Understanding The CoreWeave (CRWV) Stock Dip On Thursday

Table of Contents

Analyzing the CoreWeave (CRWV) Stock Performance on Thursday

Pre-Market Activity and Initial Dip

The CoreWeave (CRWV) stock dip on Thursday wasn't entirely unexpected. Pre-market activity showed a concerning trend, hinting at the downturn to come.

- Significant Percentage Drop: The stock experienced a [Insert Percentage]% drop in pre-market trading, signaling a potential negative opening. (Note: Replace "[Insert Percentage]%" with the actual percentage drop from reliable sources.)

- Comparison to Broader Market Trends: While the broader market experienced [Insert Market Trend, e.g., a slight decline/a moderate increase], CRWV's pre-market performance significantly underperformed, suggesting company-specific issues at play. (Note: Replace "[Insert Market Trend]" with accurate market data.)

- News Releases Preceding the Dip: [Mention any news releases, earnings reports, or announcements that preceded the dip and might have influenced investor sentiment. If no specific news is identifiable, state that clearly.]

Potential Factors Contributing to the CRWV Stock Decline

Several factors could have contributed to the CRWV stock decline. These include both broader market forces and company-specific concerns:

- Broader Market Sell-Off: A general sell-off in the tech sector or the overall market could have negatively impacted CRWV, regardless of the company's specific performance.

- Sector-Specific Concerns: The cloud computing industry, while generally robust, faces its own challenges. Increased competition, slowing growth in certain segments, or concerns about profitability could have weighed on investor sentiment for the entire sector, affecting CRWV.

- Specific News Affecting CoreWeave: Any negative news related to CoreWeave, such as a disappointing earnings report, unexpected regulatory hurdles, or negative analyst ratings, could trigger a significant stock price drop. [Insert any specific news if available].

- Competitor Activity: Aggressive moves by competitors in the cloud computing space could have impacted investor confidence in CRWV’s market position.

Impact of Recent IPO and Investor Sentiment

CoreWeave's recent Initial Public Offering (IPO) plays a significant role in understanding Thursday's dip.

- Initial Public Offering (IPO) Price: The IPO price and the subsequent trading activity set initial investor expectations. Any deviation from these expectations can impact short-term volatility.

- Early Investor Reaction: Early investor enthusiasm and subsequent selling pressure could have contributed to the price fluctuation.

- Lockup Expiration Periods: The expiration of lockup periods, when early investors can sell their shares, often leads to increased selling pressure and potential price declines.

- Overall Investor Confidence: Overall market sentiment towards CoreWeave's long-term growth prospects plays a crucial role in stock price stability. Any perceived risk or uncertainty can easily lead to a sell-off.

Comparing CRWV Performance to Competitors in the Cloud Computing Sector

Benchmarking CRWV against other Cloud Computing Stocks

Understanding CRWV's performance relative to its competitors provides valuable context.

- Stock Performance Comparison: Comparing CRWV's performance on Thursday to similar companies like [mention specific company tickers, e.g., AWS (AMZN), GCP (GOOG), Azure (MSFT)] reveals whether the decline was specific to CRWV or part of a broader industry trend. (Note: This requires providing actual comparative data.)

- Industry-Wide Trends: Analyzing industry-wide trends helps determine whether the dip reflects broader market concerns or company-specific issues.

Assessing the Competitive Landscape and CRWV's Position

CRWV's competitive advantages and disadvantages are critical to assessing the long-term impact of the stock dip.

- Market Share: CRWV's current market share and its growth trajectory compared to competitors are key indicators of its future prospects.

- Technology Differentiation: The uniqueness and competitive advantage of CRWV's technology and services are vital in maintaining a strong market position.

- Financial Stability: The company's financial health, including profitability and debt levels, influences investor confidence.

- Growth Potential: CRWV's potential for future growth and expansion in the cloud computing market impacts investor sentiment.

- Risks to its Market Position: Identifying potential threats, such as increased competition or technological disruption, is crucial for understanding the risks associated with investing in CRWV.

Understanding the Implications for Long-Term CRWV Investment

Short-Term Volatility vs. Long-Term Growth Potential

The short-term volatility of CRWV stock shouldn't overshadow its long-term growth potential.

