U.S. Federal Reserve Holds Steady: Rate Hike Pause Amidst Economic Pressures

Table of Contents

Inflation Remains a Key Concern

Inflation remains a significant headwind for the U.S. economy, prompting careful consideration from the Federal Reserve. While recent data suggests a cooling of inflation, it's still significantly above the Fed's target of 2%. The impact of persistent inflation on consumer spending and business investment is considerable. High prices erode purchasing power, dampening consumer demand and impacting business confidence. This uncertainty makes it challenging for businesses to plan for the future, potentially hindering investment and job creation.

- Current CPI and PPI figures: The Consumer Price Index (CPI) and Producer Price Index (PPI) offer crucial insights into inflation's trajectory. While recent figures show a decline from peak levels, they remain elevated, indicating that inflation hasn't been fully tamed.

- Impact on consumer confidence: High inflation erodes consumer confidence, leading to decreased spending and a potential slowdown in economic activity.

- Analysis of core inflation: Core inflation, which excludes volatile food and energy prices, provides a clearer picture of underlying inflationary pressures. Monitoring core inflation helps the Fed gauge the persistence of inflationary trends.

- Potential future inflation scenarios: Economists offer varying predictions about future inflation, with some suggesting a sustained decline, while others anticipate lingering inflationary pressures.

- Related keywords: inflation rate, CPI, PPI, consumer price index, producer price index, inflation targeting, core inflation.

Economic Growth Slows, Raising Concerns

The U.S. economy is exhibiting signs of slowing growth, adding another layer of complexity to the Federal Reserve's decision-making process. While the unemployment rate remains relatively low, GDP growth has decelerated, raising concerns about a potential recession or a "soft landing." Global economic uncertainties, including supply chain disruptions and geopolitical risks, further complicate the picture.

- Recent GDP growth figures: Recent GDP growth figures reveal a slowdown from previous quarters, highlighting the fragility of the current economic expansion.

- Unemployment rate and job creation data: While unemployment remains low, the rate of job creation has also slowed, suggesting a potential cooling of the labor market.

- Impact of supply chain disruptions: Lingering supply chain issues continue to exert upward pressure on prices and constrain economic growth.

- Geopolitical risks and their influence: Geopolitical instability can significantly impact the global economy, creating uncertainty and potentially hindering economic growth in the U.S.

- Related keywords: GDP growth, economic growth, recession, soft landing, unemployment rate, global economy, supply chain disruptions.

The Federal Reserve's Reasoning Behind the Pause

The Federal Reserve's decision to pause interest rate hikes reflects a data-driven approach. The Fed's official statement acknowledged the cooling inflation trend, but also emphasized the need to monitor incoming data carefully. This pause offers the Fed valuable time to assess the cumulative impact of previous rate increases on inflation and economic growth.

- Quote from the Federal Reserve's statement: The official statement from the Federal Open Market Committee (FOMC) provides crucial insights into the rationale behind the pause.

- Discussion of the Federal Open Market Committee (FOMC) meeting: The FOMC meeting minutes shed light on the discussions and deliberations that led to the decision.

- Analysis of the Fed's forward guidance: The Fed's forward guidance, indicating future policy intentions, provides clues about potential future interest rate adjustments.

- Potential future interest rate adjustments: While the current decision is a pause, the possibility of future rate increases or decreases remains open, depending on evolving economic conditions.

- Related keywords: Federal Open Market Committee (FOMC), monetary policy, interest rate decision, quantitative easing, forward guidance, rate hike pause.

Market Reactions and Future Outlook

The market's response to the Federal Reserve's decision has been mixed. While some sectors reacted positively to the pause, others remain cautious. The stock market experienced a moderate increase following the announcement, while bond yields reacted differently depending on their maturity. The U.S. dollar also experienced fluctuations in response to this news.

- Stock market performance following the announcement: The stock market’s response reflects investor sentiment regarding the implications of the pause for corporate earnings and future economic growth.

- Changes in bond yields: Bond yields generally react inversely to interest rate decisions, reflecting expectations about future interest rate adjustments.

- Impact on the US dollar exchange rate: The value of the US dollar can be impacted by interest rate decisions, influencing international trade and investment flows.

- Expert opinions and forecasts: Economic experts offer varied opinions on the likely future trajectory of interest rates and their impact on various market sectors.

- Related keywords: stock market, bond yields, US dollar, market reaction, economic forecast, interest rate futures.

Conclusion: Understanding the Federal Reserve's Rate Hike Pause

The Federal Reserve's decision to hold steady on interest rates reflects a careful assessment of current economic conditions. While inflation is cooling, it remains above the Fed's target, and economic growth has slowed, creating uncertainty. The pause allows the Fed time to evaluate the cumulative effects of prior rate hikes and gather more data before determining its next course of action. This decision's significance for the U.S. economy cannot be overstated. The interplay between inflation, economic growth, and monetary policy will continue to shape the economic landscape in the coming months. To stay informed about future Federal Reserve decisions and their impact on the economy, follow relevant news sources and subscribe to updates on the Federal Reserve's interest rates and monetary policy. Understanding these complexities is crucial for navigating the ever-evolving economic environment.

