Understanding D-Wave Quantum's (QBTS) Stock Decline On Thursday

Table of Contents

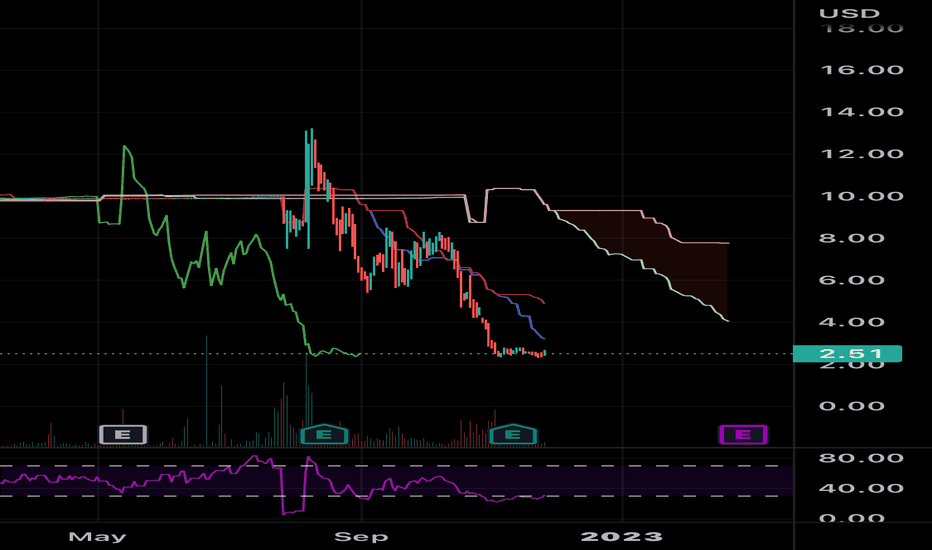

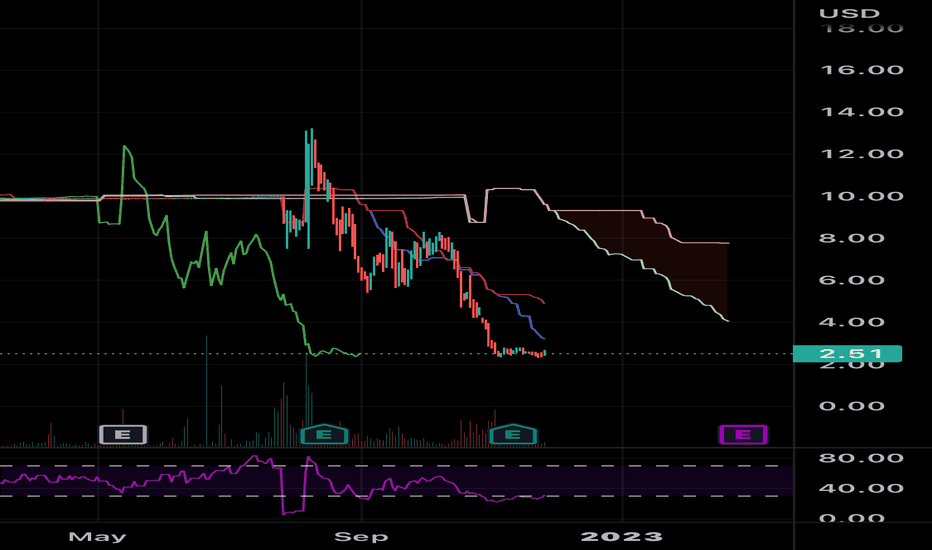

Analyzing the Market Conditions Preceding the QBTS Stock Drop

Several macroeconomic and sector-specific factors might have contributed to the D-Wave Quantum (QBTS) stock decline. Understanding the overall market sentiment and the performance of competitors is essential for a complete picture.

Overall Market Sentiment

The broader market environment played a role in Thursday's downturn. Investor confidence can significantly impact individual stock performance, especially in a volatile sector like technology.

- Market Indices: The [Name of Major Market Index], a key indicator of overall market health, experienced a [Percentage]% drop on Thursday. Similarly, the [Name of Tech-Specific Index] also saw a decline of [Percentage]%, reflecting a negative sentiment within the technology sector.

- External News and Events: News surrounding [Mention relevant news, e.g., interest rate hikes, geopolitical events] could have created a climate of uncertainty and risk aversion, leading investors to sell off shares in riskier assets, including QBTS.

Quantum Computing Sector Performance

It's vital to assess whether the D-Wave Quantum (QBTS) stock decline was isolated or part of a broader trend in the quantum computing industry.

- Competitor Performance: Companies like [Name Competitor 1] and [Name Competitor 2] also experienced [Percentage]% and [Percentage]% drops respectively, suggesting a sector-wide correction. However, [Name Competitor 3] bucked the trend, showing [Percentage]% growth, indicating that the decline might be more specific to D-Wave.

- Correlation Analysis: The correlation between QBTS's performance and other quantum computing stocks requires further investigation. A strong positive correlation would suggest a sector-wide issue, while a weak or negative correlation points to company-specific problems.

