Uber's Resilience: Analyzing The Stock's Recession Resistance

Table of Contents

While many companies falter during economic downturns, Uber has demonstrated surprising resilience. This article analyzes Uber's recession resistance, exploring the key factors that contribute to its stock's ability to withstand economic fluctuations. Uber, a global leader in ride-sharing and delivery services, occupies a unique position in the market, offering insights into how businesses can navigate periods of economic uncertainty. This analysis will delve into the multifaceted reasons behind Uber's robust performance, even during times of recession.

Uber's Diversified Revenue Streams as a Recession Hedge:

Uber's success in weathering economic storms is significantly tied to its diverse revenue streams. Unlike companies reliant on single product lines or services, Uber’s diversified business model acts as a natural hedge against economic downturns.

Ride-Sharing's Role: The ride-sharing sector, while cyclical, is not entirely immune to recessionary pressures. Discretionary spending often takes a hit during economic uncertainty, potentially reducing ride-sharing usage.

- Impact of recession on discretionary spending: Consumers may curtail non-essential travel during recessions, leading to decreased demand for ride-sharing services.

- Potential for reduced ride-sharing usage during downturns: This reduction in demand can impact Uber's ride-sharing revenue.

- Uber's strategies to mitigate this impact: Uber employs various strategies to counteract this, including dynamic pricing adjustments, targeted promotions, and increased marketing efforts to attract price-sensitive customers.

Delivery Services (Uber Eats) as a Stabilizer: The food delivery segment, however, showcases remarkable resilience during economic downturns. Even during challenging times, people still require sustenance, and convenience often becomes a higher priority.

- Growth of online food ordering: The trend of ordering food online has been steadily rising, making it less susceptible to economic fluctuations.

- Increased demand for convenience during economic uncertainty: Consumers often seek convenient alternatives to grocery shopping during recessions, boosting demand for Uber Eats.

- The role of Uber Eats in maintaining revenue during slowdowns: Uber Eats has consistently shown robust performance, acting as a crucial revenue stabilizer for the company during economic downturns.

Freight Services (Uber Freight): Uber Freight, the company's logistics arm, benefits from the less volatile nature of freight transportation. The movement of goods remains essential, even during economic contractions.

- Essential nature of goods movement: The transportation of goods is vital for the functioning of the economy, irrespective of the economic climate.

- Resilience of the logistics sector during recessions: The logistics sector is comparatively less impacted by economic downturns than other sectors, providing stability for Uber Freight.

- Uber Freight's contribution to overall revenue stability: This relatively stable revenue stream further enhances Uber's overall resilience to economic shocks.

Cost-Cutting Measures and Operational Efficiency:

Uber's commitment to operational efficiency and cost reduction plays a significant role in its recession resistance. By leveraging technology and optimizing its workforce, Uber effectively mitigates the impact of economic downturns.

Technological Investments: Uber's substantial investment in technology has been pivotal in driving cost efficiencies.

- Algorithmic optimization of routes, driver allocation, and pricing: Sophisticated algorithms optimize routes, driver allocation, and pricing strategies, minimizing operational costs.

- Use of data analytics to improve decision-making: Data analytics aids in informed decision-making, optimizing resource allocation and improving efficiency.

- Automation of certain processes: Automation helps streamline various operations, further reducing manual labor costs.

Workforce Management: The flexible nature of Uber's gig economy model provides inherent resilience.

- Flexibility of the gig economy model: Uber can quickly adjust its driver base based on fluctuating demand, avoiding the costs associated with maintaining a large, fixed workforce.

- Ability to adjust driver numbers based on demand: This flexibility ensures that Uber doesn't incur unnecessary expenses during periods of reduced demand.

- Cost-saving measures related to driver compensation (e.g., incentives, bonuses): Uber can strategically adjust driver compensation packages based on demand, optimizing costs without significantly affecting service levels.

Adaptability and Market Innovation:

Uber’s proactive approach to market innovation and expansion significantly contributes to its resilience. Its willingness to adapt and introduce new services minimizes its dependence on any single revenue stream.

Expansion into New Markets and Services: Uber continually seeks new opportunities for growth.

- Examples of new services introduced (e.g., Uber Health, Uber Connect): Diversification into new sectors, such as healthcare transportation and package delivery, reduces reliance on traditional ride-sharing.

- Geographical expansion into emerging markets: Expanding into new geographical markets diversifies revenue streams and mitigates risk.

- Diversification as a key factor in mitigating risk: This strategy significantly reduces the impact of economic downturns on any single sector.

Strategic Partnerships and Acquisitions: Uber’s strategic partnerships and acquisitions strengthen its market position and competitive advantage.

- Examples of significant partnerships and acquisitions: These collaborations often lead to synergies and expanded market reach.

- Synergies created through these collaborations: Partnerships unlock operational efficiencies and access to new technologies.

- Enhancing competitive advantage: Strategic moves strengthen Uber's competitive position, insulating it against economic shocks.

Conclusion:

Uber's recession resistance stems from a combination of factors: its diversified revenue streams, including the relatively stable freight and food delivery segments; its commitment to technological innovation and operational efficiency; and its proactive approach to market expansion and strategic partnerships. While external economic factors always pose some level of risk, Uber's business model demonstrates remarkable adaptability and resilience. While challenges remain, Uber's strategic positioning suggests a strong ability to navigate future economic uncertainty. By analyzing Uber's recession-proof strategies and its ongoing innovations, investors can gain valuable insights into investing in recession-resistant stocks like Uber. Further research into Uber's stock performance is encouraged to fully assess its potential as a long-term investment, considering Uber's stock resilience as a key factor in your investment decisions.

