Understanding Your New HMRC Tax Code: Implications For Savings

Table of Contents

Understanding the Structure of Your HMRC Tax Code

What does my tax code actually mean?

Your HMRC tax code is a combination of numbers and sometimes letters that dictates how much income tax is deducted from your earnings. The numerical part represents your personal allowance – the amount of income you can earn tax-free. The letters, if present, indicate adjustments or special circumstances.

For example:

- 1257L: The '1257' indicates a personal allowance of £12,570. The 'L' signifies a tax adjustment, often related to student loan repayments.

- 1100L: Similar to above, but with a lower personal allowance.

- BR: This is a tax code often used for those with no tax-free allowance.

Understanding these components is key to comprehending your net income. For more detailed information, refer to the official on tax codes.

- Breakdown of the numerical component: This represents your annual personal allowance.

- Explanation of any letters included in the code: These letters indicate adjustments such as student loan repayments, marriage allowance, or other special circumstances.

- Examples: 1257L (standard code with student loan deductions), 1100L (lower allowance, possibly due to additional income), BR (basic rate, no personal allowance).

Common Tax Code Scenarios and Their Impact on Savings

Different life circumstances lead to varying tax codes, directly impacting your disposable income and savings potential.

- Emergency Tax Code: If your employer doesn't have enough information about your income, you might receive an emergency tax code (like 0T or K). This results in higher tax deductions initially, leading to a lower take-home pay until the correct code is applied. Contact HMRC immediately to rectify this.

- Student Loan deductions: If you have outstanding student loans, your tax code will reflect this. The deductions reduce your take-home pay but are ultimately contributing towards your loan repayment. This affects your ability to save but remember it's a crucial investment in your future.

- Tax codes for second jobs or multiple income streams: Having multiple income sources can sometimes complicate your tax code. Ensure you inform HMRC about all your income to avoid discrepancies and incorrect tax deductions which can impede your savings goals.

Using Your HMRC Tax Code to Optimize Your Savings

Budgeting Effectively Based on Your Tax Code

Effective budgeting is paramount. Your HMRC tax code dictates your net income, so your budget must accurately reflect this post-tax amount.

- Track your income and expenses meticulously: Use spreadsheets, budgeting apps (like Mint or YNAB), or even a simple notebook to monitor your cash flow.

- Create a realistic budget reflecting your post-tax income: Don't budget based on your gross income; use your net income (after tax) to avoid overspending.

- Utilize budgeting apps and tools: These tools can automate tracking, categorize expenses, and provide insights into your spending habits, assisting you in reaching your savings goals.

Tax-Efficient Savings Strategies

Knowing your tax code helps you make informed decisions about your savings.

- ISAs (Individual Savings Accounts): ISAs offer tax-free savings and investments, allowing your money to grow without paying income tax or capital gains tax, making them an attractive option for many. Eligibility depends on your individual circumstances.

- Pensions: Contributions to pension schemes often attract tax relief from the government, meaning the government tops up your contributions. The amount of tax relief depends on your tax bracket, making it an especially effective savings vehicle for higher earners.

- Other tax-efficient savings options: Explore options like NS&I savings products or other government-backed schemes, which sometimes offer additional advantages and may be beneficial depending on your HMRC tax code.

Addressing Potential Issues with Your HMRC Tax Code

Identifying and Resolving Tax Code Discrepancies

Regularly reviewing your tax code is essential.

- Accessing your tax code online through HMRC: Use the HMRC website to check your current tax code and ensure accuracy.

- Contacting HMRC to resolve discrepancies: If you believe there is an error, contact HMRC immediately to avoid unnecessary tax overpayments or underpayments that could impact your savings.

- Understanding your P60 and P45 documents: These documents provide crucial information about your earnings and tax deductions for the relevant tax year.

Seeking Professional Advice

Complex tax situations or significant uncertainties benefit from expert guidance.

- Situations requiring professional financial advice: If you have multiple income sources, significant investments, or are unsure about your tax obligations, consulting a financial advisor is recommended.

- Finding a reputable financial advisor: Seek qualified and regulated financial advisors who can provide tailored advice based on your specific HMRC tax code and financial circumstances.

Conclusion

Understanding your HMRC tax code is fundamental to effective financial management and maximizing your savings potential. By carefully analyzing your code, creating a realistic budget, and exploring tax-efficient savings options, you can take control of your finances and build a secure financial future. Don't hesitate to contact HMRC or seek professional advice if you have any concerns or uncertainties about your HMRC tax code. Take action today and optimize your savings based on your unique HMRC tax code!

