UK Inflation Data Sparks Pound Surge As BOE Rate Cut Bets Diminish

Table of Contents

Lower-Than-Expected UK Inflation Figures

The recently released UK inflation data revealed a considerably lower-than-expected rate of price increases. The Consumer Price Index (CPI), a key measure of inflation, registered a [insert actual CPI percentage] increase, compared to market forecasts of [insert forecasted CPI percentage] and the previous month's figure of [insert previous month's CPI percentage]. Similarly, the Retail Price Index (RPI) showed a [insert actual RPI percentage] increase.

This unexpected drop can be attributed to several key factors:

- Falling energy prices: A significant decrease in global energy prices has eased pressure on household budgets and reduced inflationary pressures.

- Easing supply chain pressures: While still present, supply chain disruptions have shown signs of improvement, leading to a moderation in the price of goods.

- Weakening demand: Concerns about a potential recession are leading to reduced consumer spending, thus dampening inflationary pressures.

Key aspects of the inflation report:

- CPI significantly below market consensus.

- RPI also showing a decline from previous months.

- Clear evidence of easing inflationary pressures across various sectors.

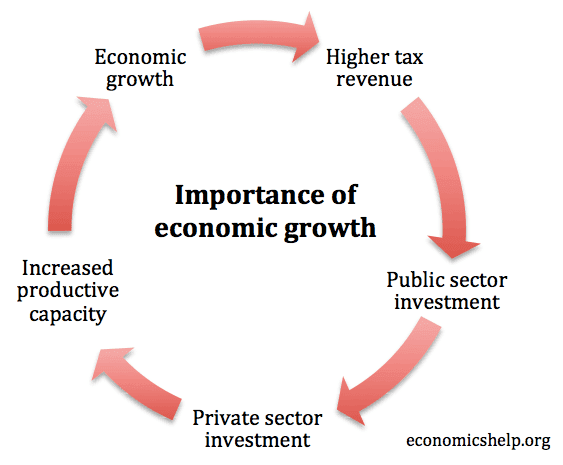

Impact on Bank of England (BOE) Monetary Policy

The unexpectedly low UK inflation data significantly reduces the pressure on the BOE to continue its policy of interest rate cuts. Market analysts had previously anticipated a [insert percentage]% rate cut at the next Monetary Policy Committee (MPC) meeting, reflecting concerns about persistent inflation. However, the latest figures suggest that such aggressive action may no longer be necessary.

- Shift in market expectations: The probability of a BOE rate cut has decreased dramatically following the release of the data.

- Potential future BOE policy: The central bank is now more likely to maintain interest rates at their current level or even consider a pause in its easing cycle.

- Implications for the Pound: The reduced expectation of rate cuts has boosted investor confidence in the Pound, leading to its appreciation.

Shift in BOE rate cut probabilities:

- Before data release: High probability of a [insert percentage]% cut.

- After data release: Significantly reduced probability, potential for a pause or even a rate hike in the future.

Pound Sterling's Surge Against Major Currencies

Following the release of the favorable UK inflation data, the Pound Sterling experienced a notable surge against several major currencies. The GBP/USD exchange rate saw a [insert percentage]% increase, reaching [insert exchange rate], while the GBP/EUR exchange rate climbed by [insert percentage]%, reaching [insert exchange rate].

- Impact on UK exporters and importers: A stronger Pound benefits importers by reducing the cost of imported goods but makes UK exports more expensive in international markets.

- Short-term outlook: The Pound is expected to remain relatively strong in the short term, barring any unforeseen economic shocks.

- Long-term outlook: The long-term outlook depends on various factors, including the future trajectory of UK inflation, BOE policy decisions, and global economic conditions.

Key currency pairs and their percentage changes:

- GBP/USD: +[insert percentage]%

- GBP/EUR: +[insert percentage]%

- GBP/JPY: +[insert percentage]%

Market Reactions and Analyst Commentary

The unexpected UK inflation data and the subsequent Pound surge have generated considerable discussion among market analysts and financial institutions. Many analysts now believe that the BOE may adopt a more cautious approach to monetary policy. [Insert quote from a prominent analyst]. The impact extends beyond the currency markets; the improved inflation outlook has also positively impacted UK government bonds (gilts), leading to [insert specific market movements].

Summarizing expert opinions and predictions:

- Many analysts have revised their forecasts for BOE interest rates downwards.

- A more positive outlook for the UK economy is emerging.

- Increased investor confidence in UK assets is evident.

Conclusion: Navigating the Implications of UK Inflation Data on the Pound

In conclusion, the lower-than-expected UK inflation data has had a significant and largely positive impact on the Pound Sterling. Reduced expectations of BOE rate cuts have led to a notable surge in the currency's value against major counterparts. While this development presents opportunities, investors should also consider potential risks and closely monitor the evolving economic landscape. To stay informed about the latest UK inflation news and their effects on the Pound, subscribe to our newsletter for regular updates and analysis on the pound sterling forecast. Follow us on social media for the latest market insights and further analysis on this crucial economic indicator.

