Uber's Autonomous Vehicle Push: Investing In The Future With ETFs

Table of Contents

Uber's Investment in Autonomous Driving Technology

Uber's journey into self-driving technology began with the acquisition of Otto, a self-driving truck startup, in 2016. This marked a significant step towards its ambitious goal of deploying a fully autonomous ride-hailing service. Uber's Advanced Technologies Group (ATG) spearheaded the development of its self-driving car technology, conducting extensive road testing and data collection.

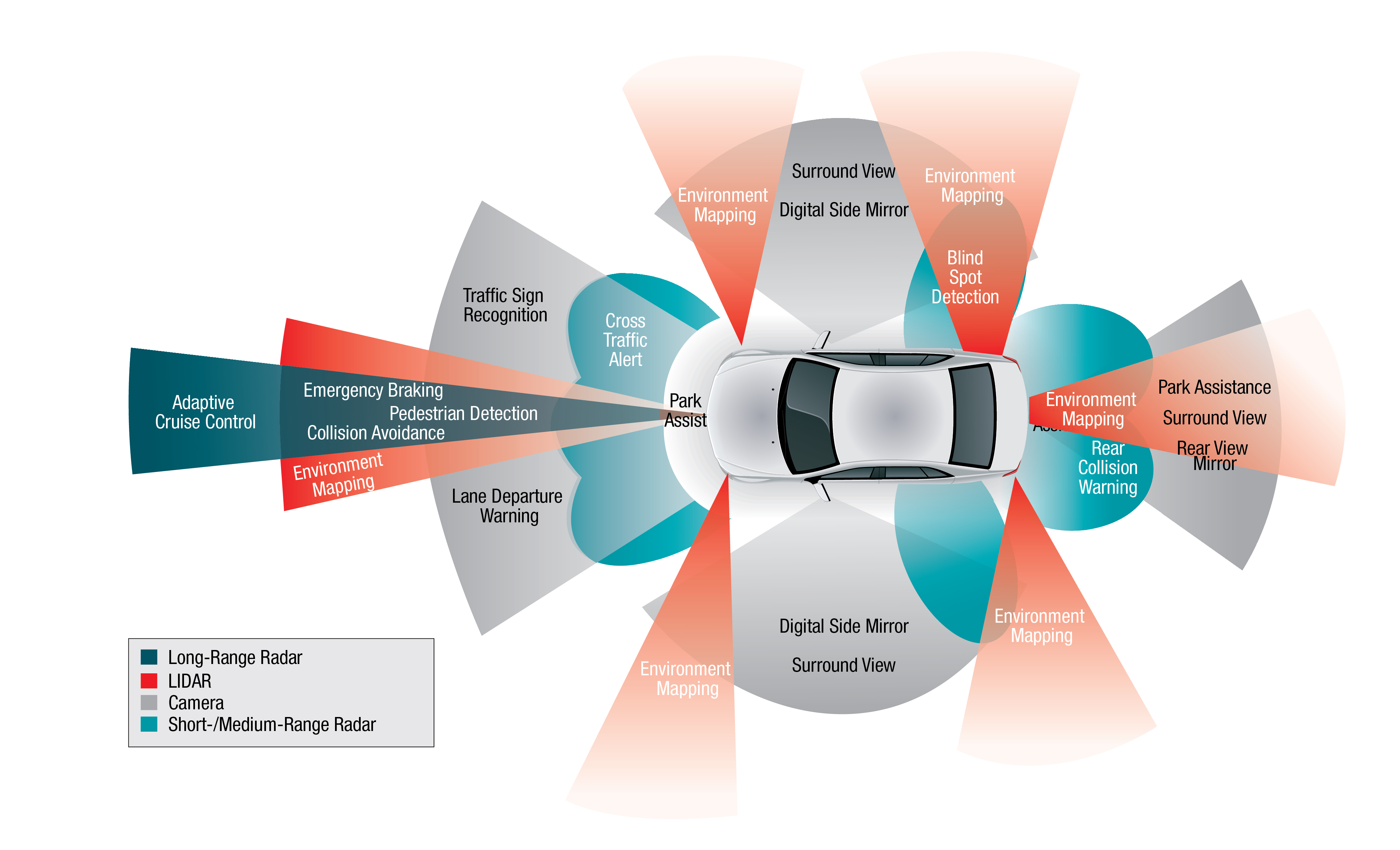

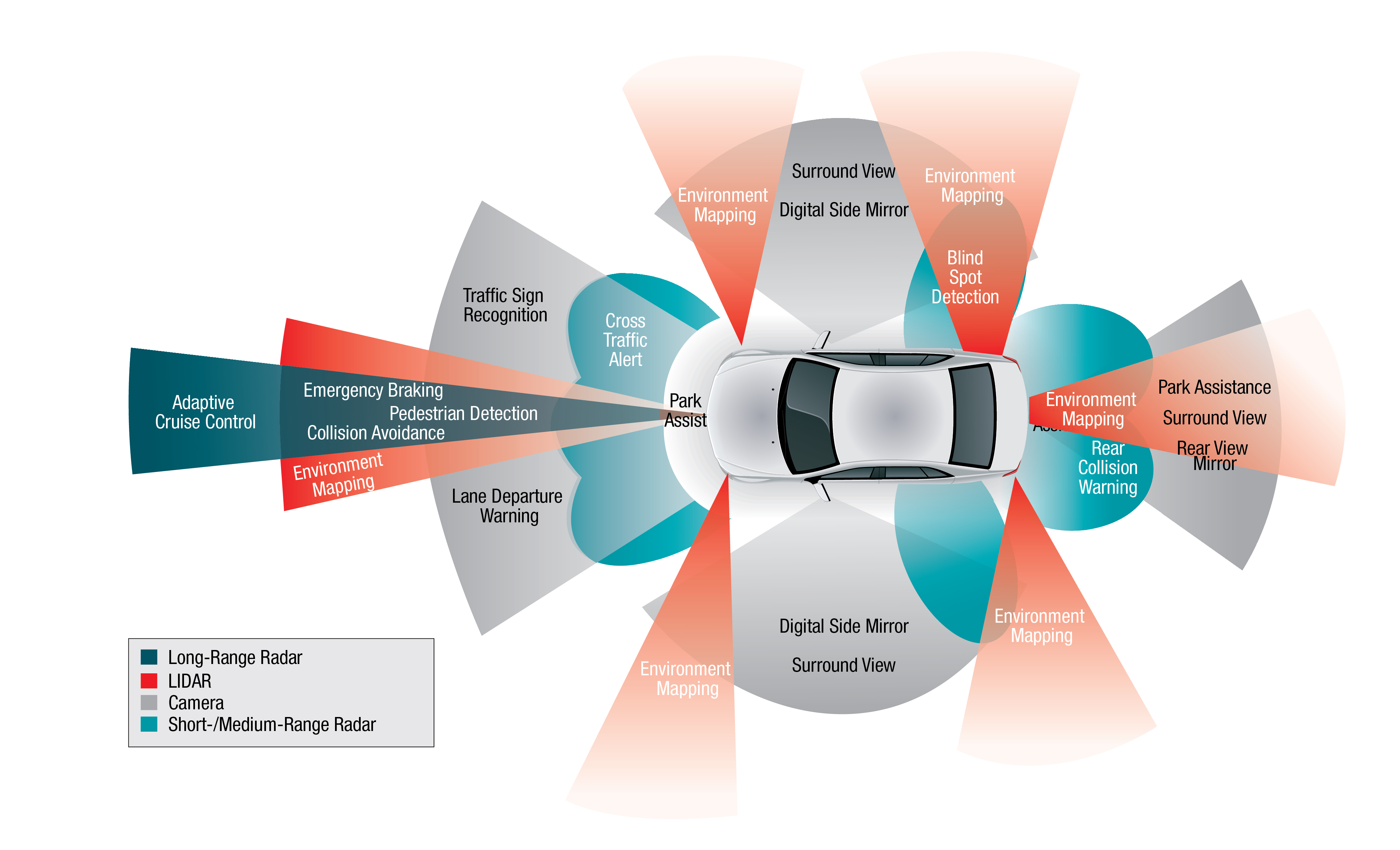

- Key Partnerships and Collaborations: Uber ATG has collaborated with various companies in the autonomous driving space, including mapping providers and sensor manufacturers, to leverage expertise and accelerate development.

