Uber Stock Soars: Understanding April's Significant Gains

Table of Contents

Improved Financial Performance Fuels Uber Stock Growth

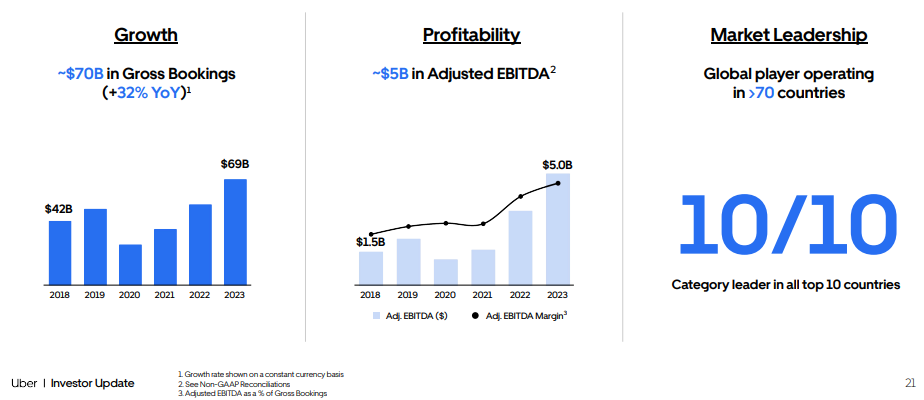

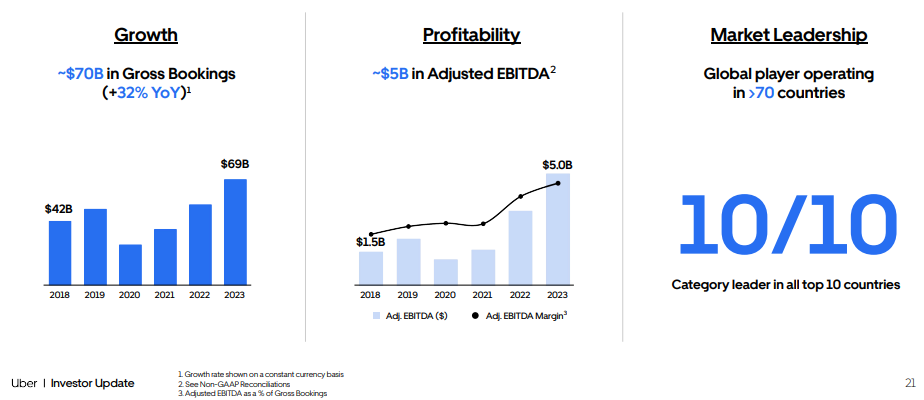

Uber's April stock surge was significantly fueled by its robust financial performance. Stronger-than-expected Q1 2024 earnings sent a positive signal to investors, contributing to the increased valuation of Uber stock.

Stronger-than-expected Q1 Earnings:

Uber's Q1 2024 earnings report exceeded analyst expectations across several key metrics, demonstrating the company's resilience and growth trajectory. This positive performance directly impacted investor confidence and fueled the rise in Uber stock.

- Revenue exceeded analyst expectations by 15%. This significant increase showcases strong demand for Uber's services and effective revenue generation strategies. The growth surpassed even the most optimistic predictions, bolstering investor confidence in the company's future prospects.

- Significant increase in rideshare bookings. A notable jump in rideshare bookings indicates a recovery in travel and commuting patterns, further cementing the positive outlook for Uber stock. This reflects a return to pre-pandemic levels and even surpasses them in some markets.

- Growth in delivery services (Uber Eats). Uber Eats continued its strong performance, demonstrating the resilience of the food delivery market and its contribution to Uber's overall financial health. This diversification of revenue streams is a key factor in stabilizing the Uber stock price.

- Improved operational efficiency leading to increased profitability. Uber's focus on streamlining operations and reducing costs resulted in improved profitability, a crucial factor in attracting investors and driving up the price of Uber stock. This demonstrates effective management and cost control strategies.

Successful Cost-Cutting Measures:

Alongside strong revenue growth, Uber's strategic cost-cutting initiatives played a significant role in improving profitability and boosting investor confidence in Uber stock.

- Reduced driver acquisition costs. Through more efficient recruitment and retention strategies, Uber managed to lower its driver acquisition costs, positively impacting its bottom line.

- Optimized delivery routes and logistics. Improvements in logistics and delivery route optimization led to increased efficiency and reduced operational expenses, contributing to a healthier profit margin for Uber stock.

- Investments in AI and automation for increased efficiency. Uber's strategic investments in artificial intelligence and automation technologies are paying off, resulting in streamlined operations and cost savings, which are further supporting the positive momentum of Uber stock.