Featured Posts

-

Global Forest Destruction A Record Year Driven By Wildfires

May 24, 2025

Global Forest Destruction A Record Year Driven By Wildfires

May 24, 2025 -

La Repression Chinoise Des Dissidents En France Une Analyse

May 24, 2025

La Repression Chinoise Des Dissidents En France Une Analyse

May 24, 2025 -

Neal Mc Donough And The Last Rodeo A Western Showdown

May 24, 2025

Neal Mc Donough And The Last Rodeo A Western Showdown

May 24, 2025 -

Najvaecsie Nemecke Firmy Prepustaju Tisice Ludi Prichadzaju O Pracu

May 24, 2025

Najvaecsie Nemecke Firmy Prepustaju Tisice Ludi Prichadzaju O Pracu

May 24, 2025 -

Bangladeshs Economic Growth The Importance Of European Partnerships

May 24, 2025

Bangladeshs Economic Growth The Importance Of European Partnerships

May 24, 2025

Latest Posts

-

Get Ready Tulsa King Season 2 Blu Ray Featuring Sylvester Stallone

May 24, 2025

Get Ready Tulsa King Season 2 Blu Ray Featuring Sylvester Stallone

May 24, 2025 -

Sylvester Stallone In Tulsa King Season 2 Blu Ray Details Revealed

May 24, 2025

Sylvester Stallone In Tulsa King Season 2 Blu Ray Details Revealed

May 24, 2025 -

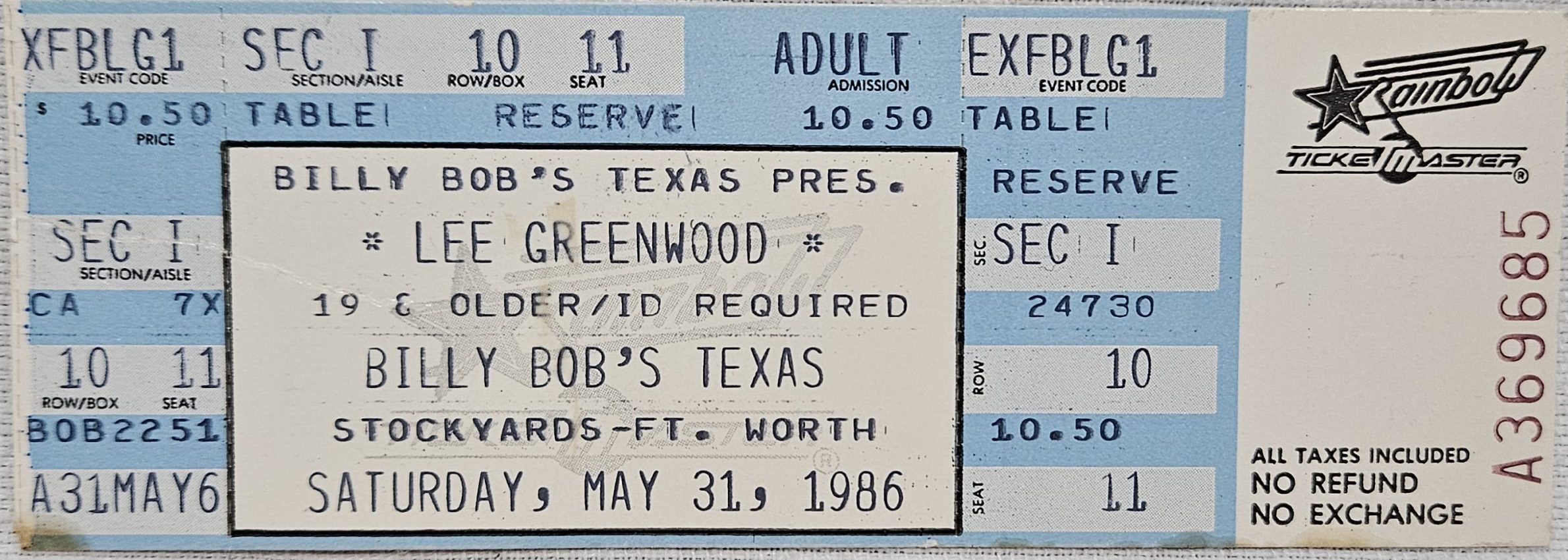

Fort Worth Stockyards Joe Jonas Surprise Show Delights Fans

May 24, 2025

Fort Worth Stockyards Joe Jonas Surprise Show Delights Fans

May 24, 2025 -

Exclusive First Look Tulsa King Season 2 Blu Ray With Sylvester Stallone

May 24, 2025

Exclusive First Look Tulsa King Season 2 Blu Ray With Sylvester Stallone

May 24, 2025 -

Unexpected Concert Joe Jonas Plays The Fort Worth Stockyards

May 24, 2025

Unexpected Concert Joe Jonas Plays The Fort Worth Stockyards

May 24, 2025