Uber Investment: Potential Returns And Risks

Table of Contents

Potential Returns of Uber Investment

Uber's success isn't just a matter of speculation; it's built on a foundation of significant market share and ambitious growth strategies. Understanding these factors is key to assessing the potential returns of an Uber investment.

Market Dominance and Growth

Uber's global reach and market dominance in ride-hailing are undeniable. This strong market position, coupled with its expansion into complementary services like Uber Eats, Uber Freight, and micromobility options, creates significant potential for future growth.

- Global Reach: Uber operates in numerous countries worldwide, providing a diversified revenue stream less susceptible to regional economic downturns.

- Increased Market Penetration: Further penetration within existing markets and expansion into underserved areas present significant growth opportunities for Uber stock returns.

- New Market Expansion: Uber continues to explore and enter new markets, extending its reach and revenue potential.

- Technological Innovation: Uber's continuous investment in technology drives efficiency and improves the user experience, contributing to growth. This makes an Uber Eats investment particularly compelling for those focused on tech-driven businesses.

Technological Innovation and Future Potential

Uber's investment in cutting-edge technologies like autonomous vehicles and electric vehicles positions it for long-term success and potentially massive returns.

- Cost Reduction: Autonomous vehicles have the potential to significantly reduce operational costs, increasing profitability.

- Increased Efficiency: Technological advancements lead to improved dispatch systems, optimized routes, and a smoother user experience.

- First-Mover Advantage: Uber's early adoption of autonomous vehicle technology could provide a significant competitive advantage.

- Disruption of Traditional Transportation: Uber's innovation disrupts traditional transportation models, opening new markets and revenue streams. This makes investing in the future of ride-sharing a particularly attractive proposition.

Diversification and Revenue Streams

Uber's diversified revenue streams beyond ride-hailing mitigate risk and enhance profitability. Uber Eats, in particular, has become a significant contributor.

- Reduced Reliance on a Single Revenue Source: The success of Uber Eats provides a buffer against fluctuations in ride-hailing demand. This diversified investment portfolio approach minimizes risk.

- Synergistic Growth: The integration of various services, such as ride-hailing and food delivery, creates opportunities for synergistic growth and increased customer engagement. This potential for Uber Eats profitability further enhances the overall investment appeal.

- Advertising Revenue: Uber's platform provides opportunities for targeted advertising, generating additional revenue streams.

Risks Associated with Uber Investment

While the potential returns are significant, investing in Uber also carries substantial risks that must be carefully considered.

Regulatory Hurdles and Legal Challenges

Uber faces ongoing legal battles and regulatory challenges in various jurisdictions, creating uncertainty and potential financial liabilities.

- Driver Classification Debates: The ongoing debate about driver classification as employees or independent contractors poses significant legal and financial risks.

- Licensing Issues: Navigating complex licensing and regulatory requirements in different regions can be costly and time-consuming.

- Competition from Rivals: Intense competition from established players like Lyft and emerging competitors creates pressure on pricing and market share.

- Potential for Fines and Legal Settlements: Negative legal outcomes could significantly impact Uber's financial performance. Understanding Uber regulatory risks is crucial for any investor.

Intense Competition and Market Saturation

The ride-sharing market is becoming increasingly saturated, leading to intense competition and potential pressure on profit margins.

- Price Wars: Competitive pressure can lead to price wars, reducing profitability and impacting Uber's stock price.

- Market Share Battles: Competition for market share requires significant investment in marketing and technology, impacting profitability.

- Declining Profit Margins: Increased competition and market saturation could lead to declining profit margins. Understanding Uber competition is vital for assessing investment viability.

Economic Volatility and Market Sentiment

Uber's stock price is susceptible to broader economic factors and investor sentiment.

- Sensitivity to Economic Downturns: During economic downturns, consumer spending on ride-hailing and food delivery can decrease, impacting Uber's revenue.

- Fluctuations in Fuel Prices: Changes in fuel prices directly affect Uber's operational costs and profitability.

- Impact of Inflation on Consumer Spending: Inflation can reduce consumer discretionary spending, affecting demand for Uber's services. Assessing Uber stock volatility requires careful consideration of macroeconomic factors.

Conclusion

Investing in Uber presents a compelling opportunity for significant returns, driven by market dominance, technological innovation, and diversified revenue streams. However, substantial risks exist, including regulatory hurdles, intense competition, and sensitivity to economic volatility. Before considering an Uber investment, thorough due diligence is essential. Understanding both the potential rewards and the inherent risks is crucial. Consult a financial advisor before making any investment decisions, and remember that any investment, including an Uber investment, involves inherent risk. Carefully weigh the potential benefits against the potential drawbacks before committing your capital.

