Understanding ING Group's 2024 Results: Insights From The Form 20-F Report

Table of Contents

Key Financial Highlights from ING Group's 2024 Form 20-F

Analyzing ING Group's 2024 Form 20-F reveals significant trends in the company's financial performance. We'll examine key metrics to understand its financial health.

Revenue and Net Income Analysis

ING Group's revenue and net income figures for 2024 provide a snapshot of its overall financial performance. Comparing these figures to previous years is vital for identifying trends and assessing the company's growth trajectory.

- Revenue: (Insert actual figure from the 20-F report here) – representing a (Insert percentage change compared to 2023) increase/decrease.

- Net Income: (Insert actual figure from the 20-F report here) – showing a (Insert percentage change compared to 2023) increase/decrease.

- Key Profit Metrics: (Include relevant metrics like Return on Equity (ROE), Return on Assets (ROA), and Net Interest Margin (NIM) with figures and percentage changes).

Analysis: The changes in ING Group revenue and net income should be interpreted in the context of macroeconomic factors, specific business strategies, and industry trends. A detailed analysis will highlight whether the performance reflects positive growth or potential challenges. For example, a decrease in net income despite increased revenue might indicate rising operating expenses. Conversely, strong revenue and net income growth demonstrates robust profitability and effective business strategies. This profitability analysis is crucial for evaluating ING Group's financial strength.

Capital Ratios and Solvency

ING Group's capital ratios are a crucial indicator of its financial stability and ability to withstand economic shocks. A strong capital base is essential for maintaining investor confidence and ensuring the long-term health of the institution.

- Tier 1 Capital Ratio: (Insert actual figure from the 20-F report here)

- Other Key Capital Ratios: (Include other relevant ratios as per the 20-F report, with corresponding figures).

Analysis: These ING Group capital ratio figures demonstrate the bank's solvency. Analyzing these ratios against regulatory requirements and industry benchmarks allows for a comprehensive assessment of ING Group's financial stability and its risk management capabilities. A higher-than-required ratio indicates a strong capital position, suggesting greater resilience to potential financial distress.

Significant Business Segments' Performance

ING Group operates across various business segments. Analyzing each segment's performance offers a granular understanding of the company's overall financial health.

- Wholesale Banking: (Include revenue growth, cost-income ratio, and other relevant metrics).

- Retail Banking: (Include revenue growth, customer acquisition, and other relevant metrics).

- (Other relevant business segments): (Repeat the above for other significant business units).

Analysis: The performance of individual ING Group business segments provides valuable insights into the drivers of overall financial results. Identifying high-performing and underperforming segments allows for a more nuanced understanding of ING Group's strategic priorities and their effectiveness. Segmental analysis enables investors to assess the diversification of ING Group's revenue streams and the resilience of each business unit to economic fluctuations.

Risk Factors and Challenges Highlighted in the 20-F Report

The Form 20-F report also details various risks that could impact ING Group's future performance. Understanding these risks is crucial for any informed investment decision.

Geopolitical and Economic Risks

ING Group's operations are exposed to various macroeconomic factors and geopolitical risks.

- Inflation: (Discuss the potential impact of inflation on ING Group’s operations as highlighted in the 20-F report).

- Interest Rate Changes: (Analyze how interest rate fluctuations could affect ING Group’s profitability and lending activities).

- Global Uncertainty: (Assess the potential impact of global political instability on ING Group’s business).

Analysis: These ING Group risk factors are interconnected and can significantly influence the company's future performance. A thorough understanding of these risks is essential for investors to gauge the potential volatility of ING Group's investment.

Regulatory and Compliance Risks

The financial services industry is heavily regulated, and ING Group faces potential regulatory changes and compliance challenges.

- Regulatory Changes: (Discuss any specific regulatory changes mentioned in the 20-F report and their potential implications).

- Compliance Costs: (Analyze the potential impact of regulatory compliance on ING Group's operating expenses).

Analysis: ING Group's regulatory compliance efforts are crucial for maintaining its operating license and avoiding potential penalties. The ability to adapt to changing regulations effectively is a key factor in determining the company's long-term success.

Other Key Risk Factors

Besides geopolitical and regulatory risks, other factors can impact ING Group's performance.

- Cybersecurity Risk: (Discuss the potential impact of cyberattacks on ING Group's operations and reputation).

- Credit Risk: (Analyze the risk of loan defaults and their impact on the company's financial health).

Analysis: A comprehensive assessment of these ING Group credit risk and operational risks is crucial for understanding the complete risk profile of the company.

Future Outlook and Investment Implications Based on the 2024 Results

Based on the analysis of the 2024 Form 20-F, we can examine ING Group's future outlook and its implications for investors.

