Understanding CoreWeave Inc.'s (CRWV) Share Price Decrease On Thursday

Table of Contents

Market-Wide Factors Influencing CRWV Stock Performance

Several macroeconomic factors contributed to the overall market downturn, impacting CRWV stock along with other cloud computing stocks.

Overall Market Sentiment and Downturn

Thursday's market displayed a general bearish sentiment, likely influenced by several economic headwinds. The S&P 500 and Nasdaq Composite both experienced declines, indicating a broader market correction. This negative market sentiment significantly impacted investor confidence and risk appetite, leading to selling pressure across various sectors, including technology.

- Impact of rising interest rates on tech stocks: Increased interest rates generally lead to higher borrowing costs for tech companies, impacting growth and potentially reducing investor enthusiasm for high-growth stocks like CRWV.

- Influence of macroeconomic indicators on investor confidence: Negative economic indicators, such as slower-than-expected GDP growth or rising inflation, can further dampen investor sentiment, contributing to market sell-offs.

- Correlation between CRWV and broader market trends: CRWV stock, like many other tech stocks, often exhibits a strong correlation with broader market trends. A negative market day often translates to downward pressure on CRWV share price.

Sector-Specific Pressures on Cloud Computing Stocks

The cloud computing sector itself faced some headwinds on Thursday. While not solely responsible for CRWV's drop, sector-specific pressures amplified the negative market impact.

- Competition within the cloud computing industry: The cloud computing market is fiercely competitive, with major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform vying for market share. Increased competition can pressure margins and impact investor confidence in individual companies.

- Concerns about cloud computing spending growth: Concerns about a slowdown in cloud computing spending growth, particularly among smaller companies or those facing economic uncertainty, can impact investor perception of the sector’s overall future.

- Impact of regulatory changes on the sector: Potential regulatory changes or increased scrutiny could also impact investor sentiment towards cloud computing companies, affecting their stock prices.

Company-Specific News and Developments Affecting CRWV

While market-wide factors played a role, company-specific news, or the lack thereof, also contributed to the CRWV share price decrease.

Absence of Positive Catalysts

The absence of positive news or catalysts for CRWV contributed to the negative investor sentiment. Without significant developments, the stock became susceptible to the broader market pressures.

- Absence of significant contract wins: The lack of announcements regarding large contract wins could have disappointed investors hoping for growth signals from CoreWeave.

- Lack of product announcements or updates: No new product releases or significant updates could have signaled a lack of innovation or competitive advantage in the minds of some investors.

- Potential delay in anticipated milestones: Any delays in achieving previously announced milestones could have further dampened investor enthusiasm and contributed to selling pressure.

Analyst Ratings and Price Target Revisions

Negative analyst sentiment can significantly impact a stock's price. While not the sole cause, any downgrades or revised price targets for CRWV could have exacerbated the situation.

- Summary of analyst ratings and price targets: Tracking analyst ratings and price target revisions provides valuable insights into market sentiment towards a particular stock. A consensus of negative opinions can fuel selling pressure.

- Impact of negative analyst sentiment on investor confidence: Negative analyst reports can erode investor confidence, leading to a sell-off as investors react to perceived risks.

- Comparison with competitor's stock performance and analyst ratings: Comparing CRWV's performance and analyst ratings with its competitors can offer a clearer perspective on the company's relative position within the market.

Technical Analysis of CRWV Stock Chart

Technical analysis of the CRWV stock chart can provide further insights into the price decline. Identifying key support and resistance levels helps understand the price action.

Identifying Key Support and Resistance Levels

Examining the CRWV stock chart reveals potential support and resistance levels that may have contributed to the price drop. A breach of a key support level can trigger further selling.

- Technical indicators suggesting a potential price decrease: Technical indicators, such as moving averages or Relative Strength Index (RSI), can signal potential price reversals or downtrends.

- Analysis of trading volume during the price decline: High trading volume during the price decline suggests significant selling pressure, reinforcing the downward trend.

- Identification of crucial support and resistance levels: Identifying these levels allows investors to anticipate potential price reversals or further declines.

Conclusion: Understanding the CoreWeave Inc. (CRWV) Stock Dip and Looking Ahead

The CoreWeave Inc.'s (CRWV) share price decrease on Thursday stemmed from a confluence of factors, including a broader market downturn, sector-specific pressures within the cloud computing industry, and the absence of positive company-specific news. Understanding these elements is crucial for informed investment decisions. While the short-term outlook may be uncertain, CoreWeave's long-term prospects within the growing cloud computing market remain noteworthy. However, it's essential to approach any investment in CRWV with caution.

Call to action: Before making any investment decisions regarding CoreWeave Inc.'s (CRWV) stock or other cloud computing stocks, conduct thorough research, including a comprehensive CRWV stock analysis, consider diversifying your portfolio to mitigate risk, and develop a sound CRWV investment strategy based on your risk tolerance and long-term financial goals. Staying informed about CRWV future prospects and market trends is critical for navigating the volatility of the cloud computing sector.