Featured Posts

-

Kanye West Bianca Censori A Spanish Reunion

May 18, 2025

Kanye West Bianca Censori A Spanish Reunion

May 18, 2025 -

Daily Lotto Results 30th April 2025 Wednesday

May 18, 2025

Daily Lotto Results 30th April 2025 Wednesday

May 18, 2025 -

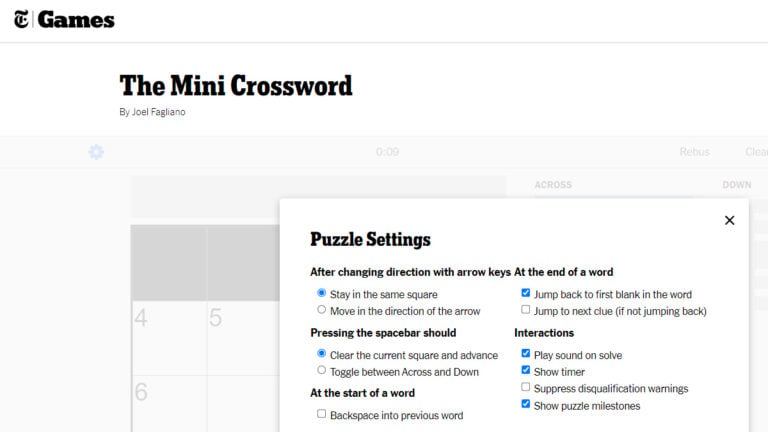

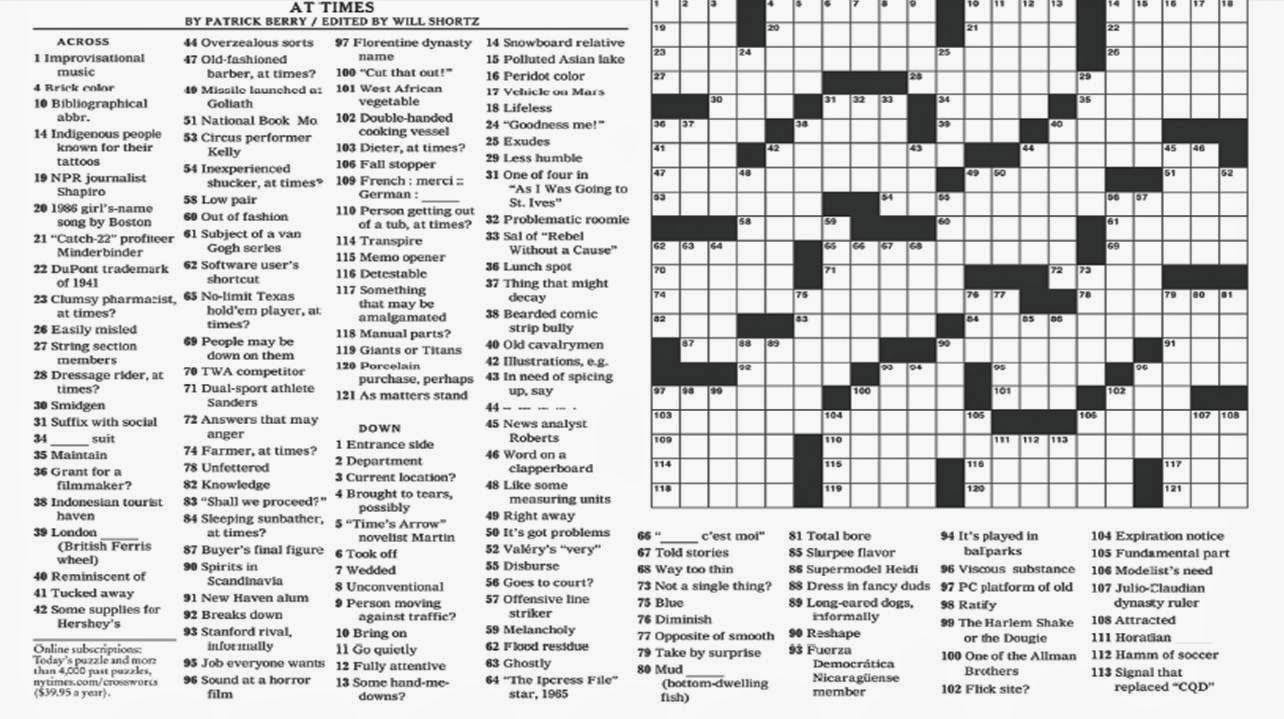

Solve The Nyt Mini Crossword March 13 2025 Answers And Hints

May 18, 2025

Solve The Nyt Mini Crossword March 13 2025 Answers And Hints

May 18, 2025 -

Office365 Executive Inbox Hacks Result In Multi Million Dollar Theft

May 18, 2025

Office365 Executive Inbox Hacks Result In Multi Million Dollar Theft

May 18, 2025 -

Meo Kalorama 2025 Lineup Pet Shop Boys Fka Twigs Jorja Smith And Father John Misty Lead The Charge

May 18, 2025

Meo Kalorama 2025 Lineup Pet Shop Boys Fka Twigs Jorja Smith And Father John Misty Lead The Charge

May 18, 2025

Latest Posts

-

Nyt Mini Crossword Help March 5 2025 Answers And Clues

May 18, 2025

Nyt Mini Crossword Help March 5 2025 Answers And Clues

May 18, 2025 -

Nyt Mini Crossword Answers For February 26 2025

May 18, 2025

Nyt Mini Crossword Answers For February 26 2025

May 18, 2025 -

Nyt Mini Crossword Clues And Solutions March 26 2025

May 18, 2025

Nyt Mini Crossword Clues And Solutions March 26 2025

May 18, 2025 -

Nyt Mini Crossword February 27 2025 Solutions And Clues

May 18, 2025

Nyt Mini Crossword February 27 2025 Solutions And Clues

May 18, 2025 -

Nyt Mini Crossword Clues And Answers March 12 2025

May 18, 2025

Nyt Mini Crossword Clues And Answers March 12 2025

May 18, 2025