Featured Posts

-

Thousands With Savings Accounts Unknowingly Owe Hmrc Tax

May 20, 2025

Thousands With Savings Accounts Unknowingly Owe Hmrc Tax

May 20, 2025 -

F1 Champions Support Bolsters Mick Schumachers Cadillac Bid

May 20, 2025

F1 Champions Support Bolsters Mick Schumachers Cadillac Bid

May 20, 2025 -

March 22 Nyt Mini Crossword Answers Full Solution Guide

May 20, 2025

March 22 Nyt Mini Crossword Answers Full Solution Guide

May 20, 2025 -

Le Mercato Des Restaurants A Biarritz Nouvelles Adresses Et Chefs Talentueux

May 20, 2025

Le Mercato Des Restaurants A Biarritz Nouvelles Adresses Et Chefs Talentueux

May 20, 2025 -

The Unexpected Link Between Agatha Christie And M Night Shyamalans The Village

May 20, 2025

The Unexpected Link Between Agatha Christie And M Night Shyamalans The Village

May 20, 2025

Latest Posts

-

Le Gigantesque Diletta Arrive Au Port D Abidjan Un Nouveau Record Pour La Cote D Ivoire

May 20, 2025

Le Gigantesque Diletta Arrive Au Port D Abidjan Un Nouveau Record Pour La Cote D Ivoire

May 20, 2025 -

Trafic Portuaire D Abidjan Hausse Modeste En 2022

May 20, 2025

Trafic Portuaire D Abidjan Hausse Modeste En 2022

May 20, 2025 -

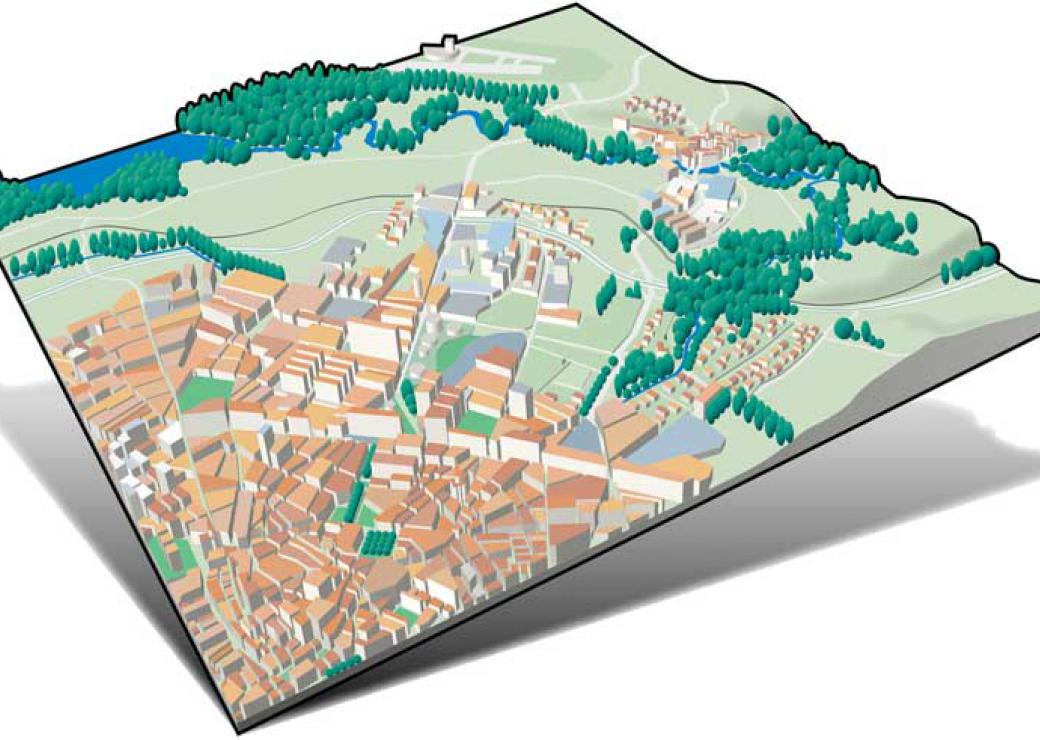

Plans D Urbanisme De Detail En Cote D Ivoire Bruno Kone Appelle A La Participation Des Maires

May 20, 2025

Plans D Urbanisme De Detail En Cote D Ivoire Bruno Kone Appelle A La Participation Des Maires

May 20, 2025 -

Cote D Ivoire Le Port D Abidjan Accueille Le Plus Grand Navire De Son Histoire

May 20, 2025

Cote D Ivoire Le Port D Abidjan Accueille Le Plus Grand Navire De Son Histoire

May 20, 2025 -

Cote D Ivoire Lancement Des Plans D Urbanisme De Detail Une Invitation Aux Maires

May 20, 2025

Cote D Ivoire Lancement Des Plans D Urbanisme De Detail Une Invitation Aux Maires

May 20, 2025