Understanding The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

Understanding the Amundi MSCI World II UCITS ETF Dist

The Amundi MSCI World II UCITS ETF Dist is a passively managed ETF that tracks the MSCI World Index. This index represents a broad range of large and mid-cap equities from developed markets across the globe, offering significant diversification.

- Investment Strategy: The ETF employs a market capitalization-weighted investment strategy, meaning its holdings reflect the relative market values of the companies within the MSCI World Index. Larger companies have a proportionally larger weighting in the portfolio.

- Distribution Policy: The "Dist" in the ETF's name indicates a distribution policy. This means the ETF distributes dividends received from its underlying holdings to its shareholders periodically. This is a key consideration for investors focused on income generation.

- Key Features: The Amundi MSCI World II UCITS ETF Dist is known for its low expense ratio, making it a cost-effective way to gain broad global market exposure. Its extensive diversification across numerous countries and sectors mitigates risk.

- Keywords: Amundi MSCI World II UCITS ETF, MSCI World Index ETF, Global Equity ETF, Diversified ETF, Low-Cost ETF.

How is the NAV of Amundi MSCI World II UCITS ETF Dist Calculated?

The NAV (Net Asset Value) of the Amundi MSCI World II UCITS ETF Dist is calculated daily, reflecting the current market value of the ETF's holdings. The calculation is straightforward:

(Total Asset Value – Liabilities) / Number of Outstanding Shares = NAV

Let's break down each component:

- Total Asset Value: This represents the total market value of all the securities held within the ETF, calculated by multiplying the number of shares of each holding by its current market price.

- Liabilities: These include the fund's expenses, such as management fees, administrative costs, and any other outstanding obligations.

- Number of Outstanding Shares: This refers to the total number of ETF units currently held by investors.

The fund manager is responsible for the accurate calculation and daily publication of the NAV. This ensures transparency and allows investors to track the performance of their investment.

- Keywords: ETF NAV Calculation, Asset Value Calculation, Liability Calculation, Daily NAV, Fund Manager Role.

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF Dist

Several factors can influence the daily NAV of the Amundi MSCI World II UCITS ETF Dist:

-

Market Performance: The primary driver of NAV fluctuations is the performance of the underlying MSCI World Index. Positive market movements generally lead to increased NAV, while negative movements result in a decreased NAV.

-

Currency Fluctuations: As the ETF invests globally, changes in exchange rates between currencies can affect the value of its holdings and, consequently, its NAV.

-

Dividend Income: Dividends received from the underlying companies are added to the ETF's assets, contributing positively to the NAV.

-

Management Fees and Expenses: These costs are deducted from the ETF's assets, slightly lowering the NAV.

-

Capital Gains/Losses: Profits or losses from the sale of assets within the ETF portfolio impact the NAV.

-

Keywords: NAV Volatility, Market Fluctuation Impact, Currency Exchange Impact, Dividend Impact, Expense Ratio Impact.

The Importance of NAV for Amundi MSCI World II UCITS ETF Dist Investors

Understanding the NAV is critical for tracking your investment performance and making informed decisions:

-

Reflects Investment Value: The NAV represents the net asset value per share of the ETF, directly reflecting the value of your investment.