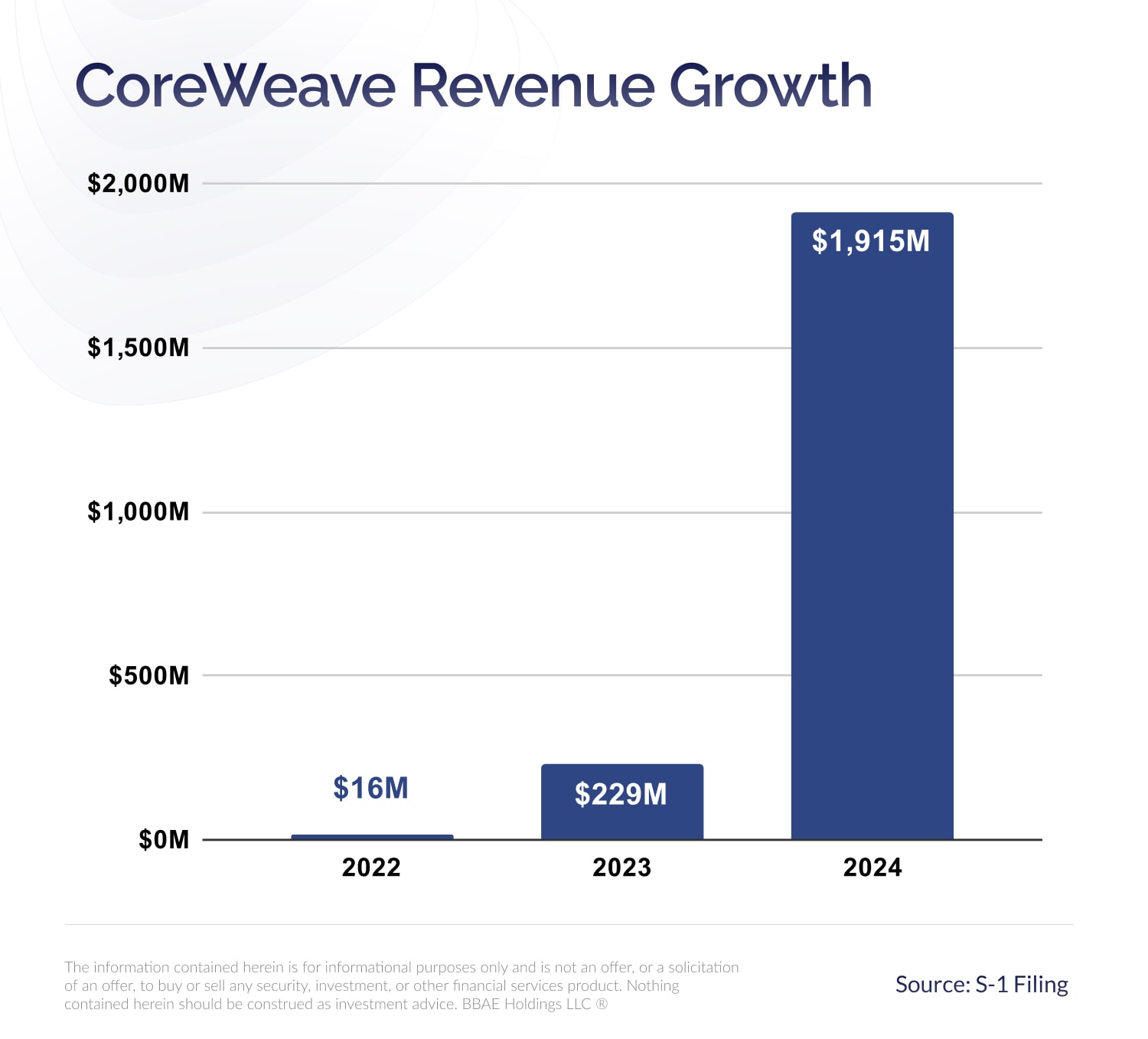

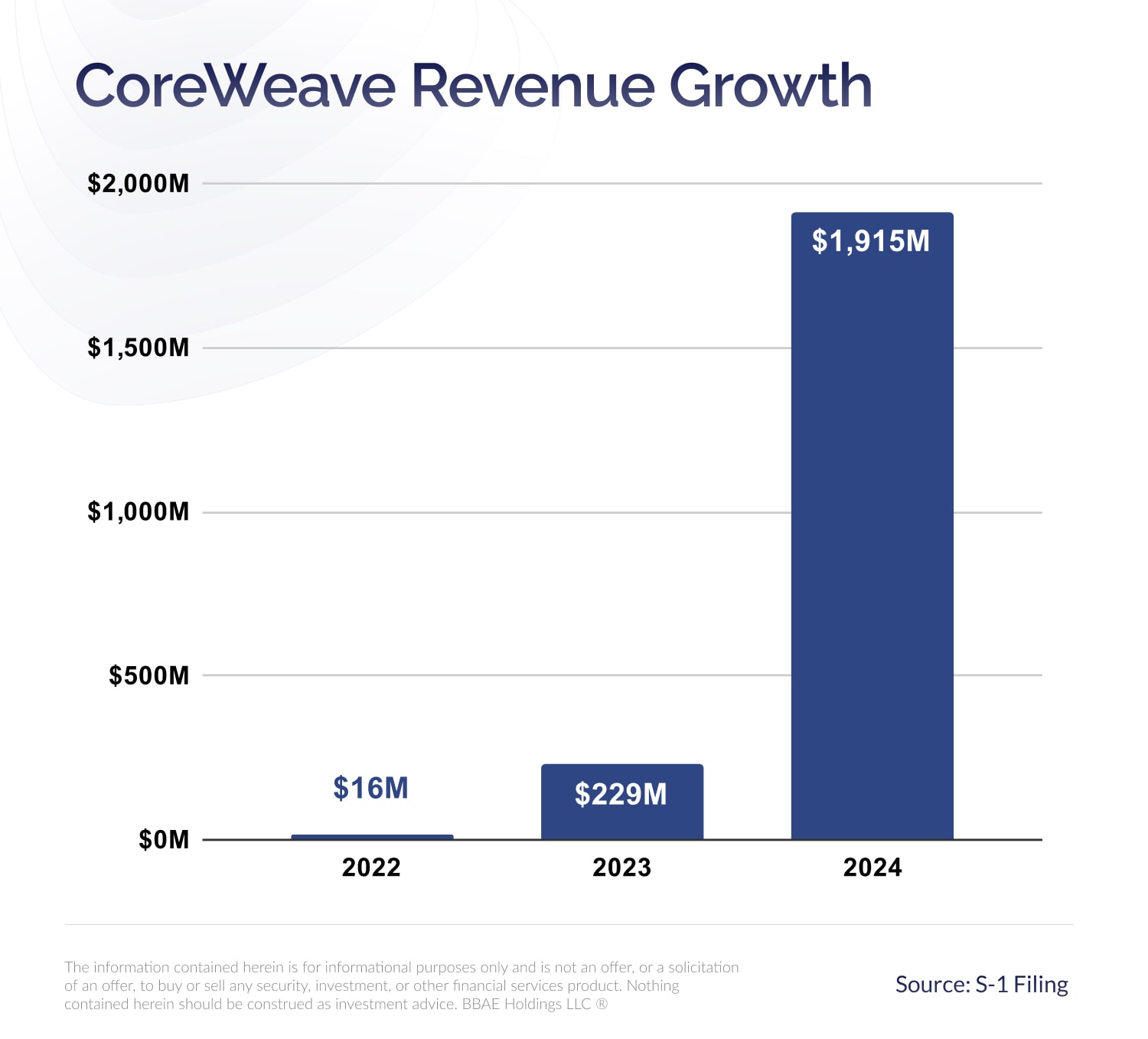

- Analyst Predictions: Consider analyst predictions for CRWV's future growth and revenue projections.

- Long-Term Investor Considerations: Long-term investors with a higher risk tolerance may view the dip as a buying opportunity.

- Risk Tolerance Levels: Investors need to assess their own risk tolerance before making any investment decisions.

Strategic Considerations for Investors Holding CRWV Stock

Investors need to develop a strategy based on their individual circumstances and risk tolerance.

- Diversification: Diversification is crucial to mitigate risk. Don't over-invest in a single stock, especially in a volatile market.

- Risk Management: Employ appropriate risk management techniques to protect your investment portfolio.

- Monitoring Market Conditions: Stay informed about developments in the cloud computing industry and CRWV's performance to make informed decisions.

Conclusion

The CoreWeave (CRWV) stock dip on Thursday resulted from a confluence of factors, including broader market trends, sector-specific concerns, and potentially company-specific news. While the short-term volatility is concerning, the long-term growth potential of CRWV in the rapidly expanding cloud computing market remains a significant consideration. However, it's crucial for investors to conduct thorough due diligence, understand the inherent risks, and consult with a financial advisor before making any investment decisions regarding CoreWeave (CRWV) stock or other cloud computing investments. Stay informed about future developments to make informed decisions about your CoreWeave investments.

