Understanding The Uber (UBER) Investment Landscape

Table of Contents

H2: Uber's Business Model and Financial Performance

H3: Revenue Streams and Growth Prospects

Uber's diversified revenue model is a key factor driving investor interest. The company's revenue streams can be broken down into several key areas:

-

Ridesharing: This remains Uber's core business, although its growth rate has slowed in recent years due to increased competition and fluctuating demand. Understanding Uber revenue from this sector requires analyzing factors like pricing strategies, driver availability, and overall market saturation.

-

Uber Eats: This food delivery service has experienced explosive growth, becoming a major competitor in the rapidly expanding food delivery market. Examining Uber Eats growth is crucial, as it represents a significant portion of Uber's overall revenue and profitability. Analyzing factors like market share, customer acquisition costs, and competition from rivals like DoorDash is essential for a full understanding.

-

Uber Freight: This segment, focusing on the logistics and transportation of goods, represents a potentially high-growth area. Tracking the progress and market penetration of Uber freight is vital for assessing Uber’s future potential diversification and revenue stability.

Analyzing the financial performance Uber requires a deep dive into the contribution of each segment. Growth rates, market share, and operational efficiencies all play a crucial role in determining the overall Uber profitability. Charts and graphs illustrating revenue breakdowns and growth trajectories over time can provide valuable insights.

H3: Key Financial Metrics and Indicators

Investors carefully monitor several key Uber financials to gauge the company's health and potential:

-

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): This metric provides insight into Uber's operational profitability, excluding financing and accounting effects. Tracking changes in Uber EBITDA over time is vital for understanding operational efficiency and growth.

-

Net Income: This indicates Uber's profitability after considering all expenses, including interest, taxes, depreciation, and amortization. Consistent and increasing net income are strong indicators of a healthy business model.

-

Free Cash Flow: This shows the cash generated by Uber's operations after accounting for capital expenditures. Positive and growing Uber cash flow signals financial stability and potential for future investment and expansion.

-

Debt-to-Equity Ratio: This metric helps assess Uber's financial risk. A high ratio indicates higher financial leverage and increased risk. Monitoring the Uber valuation considering its debt load provides context for investment decisions. Analyzing these metrics in conjunction with the company's overall Uber stock performance provides a complete financial picture.

H2: Factors Influencing Uber Stock Price

H3: Market Competition and Regulatory Landscape

The Uber stock price is significantly influenced by the competitive landscape and regulatory environment. Key factors include:

-

Competition: Companies like Lyft, DoorDash, and other ride-sharing and food delivery services create a highly competitive environment. Analyzing Uber competitors and their market strategies is critical.

-

Regulation: Government regulations regarding ride-sharing and food delivery vary significantly across different regions. Understanding the ride-sharing regulation and its impact on Uber legal issues in different markets is vital. Changes in regulations can drastically affect Uber's profitability and operations. This includes monitoring potential changes in the regulatory environment influencing the food delivery competition.

H3: Technological Advancements and Innovation

Uber's investment in technology significantly impacts its future prospects. Key aspects include:

-

Autonomous Vehicles: Uber's continued investment in Uber self-driving cars and autonomous vehicle technology has the potential to revolutionize its operations and significantly reduce costs. However, this represents a considerable long-term investment with inherent risks.

-

Artificial Intelligence (AI) and Data Analytics: Uber uses Uber AI and data analytics to optimize pricing, route planning, and customer service. The effectiveness of these technologies in improving Uber technology and driving efficiency significantly impacts profitability. The company's capacity for Uber innovation in this field is a key factor driving investor confidence.

