Understanding Jim Cramer's Perspective On CoreWeave (CRWV)

Table of Contents

Jim Cramer, the renowned television personality and financial commentator, wields considerable influence over individual investor decisions. His opinions, often expressed on his popular shows like "Mad Money" and through various media appearances, can significantly impact the stock market. CoreWeave (CRWV), a rapidly growing player in the cloud computing sector, has recently become a subject of Cramer's commentary. This article aims to analyze Jim Cramer's perspective on CoreWeave (CRWV), examining the evolution of his views and exploring the implications for investors interested in this burgeoning segment of the cloud computing market. We'll delve into his analysis of CRWV, considering the broader market context and CoreWeave's financial performance to understand the weight his opinions carry and how investors should approach the situation.

H2: Cramer's Initial Assessment of CoreWeave (CRWV)

Jim Cramer's initial commentary on CRWV, while not extensively documented in a single, easily accessible source, can be pieced together from various media appearances. To fully understand Cramer's initial CRWV analysis, one needs to piece together comments made across different platforms. While pinning down a precise date and segment for his first discussion is difficult, the overall initial sentiment can be inferred.

-

Positive or negative sentiment? Early indications suggest a cautiously optimistic stance. Cramer likely acknowledged the potential of CoreWeave's innovative approach to cloud computing but may have expressed some concerns regarding the competitive landscape.

-

Specific reasons cited for his opinion: His initial opinions likely centered on CoreWeave's focus on high-performance computing and its potential to disrupt established players. The company's specialized infrastructure for AI and machine learning likely played a role in his consideration. However, concerns about profitability and market share might have tempered his enthusiasm.

-

Comparison to competitors in the cloud computing sector: Cramer likely compared CoreWeave's strategy and market position to giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), highlighting both advantages and disadvantages. The company's niche focus, while potentially lucrative, may have also been viewed as a risk factor.

H2: Evolution of Cramer's View on CoreWeave (CRWV)

Has Jim Cramer's opinion on CRWV remained consistent? Tracking the evolution of his perspective requires careful monitoring of his appearances and commentary. While he might not explicitly announce changes, shifts in his tone and investment recommendations can reveal an evolving viewpoint.

-

Specific dates or events that influenced his opinion: Significant events such as CoreWeave's quarterly earnings reports, major partnerships, or changes in the competitive landscape would undoubtedly influence Cramer's analysis and influence his overall assessment of the CRWV stock.

-

Changes in his investment recommendations: If Cramer initially leaned towards a "buy" or "hold" recommendation, any subsequent shift to a "sell" recommendation would indicate a significant change in his outlook. Conversely, a shift from "hold" to "buy" would signal increased confidence.

-

Mention any contradictory statements or evolving narratives: It's not uncommon for financial analysts, even those as prominent as Jim Cramer, to refine their opinions over time. Documenting any contradictory statements or changes in narrative provides valuable insight into the complexities of evaluating a rapidly evolving company like CoreWeave.

H2: Factors Influencing Cramer's CRWV Perspective

Numerous factors beyond CoreWeave's internal performance can influence Jim Cramer's assessment. Understanding these broader contexts is crucial for a comprehensive analysis.

-

Overall market conditions (bull vs. bear): A bullish market might lead Cramer to favor growth stocks like CoreWeave, while a bearish market might cause him to adopt a more cautious approach.

-

Competitor performance (e.g., NVIDIA, AWS): The success or failure of CoreWeave's competitors directly impacts its market position and attractiveness as an investment. Cramer would likely weigh the competitive dynamics heavily.

-

CoreWeave’s financial performance (revenue, profits, growth rate): Fundamental financial data, such as revenue growth, profitability, and debt levels, provides a strong basis for any stock evaluation and significantly influences any investor, including Jim Cramer.

-

Technological advancements and innovation in the cloud sector: Rapid technological advancements within the cloud computing sector constantly reshape the competitive landscape. Cramer would need to factor in these shifts and their potential impact on CoreWeave's long-term prospects.

H2: Analyzing the Implications of Cramer's CRWV Opinion for Investors

While Jim Cramer’s opinions carry weight, investors should treat them as one data point among many. Blindly following any financial commentator, including Jim Cramer, is risky.

-

The importance of independent research and due diligence: Investors must conduct thorough independent research, examining financial statements, competitive landscapes, and technological trends.

