U.S. Economic Slowdown: 0.2% Shrinkage Reflects Lower Spending And Tariff Impacts

Table of Contents

Decreased Consumer Spending: A Major Contributing Factor

Reduced consumer spending is a primary driver of the recent U.S. economic slowdown. Several factors have contributed to this decrease, impacting overall GDP growth and creating uncertainty in various sectors.

Reduced Consumer Confidence

Several factors have eroded consumer confidence, leading to decreased spending.

- Inflation eroding purchasing power: High inflation has significantly reduced the real value of wages, leaving consumers with less disposable income. The rising cost of living, particularly for essential goods like food and energy, forces households to cut back on discretionary spending.

- Increased interest rates impacting borrowing: The Federal Reserve's interest rate hikes, aimed at combating inflation, have increased borrowing costs for consumers. This makes it more expensive to finance large purchases like homes and cars, further dampening consumer spending.

- Global uncertainty impacting investment and employment: Geopolitical instability and concerns about a potential recession have created uncertainty in the job market, impacting consumer confidence and willingness to spend.

Data from the Conference Board Consumer Confidence Index shows a decline in recent months, reflecting this growing pessimism. This reduced confidence directly translates into lower consumer spending, impacting retail sales and overall economic activity.

Shifting Spending Priorities

Consumers are adjusting their spending habits, prioritizing essential goods over non-essential items.

- Decreased spending on non-essential goods: Areas like entertainment, travel, and dining out have seen a noticeable decrease in spending as consumers focus on necessities.

- Increased focus on necessities: Spending on essential goods like groceries and utilities remains high, even as inflation continues to rise. This shift in priorities highlights the strain on household budgets.

- Impact on different sectors (e.g., retail, hospitality): The retail and hospitality sectors are particularly vulnerable to shifts in consumer spending. Reduced discretionary spending directly translates to lower sales and revenue for businesses in these sectors.

For example, the decline in retail sales of clothing and electronics reflects the prioritization of essential spending over discretionary purchases. This shift in consumer behavior is a significant contributing factor to the overall economic slowdown.

The Lingering Impact of Tariffs on Economic Growth

Tariffs imposed on imported goods continue to negatively impact the U.S. economy, contributing to the slowdown.

Increased Import Costs

Tariffs have increased the cost of imported goods for both businesses and consumers.

- Higher prices for imported goods: Tariffs directly increase the price of imported goods, leading to higher prices for consumers and reduced purchasing power.

- Reduced competitiveness for domestic businesses: Higher import costs can make domestically produced goods less competitive, potentially harming domestic industries.

- Impact on supply chains: Tariffs can disrupt global supply chains, leading to shortages and further increasing prices.

The impact of tariffs is particularly evident in industries heavily reliant on imported goods, such as manufacturing and agriculture. Data on import/export volumes and prices clearly show the negative effects of these trade policies on economic growth.

Retaliatory Tariffs and Global Trade Disruptions

Retaliatory tariffs imposed by other countries have further exacerbated the negative impact on U.S. economic growth.

- Reduced exports from the U.S.: Retaliatory tariffs have decreased the demand for U.S. exports, harming American businesses and workers.

- Trade wars impacting international relations: Escalating trade tensions create uncertainty and instability in global markets.

- Challenges for businesses engaging in global trade: Businesses involved in international trade face increased costs, bureaucratic hurdles, and unpredictable market conditions.

The ongoing trade disputes between the U.S. and other countries contribute significantly to the uncertainty and instability impacting global trade flows, further hindering economic growth.

Other Factors Contributing to the U.S. Economic Slowdown

Beyond consumer spending and tariffs, other factors contribute to the current economic slowdown.

Geopolitical Uncertainty

Global events and geopolitical instability significantly impact investor confidence and economic growth.

- Impact of war: Ongoing conflicts and geopolitical tensions create uncertainty and negatively impact investment and economic activity.

- Global energy crisis: Energy price volatility and shortages create inflationary pressures and impact business costs.

- Supply chain disruptions: Global supply chain disruptions, exacerbated by geopolitical events, continue to hamper economic activity.

These factors contribute to a climate of uncertainty, deterring investment and negatively impacting business decisions, slowing overall economic growth.

Monetary Policy and Interest Rate Hikes

The Federal Reserve's monetary policy and interest rate hikes also play a role in the slowdown.

- Impact on borrowing costs for businesses and consumers: Higher interest rates increase borrowing costs for businesses and consumers, reducing investment and spending.

- Influence on investment: Higher interest rates make borrowing more expensive, leading to decreased business investment.

- Effects on inflation: While intended to curb inflation, interest rate hikes can also slow economic growth, potentially leading to a recession.

The Federal Reserve's actions, while aimed at controlling inflation, have unintended consequences, contributing to the current economic slowdown.

