Uber's Self-Driving Gamble: ETF Investing Opportunities

Table of Contents

The Promise and Peril of Autonomous Vehicles

The potential of self-driving cars is undeniable, promising a safer, more efficient, and fundamentally different transportation system. However, significant hurdles remain before this vision becomes a reality.

Market Potential of Self-Driving Technology

The autonomous vehicle market is projected to experience explosive growth in the coming decades. Analysts predict a massive expansion, driven by increasing demand for ride-sharing services, last-mile delivery solutions, and the overall modernization of transportation. This technological leap isn't limited to Uber; key players like Waymo (Alphabet's self-driving car project), Tesla, and numerous other startups are vying for dominance. The potential impact spans multiple industries:

- Logistics: Autonomous trucks could revolutionize freight transportation, increasing efficiency and reducing costs.

- Transportation: Ride-hailing services, like Uber and Lyft, stand to benefit significantly from lower operational costs and increased capacity.

- Personal Transportation: Self-driving cars could provide greater accessibility for the elderly and people with disabilities.

Increased efficiency, reduced accidents, and entirely new transportation models are just some of the potential benefits of widespread autonomous vehicle adoption.

Technological and Regulatory Hurdles

Despite the promise, significant challenges hinder the widespread adoption of self-driving cars:

- Software Development: Creating truly reliable and safe autonomous driving software is incredibly complex and requires overcoming numerous unforeseen scenarios.

- Sensor Limitations: Sensors, like lidar and cameras, are crucial for self-driving cars, but their performance can be affected by weather conditions and other environmental factors.

- Legal Liabilities: Determining liability in the event of an accident involving an autonomous vehicle presents complex legal challenges.

- Public Acceptance: Overcoming public concerns about safety and trust in autonomous technology is crucial for widespread adoption.

These technological and regulatory hurdles represent substantial risks that investors need to consider.

Identifying Relevant ETFs for Exposure

Investing directly in individual self-driving companies can be risky and complex. ETFs offer a more diversified approach to gain exposure to this burgeoning sector.

Technology Sector ETFs

Broad technology ETFs provide indirect exposure to companies involved in the development of autonomous vehicle technology. These ETFs typically hold shares of major technology companies that are either directly involved in the development of autonomous driving technology or indirectly benefit from its advancements.

- QQQ (Invesco QQQ Trust): This ETF tracks the Nasdaq-100 Index, which includes companies like Apple, Microsoft, and Google (Alphabet), all of whom are involved in various aspects of autonomous vehicle technology.

- XLK (Technology Select Sector SPDR Fund): This ETF focuses on the technology sector of the S&P 500, offering broad exposure to various technology companies, some of which are involved in autonomous vehicle development.

These ETFs offer broad market diversification, exposure to multiple tech giants, and a lower risk profile than concentrated bets on individual companies.

Thematic ETFs Focused on Innovation

Some ETFs specifically focus on disruptive technologies or future transportation, providing more targeted exposure to the autonomous vehicle sector. However, these ETFs often carry higher risk due to their concentrated focus. (Note: Specific ETF tickers will need to be researched and added here as market conditions and offerings change frequently.) Look for ETFs focusing on:

- Robotics and Artificial Intelligence

- Future Transportation

- Disruptive Technologies

While offering higher potential returns, these thematic ETFs also carry a higher risk profile due to their concentration in specific technological trends.

Assessing Investment Risk and Diversification

Investing in the autonomous vehicle sector through ETFs involves inherent risks. Careful consideration of risk tolerance and diversification strategies is crucial.

Risk Tolerance and Investment Goals

Before investing, honestly assess your risk tolerance and investment goals. Investing in this sector requires a long-term perspective, as the full realization of the autonomous vehicle market's potential may take years.

- Long-term investment horizon recommended: This is not a short-term investment opportunity.

- Consider diversification across asset classes: Don't put all your eggs in one basket. Diversify your portfolio to mitigate risk.

- Assess your risk appetite: Are you comfortable with potentially higher volatility in exchange for potentially higher returns?

Due Diligence and Research

Thorough research is paramount before investing in any ETF.

