Unicaja Investors Targeted By Sabadell In Potential Acquisition

Table of Contents

Sabadell's Interest and Potential Offer

Banco Sabadell has publicly indicated its interest in acquiring Unicaja Banco, a move driven by strategic objectives. A successful "Unicaja acquisition" would significantly expand Sabadell's market share in Spain, boosting its overall size and influence. Synergies between the two banks, particularly in areas like branch networks and technological infrastructure, could lead to significant cost savings and increased efficiency. While specific details of a potential offer remain undisclosed, market speculation suggests a valuation in the billions of Euros.

- Potential timeline for a formal offer: While no official timeline has been released, market analysts anticipate a formal offer within the next few months, pending regulatory approvals and internal due diligence.

- Speculation on the offer price and its impact on Unicaja's share price: The anticipated offer price is crucial for Unicaja investors. A generous offer could lead to significant gains, while a lower-than-expected price could result in losses. The stock market reaction will be closely tied to the offer's terms.

- Analysis of Sabadell's financial position and ability to finance the acquisition: Sabadell's financial health is a key factor in determining the viability of the acquisition. A thorough assessment of their financial resources and debt capacity will be necessary to judge their ability to successfully complete the deal.

Impact on Unicaja Investors

The potential Sabadell takeover of Unicaja presents a complex scenario for Unicaja investors. The outcome will depend heavily on the specifics of the offer, including the offer price and the method of payment (cash or shares).

- Potential gains or losses for investors depending on the offer terms: A higher offer price than the current market value will naturally benefit investors. However, a share exchange might be less attractive depending on the exchange ratio and Sabadell's future prospects.

- Analysis of alternative investment options for Unicaja investors: Investors should carefully consider their alternatives should they be dissatisfied with the offer. This might include holding onto their shares, seeking other investment opportunities, or diversifying their portfolio.

- Advice for investors on how to respond to the potential acquisition: Investors should consult with financial advisors to assess the potential impact on their portfolios and to make informed investment decisions. Rushing into decisions without proper analysis could prove detrimental.

Regulatory and Competitive Landscape

The proposed "Spanish banking merger" between Sabadell and Unicaja faces significant regulatory hurdles. Securing approvals from the European Central Bank (ECB) and other relevant regulatory bodies is crucial for the deal's success. Antitrust concerns regarding market dominance will also need to be addressed.

- Key regulatory challenges Sabadell might face: The ECB will scrutinize the merger for its impact on financial stability and competition within the Spanish banking sector. Meeting their stringent requirements will be crucial.

- Impact on competition within the Spanish banking market: The merger could potentially reduce competition within the Spanish banking sector, raising concerns about market power and pricing.

- Potential antitrust concerns: Regulatory bodies will likely analyze the deal's impact on market concentration and competition, potentially requiring concessions or modifications to proceed.

Alternative Scenarios and Future Outlook

While a Sabadell takeover is the current focus, alternative scenarios must be considered. If the acquisition falls through, Unicaja's standalone future prospects will be paramount.

- Probability of a successful acquisition: The probability of a successful acquisition depends on several factors, including regulatory approvals, the offer price, and the willingness of Unicaja's shareholders to accept the offer.

- Potential consequences of a failed acquisition for both banks: A failed acquisition could negatively affect the share prices of both banks and potentially impact investor confidence.

- Long-term implications for the Spanish banking sector: Regardless of the outcome, the proposed merger highlights ongoing consolidation within the Spanish banking sector, driven by factors such as increased competition and regulatory changes.

Conclusion

The potential "Unicaja acquisition" by Sabadell represents a significant development in the Spanish banking sector, carrying both opportunities and risks for Unicaja investors. Understanding the implications of this potential merger requires careful consideration of the offer terms, regulatory landscape, and alternative scenarios. While a successful acquisition could bring substantial gains for some investors, a less favorable outcome could lead to losses. To navigate this complex situation, it's crucial to stay informed and seek professional advice. Monitor the Unicaja stock price, stay updated on the acquisition process, and consult a financial professional for advice on Unicaja investments. The future of Unicaja, and its impact on investors, remains uncertain, demanding a vigilant approach.