- Significant Milestones: Uber ATG achieved milestones such as millions of miles of autonomous driving tests, demonstrating progress in its technology's capabilities and safety features.

- Challenges Faced: The development of autonomous driving technology has presented considerable challenges for Uber, including regulatory hurdles related to testing and deployment, and addressing public safety concerns surrounding autonomous vehicle accidents. These challenges underscore the inherent risks associated with investing in this sector.

Understanding Autonomous Vehicle ETFs

Exchange Traded Funds (ETFs) are investment funds traded on stock exchanges, offering investors a diversified portfolio of assets. They provide a cost-effective and convenient way to gain exposure to a specific market segment, minimizing the risk associated with investing in individual companies.

- Autonomous Vehicle ETFs Defined: Autonomous vehicle ETFs provide diversified exposure to companies involved in various aspects of the autonomous driving industry, from technology development to automotive manufacturing.

- Types of Companies Included: These ETFs typically include a mix of technology companies developing autonomous driving software and hardware, automotive manufacturers integrating self-driving features into their vehicles, and companies providing supporting infrastructure, such as mapping and sensor technologies.

- Risks Involved: Investing in autonomous vehicle ETFs carries inherent risks. Market volatility, technological setbacks, and regulatory changes can significantly impact the performance of these ETFs. The nascent nature of the industry also introduces considerable uncertainty.

Identifying Promising Autonomous Vehicle ETFs

Several ETFs offer exposure to the autonomous vehicle market. While specific holdings and performance vary, here are a few examples (Note: Always conduct thorough research before investing, and the inclusion of these ETFs does not constitute a recommendation):

-

[Example ETF 1: Ticker Symbol – e.g., DRV]: This ETF focuses on companies directly involved in the development and production of autonomous vehicle technology. Its investment strategy prioritizes companies with strong growth potential in the sector.

-

[Example ETF 2: Ticker Symbol – e.g., AUTO]: This ETF offers broader exposure to the automotive industry, including companies involved in autonomous vehicle development. It might include established automakers alongside technology firms.

-

ETF Comparison and Considerations: When comparing ETFs, consider factors such as expense ratios (the fees charged to manage the fund), historical performance (past performance is not indicative of future results), and the ETF's specific investment strategy and holdings.

Due Diligence and Risk Management

Investing in any ETF, including those focused on autonomous vehicles, requires thorough research and a clear understanding of your own risk tolerance.

- Understanding Your Risk Tolerance: Assess your comfort level with potential losses before investing any significant amount of capital.

- Consulting a Financial Advisor: Seek professional advice from a qualified financial advisor who can help you determine if autonomous vehicle ETFs align with your investment goals and risk profile.

- Portfolio Diversification: Never put all your eggs in one basket. Diversify your investment portfolio across various asset classes to mitigate risk and reduce the impact of any single investment's underperformance.

Conclusion

Uber's commitment to autonomous vehicles represents a significant opportunity for investors. By understanding the technology and strategically investing in autonomous vehicle ETFs, you can gain exposure to this rapidly growing sector. Remember to conduct thorough research and consider your risk tolerance before investing. Don't miss out on the potential of this exciting market; start exploring autonomous vehicle ETFs today!

Featured Posts

-

Hrvatska Na Eurosongu Marko Bosnjak Nosi Zastavu

May 19, 2025

Hrvatska Na Eurosongu Marko Bosnjak Nosi Zastavu

May 19, 2025 -

Ryujinx Switch Emulator Development Ceases Following Nintendo Contact

May 19, 2025

Ryujinx Switch Emulator Development Ceases Following Nintendo Contact

May 19, 2025 -

Jyoti Malhotra Puris Srimandir Visit Espionage Probe And Released Footage

May 19, 2025

Jyoti Malhotra Puris Srimandir Visit Espionage Probe And Released Footage

May 19, 2025 -

Sveriges Svt Redo Att Arrangera Eurovision 2024 Om Kaj Vinner

May 19, 2025

Sveriges Svt Redo Att Arrangera Eurovision 2024 Om Kaj Vinner

May 19, 2025 -

The Palm Springs Fertility Clinic Bombing Key Facts About Suspect Guy Bartkus

May 19, 2025

The Palm Springs Fertility Clinic Bombing Key Facts About Suspect Guy Bartkus

May 19, 2025