Conclusion

The 0.2% shrinkage in U.S. GDP reflects a confluence of factors, primarily decreased consumer spending and the enduring effects of tariffs. Addressing these issues requires a multi-pronged approach, including strategies to bolster consumer confidence, mitigate the impact of tariffs, and navigate the challenges of geopolitical uncertainty. Understanding the complexities of this U.S. economic slowdown is crucial for businesses, investors, and policymakers alike. Staying informed about these economic indicators and their impact is key to navigating this period of uncertainty. For further analysis on the ongoing U.S. economic slowdown and its potential future implications, continue researching economic data and expert opinions.

Featured Posts

-

La Receta Facil Y Sabrosa De Lasana De Calabacin De Pablo Ojeda Mas Vale Tarde

May 31, 2025

La Receta Facil Y Sabrosa De Lasana De Calabacin De Pablo Ojeda Mas Vale Tarde

May 31, 2025 -

Early Start To Fire Season In Canada And Minnesota

May 31, 2025

Early Start To Fire Season In Canada And Minnesota

May 31, 2025 -

Guelsen Bubikoglu Nun Son Hali Yesilcam Guezeli Hayranlarini Sasirtti Mine Tugay Dan Da Tepki Geldi

May 31, 2025

Guelsen Bubikoglu Nun Son Hali Yesilcam Guezeli Hayranlarini Sasirtti Mine Tugay Dan Da Tepki Geldi

May 31, 2025 -

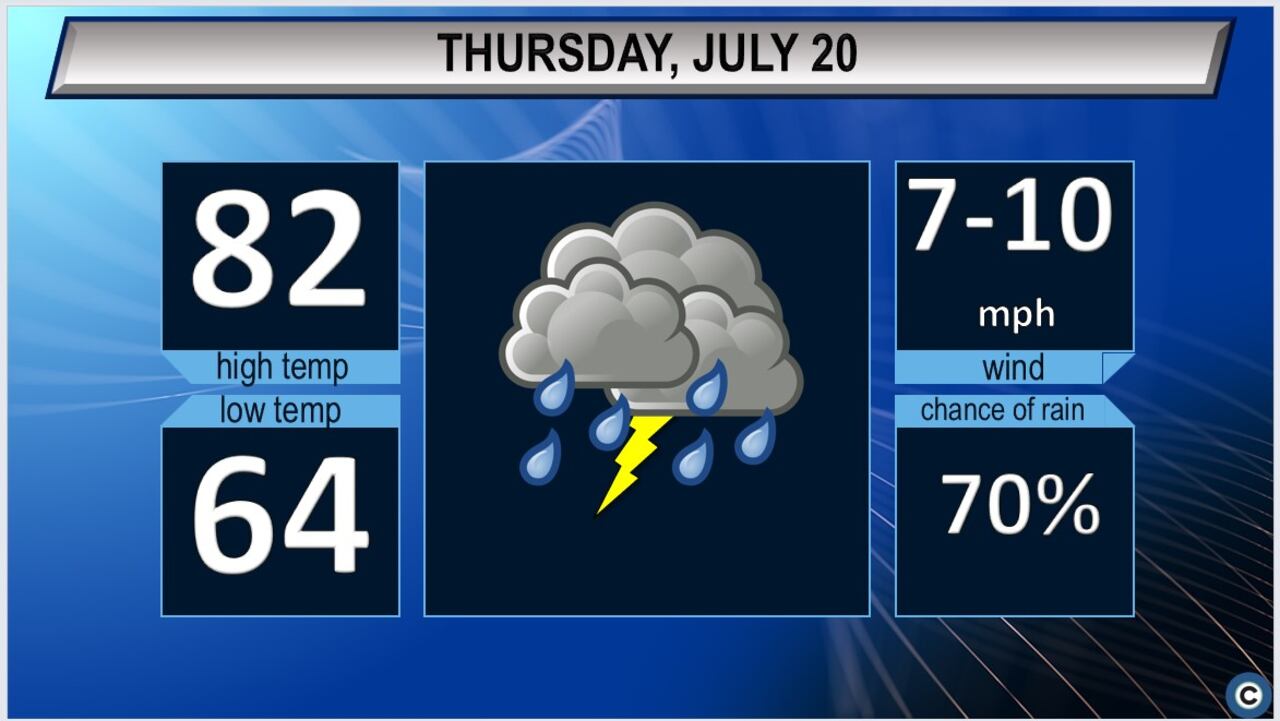

Strong Thunderstorms Expected In Northeast Ohio What You Need To Know

May 31, 2025

Strong Thunderstorms Expected In Northeast Ohio What You Need To Know

May 31, 2025 -

Provincial Regulations The Key To Accelerating Home Construction

May 31, 2025

Provincial Regulations The Key To Accelerating Home Construction

May 31, 2025