Featured Posts

-

Heatstroke Alert In Delhi Government Issues Urgent Advisory

May 13, 2025

Heatstroke Alert In Delhi Government Issues Urgent Advisory

May 13, 2025 -

Italian Open Sabalenka Through To Round Of 32

May 13, 2025

Italian Open Sabalenka Through To Round Of 32

May 13, 2025 -

Hit The Road Drax Protest Song A 2024 Remembrance

May 13, 2025

Hit The Road Drax Protest Song A 2024 Remembrance

May 13, 2025 -

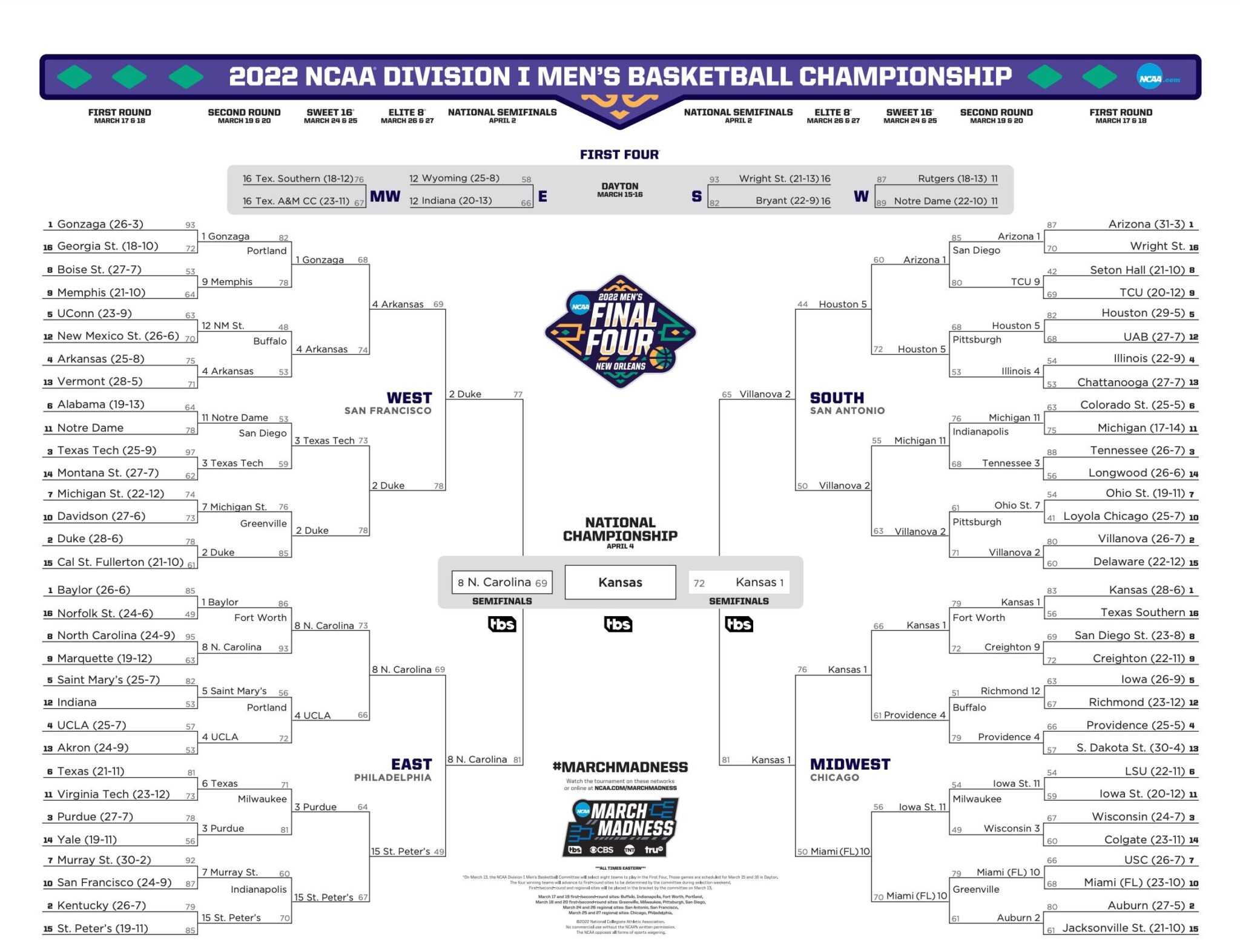

Ncaa Tournament Duke Vs Oregon Live Game Updates And Viewing Guide

May 13, 2025

Ncaa Tournament Duke Vs Oregon Live Game Updates And Viewing Guide

May 13, 2025 -

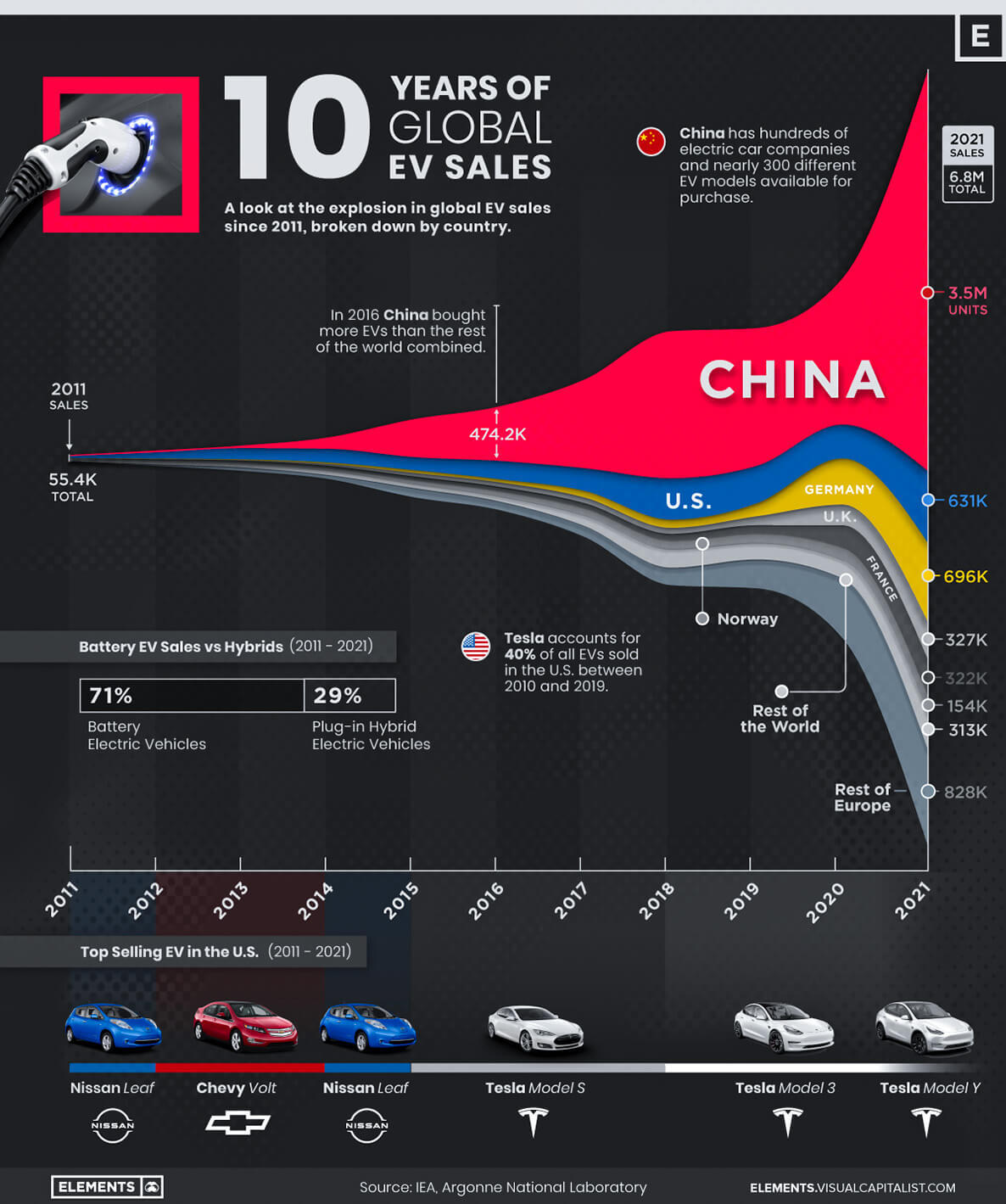

Exclusive Byds Plan To Conquer The Global Automotive Market

May 13, 2025

Exclusive Byds Plan To Conquer The Global Automotive Market

May 13, 2025

Latest Posts

-

Analiza Kako Je Dokovic Srusio Federerove Rekorde

May 14, 2025

Analiza Kako Je Dokovic Srusio Federerove Rekorde

May 14, 2025 -

Federerovi Rekordi Dokoviceva Dominacija I Buducnost Tenisa

May 14, 2025

Federerovi Rekordi Dokoviceva Dominacija I Buducnost Tenisa

May 14, 2025 -

Rekord Po Rekord Dokovic Nadmasuje Federera

May 14, 2025

Rekord Po Rekord Dokovic Nadmasuje Federera

May 14, 2025 -

Global Sales Boost Sends Swiss Sneaker Brands Stock Price Higher

May 14, 2025

Global Sales Boost Sends Swiss Sneaker Brands Stock Price Higher

May 14, 2025 -

Dokovicev Put Do Dominacije Preuzimanje Federerove Krune

May 14, 2025

Dokovicev Put Do Dominacije Preuzimanje Federerove Krune

May 14, 2025