- Review ETF prospectuses: Understand the ETF's investment strategy, underlying holdings, and expense ratio.

- Analyze fund performance: Review historical performance, but remember past performance is not indicative of future results.

- Seek professional advice: Consult a qualified financial advisor to discuss your investment goals and risk tolerance.

Always conduct thorough due diligence before making any investment decisions.

Conclusion

Uber's self-driving initiatives represent a significant gamble with substantial potential rewards. While direct investment in Uber's autonomous vehicle division might be challenging, exposure can be gained through strategic ETF investing. Careful consideration of risk tolerance and diversification is crucial. By understanding the potential market, the associated risks, and the investment vehicles available, you can make informed decisions.

Begin your exploration of the self-driving car revolution and the investment opportunities within the ETF market. Research the ETFs mentioned and determine if they align with your investment goals and risk tolerance. Remember to always conduct thorough due diligence before making any investment decisions related to Uber's self-driving gamble or other autonomous vehicle technologies via ETFs.

Featured Posts

-

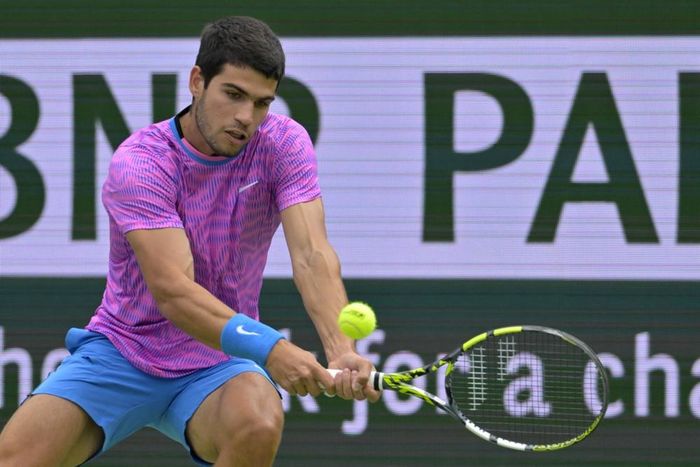

Vo Dich Indian Wells Co Gai 17 Tuoi Nguoi Nga Tao Nen Lich Su

May 18, 2025

Vo Dich Indian Wells Co Gai 17 Tuoi Nguoi Nga Tao Nen Lich Su

May 18, 2025 -

Amanda Bynes Only Fans A Post Hollywood Career Path