H3: Economic and Geopolitical Factors

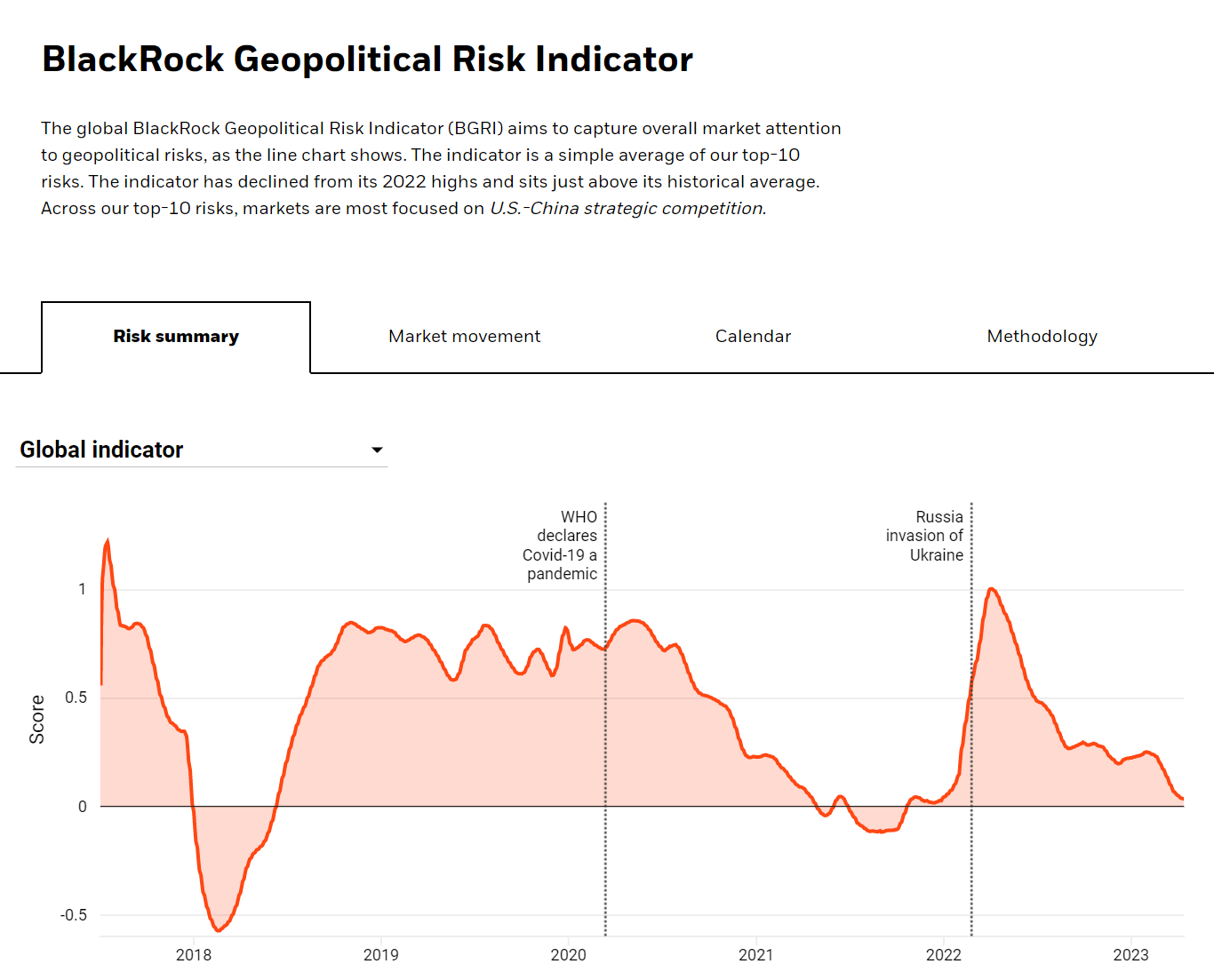

Macroeconomic conditions and geopolitical events significantly influence Uber's performance:

-

Macroeconomic Conditions: Recessions, inflation, and interest rates all impact consumer spending and demand for ride-sharing and delivery services. Understanding the Uber economy and how macroeconomic factors influence consumer behavior is essential. Fluctuations in Uber inflation impact pricing strategies and profitability.

-

Geopolitical Factors: Geopolitical instability and global economic trends directly affect Uber's international operations. Assessing global impact Uber and the geopolitical risks Uber faces across various regions is crucial. External factors such as fuel prices and exchange rate fluctuations also significantly impact profitability.

H2: Investment Strategies and Considerations for Uber

H3: Long-Term vs. Short-Term Investments

Investors should consider their investment horizon when assessing Uber stock. A long-term investment strategy might be suitable for those who believe in Uber's long-term growth potential, while a short-term strategy might be employed by traders looking for short-term price movements.

H3: Risk Assessment and Diversification

Investing in Uber carries inherent risks. A thorough Uber risk assessment should consider the competitive landscape, regulatory hurdles, and macroeconomic factors. Uber investment strategy should always emphasize portfolio diversification to mitigate risk.

H3: Fundamental vs. Technical Analysis

Investors use both fundamental and technical analysis approaches to evaluate Uber stock analysis. Fundamental analysis focuses on the company's financial performance and intrinsic value, while technical analysis focuses on price charts and patterns to predict future price movements.

3. Conclusion: Making Informed Decisions in the Uber (UBER) Investment Landscape

This article explored the multifaceted Uber (UBER) investment landscape, highlighting the importance of understanding Uber's diverse revenue streams, financial performance, competitive environment, and the impact of technological advancements and macroeconomic factors. Key takeaways include the importance of considering both long-term and short-term investment strategies, conducting thorough risk assessments, and diversifying your portfolio. Remember, before investing in Uber or any stock, it's crucial to conduct thorough due diligence. Utilize resources like financial news websites and the SEC's EDGAR database to access company filings and gain a deeper understanding of the Uber investment strategy. By understanding the complexities of the Uber (UBER) investment landscape, you can make more informed and confident investment decisions.

Featured Posts

-

First Look The Long Walk A Stephen King Adaptation Trailer

May 08, 2025

First Look The Long Walk A Stephen King Adaptation Trailer

May 08, 2025 -

Nuggets Vs Bulls De Andre Jordans Milestone Moment

May 08, 2025

Nuggets Vs Bulls De Andre Jordans Milestone Moment

May 08, 2025 -

Bitcoin Madenciliginin Sonu Yaklasiyor Mu

May 08, 2025

Bitcoin Madenciliginin Sonu Yaklasiyor Mu

May 08, 2025 -

Dodger Mookie Betts Misses Freeway Series Opener Due To Illness

May 08, 2025

Dodger Mookie Betts Misses Freeway Series Opener Due To Illness

May 08, 2025 -

Cryptocurrency And Geopolitical Risk A Winning Strategy

May 08, 2025

Cryptocurrency And Geopolitical Risk A Winning Strategy

May 08, 2025