Understanding The Recent 20-Cent Gas Price Surge

Table of Contents

Global Crude Oil Prices and Their Impact

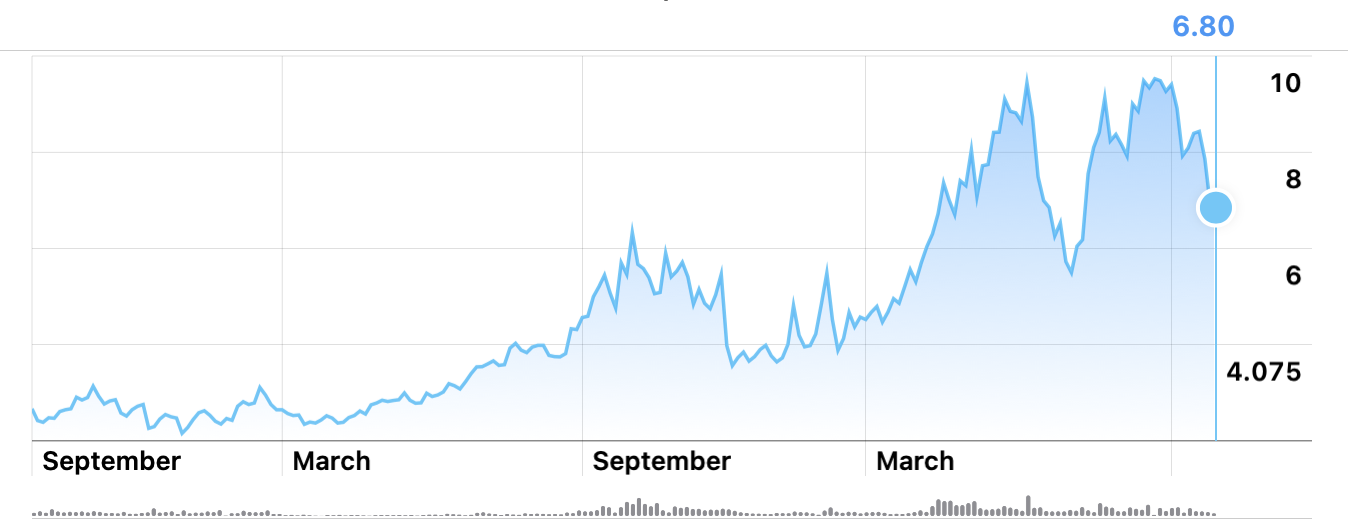

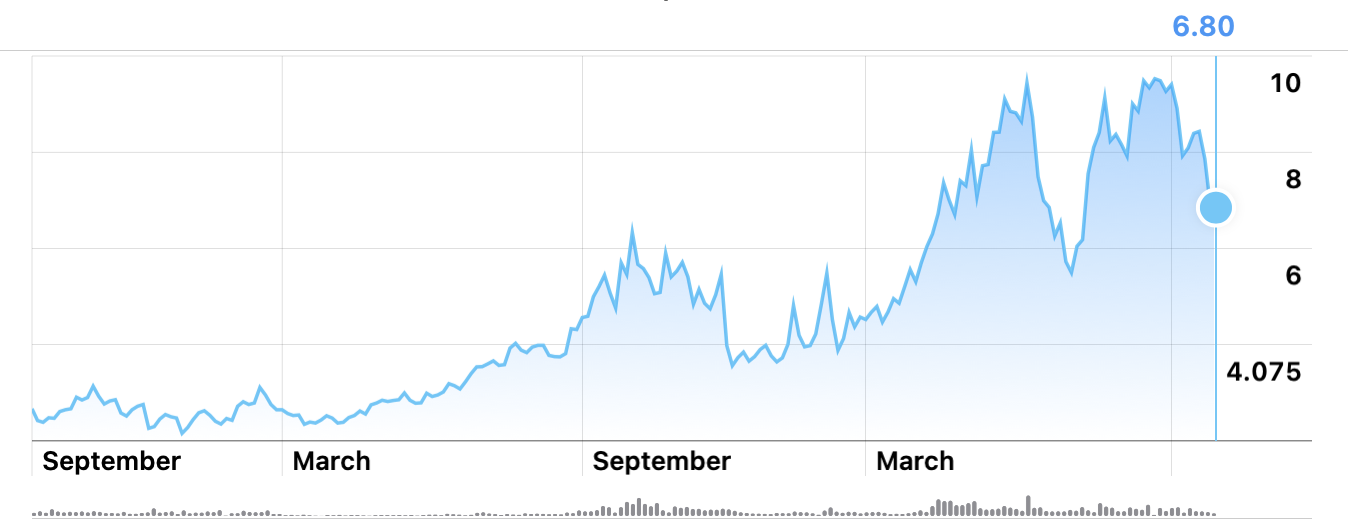

The price of gasoline at the pump is intrinsically linked to global crude oil prices. Crude oil is the primary raw material used in gasoline production, so fluctuations in its cost directly impact the final price consumers pay. Recent increases in global crude oil prices are a major contributor to the 20-cent gas price surge.

Several factors are influencing crude oil supply and demand:

- Increased global demand for oil: As the global economy recovers from the pandemic, demand for oil has significantly increased, outpacing supply in many regions. This increased demand puts upward pressure on prices.

- Geopolitical instability impacting oil production: Geopolitical tensions in various parts of the world, including ongoing conflicts and sanctions, disrupt oil production and distribution networks, limiting supply and driving up prices. The Organization of the Petroleum Exporting Countries (OPEC+) plays a significant role, and their production decisions heavily influence global oil prices.

- Reduced oil reserves: Strategic petroleum reserves, intended to cushion against supply shocks, are at lower levels than in recent years, reducing the ability to counter price spikes quickly.

- Speculation in the oil futures market: Trading in oil futures contracts can amplify price volatility. Speculative trading based on anticipated supply shortages or geopolitical events can lead to sharp price increases, even if underlying fundamentals remain unchanged. Understanding these market dynamics is crucial to interpreting price fluctuations.

Refinery Capacity and Operational Challenges

Beyond global crude oil prices, domestic refinery capacity and operational challenges play a crucial role in determining gasoline prices. Refineries process crude oil into gasoline and other petroleum products. Any disruptions to their operation can significantly impact the supply and, subsequently, the price at the pump.

- Planned and unplanned refinery maintenance: Regular maintenance shutdowns at refineries are necessary but can temporarily reduce gasoline production, leading to price increases. Unforeseen outages due to accidents or equipment failures further exacerbate the situation.

