gains than others, reflecting their varying levels of exposure to the trade war and the broader global economy.

- Technology Stocks: Technology stocks, particularly those with significant exposure to the Chinese market, have seen substantial gains due to the reduction in trade-related uncertainties.

- Emerging Markets: Emerging markets, often heavily reliant on global trade, have also benefited from the improved outlook. Reduced trade tensions generally lead to increased capital flows into these markets.

- Small-Cap Stocks: Small-cap stocks, typically more volatile, have also participated in the rally, though their performance may be more susceptible to future shifts in the geopolitical climate.

- Investment Opportunities: The shift provides potential investment opportunities across various sectors, but careful analysis is needed to identify companies best positioned to benefit from the easing tensions.

- Performance Comparison: A clear comparison of market performance data before and after the truce announcement highlights the significant impact of the easing tensions on investor sentiment and market valuations.

Potential Risks and Uncertainties

While the U.S.-China truce fuels optimism, it’s crucial to acknowledge significant risks and uncertainties that could impact the sustainability of this market rally.

- Fragile Truce: The truce is far from guaranteed, and any escalation could trigger a sharp market correction. The inherent volatility of the US-China relationship requires continuous monitoring.

- Geopolitical Risks: Other geopolitical factors – conflicts, political instability, or unexpected economic events – could easily destabilize markets.

- Economic Uncertainty: The long-term economic impact of the truce remains uncertain. While there’s optimism about economic growth, actual results may vary.

- Risk Management Strategies: Investors need to implement robust risk management strategies, including diversification and hedging, to mitigate potential losses.

- Portfolio Diversification: Diversifying investments across different asset classes and geographical regions is crucial to reduce overall portfolio volatility.

Analyzing Market Volatility in the Wake of the Truce

The initial rally following the U.S.-China truce announcement should not be viewed in isolation. Close monitoring of market volatility is crucial to understand its sustainability.

- Volatility Index (VIX): Tracking the VIX, a widely used measure of market volatility, provides valuable insights into investor sentiment and potential risk. A rising VIX often indicates increased uncertainty.

- Potential Market Correction: The possibility of a market correction following the initial surge cannot be discounted. A period of consolidation or even a decline is a common market occurrence after a rapid rally.

- Risk Assessment and Investment Strategies: Thorough risk assessment and the development of appropriate investment strategies are vital for navigating the potential market fluctuations.

- Hedging Strategies: Exploring hedging strategies, such as put options, can help mitigate potential losses in case of a market downturn.

Conclusion

The U.S.-China truce has undeniably fueled a significant global stock market rally, driven primarily by easing trade tensions and renewed investor optimism. While this development offers promising opportunities, it’s crucial to acknowledge the inherent risks and uncertainties that remain. The fragility of the truce and the potential for unforeseen geopolitical events necessitate caution.

Call to Action: Understanding the complexities of the U.S.-China relationship and its impact on the global stock market is essential for informed investment decisions. Stay informed about further developments regarding the U.S.-China truce and its ripple effects on global markets to capitalize on potential opportunities and mitigate potential risks. Continue to research the U.S.-China truce's influence on your investment portfolio and adjust your strategy accordingly. Don't hesitate to consult with a financial advisor to develop a comprehensive investment plan that aligns with your risk tolerance and financial goals.

Featured Posts

-

Liverpool Transfer Rumours Focus On Dean Huijsen

May 14, 2025

Liverpool Transfer Rumours Focus On Dean Huijsen

May 14, 2025 -

Stylish And Functional The Best Loungefly Pokemon Bags And Wallets

May 14, 2025

Stylish And Functional The Best Loungefly Pokemon Bags And Wallets

May 14, 2025 -

Federers Honorary Role At The Le Mans 24 Hour Race

May 14, 2025

Federers Honorary Role At The Le Mans 24 Hour Race

May 14, 2025 -

Sanremo Il Comune E La Rai In Contrasto Cosa Significa La Diffida

May 14, 2025

Sanremo Il Comune E La Rai In Contrasto Cosa Significa La Diffida

May 14, 2025 -

Portugal Snap Election May Vote Looms Amidst Government Instability

May 14, 2025

Portugal Snap Election May Vote Looms Amidst Government Instability

May 14, 2025