Management’s Guidance and Expectations

ING Group's management provides guidance on the company's expected performance for the coming year.

- Revenue Growth Projections: (Include any specific revenue projections provided by management).

- Net Income Expectations: (Include any specific net income projections).

Analysis: Management's guidance provides a valuable insight into their expectations for the future. However, it’s important to note that these are projections and actual results may differ.

Investment Recommendations

Based on the analysis of ING Group's 2024 results and its future outlook, investors should consider several factors:

- Growth Potential: (Discuss the potential for future growth based on the company's strategic initiatives and market conditions).

- Risk Tolerance: (Emphasize that the analysis should be considered alongside an individual investor’s risk tolerance).

Analysis: This section offers a balanced perspective. Remember, this is not financial advice. Conduct thorough due diligence before making any investment decisions related to ING Group stock.

Conclusion: Key Takeaways and Call to Action

Analyzing ING Group's 2024 results from the Form 20-F report reveals a complex picture of its financial performance, highlighting both strengths and risks. Key financial highlights include (summarize key figures for revenue, net income, and capital ratios). Significant risks include (mention key risks, e.g., geopolitical uncertainty, regulatory changes). Management’s guidance offers a perspective on the future, but investors should conduct their own in-depth analysis. To gain a complete understanding of ING Group's financial performance, we strongly encourage you to review the full Form 20-F report and conduct further research into ING Group's 2024 results and future outlook. This will allow for a more informed investment strategy.

Featured Posts

-

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 21, 2025

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 21, 2025 -

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025 -

Espns Bruins Offseason Analysis Key Franchise Altering Moves

May 21, 2025

Espns Bruins Offseason Analysis Key Franchise Altering Moves

May 21, 2025 -

Clisson Hell City La Brasserie Ideale Avant Apres Le Hellfest

May 21, 2025

Clisson Hell City La Brasserie Ideale Avant Apres Le Hellfest

May 21, 2025 -

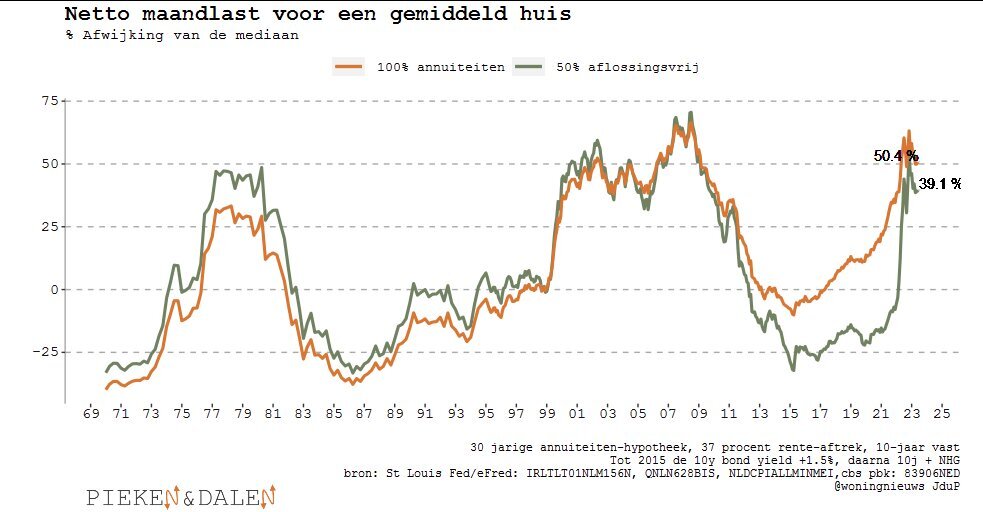

Geen Stijl En Abn Amro Debat Over Betaalbaarheid Woningen In Nederland

May 21, 2025

Geen Stijl En Abn Amro Debat Over Betaalbaarheid Woningen In Nederland

May 21, 2025

Latest Posts

-

Antiques Roadshow National Treasure Unearthed Leading To Arrest Of Couple

May 21, 2025

Antiques Roadshow National Treasure Unearthed Leading To Arrest Of Couple

May 21, 2025 -

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal Of National Treasure

May 21, 2025

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal Of National Treasure

May 21, 2025 -

Antiques Roadshow Stolen Treasures Result In Criminal Charges

May 21, 2025

Antiques Roadshow Stolen Treasures Result In Criminal Charges

May 21, 2025 -

Stolen Antiques Antiques Roadshow Appearance Ends In Arrest

May 21, 2025

Stolen Antiques Antiques Roadshow Appearance Ends In Arrest

May 21, 2025 -

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 21, 2025

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 21, 2025