Understanding The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Table of Contents

What is the Net Asset Value (NAV) and how is it calculated for this specific ETF?

The Net Asset Value (NAV) represents the net value of an ETF's assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF (Distributing), the NAV calculation involves several steps:

-

Total Value of Holdings: This is the sum of the current market value of all the stocks that make up the Dow Jones Industrial Average held within the ETF. Since the ETF aims to mirror the index, this represents the collective value of those 30 major US companies.

-

Less Any Liabilities: This includes expenses incurred in managing the ETF, such as administrative fees, brokerage commissions, and other operational costs. These are subtracted from the total value of the holdings.

-

Divided by Outstanding Shares: The resulting net asset value (after deducting liabilities) is then divided by the total number of Amundi Dow Jones Industrial Average UCITS ETF (Distributing) shares currently outstanding in the market. This gives you the NAV per share.

The NAV is calculated daily by Amundi, the ETF provider, and is usually published at the close of the market. Market fluctuations throughout the trading day directly impact the value of the underlying assets, and therefore the NAV. It's important to understand that the NAV and the ETF's market price may differ slightly. This difference can be due to supply and demand dynamics in the ETF market itself.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Several factors influence the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing):

-

Dow Jones Industrial Average Performance: The primary driver of the ETF's NAV is the performance of the underlying Dow Jones Industrial Average stocks. Positive performance in the index will generally lead to an increase in the ETF's NAV, and vice-versa.

-

Currency Fluctuations: As a UCITS ETF, the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) may be susceptible to currency fluctuations if its holdings are denominated in a currency other than the investor's base currency. These fluctuations can influence the NAV.

-

Dividends: Dividends paid by the companies within the Dow Jones Industrial Average are a key consideration. These dividends increase the overall value of the ETF's holdings before being distributed, influencing the NAV.

-

Management Fees and Expenses: The ETF's management fees and other operational expenses directly reduce the net assets available for distribution among shareholders, impacting the NAV.

-

Extraordinary Events: Corporate actions like mergers, acquisitions, or significant legal disputes involving companies within the Dow Jones Industrial Average can also have a substantial impact on the NAV of the ETF.

Understanding the "Distributing" aspect of the ETF and its relation to NAV

The "Distributing" designation in the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) name indicates that the ETF distributes dividends received from the underlying companies to its shareholders. This distribution of dividends affects the NAV in the following way:

- Before Distribution: The NAV reflects the total value of the underlying assets including the accumulated dividends.

- After Distribution: Once the dividends are paid out to shareholders, the NAV is adjusted downward to reflect the reduction in assets held within the ETF.

Using NAV Information to Make Informed Investment Decisions

Understanding the NAV is critical for effective ETF investment:

-

Performance Tracking: Comparing the NAV over time allows investors to track the ETF's performance against the Dow Jones Industrial Average and assess the effectiveness of the fund's management.

-

Identifying Opportunities: By comparing the NAV to the market price of the ETF, investors can potentially identify buying opportunities when the market price is below the NAV, and selling opportunities when the market price is significantly above the NAV.

-

Long-Term Trends: Monitoring the NAV's trend over time provides valuable insights into the long-term growth potential of the investment and the health of the underlying Dow Jones Industrial Average.

-

Holistic Approach: While the NAV is an essential metric, it's crucial to consider other factors such as expense ratios, trading volume, and your overall investment goals before making any investment decisions.

Conclusion

The Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is a crucial indicator of its underlying value and performance. Understanding how the NAV is calculated, the factors influencing it, and how to utilize this information for investment decisions is essential for any investor considering this or similar ETFs. Regularly monitoring the NAV, along with other relevant information, empowers you to make informed decisions about your investment in the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) or other ETFs. For further resources on ETF investing and NAV calculations, refer to your financial advisor or reputable online financial resources.

