Understanding High Stock Market Valuations: BofA's Perspective For Investors

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

BofA's overall view on the current market often reflects a cautious optimism. While acknowledging the elevated valuations, they highlight several factors contributing to this situation. These factors include historically low interest rates, strong corporate earnings, and continued government stimulus. Understanding how these factors influence valuations is key to making informed investment decisions.

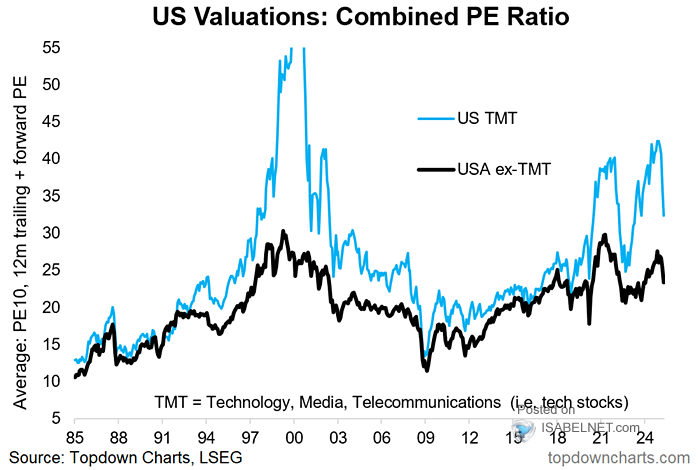

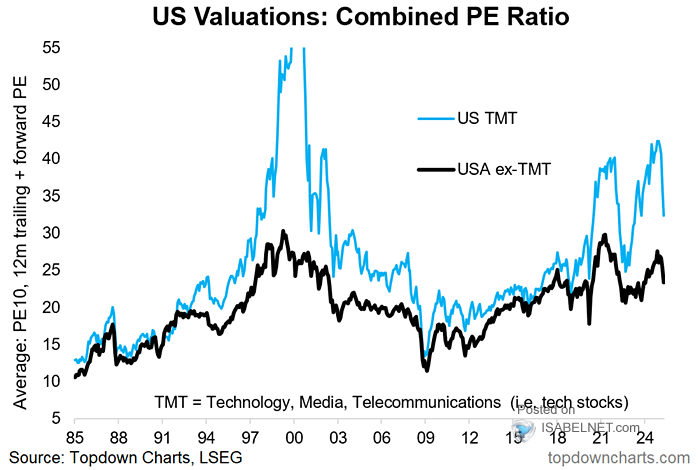

- Valuation Metrics: BofA utilizes several key valuation metrics to assess the market, including the Price-to-Earnings ratio (P/E), the Shiller PE (CAPE ratio), and other forward-looking metrics. These metrics provide a comparative view of current valuations relative to historical averages and future earnings expectations.

- Historical Comparisons: BofA's analysis compares current P/E ratios and CAPE ratios to their historical averages. This comparison helps determine whether current valuations are significantly overextended or within a reasonable range considering the current economic climate and future growth prospects. Deviations from historical averages signal potential risks or opportunities.

- Potential Risks: BofA identifies potential risks associated with high valuations, including the vulnerability to interest rate hikes, potential for market corrections, and the possibility of slower-than-expected economic growth impacting future corporate earnings. Understanding these risks is crucial for effective risk management.

Factors Driving High Stock Market Valuations (According to BofA)

Several key factors contribute to the elevated stock market valuations, as highlighted by BofA's analysts:

- Low Interest Rate Environment: Exceptionally low interest rates incentivize investors to seek higher returns in the stock market, driving up demand and consequently, valuations. This low-interest-rate environment makes bonds less attractive compared to riskier assets like stocks.

- Strong Corporate Earnings and Profit Growth: Robust corporate earnings and profit growth, particularly in specific sectors, support higher stock prices and valuation multiples. BofA's analysis focuses on identifying companies and sectors exhibiting sustained growth to aid in investment selection.

- Quantitative Easing and Monetary Policies: The impact of quantitative easing and other expansionary monetary policies from central banks globally has injected significant liquidity into the market, fueling asset price inflation, including stocks.