May 18, 2025

Amanda Bynes Only Fans A Post Hollywood Career Path

May 18, 2025 -

Fsu Shooting Details Emerge About Victim With Cia Linked Family

May 18, 2025

Fsu Shooting Details Emerge About Victim With Cia Linked Family

May 18, 2025 -

Analyzing The Spring Breakout 2025 Rosters Key Players And Predictions

May 18, 2025

Analyzing The Spring Breakout 2025 Rosters Key Players And Predictions

May 18, 2025 -

Regulatory Challenges Force Uber To Cancel Foodpanda Taiwan Acquisition

May 18, 2025

Regulatory Challenges Force Uber To Cancel Foodpanda Taiwan Acquisition

May 18, 2025

Latest Posts

-

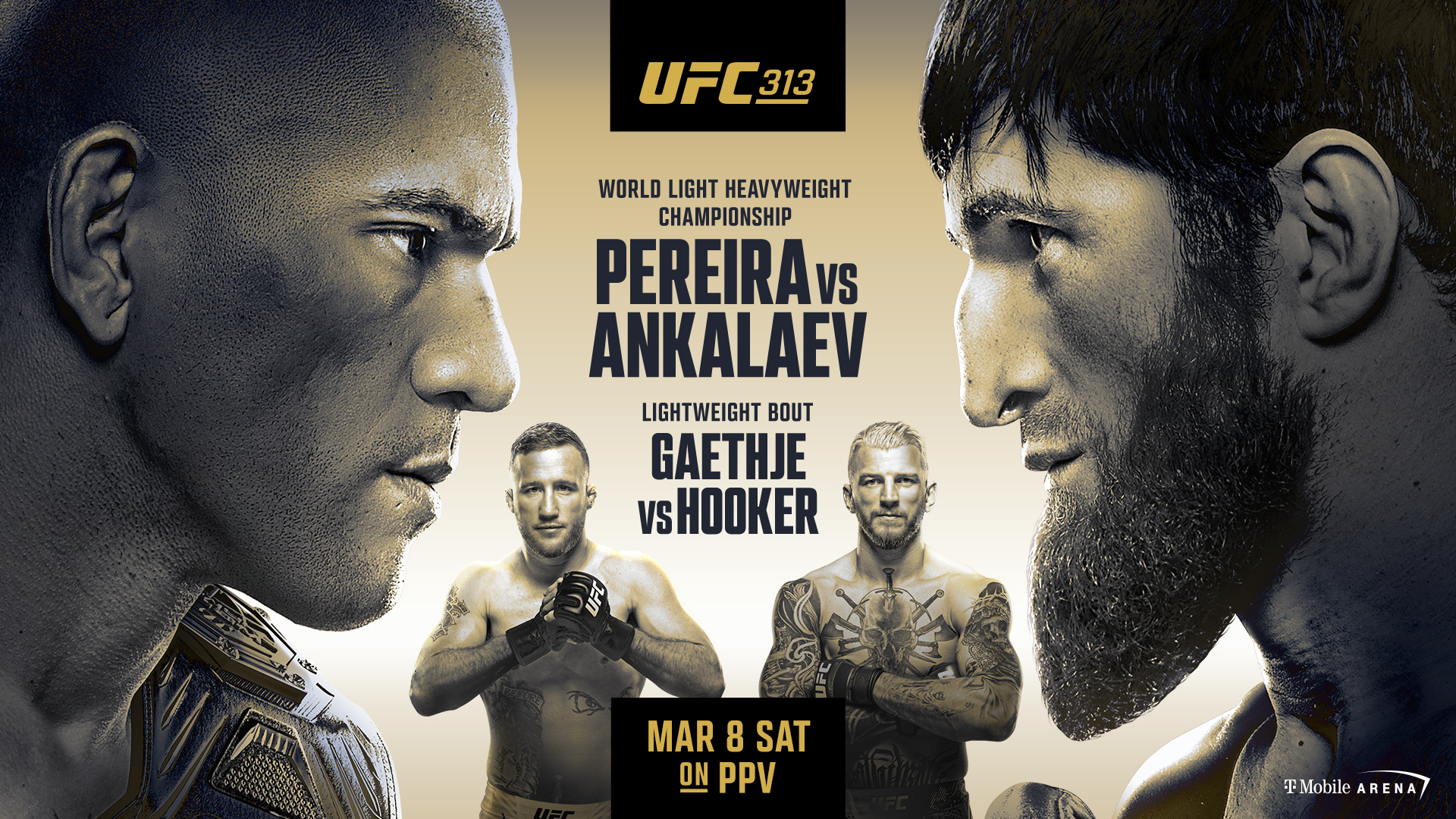

Everything You Need To Know About Ufc 313 Fight Card Viewing And Tickets

May 19, 2025

Everything You Need To Know About Ufc 313 Fight Card Viewing And Tickets

May 19, 2025 -

Mairon Santos Future Lightweight Division After Yusuff Bout

May 19, 2025

Mairon Santos Future Lightweight Division After Yusuff Bout

May 19, 2025 -

Ufc 313 Fight Card Breakdown Best Fights Viewing Details And Ticket Availability

May 19, 2025

Ufc 313 Fight Card Breakdown Best Fights Viewing Details And Ticket Availability

May 19, 2025 -

Ufc Vegas 106 Expert Picks Burns Morales Prediction And Betting Odds

May 19, 2025

Ufc Vegas 106 Expert Picks Burns Morales Prediction And Betting Odds

May 19, 2025 -

Ufc 313 Your Guide To The Event Fight Card Viewing Options And Ticket Information

May 19, 2025

Ufc 313 Your Guide To The Event Fight Card Viewing Options And Ticket Information

May 19, 2025