Understanding High Stock Market Valuations: A BofA Perspective

Table of Contents

Key Metrics for Assessing Stock Market Valuation

Several key metrics help assess whether stock market valuations are justified. Understanding these metrics is crucial for making sound investment decisions.

Price-to-Earnings Ratio (P/E):

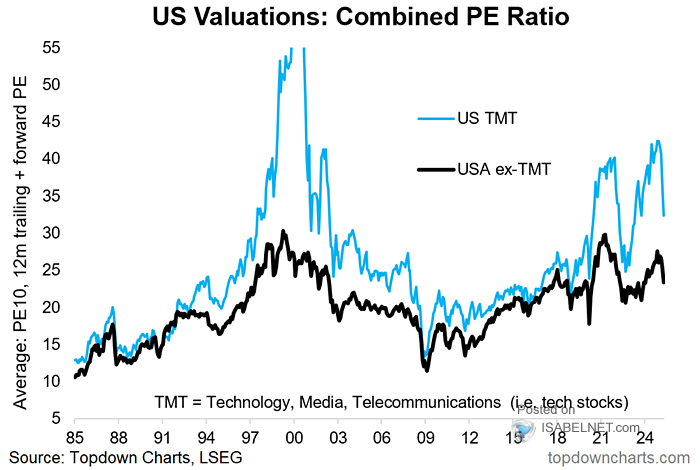

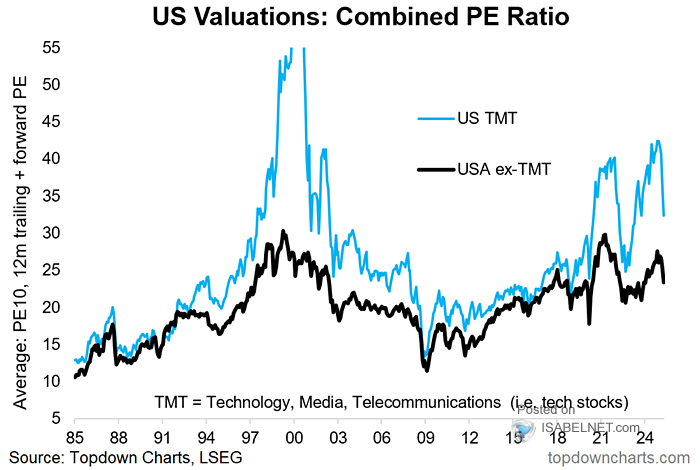

The Price-to-Earnings Ratio (P/E) is a fundamental valuation metric calculated by dividing a company's stock price by its earnings per share (EPS). A high P/E ratio suggests investors are willing to pay a premium for each dollar of earnings, potentially indicating high growth expectations or overvaluation. Conversely, a low P/E ratio might suggest undervaluation or lower growth prospects.

- Forward vs. Trailing P/E: The forward P/E uses projected future earnings, while the trailing P/E uses past earnings. The forward P/E is often preferred as it reflects future expectations, but it relies on potentially inaccurate forecasts.

- Sectoral Differences: P/E ratios vary significantly across sectors. High-growth technology companies often command higher P/E ratios than mature, slower-growth sectors like utilities.

- BofA's Perspective: BofA analysts constantly monitor P/E ratios across various sectors, comparing them to historical averages and industry benchmarks to gauge relative valuation. Their analysis considers the interplay between growth expectations and risk premiums.

Cyclically Adjusted Price-to-Earnings Ratio (CAPE):

The CAPE ratio, also known as the Shiller P/E, is a variation of the P/E ratio that adjusts for inflation and uses a ten-year average of real earnings. This smoother metric helps to account for the cyclical nature of earnings and provides a longer-term perspective on valuation.

- Accounting for Economic Cycles: The CAPE ratio’s use of a ten-year average reduces the impact of short-term economic fluctuations, offering a more stable measure of valuation compared to the standard P/E ratio.

- Historical Context: Comparing the current CAPE ratio to its historical average helps determine whether valuations are unusually high or low relative to past market cycles.

- BofA's Analysis: BofA incorporates the CAPE ratio into its valuation models, acknowledging its usefulness for long-term investors, although it also recognizes limitations related to its reliance on past data.

Other Valuation Metrics:

While P/E and CAPE are widely used, a comprehensive valuation requires considering other metrics.

- Price-to-Sales (P/S): This ratio compares a company’s market capitalization to its revenue. It is particularly useful for companies with negative earnings.

- Price-to-Book (P/B): This ratio compares a company's market value to its book value (assets minus liabilities). It is often used to evaluate value stocks.

- Dividend Yield: The annual dividend per share divided by the stock price. It indicates the return from dividends.

