Understanding The Challenges Of Japan's Steep Bond Curve

Table of Contents

The Mechanics of Japan's Steep Yield Curve

Understanding Japan's steep bond curve requires grasping the concept of a yield curve itself. A yield curve graphically represents the relationship between the interest rates (or yields) of bonds with different maturities. It plots the yield on the vertical axis and the maturity (time to expiration) on the horizontal axis. A "steep" yield curve indicates a significant difference between short-term and long-term bond yields; in Japan's case, long-term yields are considerably higher than short-term yields. Key terms include:

- Yield Curve: A graphical representation of the relationship between bond yields and their maturities.

- Maturity: The length of time until a bond's principal is repaid.

- Bond Yields: The return an investor receives from holding a bond to maturity.

Bullet Points:

- Current State: Japan's yield curve is currently significantly steeper than those of many other developed nations, reflecting a notable divergence between short-term and long-term interest rates on Japanese Government Bonds (JGBs).

- Long-Term vs. Short-Term: The substantial gap between long-term and short-term JGB yields is the defining characteristic of the steep curve. This disparity signals differing expectations about future economic conditions and interest rate movements.

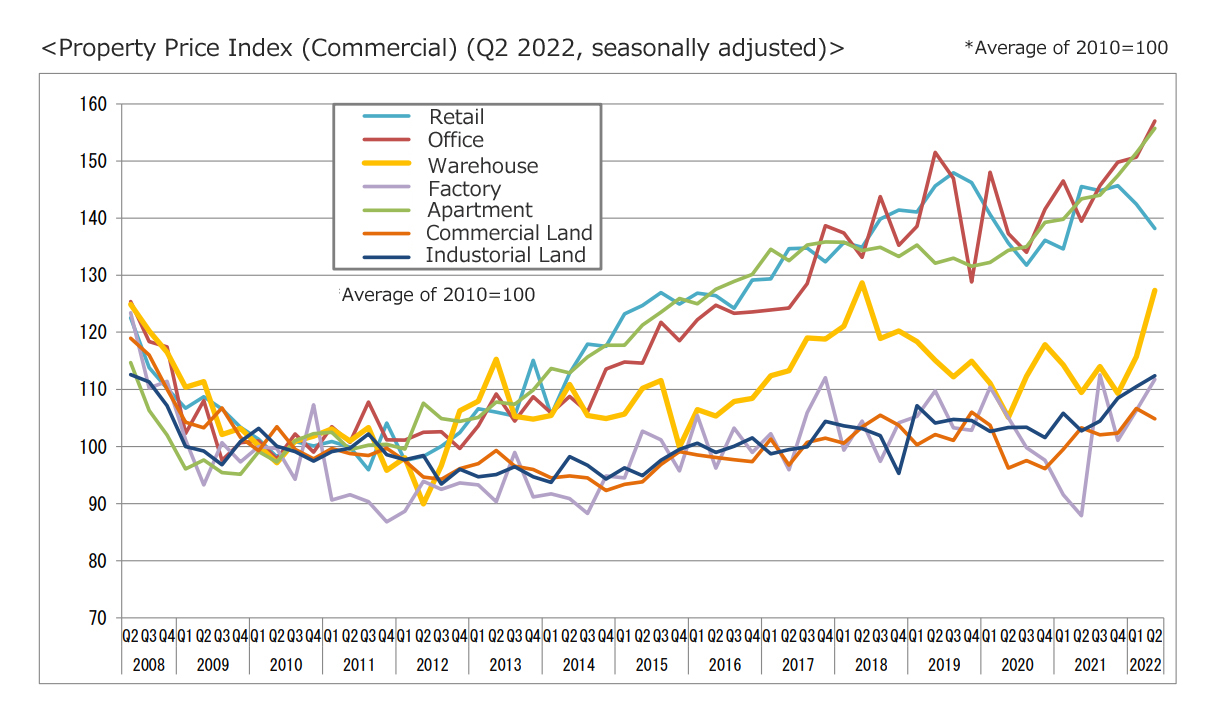

- Visual Aid: [Insert a chart or graph here visually depicting the current Japanese Government Bond yield curve. Source the data clearly.]

Factors Contributing to the Steep Curve

Several interconnected factors contribute to the steepness of Japan's yield curve. These include the Bank of Japan's monetary policy, demographic shifts, and global economic uncertainty.

