Understanding CoreWeave's Stock Performance

Table of Contents

Key Factors Influencing CoreWeave's Stock Price

Several interconnected factors significantly impact CoreWeave's stock price. Understanding these dynamics is crucial for any investor considering a CoreWeave investment.

Macroeconomic conditions play a substantial role. The tech sector, including cloud computing, is sensitive to interest rate hikes and overall market volatility. Rising interest rates, for example, increase borrowing costs for companies, potentially slowing growth and impacting investor sentiment. Conversely, periods of market stability generally boost investor confidence, leading to higher valuations for growth stocks like CoreWeave.

- Impact of interest rate hikes on tech valuations: Higher rates increase the discount rate applied to future earnings, reducing the present value of a company's projected growth.

- Influence of overall market volatility on CoreWeave's stock: During periods of market uncertainty, investors often move towards safer investments, causing a sell-off in more speculative stocks, potentially impacting CoreWeave's share price.

- Investor confidence in the future of AI and cloud computing: CoreWeave's success is intrinsically linked to the growth of AI and cloud computing. Positive developments and increased adoption in these sectors will likely boost investor confidence and drive up the CoreWeave share price.

- Comparison to competitor stock performance (e.g., AWS, Google Cloud): Analyzing the performance of established players like Amazon Web Services (AWS) and Google Cloud provides a benchmark against which CoreWeave's performance can be evaluated, influencing investor perception.

Analyzing CoreWeave's Financial Performance

Analyzing CoreWeave's financial performance involves scrutinizing its revenue growth, profitability, and overall financial health. Studying CoreWeave's financial reports and investor presentations offers valuable insights into its operational efficiency and future prospects.

- Revenue growth and projections: Consistent and significant revenue growth demonstrates strong market demand for CoreWeave's services, a positive indicator for investors. Analyzing projected revenue growth can help estimate future stock performance.

- Profit margins and operating expenses: Healthy profit margins suggest effective cost management and pricing strategies, contributing positively to the CoreWeave share price. High operating expenses may raise concerns.

- Debt levels and financial health: High debt levels can pose a risk, particularly in volatile market conditions. A strong balance sheet and low debt are generally viewed favorably by investors.

- Key performance indicators (KPIs) related to customer acquisition and retention: Metrics such as customer churn rate and customer lifetime value are important indicators of the company's ability to attract and retain clients, which directly impacts revenue growth and profitability.

Evaluating CoreWeave's Competitive Landscape

CoreWeave operates in a competitive market dominated by giants like AWS, Microsoft Azure, and Google Cloud Platform (GCP). Understanding its competitive positioning is crucial for assessing its long-term growth potential.

- Comparison with major cloud providers (AWS, Azure, GCP): CoreWeave needs to differentiate itself from these established players through specialized services, competitive pricing, or superior customer service.

- CoreWeave's unique selling proposition (USP) and competitive advantages: What sets CoreWeave apart from its competitors? Is it its focus on AI workloads, its specialized infrastructure, or its customer support?

- Potential market disruptions and emerging competitors: The cloud computing landscape is dynamic. New technologies and competitors could emerge, impacting CoreWeave's market share.

- Analysis of partnerships and strategic alliances: Strategic partnerships can provide access to new markets and technologies, bolstering CoreWeave's competitive position.

Predicting Future Stock Performance

Predicting future stock performance is inherently uncertain, but analyzing potential growth opportunities and risks can provide a clearer picture.

- Long-term growth potential in the AI and cloud computing sectors: The continued expansion of AI and cloud computing suggests significant growth potential for CoreWeave, provided it can maintain its competitive edge.

- Potential for acquisitions or mergers: Acquisitions can significantly impact a company's growth trajectory and stock price.

- Regulatory risks and compliance issues: Navigating regulatory hurdles and ensuring compliance are crucial for maintaining a strong reputation and avoiding potential penalties.

- Technological advancements and innovation within the industry: CoreWeave's ability to adapt to technological advancements and innovate will influence its future success and stock performance.