-

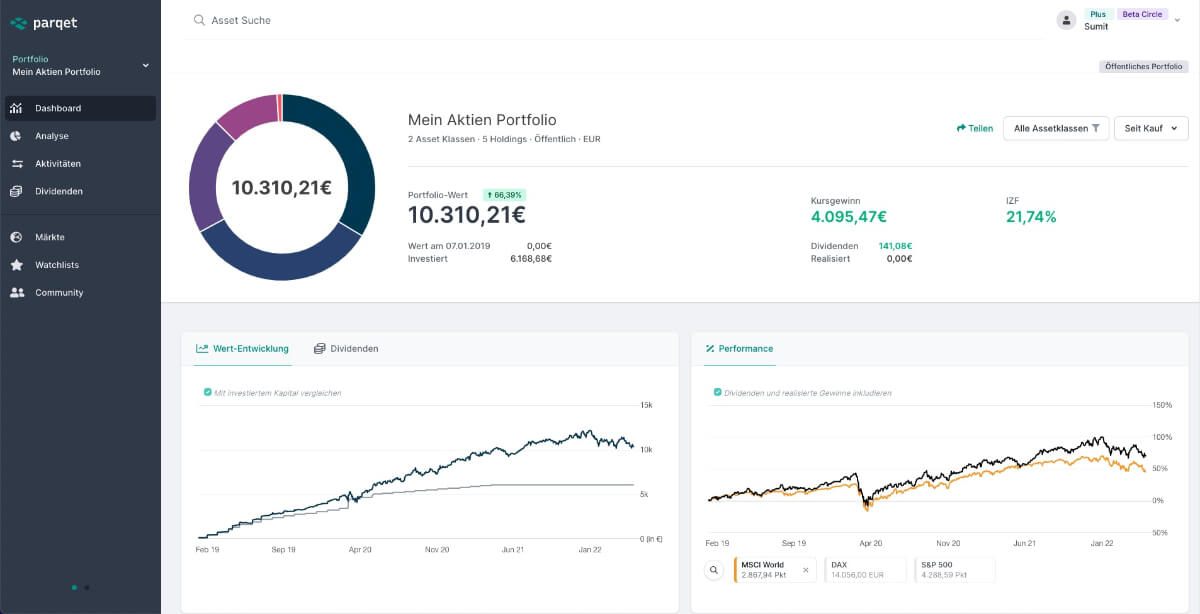

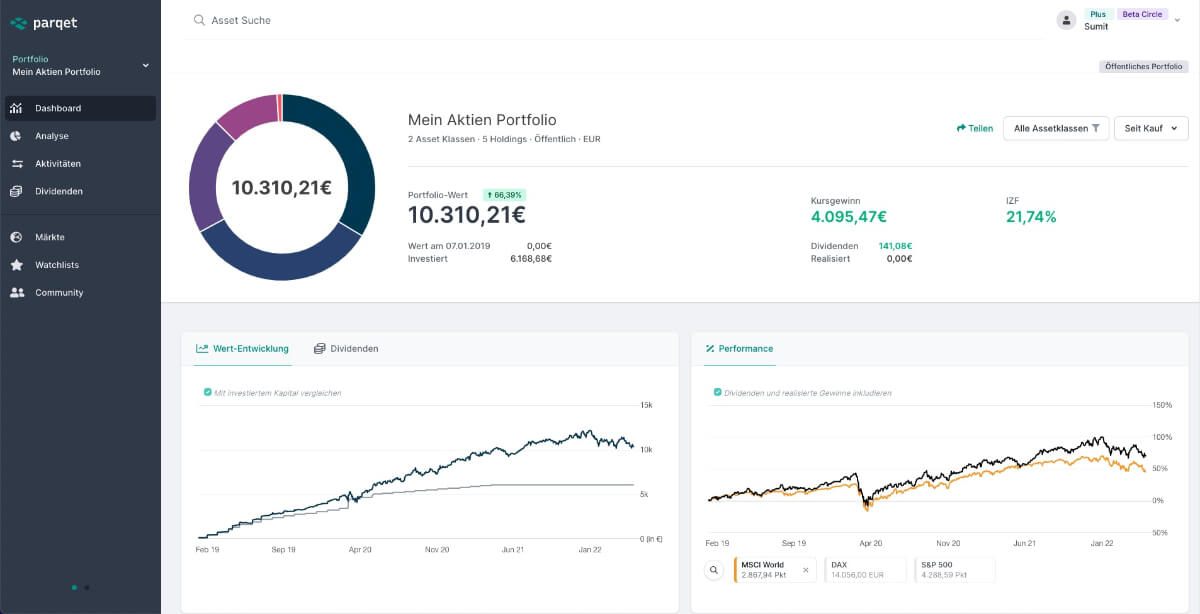

Performance Monitoring: By monitoring NAV changes over time, you can track the performance of your investment and compare it to benchmarks.

-

Buy and Sell Prices: While the actual trading price of the ETF may differ slightly from the NAV due to supply and demand, the NAV serves as a crucial benchmark for determining the fair value.

-

Return on Investment: Changes in the NAV directly impact your potential returns or losses.

-

Keywords: Investment Performance, Return on Investment, Buy and Sell Prices, Unit Price, Portfolio Tracking.

Conclusion: Mastering the NAV of Amundi MSCI World II UCITS ETF Dist for Informed Investment Decisions

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist is essential for any investor. This article has explained how the NAV is calculated, the factors that influence it, and its significance for tracking investment performance and making informed decisions. Regularly monitoring the Amundi MSCI World II UCITS ETF Dist NAV allows you to stay informed about the value of your investment and adjust your investment strategy accordingly. Stay informed about the Amundi MSCI World II UCITS ETF Dist NAV and make strategic investment decisions.

Featured Posts

-

Lego Master Manny Garcia Inspires Veterans Memorial Elementary Students Photo Gallery

May 24, 2025

Lego Master Manny Garcia Inspires Veterans Memorial Elementary Students Photo Gallery

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Implications

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Implications

May 24, 2025 -

Dayamitra Mtel Dan Merdeka Battery Mbma Prospek Pasca Penambahan Msci Small Cap

May 24, 2025

Dayamitra Mtel Dan Merdeka Battery Mbma Prospek Pasca Penambahan Msci Small Cap

May 24, 2025 -

How To Get Bbc Radio 1s Big Weekend 2025 Sefton Park Tickets

May 24, 2025

How To Get Bbc Radio 1s Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

Footballer Kyle Walker Seen With Models In Milan After Wifes Trip Home

May 24, 2025

Footballer Kyle Walker Seen With Models In Milan After Wifes Trip Home

May 24, 2025

Latest Posts

-

Tariffe Trump Del 20 Analisi Dell Effetto Sui Brand Di Moda Europei E Americani

May 24, 2025

Tariffe Trump Del 20 Analisi Dell Effetto Sui Brand Di Moda Europei E Americani

May 24, 2025 -

L Impatto Delle Tariffe Trump Del 20 Sul Settore Moda Analisi Di Caso Nike E Lululemon

May 24, 2025

L Impatto Delle Tariffe Trump Del 20 Sul Settore Moda Analisi Di Caso Nike E Lululemon

May 24, 2025 -

Crisi Moda L Effetto Delle Tariffe Trump Del 20 Sull Unione Europea

May 24, 2025

Crisi Moda L Effetto Delle Tariffe Trump Del 20 Sull Unione Europea

May 24, 2025 -

Dazi Trump Come Il 20 Sui Prodotti Ue Ha Colpito Nike E Lululemon

May 24, 2025

Dazi Trump Come Il 20 Sui Prodotti Ue Ha Colpito Nike E Lululemon

May 24, 2025 -

Dazi Trump Sul 20 L Impatto Negativo Sul Settore Moda

May 24, 2025

Dazi Trump Sul 20 L Impatto Negativo Sul Settore Moda

May 24, 2025