The Bank of Japan's (BOJ) Monetary Policy

The BOJ's Yield Curve Control (YCC) policy plays a central role in shaping the yield curve. YCC aims to manage the short-term interest rate while guiding the long-term interest rate through setting a target range for the 10-year JGB yield.

Bullet Points:

- YCC Effectiveness: While YCC has successfully kept short-term interest rates low, its effectiveness in consistently controlling the long-term yield has been debated, leading to periods of significant yield fluctuations.

- Side Effects: The policy has faced criticism for potentially distorting market signals and hindering the efficient allocation of capital within the Japanese economy.

- Future Adjustments: The BOJ has recently shown a willingness to adjust its YCC policy, indicating a potential shift in its approach to managing the yield curve. Market participants keenly watch these adjustments for their impact on the yield curve's steepness.

Demographic Shifts and Aging Population

Japan's rapidly aging population and shrinking workforce are significant drivers of the steep yield curve.

Bullet Points:

- Funding Government Debt: An aging population implies a shrinking tax base, making it increasingly challenging to fund Japan's substantial government debt. This pressure can push up long-term bond yields.

- Investment and Savings: Demographic shifts also influence savings and investment patterns. Lower birth rates and an aging population can lead to reduced savings rates and a potentially lower demand for long-term government bonds.

- Long-Term Growth: Slowing economic growth driven by a shrinking workforce further contributes to the challenges in managing government debt and influences investor perceptions of long-term bond yields.

Global Economic Uncertainty and Risk Aversion

Global economic conditions significantly influence investor behavior and Japan's bond market.

Bullet Points:

- Global Inflation: Rising global inflation can increase demand for safe-haven assets like Japanese government bonds, potentially driving up long-term yields.

- Geopolitical Events: Geopolitical instability can boost risk aversion, leading investors to seek the perceived safety of JGBs, again affecting long-term yields.

- Currency Fluctuations: Yen depreciation can make Japanese bonds more attractive to foreign investors, potentially increasing demand and influencing bond yields.

Risks and Implications of a Steep Yield Curve

A persistently steep yield curve presents several risks and implications for Japan.

Increased Borrowing Costs for the Government

Rising long-term interest rates significantly increase the cost of servicing Japan's substantial national debt.

Bullet Points:

- Increased Debt Servicing Costs: A steep yield curve directly translates into higher interest payments on government bonds, putting pressure on public finances.

- Debt Crisis Potential: If long-term interest rates rise substantially, it could lead to an unsustainable debt burden, potentially triggering a debt crisis.

- Mitigation Measures: The government may need to implement fiscal reforms to reduce the debt burden or explore alternative financing strategies.

Impact on the Japanese Economy

The steep yield curve can negatively affect the broader Japanese economy.

Bullet Points:

- Business Investment: Higher borrowing costs can stifle business investment, hindering economic expansion and job creation.

- Consumer Spending: Increased interest rates can reduce consumer confidence and dampen spending, potentially leading to slower economic growth.

- Economic Slowdown: The combined effects of higher borrowing costs and reduced consumer confidence pose a significant risk to Japan's economic growth.

Conclusion

Japan's steep bond curve is a multifaceted issue stemming from a combination of the BOJ's monetary policy, demographic challenges, and global economic uncertainties. This complex situation presents significant risks to the Japanese economy, including increased borrowing costs for the government and potential impacts on economic growth. Understanding the nuances of Japan's steep bond curve is crucial for investors, policymakers, and anyone interested in the future of the Japanese economy. Further research into the implications of this phenomenon is essential for developing effective strategies to mitigate potential risks and ensure long-term economic stability.

Featured Posts

-

The Knicks And Landry Shamet A Roster Spot Decision

May 17, 2025

The Knicks And Landry Shamet A Roster Spot Decision

May 17, 2025 -

Escape The Noise Soundproof Apartments And Quiet Salons In Tokyo Real Estate

May 17, 2025

Escape The Noise Soundproof Apartments And Quiet Salons In Tokyo Real Estate

May 17, 2025 -

Major Reddit Outage Page Not Found Errors Reported Across The Us

May 17, 2025

Major Reddit Outage Page Not Found Errors Reported Across The Us

May 17, 2025 -

Andor Season 1 Where To Watch Episodes Online Hulu And You Tube

May 17, 2025

Andor Season 1 Where To Watch Episodes Online Hulu And You Tube

May 17, 2025 -

Wnba Stars New Team Golden State Valkyries

May 17, 2025

Wnba Stars New Team Golden State Valkyries

May 17, 2025