Conclusion: Making Informed Decisions About CoreWeave Stock

CoreWeave's stock performance is influenced by a complex interplay of macroeconomic factors, financial performance, competitive landscape, and future growth prospects. While the potential for growth in the AI and cloud computing sectors is significant, making informed investment decisions requires careful consideration of various factors. Before investing in CoreWeave stock or considering a CoreWeave investment, conduct thorough due diligence, research CoreWeave's financial statements, and stay updated on the latest news concerning the company and the broader market. Consult with a qualified financial advisor to assess the risks and suitability of CoreWeave stock for your investment portfolio. Remember to carefully monitor CoreWeave's share price and market trends for informed decision-making related to your CoreWeave investment.

Featured Posts

-

The Goldbergs A Critical Analysis Of Its Success

May 22, 2025

The Goldbergs A Critical Analysis Of Its Success

May 22, 2025 -

Remont Pivdennogo Mostu Pidryadniki Protses Ta Zatrati

May 22, 2025

Remont Pivdennogo Mostu Pidryadniki Protses Ta Zatrati

May 22, 2025 -

Recent Gas Price Increase Up Almost 20 Cents Per Gallon

May 22, 2025

Recent Gas Price Increase Up Almost 20 Cents Per Gallon

May 22, 2025 -

China Faces International Criticism Switzerlands Response To Military Drills

May 22, 2025

China Faces International Criticism Switzerlands Response To Military Drills

May 22, 2025 -

The Goldbergs Is The Show Still Relevant Today

May 22, 2025

The Goldbergs Is The Show Still Relevant Today

May 22, 2025

Latest Posts

-

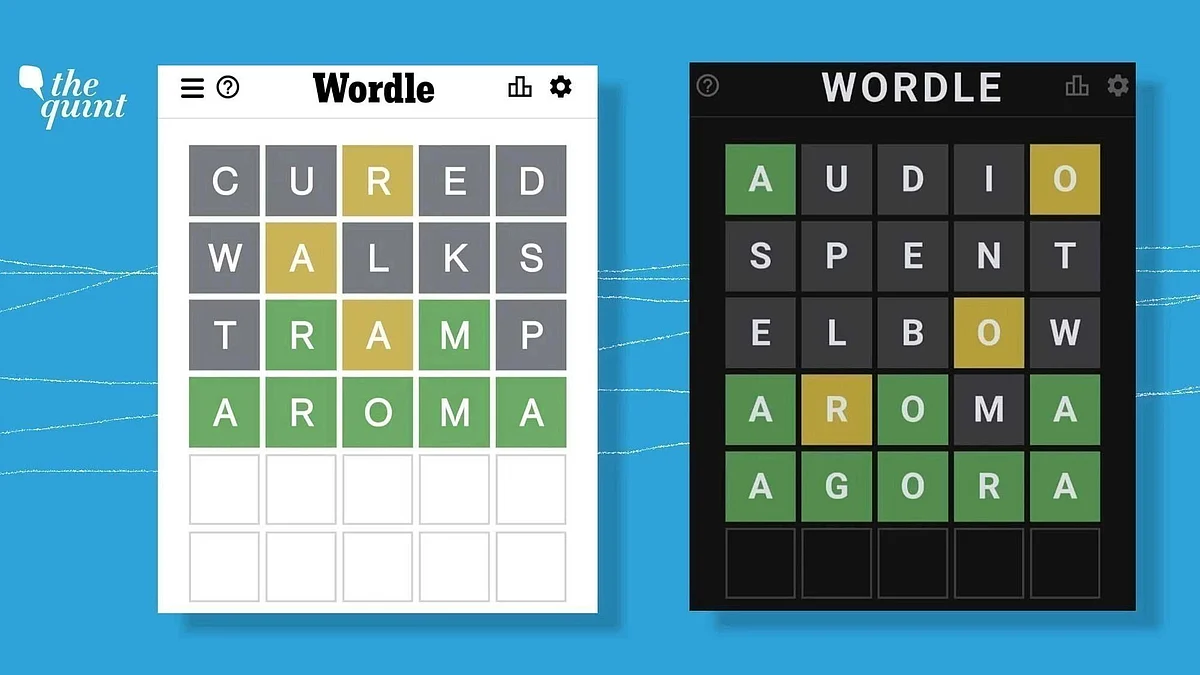

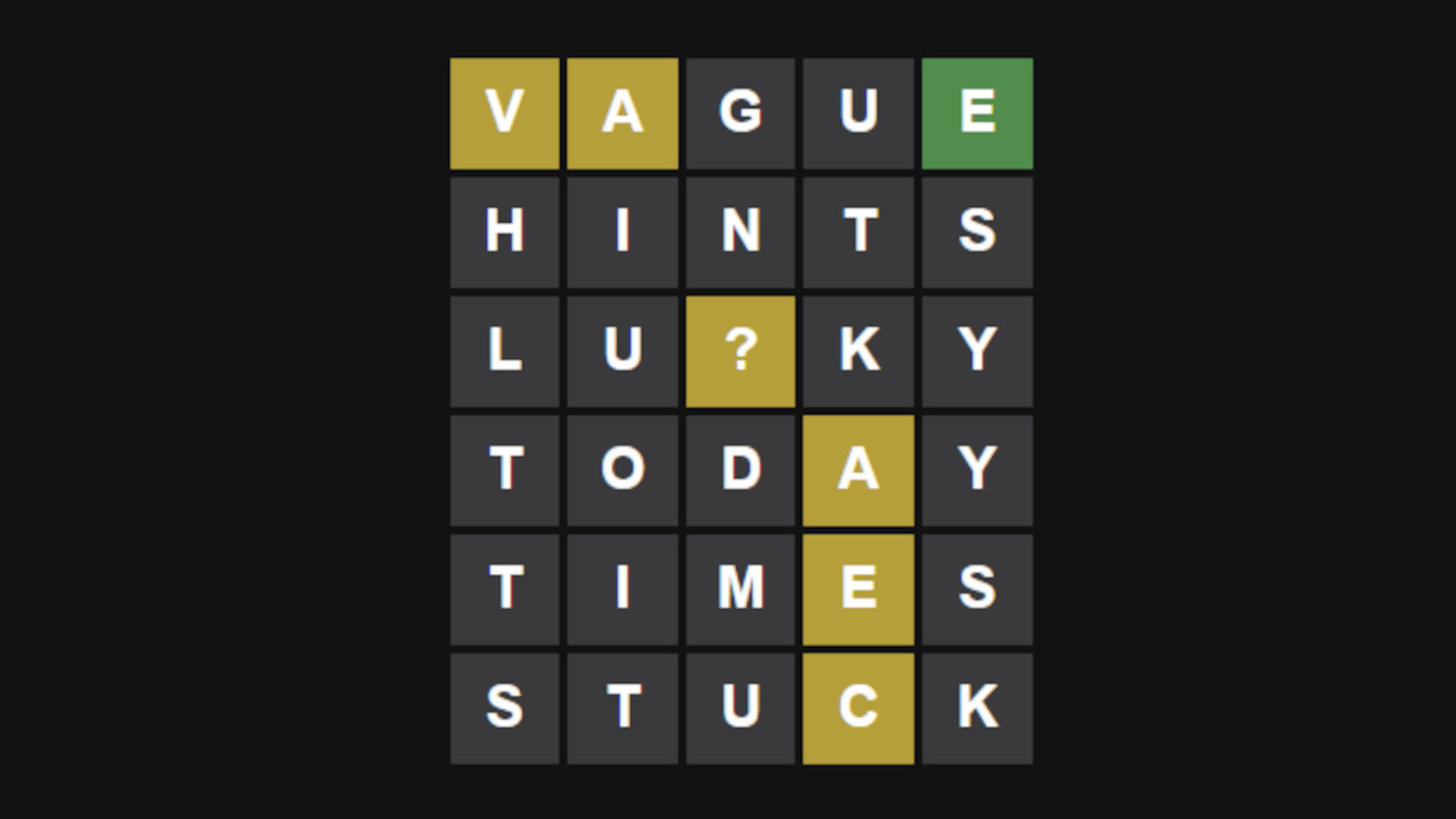

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025 -

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025 -

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025 -

Todays Wordle Answer March 16th Solving Wordle 1366

May 22, 2025

Todays Wordle Answer March 16th Solving Wordle 1366

May 22, 2025 -

Challenging Wordle Puzzle Nyt Answer For March 26

May 22, 2025

Challenging Wordle Puzzle Nyt Answer For March 26

May 22, 2025