Featured Posts

-

Egyedi Porsche Legendas F1 Motorral Hajtott

May 25, 2025

Egyedi Porsche Legendas F1 Motorral Hajtott

May 25, 2025 -

Heinekens Q Quarter Revenue Tops Forecasts Tariff Impact And Future Outlook

May 25, 2025

Heinekens Q Quarter Revenue Tops Forecasts Tariff Impact And Future Outlook

May 25, 2025 -

Public Accusations The Aftermath Of Kyle Walkers Night Out

May 25, 2025

Public Accusations The Aftermath Of Kyle Walkers Night Out

May 25, 2025 -

Demna At Gucci Design Direction And Impact

May 25, 2025

Demna At Gucci Design Direction And Impact

May 25, 2025 -

Koezuti Porsche F1 Motor Teljesitmenye

May 25, 2025

Koezuti Porsche F1 Motor Teljesitmenye

May 25, 2025

Latest Posts

-

1 500 Expected At Best Of Bangladesh Netherlands Event European Investors Attend

May 25, 2025

1 500 Expected At Best Of Bangladesh Netherlands Event European Investors Attend

May 25, 2025 -

Netherlands Hosts Major Bangladesh Business And Cultural Event

May 25, 2025

Netherlands Hosts Major Bangladesh Business And Cultural Event

May 25, 2025 -

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 25, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 25, 2025 -

