Understanding High Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Key Arguments for High Stock Market Valuations

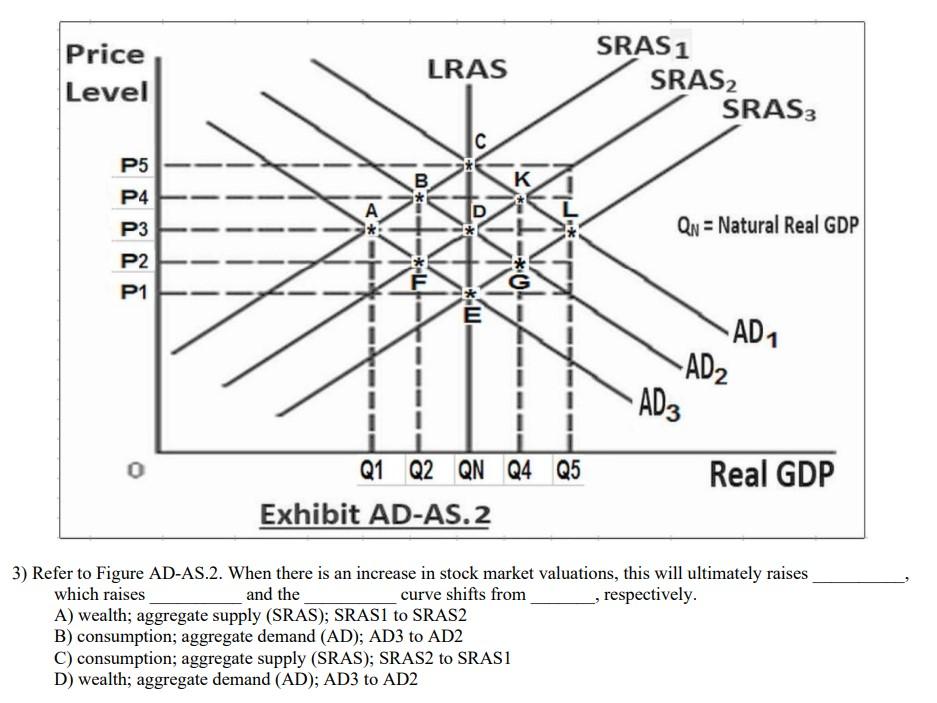

BofA's analysis suggests that the current high stock market valuations are not solely indicative of an overinflated market. Their perspective is grounded in several key factors:

Strong Corporate Earnings and Profitability

BofA highlights robust corporate earnings as a primary justification for the current valuations. They point to several key indicators:

- Sustained growth in earnings per share (EPS) across various sectors: Many companies are demonstrating consistent growth in their EPS, a crucial metric indicating profitability. This sustained growth suggests that current stock prices are, at least partially, justified by strong underlying performance.

- Increased profitability driven by operational efficiencies and pricing power: Companies are increasingly efficient, streamlining operations and improving profitability margins. Furthermore, many possess pricing power, allowing them to raise prices without significantly impacting demand.

- Positive revisions in future earnings forecasts: Analysts are generally upwardly revising their forecasts for future corporate earnings, suggesting continued optimism and a belief in sustained growth.

These strong fundamentals support the argument that current valuations, while high compared to historical averages, are not necessarily unsustainable. The underlying performance of many companies is bolstering the market.

Low Interest Rates and Abundant Liquidity

The current low-interest-rate environment and ample liquidity play a significant role in supporting higher stock prices. This easy monetary policy influences valuations in several ways:

- Continued quantitative easing measures (although less prevalent now): While quantitative easing may be less active in many economies, its legacy effect continues to influence investor behavior and market liquidity.

- Low borrowing costs for businesses and consumers: Low interest rates make borrowing cheaper, allowing businesses to expand and consumers to spend. This boosts economic activity and supports higher stock prices.

- Increased investor appetite for riskier assets: With low returns on safer investments like bonds, investors are more willing to take on risk and invest in the stock market, driving up demand and valuations.

This easy monetary policy has undeniably fueled significant investment into equities, pushing valuations higher. However, it's important to note that interest rate changes can significantly impact market valuations.