Featured Posts

-

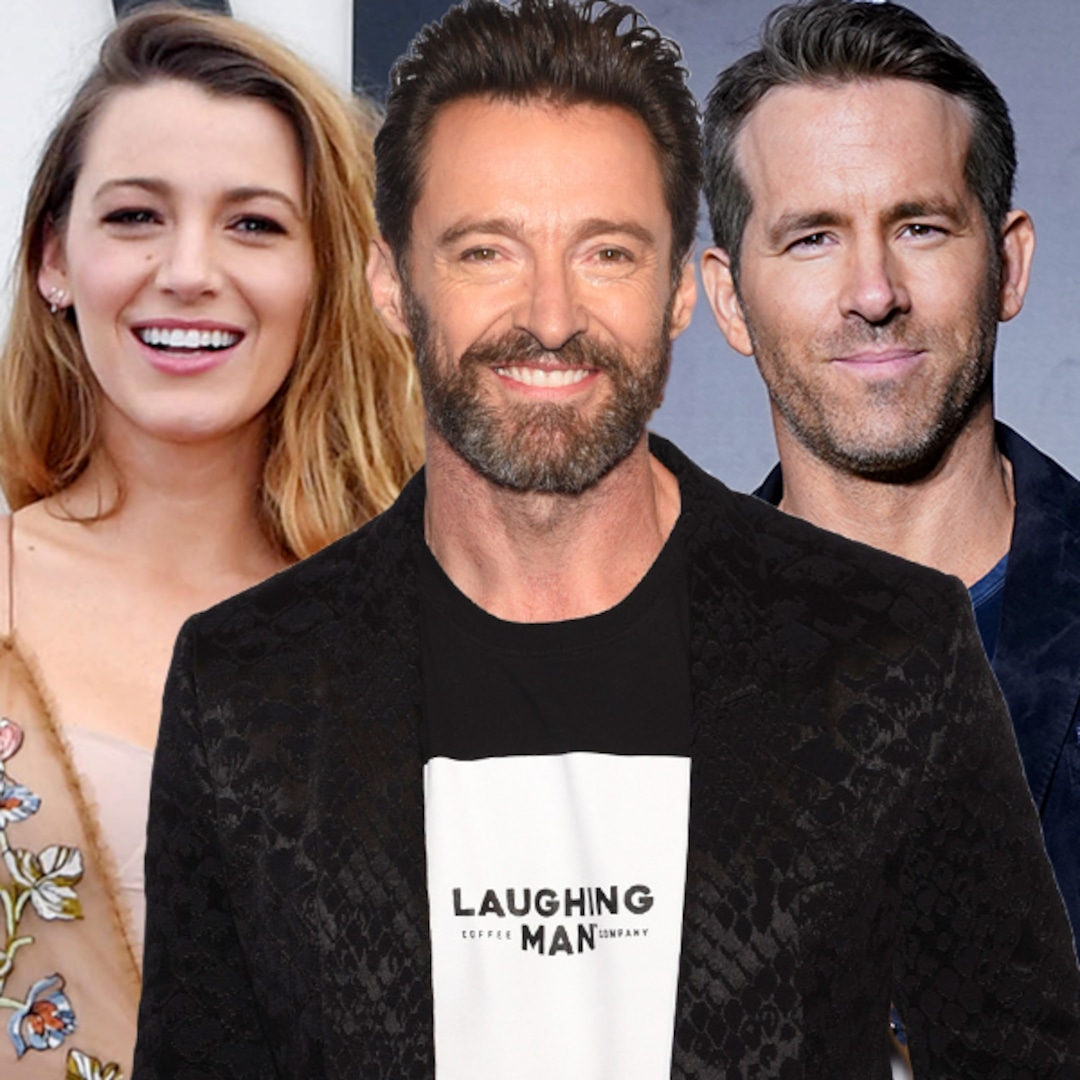

The Blake Lively Allegation Fact Checking The Latest Reports

May 22, 2025

The Blake Lively Allegation Fact Checking The Latest Reports

May 22, 2025 -

The Goldbergs Behind The Scenes Facts And Trivia You Didnt Know

May 22, 2025

The Goldbergs Behind The Scenes Facts And Trivia You Didnt Know

May 22, 2025 -

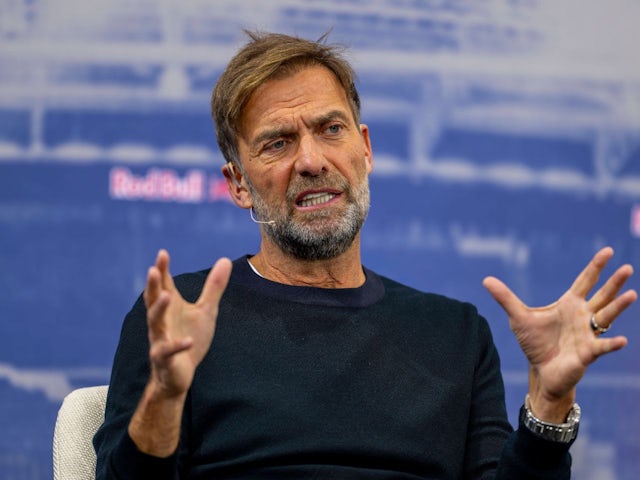

Real Madrid Manager Rumours Klopps Agent Speaks Out

May 22, 2025

Real Madrid Manager Rumours Klopps Agent Speaks Out

May 22, 2025 -

Njwm Saedt Thlatht Laebyn Yndmwn Lmntkhb Amryka Lawl Mrt

May 22, 2025

Njwm Saedt Thlatht Laebyn Yndmwn Lmntkhb Amryka Lawl Mrt

May 22, 2025 -

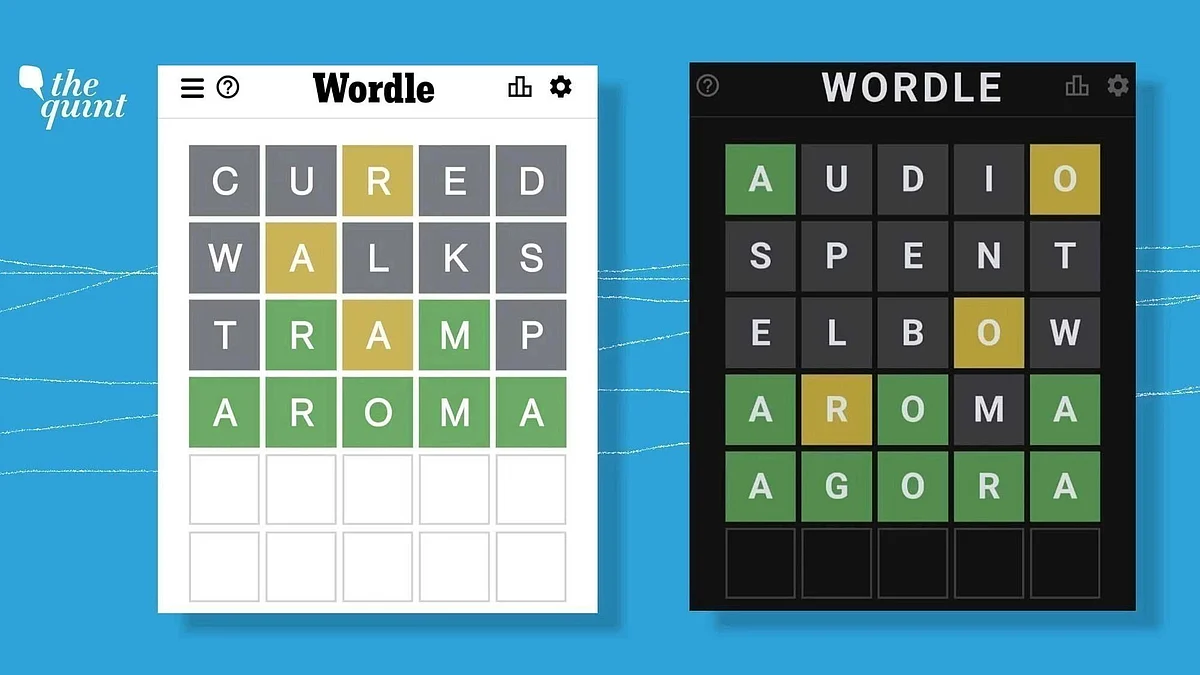

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025

Latest Posts

-

Adam Ramey Dropout Kings Vocalist Dies At 31 A Music Industry Loss

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dies At 31 A Music Industry Loss

May 22, 2025 -

Dropout Kings Singer Adam Ramey Dies Aged 31

May 22, 2025

Dropout Kings Singer Adam Ramey Dies Aged 31

May 22, 2025 -

Music World Mourns Dropout Kings Adam Ramey Dies By Suicide

May 22, 2025

Music World Mourns Dropout Kings Adam Ramey Dies By Suicide

May 22, 2025 -

Remembering Adam Ramey Dropout Kings Lead Singer Passes At 32

May 22, 2025

Remembering Adam Ramey Dropout Kings Lead Singer Passes At 32

May 22, 2025 -

Dropout Kings Vocalist Adam Ramey Dies By Suicide A Tragic Loss

May 22, 2025

Dropout Kings Vocalist Adam Ramey Dies By Suicide A Tragic Loss

May 22, 2025