BofA employs a combination of these metrics, considering their strengths and weaknesses within a holistic framework. Their analysts carefully weigh these various measures to arrive at a balanced assessment of market valuation.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the current high stock market valuations. Understanding these drivers is critical for making informed investment decisions.

Low Interest Rates:

Historically low interest rates significantly impact stock valuations. Low borrowing costs reduce the cost of capital for companies, encouraging investment and boosting corporate earnings. Simultaneously, low yields on bonds make stocks a relatively more attractive investment, driving up demand and prices.

- Inverse Relationship: Generally, there is an inverse relationship between interest rates and stock prices. As interest rates fall, stock prices tend to rise, and vice versa.

- BofA's Interest Rate Projections: BofA's economists provide forecasts on future interest rate movements, which are crucial in evaluating the sustainability of current stock valuations.

Strong Corporate Earnings:

Robust corporate earnings growth plays a vital role in supporting high valuations. Technological innovation, globalization, and efficient management have all contributed to improved corporate profitability in recent years.

- Growth Sectors: Specific sectors, such as technology and healthcare, have experienced exceptionally strong earnings growth, influencing overall market valuations.

- BofA's Earnings Forecasts: BofA's analysts provide forecasts for future earnings growth, allowing investors to assess whether current valuations are justified by future earnings potential.

Quantitative Easing and Monetary Policy:

Central banks’ quantitative easing (QE) programs and other expansionary monetary policies have significantly increased the money supply, lowering borrowing costs and boosting liquidity in the market. This has contributed to higher asset prices, including stocks.

- Impact on Asset Prices: QE programs inject liquidity into the financial system, driving up demand for assets, including stocks, bonds, and real estate.

- BofA's Long-Term View: BofA's economists and strategists analyze the long-term effects of QE on market valuations and economic growth.

Navigating High Valuations: A BofA Perspective

Navigating a market with high valuations requires a well-defined strategy and a disciplined approach.

Strategic Asset Allocation:

Diversification is paramount in a high-valuation market. A well-diversified portfolio reduces exposure to any single asset class and limits overall risk.

- Asset Allocation Strategies: BofA recommends various asset allocation strategies depending on investor risk tolerance and time horizon. These could include allocations to stocks, bonds, real estate, and alternative investments.

- BofA's Portfolio Structures: BofA provides model portfolios illustrating strategic asset allocation approaches tailored to different investor profiles.

Risk Management Techniques:

Careful risk management is crucial during periods of high valuations. This includes understanding your risk tolerance and implementing strategies to mitigate potential losses.

- Risk Mitigation Strategies: Diversification, hedging strategies (e.g., options), and stop-loss orders are crucial risk management tools.

- BofA's Risk Management Expertise: BofA leverages its extensive risk management expertise to guide investors in mitigating potential downsides.

Long-Term Investment Strategy:

Adopting a long-term investment horizon is essential to ride out short-term market volatility. Avoid emotional decision-making based on short-term market fluctuations.

- Benefits of Long-Term Investing: A long-term approach allows investors to weather market cycles and benefit from long-term growth.

- Staying Disciplined: Sticking to a well-defined investment plan, regardless of market conditions, is crucial for long-term success.

Conclusion

Understanding high stock market valuations requires a nuanced understanding of key metrics, macroeconomic conditions, and monetary policies. BofA's perspective highlights the importance of a diversified portfolio, robust risk management, and a long-term investment approach. While current valuations may seem high, a thorough understanding of the underlying dynamics enables informed decisions. By carefully considering these factors and incorporating BofA's insights, investors can navigate the complexities of high stock market valuations and make sound investment choices. Remember to consult a financial advisor for personalized guidance regarding your investment strategy and understanding high stock market valuations.

Featured Posts

-

Armenias Eurovision Song Survivor Gets Armenian Lyrics From Parg

May 19, 2025

Armenias Eurovision Song Survivor Gets Armenian Lyrics From Parg

May 19, 2025 -

Children Rescued Parents Arrested The Dalfsen Amber Alert

May 19, 2025

Children Rescued Parents Arrested The Dalfsen Amber Alert

May 19, 2025 -

Orlando Healths Brevard Hospital Closure Impact And Future Plans

May 19, 2025

Orlando Healths Brevard Hospital Closure Impact And Future Plans

May 19, 2025 -

New Photos Jennifer Lawrence And Cooke Maroney Following Second Baby Reports

May 19, 2025

New Photos Jennifer Lawrence And Cooke Maroney Following Second Baby Reports

May 19, 2025 -

The Mets Future Steve Cohens Perspective On Alonso And Sotos Performance

May 19, 2025

The Mets Future Steve Cohens Perspective On Alonso And Sotos Performance

May 19, 2025