Technological Innovation and Growth Sectors

Rapid technological advancements and the booming growth of innovative sectors are major drivers of increased valuations. This is particularly evident in:

- Significant investment in technology companies with high growth potential: Investors continue to pour money into technology companies, particularly those in artificial intelligence, cloud computing, and other disruptive sectors.

- Expansion into new markets and emerging technologies: Companies are constantly exploring new markets and developing innovative technologies, creating new opportunities for growth and higher valuations.

- The dominance of technology giants in the market capitalization: The sheer size and market influence of major technology companies significantly impact overall market valuations.

These sectors command premium valuations due to their perceived long-term growth prospects, even if their current earnings may not fully justify their price. Understanding the dynamics of these sectors is crucial for understanding overall market valuation.

Addressing Concerns about Overvaluation

While BofA acknowledges the high valuation multiples, they emphasize the importance of context and perspective when assessing the situation.

Valuation Metrics and Context

BofA doesn't ignore the high valuations, but stresses the need to avoid solely focusing on absolute numbers. A more nuanced approach is needed:

- Comparison with historical valuations across different economic cycles: Comparing current valuations to historical data, while considering the different economic contexts, helps to provide perspective and avoids making rash conclusions.

- Analysis of various valuation metrics (e.g., P/E ratio, Price-to-Sales ratio): Using multiple valuation metrics provides a more comprehensive view, mitigating the potential biases of using a single metric.

- Consideration of long-term growth expectations: Looking beyond short-term fluctuations and considering the long-term growth potential of companies and the economy is vital.

Simply looking at absolute valuation numbers, such as the price-to-earnings ratio (P/E), can be misleading. Consider the overall context and potential future growth.

Risk Management and Diversification

BofA underscores the crucial role of risk management and diversification in any investment strategy, particularly within a potentially high-valuation market. This involves:

- Strategic asset allocation to mitigate potential downside risks: Spreading investments across different asset classes helps reduce exposure to the risks associated with a single market segment.

- Regular portfolio rebalancing to maintain optimal risk exposure: Periodically adjusting the portfolio ensures the risk level remains aligned with the investor's risk tolerance.

- Investing based on long-term goals rather than short-term market fluctuations: Focusing on long-term objectives helps mitigate the impact of short-term market volatility.

A prudent approach, even in a high-valuation environment, involves mitigating potential risks through careful planning and diversification.

Conclusion

BofA's analysis suggests that while high stock market valuations are a current reality, they don't automatically signal an impending crash. Strong corporate earnings, low interest rates, and technological innovation are contributing factors. However, investors should remain cautious, considering valuation metrics within a broader economic context and employing robust risk management strategies. Understanding high stock market valuations requires a nuanced approach, combining fundamental analysis with a well-defined, diversified investment strategy. Don't panic—instead, carefully analyze your portfolio, considering diversification and risk management to navigate these high stock market valuations effectively. Consult with a financial advisor to create a personalized investment plan tailored to your individual risk tolerance and financial goals.

Featured Posts

-

Understanding Payton Pritchards Sixth Man Of The Year Contention

May 11, 2025

Understanding Payton Pritchards Sixth Man Of The Year Contention

May 11, 2025 -

Blowout Victory Propels Celtics To Division Title

May 11, 2025

Blowout Victory Propels Celtics To Division Title

May 11, 2025 -

Izgled Na Kim Kardashi An Kreatsi A Ko A Gi Potentsira Ne Zinite Oblini

May 11, 2025

Izgled Na Kim Kardashi An Kreatsi A Ko A Gi Potentsira Ne Zinite Oblini

May 11, 2025 -

Review Anthony Mackie Stars In A Pedestrian Childrens Film

May 11, 2025

Review Anthony Mackie Stars In A Pedestrian Childrens Film

May 11, 2025 -

Ufc 315 Results Full Muhammad Vs Della Maddalena Main Card Breakdown

May 11, 2025

Ufc 315 Results Full Muhammad Vs Della Maddalena Main Card Breakdown

May 11, 2025