-

Potential risks and rewards associated with investing in CRWV: Investing in CRWV, like any growth stock, involves inherent risks and rewards. Investors should weigh these carefully, considering their risk tolerance and investment goals.

-

Alternative perspectives and expert opinions on CRWV: Seek out diverse perspectives from other financial analysts and research firms to build a well-rounded view of CoreWeave.

Conclusion: Understanding Jim Cramer and Your CoreWeave (CRWV) Investment Strategy

Jim Cramer's perspective on CoreWeave (CRWV) offers valuable insights but shouldn't dictate investment decisions. His analysis reflects market conditions, competitive pressures, and CoreWeave’s financial performance, but it’s crucial to conduct your own due diligence. Understanding the evolution of his views highlights the importance of continuous monitoring and adaptation in the dynamic world of cloud computing investments. Remember that forming your own opinion, grounded in thorough research and a comprehensive understanding of CoreWeave’s business model and the broader market trends, is essential. Therefore, we urge you to conduct thorough research on CRWV and develop a well-informed investment strategy that considers all available information, including – but not limited to – Jim Cramer’s perspective on CoreWeave and its position within the cloud computing market. Don’t rely solely on Jim Cramer’s opinions; your independent analysis is key to a successful CoreWeave (CRWV) investment strategy.

Featured Posts

-

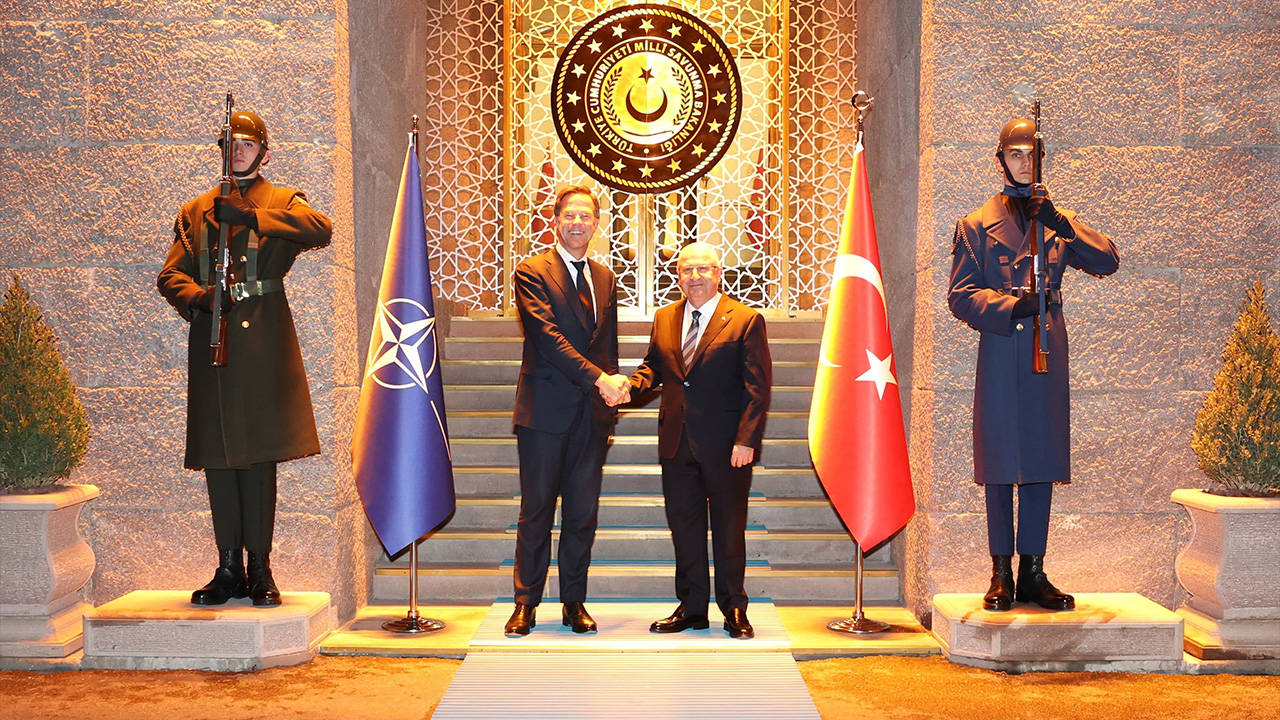

Nato Genel Sekreteri Rutte Ispanya Basbakani Sanchez Ile Enerji Guevenligi Konusunda Goeruestue

