Uber (UBER) Investment: Potential And Risks

Table of Contents

Potential Benefits of Investing in UBER

H2: Strong Market Position and Growth Potential

Uber boasts a dominant position in the global ride-sharing and food delivery markets. This strong market share, coupled with its aggressive expansion strategies, fuels considerable growth potential.

- Uber's dominance: Uber's brand recognition and extensive network provide a significant competitive advantage, allowing it to capture a substantial portion of the market share in many regions.

- Expanding horizons: Uber isn't resting on its laurels. The company continues to expand into new markets and services, including freight transportation (Uber Freight) and autonomous vehicles, broadening its revenue streams and growth opportunities. This strategic diversification contributes to overall market share growth.

- Global reach: Uber operates across numerous countries worldwide, providing a significant buffer against economic downturns in specific regions. International expansion remains a key driver of future growth for Uber stock.

- Market share growth: Analysts predict continued growth in the ride-sharing and food delivery sectors, positioning Uber for further market share gains and revenue expansion. This potential for increased market share is a significant draw for investors interested in Uber growth.

H2: Technological Innovation and Future Opportunities

Uber's commitment to technological innovation is a key factor driving its potential for future success.

- Autonomous vehicle technology: Uber's significant investments in autonomous vehicle technology could revolutionize its operations, significantly reducing costs and improving efficiency. The successful integration of self-driving cars into its fleet could dramatically impact Uber's profitability and shareholder returns.

- Enhanced user experience: Continuous development of new technologies and features enhances the user experience, attracting and retaining customers. Improvements in navigation, payment systems, and safety features contribute to customer loyalty and overall platform success.

- Opportunities in emerging markets: Uber is strategically targeting emerging markets with high growth potential, expanding its customer base and revenue streams. This expansion into underserved areas provides significant opportunities for long-term growth.

- Efficiency and cost reduction: Technology plays a crucial role in improving operational efficiency and reducing costs. Optimizing routes, managing driver assignments, and leveraging data analytics contribute to increased profitability. This efficiency is crucial for long-term Uber growth.

H2: Diversification of Revenue Streams

Uber's diverse revenue streams mitigate risk and enhance its overall financial stability.

- Multiple revenue channels: Uber generates revenue from ride-sharing, Uber Eats (food delivery), Uber Freight (freight transportation), and other emerging services. This diversification reduces reliance on any single business unit.

- Synergies between units: The different business units can leverage each other's infrastructure and customer base, creating synergistic effects and driving efficiency. For example, Uber Eats drivers can also pick up ride-share requests, maximizing utilization and improving profitability.

- Reduced risk profile: The diversification of revenue streams mitigates the risk associated with dependence on a single market or service. This stability is attractive to investors seeking a lower-risk investment.

Risks Associated with Investing in UBER

H2: Intense Competition and Market Saturation

The ride-sharing and food delivery markets are fiercely competitive, posing significant risks to Uber's dominance.

- Fierce competition: Uber faces stiff competition from established players like Lyft, DoorDash, and other regional competitors, forcing it to constantly innovate and maintain a competitive edge. This competition can negatively impact profitability and market share.

- Regulatory scrutiny: Uber operates under intense regulatory scrutiny globally, facing legal challenges and potential changes in regulations that could negatively impact its business model and profitability. This regulatory uncertainty is a significant risk factor for investors.

- Market saturation: In some mature markets, the ride-sharing and food delivery sectors are experiencing market saturation, limiting further growth potential. This limits opportunities for expanding market share and necessitates a focus on efficiency and cost optimization.

H2: Financial Performance and Profitability

Uber has historically struggled to achieve consistent profitability, a major concern for potential investors.

- Past losses: Uber has reported substantial losses in the past, raising concerns about its long-term financial sustainability. Sustained profitability remains a challenge, requiring continuous operational improvements and cost optimization.

