Understanding The Market Reaction: CoreWeave (CRWV) Stock's Tuesday Drop

Table of Contents

Analyzing CoreWeave's (CRWV) Recent Financial Performance

Understanding CoreWeave's (CRWV) recent financial performance is crucial to deciphering the Tuesday stock drop. Analyzing key metrics offers valuable insights into investor concerns.

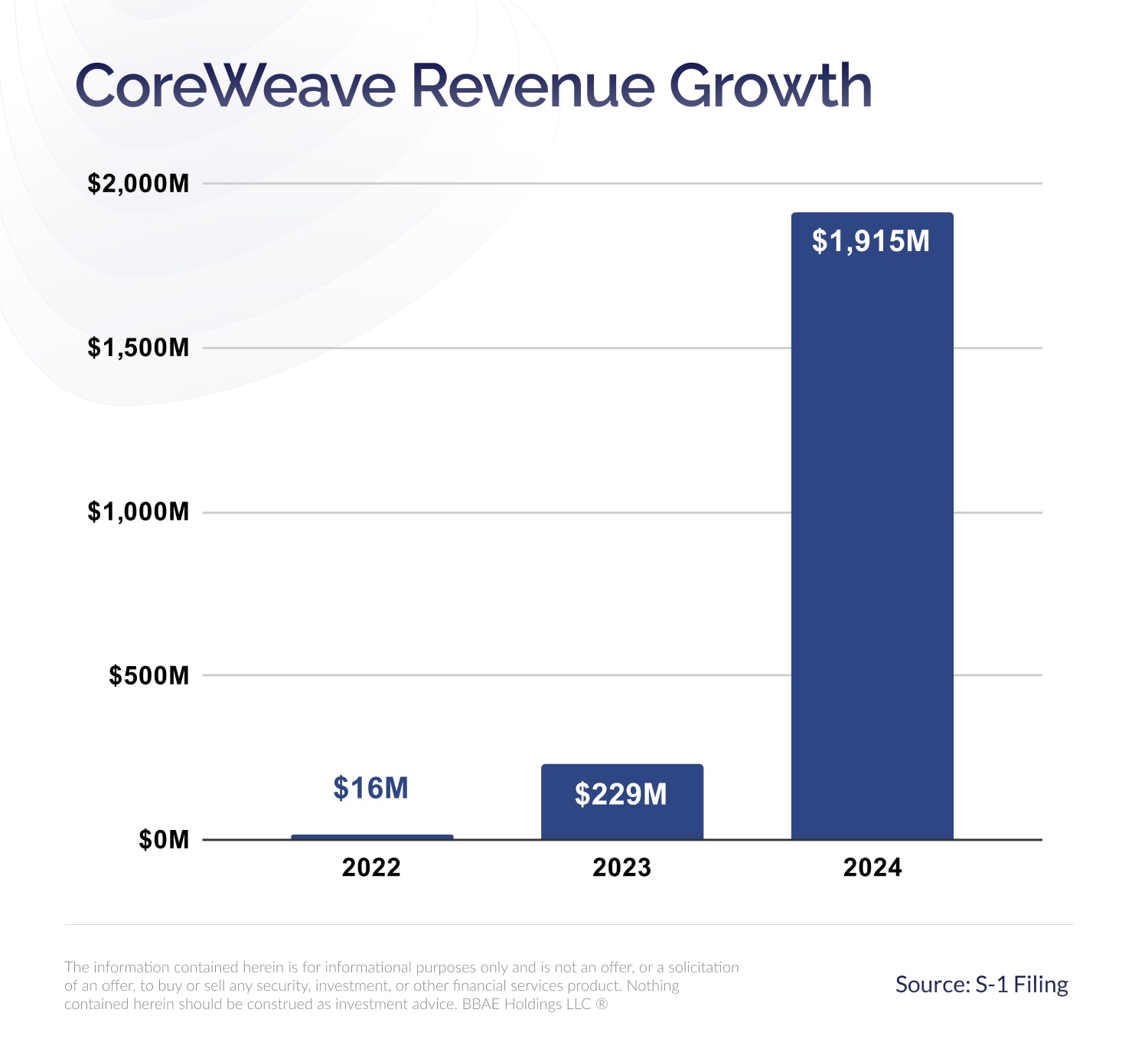

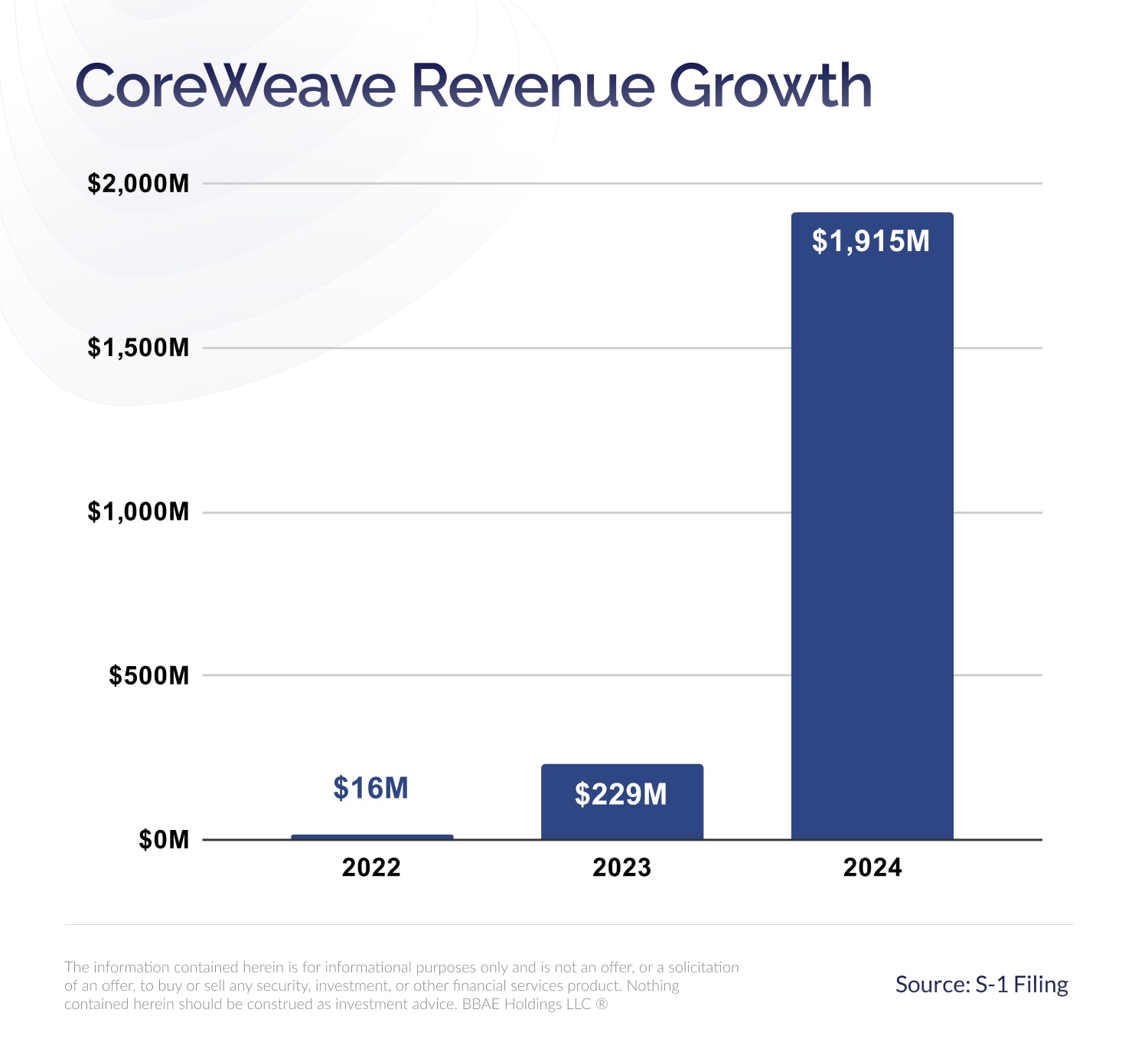

Revenue and Earnings

CoreWeave's [insert Quarter] earnings report is a key area of focus. Did the company meet or exceed analyst expectations? Were there any significant discrepancies between projected and actual results that could explain the CRWV stock drop?

- Comparison to Previous Quarters: Compare Q[insert quarter] earnings with previous quarters (Q1, Q2, Q3) to identify any trends or anomalies. Was there a significant deviation from the established growth trajectory?

- Revenue Stream Performance: Analyze the performance of CoreWeave's key revenue streams. Did any specific area underperform expectations? Did reliance on a single revenue source contribute to the vulnerability of the CRWV stock price?

- Profit Margins and Operating Expenses: Scrutinize profit margins and operating expenses. Any unexpected increases in expenses or shrinking margins could signal underlying problems, contributing to the negative market reaction and the CoreWeave (CRWV) stock drop. Investors are keenly aware of efficiency and profitability.

Growth Projections and Future Outlook

CoreWeave's future growth projections and how the market interpreted them are equally important in understanding the CRWV stock drop.

- Leadership Statements: Examine statements made by CoreWeave's leadership regarding future growth. Were there any significant changes in tone or outlook compared to previous communications?

- Revised Guidance: Did the company revise its guidance or forecasts? Lowered expectations often trigger negative market reactions and contribute to stock price declines, as seen with the CoreWeave (CRWV) stock drop.

- Long-Term Strategic Plans: Analyze CoreWeave's long-term strategic plans. Do these plans effectively address the challenges and opportunities in the competitive cloud computing market? A lack of clear strategic direction can impact investor confidence, causing volatility like the CoreWeave (CRWV) stock drop.

Market Sentiment and Investor Confidence

The overall market sentiment and investor confidence surrounding CoreWeave played a significant role in the Tuesday stock drop.

Overall Market Conditions

The broader market context is crucial. Was the CoreWeave (CRWV) stock drop isolated, or part of a wider market downturn?