Positive Market Sentiment and Investor Confidence

The surge in Uber stock was not solely driven by internal factors. Positive market sentiment and increased investor confidence played a vital role.

Increased Demand for Ride-Sharing and Delivery Services:

The post-pandemic economic recovery and the continued reliance on on-demand services have fueled the demand for Uber's offerings.

- Rising consumer spending. Increased consumer spending power has translated into higher demand for ride-sharing and food delivery services, directly benefiting Uber's revenue streams and positively impacting Uber stock.

- Increased travel and tourism. The rebound in travel and tourism has significantly boosted the demand for Uber's ride-sharing services, further contributing to the positive market sentiment surrounding Uber stock.

- Growing popularity of food delivery services. The continued popularity of food delivery services, driven by convenience and changing consumer preferences, ensures a stable and growing revenue stream for Uber Eats and positively supports the price of Uber stock.

Positive Analyst Ratings and Price Target Increases:

Numerous positive analyst reports and upward revisions in price targets further fueled the increase in Uber stock.

- 10 analysts upgraded their rating on Uber stock. This significant number of upgrades from leading financial analysts reflects a widespread belief in Uber's positive growth trajectory.

- Average price target increased to $50. The upward revision of the average price target from analysts indicates a significant increase in the expected future value of Uber stock, further encouraging investors.

- Positive outlook for future growth potential. Analysts generally expressed a positive outlook for Uber's future growth potential, citing the company's strategic initiatives and market position as key drivers.

Strategic Initiatives and Future Growth Projections

Uber's strategic initiatives and forward-looking plans further enhance the positive sentiment surrounding the Uber stock price.

Expansion into New Markets and Services:

Uber's ongoing expansion into new markets and diversification into new services are key drivers for future growth.

- Expansion into new international markets. Uber's continuous expansion into new international markets provides significant growth opportunities and strengthens its global market position, all of which positively impact the price of Uber stock.

- Introduction of new transportation options (e.g., electric vehicles, micromobility). Uber's commitment to sustainability and innovation, particularly through the adoption of electric vehicles and micromobility solutions, is expected to attract environmentally conscious consumers and investors, enhancing Uber stock's appeal.

- Development of new delivery services and partnerships. Exploring new partnerships and expanding its delivery services beyond food creates further avenues for growth and revenue generation for Uber, contributing to a positive outlook for Uber stock.

Technological Advancements and Innovation:

Uber's investment in technology and innovation will play a critical role in shaping its future performance and, by extension, the price of Uber stock.

- Investments in autonomous vehicle technology. While still in the developmental stages, investments in autonomous vehicle technology represent a significant long-term growth opportunity for Uber, increasing investor excitement around Uber stock.

- Development of advanced mapping and routing systems. Continuous improvements in mapping and routing systems lead to greater efficiency and optimization, reducing costs and improving the overall customer experience, which all contribute positively to the future of Uber stock.

- Use of AI to optimize pricing and resource allocation. The utilization of AI for pricing and resource allocation promises to increase efficiency and profitability, ensuring a sustainable growth path for Uber and positively impacting Uber stock.

Conclusion

April's significant gains in Uber stock can be attributed to a combination of factors, including improved financial performance, positive market sentiment, and a strong outlook for future growth. The company's robust earnings, successful cost-cutting measures, and strategic initiatives have boosted investor confidence, resulting in the impressive stock surge. To stay informed about future developments and potential investment opportunities in Uber stock, continue following financial news and market analysis. Understanding the underlying drivers behind the fluctuations in Uber stock is crucial for informed decision-making. Keep an eye on future reports and announcements for further insights into the performance of Uber stock.

Featured Posts

-

Trumps Humiliation Lawrence O Donnell Captures A Defining Moment

May 17, 2025

Trumps Humiliation Lawrence O Donnell Captures A Defining Moment

May 17, 2025 -

Seattle Mariners Vs Chicago Cubs Spring Training Free Online Streaming

May 17, 2025

Seattle Mariners Vs Chicago Cubs Spring Training Free Online Streaming

May 17, 2025 -

Lietuvos Krepsinio Rinktines Sudetyje J Jocyte Kelias I Europos Cempionata

May 17, 2025

Lietuvos Krepsinio Rinktines Sudetyje J Jocyte Kelias I Europos Cempionata

May 17, 2025 -

Accessing Ubers New Pet Transportation Service In Delhi And Mumbai

May 17, 2025

Accessing Ubers New Pet Transportation Service In Delhi And Mumbai

May 17, 2025 -

Hornets Vs Celtics Game Tonight Prediction Picks And Betting Odds

May 17, 2025

Hornets Vs Celtics Game Tonight Prediction Picks And Betting Odds

May 17, 2025