Understanding Guaranteed Approval For No Credit Check Loans From Direct Lenders

Table of Contents

What Does "Guaranteed Approval" Really Mean?

The term "guaranteed approval" for no credit check loans is often misleading. While many lenders advertise this enticing promise, the reality is that true guaranteed approval is rare and usually comes with strings attached. Most lenders who use this phrase impose strict conditions that make approval far from certain.

- High-Interest Rates and Fees: Lenders offering "guaranteed approval" often compensate for the increased risk associated with no credit checks by charging significantly higher interest rates and fees. This can make the loan far more expensive than anticipated.

- Pre-qualification vs. Final Approval: What many lenders actually offer is pre-qualification, not guaranteed final approval. Pre-qualification means you meet some basic requirements, like having a minimum income, but it doesn't guarantee the lender will approve your loan application. Final approval hinges on a more comprehensive review of your financial situation. Pre-qualification is simply the first step in the loan approval process. Don't confuse it with guaranteed approval of your no credit check loan.

- Understanding the Difference: Pre-qualification assesses your basic eligibility, while final approval involves a thorough review of your application, including income verification and other financial data, even if no formal credit check is conducted.

Finding Reputable Direct Lenders for No Credit Check Loans

Securing a no credit check loan requires extra caution. Choosing a reputable direct lender is paramount to avoid scams and predatory lending practices. Many illegitimate lenders prey on those with poor credit, offering loans with incredibly high-interest rates and hidden fees.

- Licensing and Regulation: Look for lenders licensed and regulated in your state or country. This provides a layer of protection and ensures the lender operates legally.

- Thorough Research and Reviews: Check online reviews and ratings from independent sources like the Better Business Bureau. Be wary of overwhelmingly positive reviews, as these may be fake.

- Realistic Terms and Transparency: Be cautious of lenders who promise unrealistic terms or are vague about fees and interest rates. Transparency is key; a reputable lender will openly explain all the terms and conditions of the loan.

- Comparison Shopping: Before committing, compare interest rates, fees, repayment terms, and other conditions from several lenders. This allows you to find the most suitable and affordable option for your financial situation.

Understanding the Risks of No Credit Check Loans

While the appeal of a no credit check loan is obvious, it's crucial to understand the inherent risks. Because lenders assume a greater risk by not reviewing your credit history, they often charge significantly higher interest rates and fees.

- The Debt Trap: High-interest rates can quickly lead to a debt trap. If you struggle to make timely payments, the interest will accumulate rapidly, making it challenging to repay the loan.

- Accumulating Debt: Numerous fees associated with no credit check loans can significantly increase the total cost, leading to larger debt burdens.

- Long-Term Credit Impact: Although these loans don't directly impact your credit score (as no credit check is conducted), missing payments can still negatively impact your financial reputation and make it harder to secure future loans.

Alternatives to No Credit Check Loans

Before opting for a no credit check loan, consider alternatives that may offer more favorable terms:

- Secured Loans: Secured loans, which require collateral (like a car or savings account), typically have lower interest rates than unsecured no credit check loans.

- Credit Unions: Credit unions often provide more favorable loan terms and greater flexibility than traditional banks, especially for borrowers with less-than-perfect credit histories.

- Financial Counseling: A financial counselor can help you better manage your finances, create a budget, and explore debt solutions to avoid relying on high-interest loans.

How to Improve Your Chances of Approval

Even without a credit check, lenders still assess your ability to repay the loan. Several factors significantly impact your approval chances:

- Stable Income and Employment: Demonstrating a stable income and employment history is crucial. Lenders need reassurance that you can afford the monthly payments.