- Technological Advancements: The rapid pace of technological advancements has led to the emergence of high-growth tech companies commanding premium valuations due to their perceived future potential. BofA's analysis includes assessing the long-term viability of these valuations.

- Geopolitical Factors: Geopolitical events and uncertainties can influence market sentiment and investor behavior, impacting stock valuations. BofA integrates geopolitical risk assessment into its overall market outlook.

The Role of Inflation in High Stock Market Valuations

Inflation plays a significant role in BofA's analysis of high stock market valuations. Rising inflation can impact future corporate earnings and valuation multiples in several ways.

- Inflation Expectations and Discount Rates: Higher inflation expectations generally lead to higher discount rates used in valuation models. Higher discount rates reduce the present value of future earnings, thus potentially dampening valuations.

- Impact on Future Stock Performance: BofA's analysts project how anticipated inflation might affect future corporate profitability and consequently, stock prices. They often incorporate inflation forecasts into their financial models.

- Investor Strategy Adjustments: BofA advises investors to adjust their investment strategies in response to potential inflationary pressures. This may involve shifting towards inflation-hedged assets or adjusting portfolio allocations.

BofA's Investment Strategies in a High Valuation Environment

Given the high valuations, BofA suggests a nuanced approach to investment strategies:

- Diversification: Diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to mitigate risk in a high-valuation environment.

- Long-Term Investment Horizon: Maintaining a long-term investment horizon allows investors to weather short-term market volatility and benefit from the potential for long-term growth.

- Sector-Specific Opportunities: BofA identifies specific sectors that may offer better value propositions despite the overall high valuations, often focusing on sectors with strong fundamentals and long-term growth potential.

- Alternative Asset Classes: Exploring alternative asset classes, such as private equity or infrastructure, can diversify portfolios and potentially offer higher returns or inflation protection.

- Identifying Undervalued Companies: BofA emphasizes the importance of rigorous fundamental analysis to identify potentially undervalued companies or sectors that may offer attractive risk-adjusted returns.

Managing Risk in a High Valuation Market

Effectively managing risk is paramount in a high-valuation market:

- Due Diligence and Fundamental Analysis: Thorough due diligence and fundamental analysis are essential to assess the intrinsic value of companies and identify potential risks.

- Risk Mitigation Strategies: Employing diversification and hedging strategies helps mitigate potential downside risks associated with market corrections or economic downturns.

- Understanding Market Corrections: Investors should anticipate potential market corrections and understand their impact on portfolio valuations. BofA often incorporates stress testing into its portfolio management advice.

- Risk Tolerance: Investment decisions must align with individual risk tolerance levels. BofA's advisors help clients assess their risk tolerance to guide investment choices.

Conclusion

Understanding high stock market valuations is crucial for making informed investment decisions. BofA's perspective offers valuable insights into the contributing factors, potential risks, and strategic approaches for navigating this market environment. By considering BofA's analysis on valuation metrics, influential factors, and risk management strategies, investors can better position themselves for long-term success. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions related to high stock market valuations. Stay informed about the ongoing developments regarding high stock market valuations and adapt your strategies accordingly.

Featured Posts

-

Princess Beatrice Discusses The Impact Of Her Parents Divorce

May 12, 2025

Princess Beatrice Discusses The Impact Of Her Parents Divorce

May 12, 2025 -

Astros Foundation College Classic Meet The 2025 All Tournament Team

May 12, 2025

Astros Foundation College Classic Meet The 2025 All Tournament Team

May 12, 2025 -

Usmnt Weekend Roundup Dests Return And Pulisics Heroics

May 12, 2025

Usmnt Weekend Roundup Dests Return And Pulisics Heroics

May 12, 2025 -

Ru Pauls Drag Race S17 E13 Drag Baby Mamas Preview Family Drama

May 12, 2025

Ru Pauls Drag Race S17 E13 Drag Baby Mamas Preview Family Drama

May 12, 2025 -

Uruguay Apuesta Por China Un Regalo Peculiar Para El Sector Ganadero

May 12, 2025

Uruguay Apuesta Por China Un Regalo Peculiar Para El Sector Ganadero

May 12, 2025