Featured Posts

-

Wordle March 8th 1358 Clues And Solution

May 22, 2025

Wordle March 8th 1358 Clues And Solution

May 22, 2025 -

Cau Ma Da Khoi Cong Thang 6 Thuc Day Giao Thuong Dong Nai Binh Phuoc

May 22, 2025

Cau Ma Da Khoi Cong Thang 6 Thuc Day Giao Thuong Dong Nai Binh Phuoc

May 22, 2025 -

Thames Water Executive Bonuses A Closer Look At The Controversy

May 22, 2025

Thames Water Executive Bonuses A Closer Look At The Controversy

May 22, 2025 -

Viral Reddit Story The Missing Girl Who Became A Sydney Sweeney Movie

May 22, 2025

Viral Reddit Story The Missing Girl Who Became A Sydney Sweeney Movie

May 22, 2025 -

Exploration De L Architecture Toscane De La Petite Italie De L Ouest

May 22, 2025

Exploration De L Architecture Toscane De La Petite Italie De L Ouest

May 22, 2025

Latest Posts

-

Wordle Game 370 March 20 Clues And Solution

May 22, 2025

Wordle Game 370 March 20 Clues And Solution

May 22, 2025 -

Wordle 370 March 20th Hints Clues And Solution

May 22, 2025

Wordle 370 March 20th Hints Clues And Solution

May 22, 2025 -

Solve Wordle 1358 Hints For Saturday March 8th

May 22, 2025

Solve Wordle 1358 Hints For Saturday March 8th

May 22, 2025 -

Wordle March 8th 1358 Clues And Solution

May 22, 2025

Wordle March 8th 1358 Clues And Solution

May 22, 2025 -

Wordle 1358 Hints And Answer For March 8th

May 22, 2025

Wordle 1358 Hints And Answer For March 8th

May 22, 2025