Featured Posts

-

Amanda Bynes And Rachel Green The Unexpected Comparison Made By Drake Bell

May 18, 2025

Amanda Bynes And Rachel Green The Unexpected Comparison Made By Drake Bell

May 18, 2025 -

Kanye Wests Super Bowl Snub Taylor Swifts Alleged Involvement

May 18, 2025

Kanye Wests Super Bowl Snub Taylor Swifts Alleged Involvement

May 18, 2025 -

Brooklyn Bridge A Critical Review Of Its Structural Integrity

May 18, 2025

Brooklyn Bridge A Critical Review Of Its Structural Integrity

May 18, 2025 -

Uber Pulls Out Of Foodpanda Taiwan Acquisition Regulatory Roadblocks Cited

May 18, 2025

Uber Pulls Out Of Foodpanda Taiwan Acquisition Regulatory Roadblocks Cited

May 18, 2025 -

Neocekivana Pobeda Runea Alkaras Povreden U Finalu Barselone

May 18, 2025

Neocekivana Pobeda Runea Alkaras Povreden U Finalu Barselone

May 18, 2025

Latest Posts

-

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 18, 2025

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 18, 2025 -

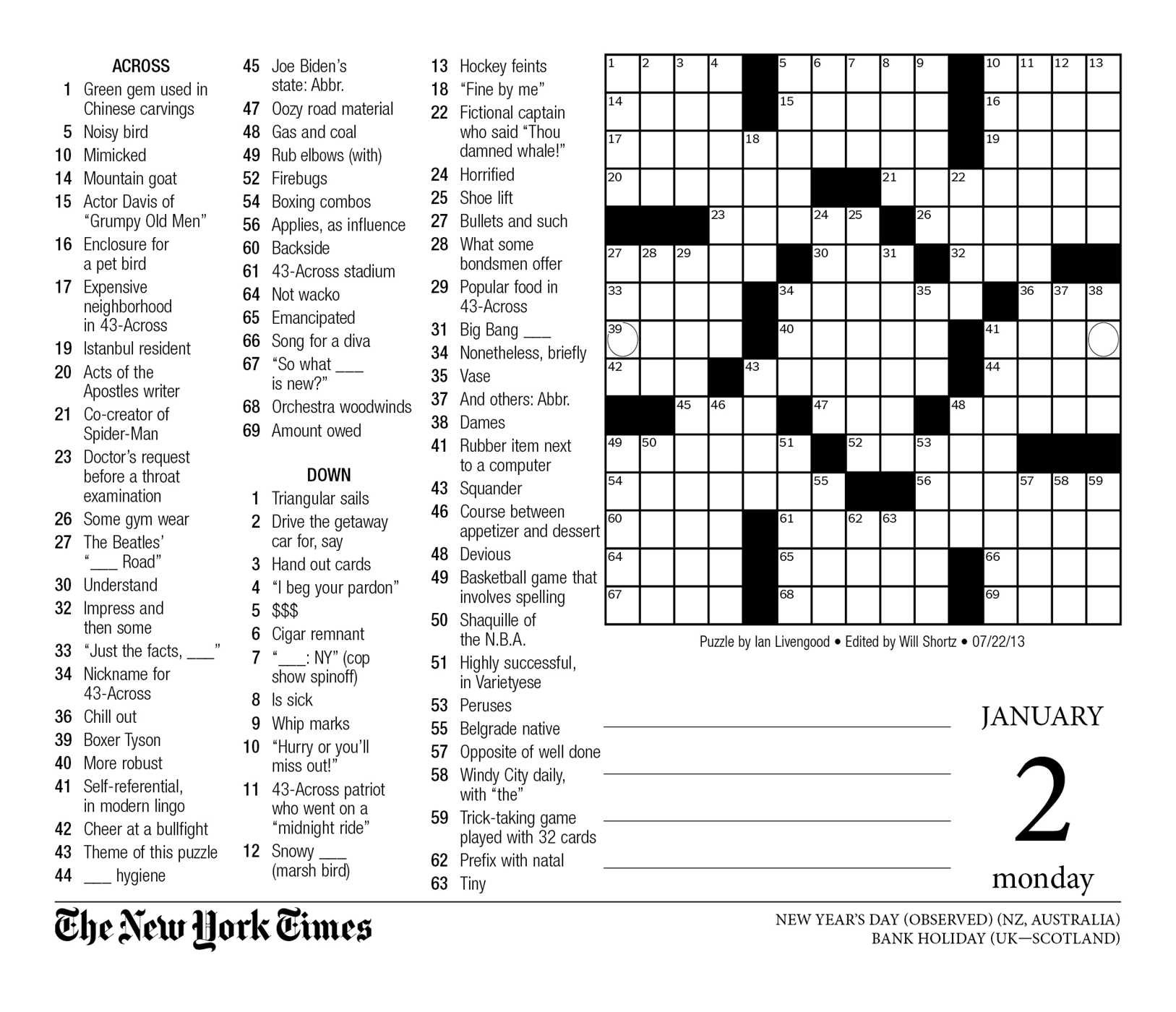

Find Answers To The Nyt Mini Crossword April 18 2025

May 18, 2025

Find Answers To The Nyt Mini Crossword April 18 2025

May 18, 2025 -

Nyt Mini Crossword Answers For Sunday May 11 Complete Guide

May 18, 2025

Nyt Mini Crossword Answers For Sunday May 11 Complete Guide

May 18, 2025 -

Nyt Mini Crossword Solutions And Clues April 18 2025

May 18, 2025

Nyt Mini Crossword Solutions And Clues April 18 2025

May 18, 2025 -

Get The Answers Nyt Mini Crossword For April 18 2025

May 18, 2025

Get The Answers Nyt Mini Crossword For April 18 2025

May 18, 2025