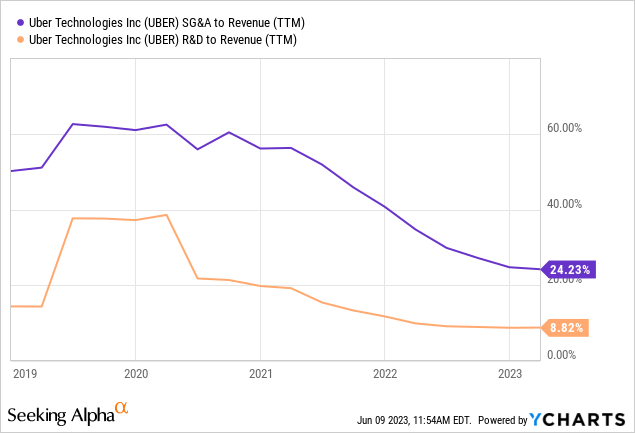

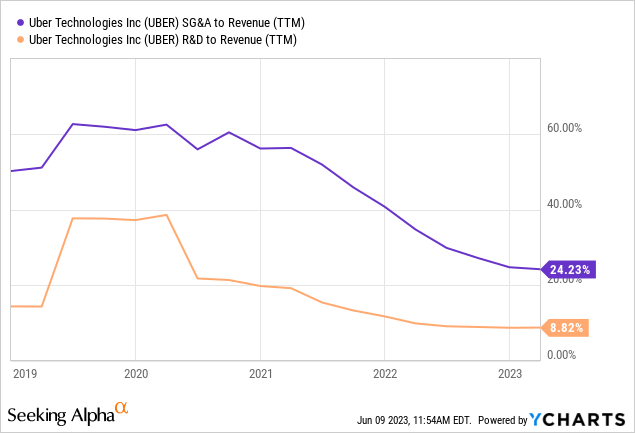

- High operating costs: Uber incurs significant operating costs, including driver compensation, marketing expenses, and technology infrastructure, impacting profitability. Managing these costs efficiently is crucial for future financial success.

- Fuel price volatility: Fluctuations in fuel prices significantly impact Uber's operational costs, making profitability difficult to predict. Fuel price volatility is an external risk factor that cannot be easily controlled.

H2: Regulatory Uncertainty and Legal Risks

Uber faces various legal and regulatory challenges across different jurisdictions, creating uncertainty for investors.

- Ongoing legal battles: Uber has been involved in numerous legal battles concerning driver classification, labor laws, and other regulatory issues, creating uncertainty and potential liabilities. These legal battles can significantly impact the company's financials and reputation.

- Changing regulations: Changes in regulations regarding driver classification, data privacy, and other areas could significantly impact Uber's business model and profitability. Adapting to these changing regulations requires substantial investments and resources.

- Driver classification issues: The classification of drivers as independent contractors versus employees is a major legal and regulatory challenge, potentially leading to significant cost increases and operational disruptions.

Conclusion: Making Informed Decisions about Your UBER Investment

Investing in Uber (UBER) presents both significant potential benefits and substantial risks. The company's strong market position, technological innovation, and diversified revenue streams offer compelling reasons for optimism. However, intense competition, financial performance concerns, and regulatory uncertainty must be carefully considered. Before investing in Uber, it's crucial to conduct thorough due diligence, including analyzing its financial statements, understanding its competitive landscape, and assessing the potential impact of regulatory changes. Assess your Uber investment strategy carefully, considering your personal risk tolerance and investment goals. Understanding the risks of Uber stock is paramount to making informed investment decisions. Only after careful research and consideration should you proceed with an Uber investment.

Featured Posts

-

Fsu Shooting Victims Family History A Cuban Exiles Cia Past

May 19, 2025

Fsu Shooting Victims Family History A Cuban Exiles Cia Past

May 19, 2025 -

Find The Best Southern Food In Orlando A Foodies Selection

May 19, 2025

Find The Best Southern Food In Orlando A Foodies Selection

May 19, 2025 -

Uber Pet Policy Mumbai Everything You Need To Know Before You Go

May 19, 2025

Uber Pet Policy Mumbai Everything You Need To Know Before You Go

May 19, 2025 -

Rave Events And Their Economic Contributions A Detailed Look

May 19, 2025

Rave Events And Their Economic Contributions A Detailed Look

May 19, 2025 -

Why Did Uber Stock Jump Double Digits In April

May 19, 2025

Why Did Uber Stock Jump Double Digits In April

May 19, 2025

Latest Posts

-

Florida State University Shooting Details Emerge About Victims Family Background

May 19, 2025

Florida State University Shooting Details Emerge About Victims Family Background

May 19, 2025 -

Morales Winning Streak Continues Another Bonus At Ufc Vegas 106

May 19, 2025

Morales Winning Streak Continues Another Bonus At Ufc Vegas 106

May 19, 2025 -

The Fsu Shooting A Tragedy Linked To A Cia Operatives Legacy

May 19, 2025

The Fsu Shooting A Tragedy Linked To A Cia Operatives Legacy

May 19, 2025 -

Ufc Vegas 106 Morales Secures Second Consecutive Bonus

May 19, 2025

Ufc Vegas 106 Morales Secures Second Consecutive Bonus

May 19, 2025 -

Florida State University Shooting Unveiling The Victims Family Connections

May 19, 2025

Florida State University Shooting Unveiling The Victims Family Connections

May 19, 2025