Featured Posts

-

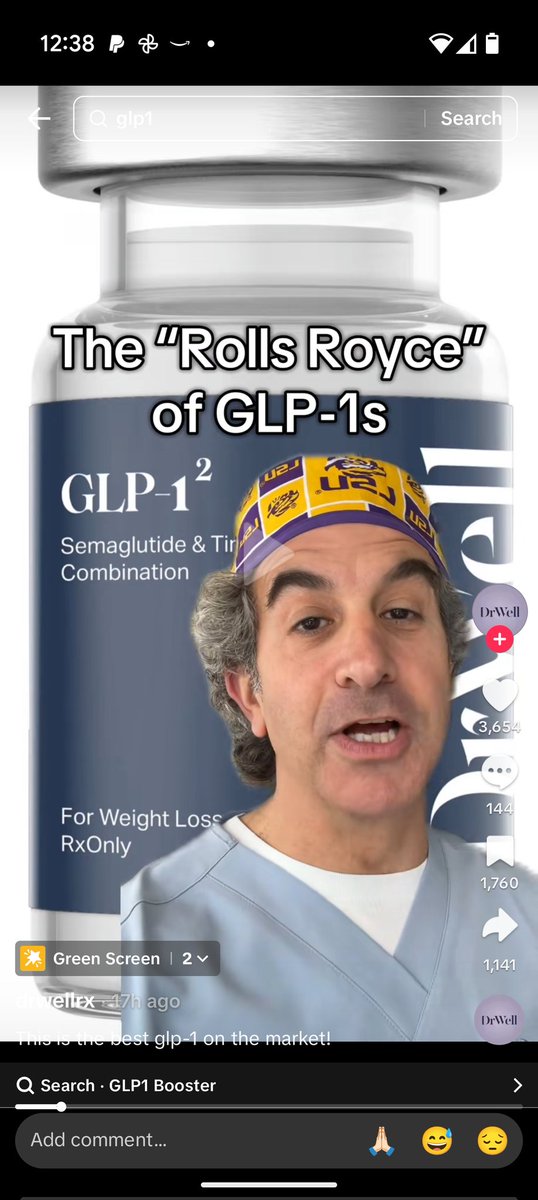

Weight Watchers Files For Bankruptcy Impact Of Weight Loss Drugs Explored

May 10, 2025

Weight Watchers Files For Bankruptcy Impact Of Weight Loss Drugs Explored

May 10, 2025 -

Family Devastated Unprovoked Racist Killing Leaves Loved Ones Broken

May 10, 2025

Family Devastated Unprovoked Racist Killing Leaves Loved Ones Broken

May 10, 2025 -

Dijon Ou Donner Ses Cheveux

May 10, 2025

Dijon Ou Donner Ses Cheveux

May 10, 2025 -

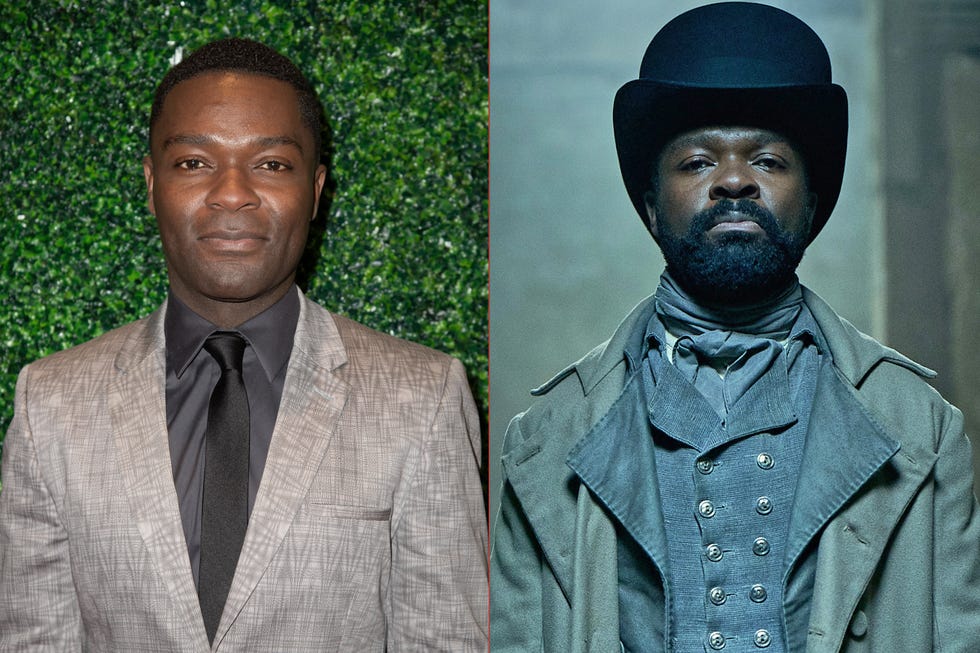

Les Miserables Cast May Boycott Trumps Kennedy Center Appearance

May 10, 2025

Les Miserables Cast May Boycott Trumps Kennedy Center Appearance

May 10, 2025 -

Identifying Emerging Business Hubs Across The Country

May 10, 2025

Identifying Emerging Business Hubs Across The Country

May 10, 2025