Potential Factors Contributing to the D-Wave Quantum (QBTS) Stock Decline

Beyond general market trends, several factors specific to D-Wave Quantum might have contributed to the QBTS stock drop.

Company-Specific News or Announcements

Any news released by D-Wave on Thursday could have triggered a sell-off.

- Press Releases/Earnings Reports: A review of D-Wave's recent press releases and financial reports is necessary to identify any potential negative news that could have alarmed investors. Did they miss earnings expectations? Were there unexpected setbacks in their R&D progress?

- Regulatory Filings: Any regulatory filings or announcements related to legal issues or investigations could also explain the sudden decline.

Analyst Ratings and Price Target Adjustments

Changes in analyst ratings and price targets can significantly influence investor sentiment and trading activity.

- Analyst Actions: Did any prominent financial analysts downgrade D-Wave's stock or lower their price targets? [Mention Specific Analyst Firms and Actions].

- Rationale: Understanding the reasons behind these adjustments—whether it's concerning the company's financial performance, competitive landscape, or technological challenges—is crucial for interpreting the market's reaction.

Investor Sentiment and Trading Activity

Analyzing trading volume and short interest provides insights into investor behavior and market dynamics.

- Trading Volume: Was there an unusually high trading volume on Thursday for QBTS? High volume often indicates significant shifts in investor sentiment.

- Short Interest: A high short interest suggests that a considerable number of investors are betting against the stock. A sudden increase in short selling could exacerbate the downward pressure on the stock price.

Long-Term Implications for D-Wave Quantum (QBTS) and the Quantum Computing Industry

The QBTS stock decline has significant implications for D-Wave and the overall quantum computing market.

Impact on Future Investment

The stock price drop could impact D-Wave's ability to secure funding for future projects.

- Research and Development: Reduced investor confidence might make it harder for D-Wave to secure the capital necessary for continued research and development in quantum computing technology.

- Future Prospects: The company’s ability to attract talent and partners might also be affected, potentially slowing down its progress in the long run.

Wider Quantum Computing Market Outlook

This event might create uncertainty within the broader quantum computing sector.

- Ripple Effects: While some competitors might benefit from the situation, a significant downturn in a leading player like D-Wave can dent investor confidence in the sector as a whole.

- Adoption and Development: Negative sentiment could delay the adoption and further development of quantum computing technologies, as investors become more hesitant to invest in the sector.

Conclusion: Understanding and Monitoring Future D-Wave Quantum (QBTS) Stock Movements

The D-Wave Quantum (QBTS) stock decline on Thursday was likely a result of a combination of factors, including broader market trends, company-specific news (or lack thereof), analyst actions, and investor sentiment. Understanding these intertwined factors is key to interpreting the market’s reaction. The key takeaway is that while the quantum computing industry holds immense promise, it's also a high-risk, high-reward sector vulnerable to market fluctuations.

To stay informed about QBTS stock performance and the future of D-Wave Quantum (QBTS), it's crucial to monitor company announcements, analyst ratings, and broader market trends. Continue to research D-Wave’s future plans and the evolving quantum computing landscape. Tracking D-Wave's progress and the wider quantum computing market is vital for navigating this dynamic sector.

Featured Posts

-

Abn Amros Investering In Het Digitale Platform Transferz Toekomst Van Online Betalingen

May 21, 2025

Abn Amros Investering In Het Digitale Platform Transferz Toekomst Van Online Betalingen

May 21, 2025 -

Ea Fc 24 Fut Birthday Which Cards Are Worth It A Tier List Analysis

May 21, 2025

Ea Fc 24 Fut Birthday Which Cards Are Worth It A Tier List Analysis

May 21, 2025 -

Is Canada Post Insolvent Report Advocates For The Phase Out Of Residential Mail Delivery

May 21, 2025

Is Canada Post Insolvent Report Advocates For The Phase Out Of Residential Mail Delivery

May 21, 2025 -

Kaellman Ja Hoskonen Laehtoe Puolasta Vahvistui

May 21, 2025

Kaellman Ja Hoskonen Laehtoe Puolasta Vahvistui

May 21, 2025 -

La Prueba De Javier Baez Salud Productividad Y Futuro

May 21, 2025

La Prueba De Javier Baez Salud Productividad Y Futuro

May 21, 2025

Latest Posts

-

Defining The Sound Perimeter Music And Shared Experience

May 22, 2025

Defining The Sound Perimeter Music And Shared Experience

May 22, 2025 -

Ea Fc 25 Fut Birthday Tier List Top Players To Target

May 22, 2025

Ea Fc 25 Fut Birthday Tier List Top Players To Target

May 22, 2025 -

Sound Perimeter Musics Role In Building Connection

May 22, 2025

Sound Perimeter Musics Role In Building Connection

May 22, 2025 -

Ea Fc 25 Fut Birthday Best Player Cards And Tier List

May 22, 2025

Ea Fc 25 Fut Birthday Best Player Cards And Tier List

May 22, 2025 -

Inside Athena Calderones Impressive Roman Milestone Party

May 22, 2025

Inside Athena Calderones Impressive Roman Milestone Party

May 22, 2025