- Tech Sector Performance: Analyze the performance of the broader technology sector and the Nasdaq on the day of the drop. A general market downturn could have exacerbated the decline in CRWV's stock price.

- Significant Market Events: Consider any significant market events that may have influenced investor sentiment. Geopolitical events, economic news, or regulatory changes can impact investor confidence, triggering stock price fluctuations like the CoreWeave (CRWV) stock drop.

News and Analyst Ratings

Negative news or changes in analyst ratings can significantly impact investor confidence and trigger selling pressure.

- Press Releases and Articles: Review any recent press releases, news articles, or social media discussions surrounding CoreWeave that could have contributed to the negative sentiment and the CoreWeave (CRWV) stock drop.

- Analyst Ratings Changes: Analyze any changes in analyst ratings from major financial institutions. Downgrades or negative comments from influential analysts can trigger a sell-off, especially in a volatile market.

Competitive Landscape and Industry Trends

The competitive landscape and industry trends within the cloud computing sector are significant factors affecting CoreWeave's valuation and the CRWV stock drop.

Competition within the Cloud Computing Sector

Intense competition within the cloud computing industry can impact CoreWeave's market share and profitability.

- Key Competitors and Activities: Identify CoreWeave's main competitors (e.g., AWS, Azure, Google Cloud) and their recent activities. New entrants or aggressive strategies from competitors can impact CRWV's market position.

- Market Share Analysis: Analyze CoreWeave's market share and its trajectory. A shrinking market share might signal weakening competitiveness, leading to investor concern and a stock price drop like the CoreWeave (CRWV) stock drop.

- Disruptive Technologies: Consider the potential impact of disruptive technologies on the cloud computing industry. Failure to adapt to technological advancements can leave companies vulnerable, impacting their stock price.

Impact of Macroeconomic Factors

Broader macroeconomic factors influence investor sentiment and stock prices.

- Inflation and Interest Rates: Analyze the impact of inflation and interest rate hikes on investor sentiment towards growth stocks like CoreWeave. Rising interest rates can decrease the attractiveness of growth stocks, potentially contributing to the CoreWeave (CRWV) stock drop.

- Correlation Analysis: Examine the correlation between interest rate changes and CRWV's stock price to determine if macroeconomic factors played a significant role in the recent decline.

Conclusion

The Tuesday drop in CoreWeave (CRWV) stock is likely a result of several interconnected factors, including potential financial performance shortfalls, negative market sentiment fueled by news or analyst ratings, and competitive pressures within the fiercely competitive cloud computing sector. Understanding these contributing elements is vital for investors to make informed decisions regarding their CRWV holdings. To stay updated on CoreWeave's (CRWV) performance and future stock movements, continue monitoring financial news, analyst reports, and the company's official announcements. By closely following the market and the competitive landscape, you can better navigate the volatility of the CoreWeave (CRWV) stock and similar investments in the cloud computing sector. Stay informed to make smart decisions about your CoreWeave (CRWV) stock holdings and mitigate the risks associated with future CoreWeave (CRWV) stock drops.

Featured Posts

-

Supera Al Arandano El Alimento Definitivo Para Una Vida Larga Y Saludable

May 22, 2025

Supera Al Arandano El Alimento Definitivo Para Una Vida Larga Y Saludable

May 22, 2025 -

Otter Conservation In Wyoming Navigating A Period Of Transformation

May 22, 2025

Otter Conservation In Wyoming Navigating A Period Of Transformation

May 22, 2025 -

A Family Legacy The Traverso Photography Dynasty At Cannes

May 22, 2025

A Family Legacy The Traverso Photography Dynasty At Cannes

May 22, 2025 -

Sesame Street Streaming On Netflix Breaking News And Updates

May 22, 2025

Sesame Street Streaming On Netflix Breaking News And Updates

May 22, 2025 -

Analysis Arne Slot Luis Enrique On Liverpools Win And Alissons Performance

May 22, 2025

Analysis Arne Slot Luis Enrique On Liverpools Win And Alissons Performance

May 22, 2025

Latest Posts

-

Dropout Kings Singer Adam Ramey Dies Aged 31

May 22, 2025

Dropout Kings Singer Adam Ramey Dies Aged 31

May 22, 2025 -

Music World Mourns Dropout Kings Adam Ramey Dies By Suicide

May 22, 2025

Music World Mourns Dropout Kings Adam Ramey Dies By Suicide

May 22, 2025 -

Remembering Adam Ramey Dropout Kings Lead Singer Passes At 32

May 22, 2025

Remembering Adam Ramey Dropout Kings Lead Singer Passes At 32

May 22, 2025 -

Dropout Kings Vocalist Adam Ramey Dies By Suicide A Tragic Loss

May 22, 2025

Dropout Kings Vocalist Adam Ramey Dies By Suicide A Tragic Loss

May 22, 2025 -

March 13th Wordle 363 Help Clues And Answer

May 22, 2025

March 13th Wordle 363 Help Clues And Answer

May 22, 2025