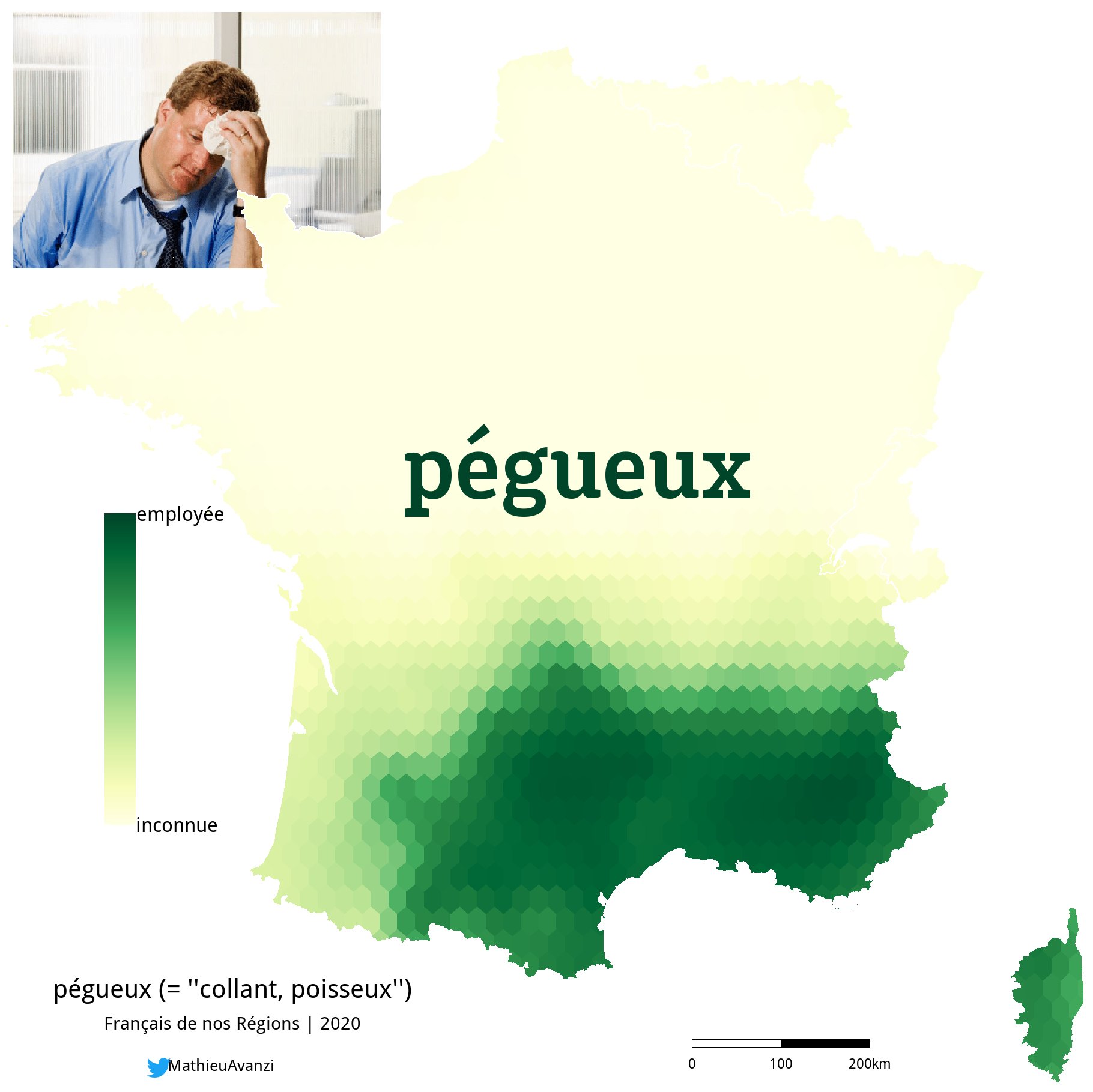

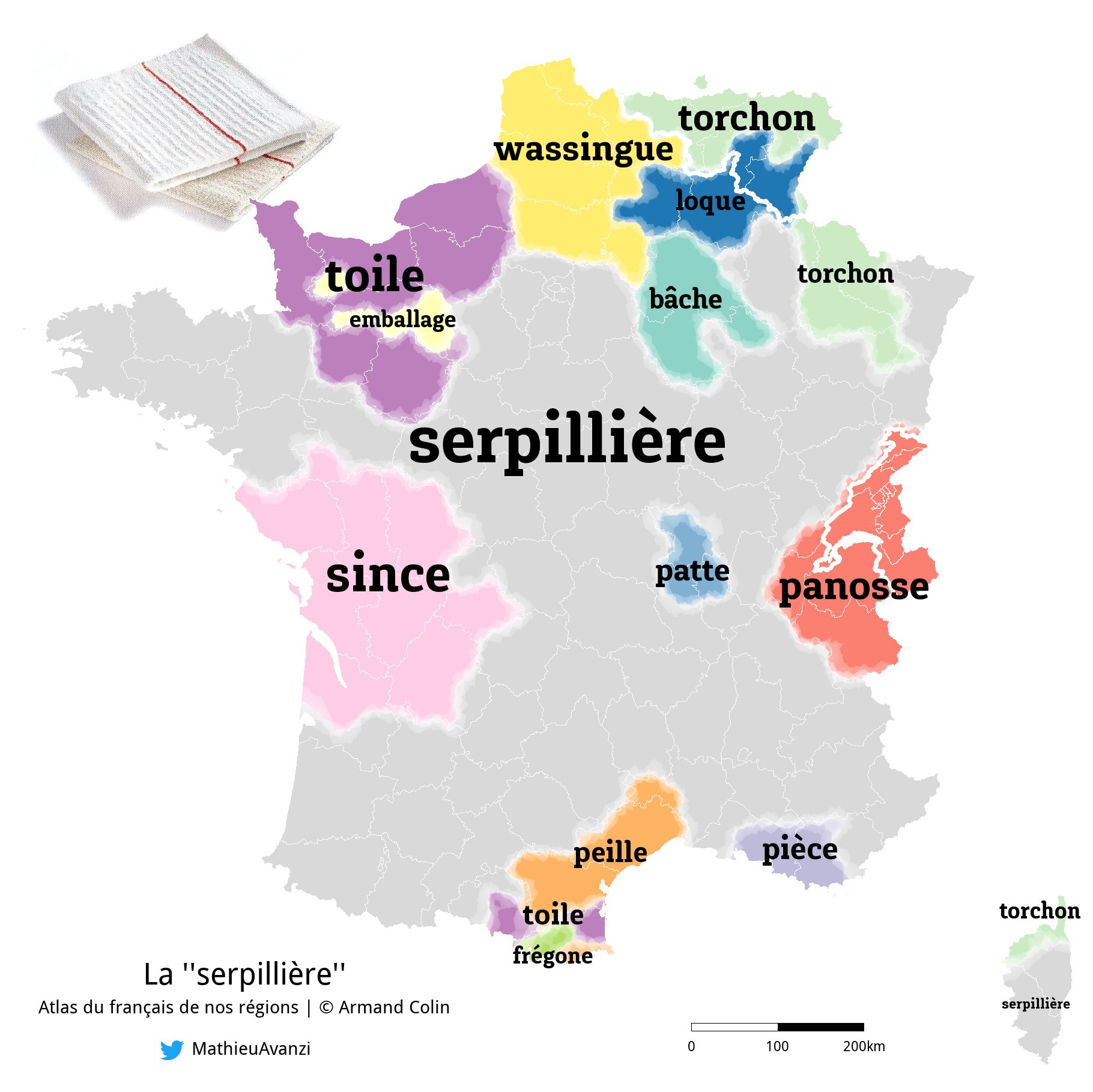

Le Francais Selon Mathieu Avanzi Bien Plus Qu Une Matiere Scolaire

May 25, 2025

Le Francais Selon Mathieu Avanzi Bien Plus Qu Une Matiere Scolaire

May 25, 2025 -

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 25, 2025

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 25, 2025