May 22, 2025

Nato Genel Sekreteri Rutte Ispanya Basbakani Sanchez Ile Enerji Guevenligi Konusunda Goeruestue

May 22, 2025 -

Former Liverpool Managers Impact On Hout Bay Fc

May 22, 2025

Former Liverpool Managers Impact On Hout Bay Fc

May 22, 2025 -

Mas Alla Del Arandano El Mejor Alimento Para Prevenir Enfermedades Y Envejecer Bien

May 22, 2025

Mas Alla Del Arandano El Mejor Alimento Para Prevenir Enfermedades Y Envejecer Bien

May 22, 2025 -

William Goodge A New Benchmark For Fastest Cross Australia Foot Race

May 22, 2025

William Goodge A New Benchmark For Fastest Cross Australia Foot Race

May 22, 2025 -

Increased Us China Trade Exporters Capitalize On Short Trade Truce Window

May 22, 2025

Increased Us China Trade Exporters Capitalize On Short Trade Truce Window

May 22, 2025

Latest Posts

-

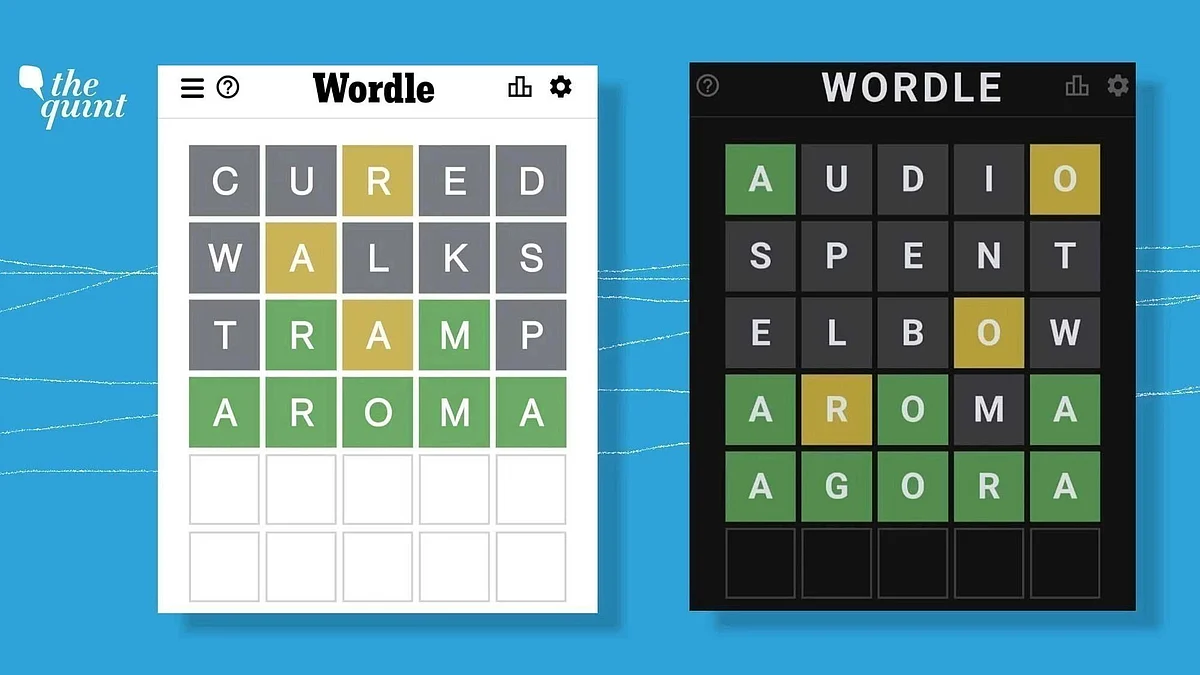

Solve Wordle 1358 Hints For Saturday March 8th

May 22, 2025

Solve Wordle 1358 Hints For Saturday March 8th

May 22, 2025 -

Wordle March 8th 1358 Clues And Solution

May 22, 2025

Wordle March 8th 1358 Clues And Solution

May 22, 2025 -

Wordle 1358 Hints And Answer For March 8th

May 22, 2025

Wordle 1358 Hints And Answer For March 8th

May 22, 2025 -

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025 -

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025