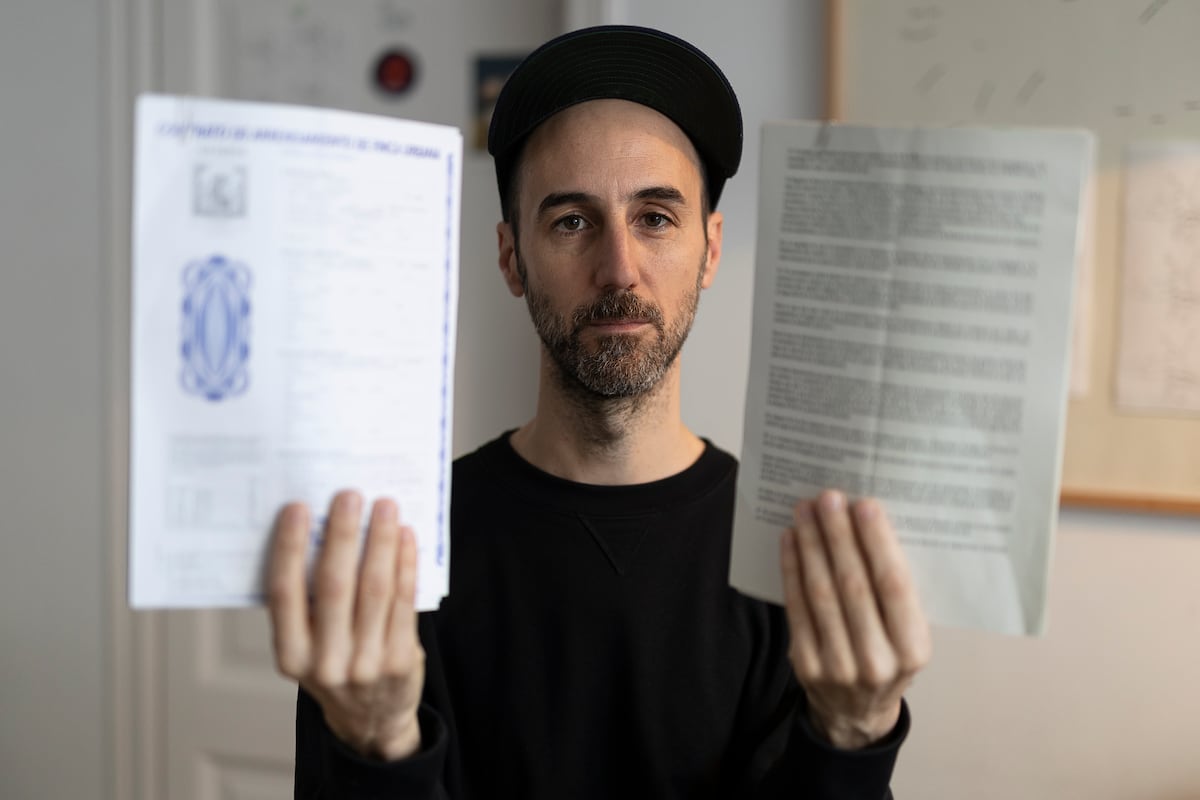

- Proof of Income: Providing documented proof of income, such as pay stubs or tax returns, significantly increases your chances of approval.

- Co-signer: If possible, having a co-signer with good credit can strengthen your application and improve your odds of approval.

- Honesty and Transparency: Be upfront and honest with lenders about your financial situation. Hiding information will likely hurt your chances and could even be grounds for rejection.

Conclusion

While the allure of "guaranteed approval" for no credit check loans is strong, it's often a misleading marketing tactic. Understanding the risks and benefits, and selecting reputable lenders, is crucial for borrowers. Remember to thoroughly research your options, compare offers from different lenders, and explore alternatives before committing. Don't let the promise of guaranteed approval cloud your judgment when searching for no credit check loans from direct lenders. Before you apply for a no credit check loan, carefully weigh the risks and benefits and explore all available options. Find a reputable direct lender and make an informed decision regarding your financial needs.

Featured Posts

-

Tenants Victims Of Rent Regulation Changes Interest Group Claims

May 28, 2025

Tenants Victims Of Rent Regulation Changes Interest Group Claims

May 28, 2025 -

Wes Anderson World Building Archives To Open In London

May 28, 2025

Wes Anderson World Building Archives To Open In London

May 28, 2025 -

San Diego Padres Toronto Series Preview And Predictions

May 28, 2025

San Diego Padres Toronto Series Preview And Predictions

May 28, 2025 -

Tyrese Haliburtons Injury Status Bulls Vs Pacers Game Update

May 28, 2025

Tyrese Haliburtons Injury Status Bulls Vs Pacers Game Update

May 28, 2025 -

Leeds United Transfer News Verbal Agreement Reached Players Stance Revealed

May 28, 2025

Leeds United Transfer News Verbal Agreement Reached Players Stance Revealed

May 28, 2025

Latest Posts

-

Agassi Recuerda A Su Gran Rival Sudamericano Rios

May 30, 2025

Agassi Recuerda A Su Gran Rival Sudamericano Rios

May 30, 2025 -

Revenirea Lui Andre Agassi Primul Meci De Pickleball

May 30, 2025

Revenirea Lui Andre Agassi Primul Meci De Pickleball

May 30, 2025 -

Andre Agassi O Noua Era In Cariera Sa Pickleball

May 30, 2025

Andre Agassi O Noua Era In Cariera Sa Pickleball

May 30, 2025 -

Legenda Tenisului Andre Agassi Joaca Pickleball

May 30, 2025

Legenda Tenisului Andre Agassi Joaca Pickleball

May 30, 2025 -

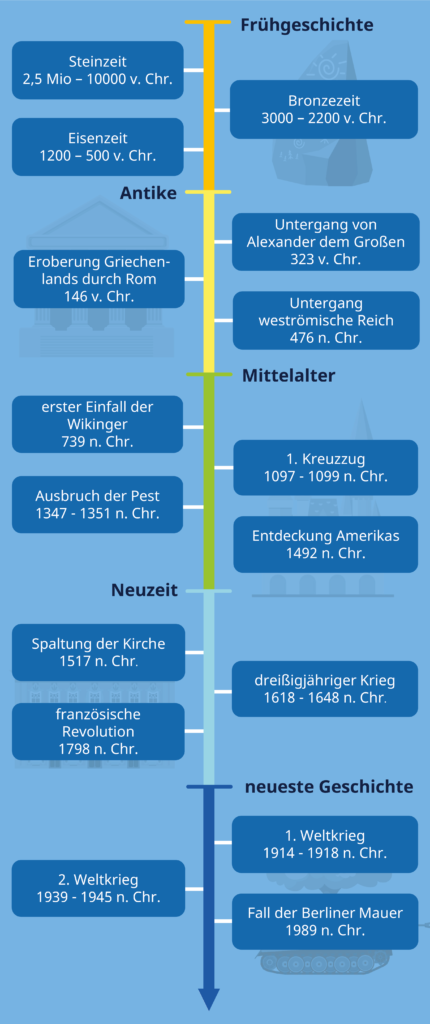

Der 10 April In Der Geschichte Daten Fakten Und Ereignisse

May 30, 2025

Der 10 April In Der Geschichte Daten Fakten Und Ereignisse

May 30, 2025