- Increased demand exceeding refinery capacity: Periods of high demand, such as the summer driving season, can sometimes exceed the operational capacity of existing refineries. This leads to a supply shortage and inevitably higher prices.

- Labor shortages affecting refinery operations: Similar to other industries, refineries have experienced labor shortages, impacting their efficiency and production capabilities. This can also lead to reduced output and higher prices.

- Transition to cleaner fuels impacting production: The increasing demand for cleaner fuels and the transition away from traditional gasoline blends can temporarily strain refinery operations and production capabilities, contributing to higher prices. This transition is essential for environmental reasons, but it does present short-term challenges.

Seasonal Demand and Transportation Costs

Seasonal changes in driving habits and increased transportation costs also factor into the recent gas price surge. Summer months witness a considerable increase in travel, placing significantly higher demand on gasoline supplies. Furthermore, the cost of transporting gasoline from refineries to gas stations contributes to the final price.

- Increased summer travel leading to higher demand: The summer driving season is a period of peak demand, with millions of people taking road trips. This increased demand invariably leads to higher prices at the pump.

- Higher costs of transporting gasoline to gas stations: The cost of fuel for trucks and other modes of transportation used to deliver gasoline to retail stations has increased significantly due to inflation and higher crude oil prices. These increased transportation costs are passed on to consumers.

- Inflationary pressures impacting transportation costs: Broader inflationary pressures are affecting various aspects of the supply chain, including transportation. Higher costs for drivers, maintenance, and fuel all contribute to increased transportation costs and hence higher gas prices.

Government Regulations and Taxes

Government policies, environmental regulations, and taxes can also impact gasoline prices. Changes in fuel taxes or the introduction of new environmental regulations can influence the cost of gasoline production and distribution.

- Changes in federal or state gas taxes: Increases in federal or state gasoline taxes directly increase the price consumers pay at the pump. These taxes are often used to fund infrastructure projects or other government programs.

- Impact of carbon taxes or emission regulations: Policies aimed at reducing carbon emissions, such as carbon taxes or stricter emission standards, can increase the cost of gasoline production and consequently, its price. These regulations are implemented to promote cleaner energy but can result in higher prices in the short term.

- Government subsidies or incentives influencing prices: Government subsidies or tax breaks offered to oil producers or refineries can sometimes lead to lower gasoline prices, while their removal or reduction can contribute to price increases.

Speculation and Market Volatility

Market speculation and volatility play a role in short-term price fluctuations. News events, investor sentiment, and perceptions about future oil supply can significantly influence prices, regardless of underlying fundamentals.

- Investor sentiment influencing oil futures prices: Investor expectations about future oil prices can significantly affect trading in oil futures markets. Positive sentiment can lead to higher prices, while negative sentiment can result in lower prices.

- Media coverage and its impact on consumer behavior: Media coverage of gas price increases can create a self-fulfilling prophecy. Negative media reports can lead to increased consumer demand, exacerbating the price surge.

- Short-term market fluctuations independent of fundamental factors: Sometimes, short-term price swings are not directly linked to underlying supply and demand fundamentals but are driven by market speculation and investor behavior.

Conclusion

This 20-cent gas price surge is a complex issue stemming from a combination of global and local factors. These include fluctuating global crude oil prices, refinery operational challenges, seasonal demand, government regulations, and market speculation. Understanding these interconnected factors is crucial for navigating the volatile energy market. Stay informed about factors affecting the price of gas. Regularly check reliable sources for updates on the latest developments influencing gas prices and plan accordingly. Continue to monitor the situation and learn more about the factors behind the fluctuating price of gas.

Featured Posts

-

Ai Mode In Google Search Benefits Challenges And Predictions

May 22, 2025

Ai Mode In Google Search Benefits Challenges And Predictions

May 22, 2025 -

Manchester Citys Pep Guardiola Succession Arsenal Legend In The Frame

May 22, 2025

Manchester Citys Pep Guardiola Succession Arsenal Legend In The Frame

May 22, 2025 -

Phan Tich Tac Dong Cua Cac Du An Ha Tang Den Giao Thong Tp Hcm Binh Duong

May 22, 2025

Phan Tich Tac Dong Cua Cac Du An Ha Tang Den Giao Thong Tp Hcm Binh Duong

May 22, 2025 -

Macrons Call For Eu To Buy European Not American

May 22, 2025

Macrons Call For Eu To Buy European Not American

May 22, 2025 -

French Night Sky Analyzing Recent Reports Of Red Light Flashes

May 22, 2025

French Night Sky Analyzing Recent Reports Of Red Light Flashes

May 22, 2025

Latest Posts

-

Grem Zaklikaye Do Vidnovlennya Viyskovoyi Dopomogi Ukrayini Analiz Situatsiyi

May 22, 2025

Grem Zaklikaye Do Vidnovlennya Viyskovoyi Dopomogi Ukrayini Analiz Situatsiyi

May 22, 2025 -

S Sh A Pripinili Viyskovu Dopomogu Grem Zaklikaye Do Negaynogo Vidnovlennya

May 22, 2025

S Sh A Pripinili Viyskovu Dopomogu Grem Zaklikaye Do Negaynogo Vidnovlennya

May 22, 2025 -

Tramp Ta Konfiskatsiya Rosiyskikh Aktiviv Reaktsiya Senatoriv S Sh A

May 22, 2025

Tramp Ta Konfiskatsiya Rosiyskikh Aktiviv Reaktsiya Senatoriv S Sh A

May 22, 2025 -

Andriy Sibiga Ta Amerikanski Senatori Pro Scho Govorili U Vashingtoni

May 22, 2025

Andriy Sibiga Ta Amerikanski Senatori Pro Scho Govorili U Vashingtoni

May 22, 2025 -

Siren Movie Review Performances And Beachside Setting

May 22, 2025

Siren Movie Review Performances And Beachside Setting

May 22, 2025