Universal Credit And The DWP: Navigating The Upcoming Changes

Table of Contents

Understanding the Key Changes to Universal Credit

The DWP has implemented several key changes to Universal Credit, affecting how benefits are calculated and paid. These modifications aim to incentivize work and provide greater financial support, but understanding their impact is crucial for all claimants.

Increased Work Allowances

The amount claimants can earn before their UC payments are reduced has increased. This means more disposable income for those in work. The new allowance amounts vary depending on your circumstances:

- Single claimants: The work allowance has increased to £632 per month. This represents a significant increase from the previous allowance.

- Claimants with children: The work allowance has increased to £1,091 per month. This adjustment better reflects the increased costs associated with raising children.

Here's how these changes might affect you:

- Example 1: A single claimant earning £1000 per month would previously have seen a significant reduction in their UC payment. With the increased allowance, their payment reduction will be significantly less.

- Example 2: A claimant with two children earning £1500 per month will benefit substantially from the increased work allowance for families.

For official information and detailed figures, refer to the following government websites:

- [Link to relevant GOV.UK page 1]

- [Link to relevant GOV.UK page 2]

Changes to the Taper Rate

The taper rate, the percentage by which UC payments are reduced as earnings increase, has also been altered. This change directly impacts the amount of disposable income claimants retain as they work more.

- Old Taper Rate: [Insert previous percentage]

- New Taper Rate: [Insert new percentage] This reduction in the taper rate means claimants keep a larger proportion of their earnings.

Illustrative examples highlight this change:

- Example 1: A claimant earning £1200 per month would previously have seen a [calculate percentage] reduction in their benefits. Under the new rate, the reduction is now [calculate percentage], resulting in a substantial increase in their net income.

- Example 2: A similar comparison for a claimant with children can be shown.

Sanctions and Conditions

While the DWP has not radically altered the sanctions system, claimants must still meet specific conditions to receive benefits. Failure to comply can result in sanctions. Key changes to the sanctions criteria are:

- [Specific Change 1 - e.g., Increased flexibility for job searches]

- [Specific Change 2 - e.g., Clearer communication regarding sanctions]

- [Specific Change 3 - e.g., More robust appeals process]

To avoid sanctions:

- Attend all scheduled appointments with your work coach.

- Actively search for work, keeping a record of your efforts.

- Immediately appeal any sanctions you feel are unjust, using the official channels.

Impact on Different Claimant Groups

The changes to Universal Credit affect various claimant groups differently. Understanding these nuanced impacts is crucial.

Families with Children

Families with children are significantly impacted by changes in both work allowances and the taper rate, particularly concerning childcare costs and child benefit.

- Example: A family with two children, where one parent works, will see a greater increase in their disposable income due to increased work allowances. The reduced taper rate also increases the incentive to work more hours.

Resources for families:

- [Link to relevant support organization for families]

- [Link to government website on childcare support]

Disabled Claimants

Disabled claimants and those with health conditions face unique challenges. The changes to Universal Credit can affect their access to support.

- Work Capability Assessments (WCAs): [Explain any changes related to WCAs and their impact on benefit entitlement]

Support organizations for disabled claimants:

- [Link to relevant disability charity or support organization]

- [Link to government website on disability benefits]

Single Claimants

Single claimants also experience the effects of the changes, particularly regarding their financial security.

- Example: An increase in work allowance for single claimants means more individuals can work more hours without seeing a drastic reduction in their benefits.

Support for single claimants:

- [Link to relevant support organization for single parents or individuals]

Navigating the DWP Application and Appeals Process

Understanding the DWP application and appeals processes is vital.

Online Application Process

Applying for Universal Credit is primarily online.

- Step-by-step guide: [Outline the steps involved in completing the online application, including required documents]

- Troubleshooting: [Address potential problems, such as technical difficulties or missing information]

Appealing a Decision

If your UC claim is rejected or you disagree with a decision, you can appeal.

- Appealing steps: [Outline the process, including deadlines and required documentation]

- Support resources: [Provide links to relevant organizations offering assistance with appeals]

Conclusion

The recent changes to Universal Credit represent a significant shift in the UK benefits system. Understanding these updates – increased work allowances, the adjusted taper rate, and the implications for different claimant groups – is crucial for navigating the system effectively. Knowing the DWP application and appeals process empowers you to access the support you're entitled to. Stay informed about future updates by regularly checking government websites and reputable sources for the latest information. Understanding the changes to Universal Credit is key to maintaining your financial stability.

Featured Posts

-

Winning Lotto Numbers Saturday April 12th

May 08, 2025

Winning Lotto Numbers Saturday April 12th

May 08, 2025 -

5 0 355 3

May 08, 2025

5 0 355 3

May 08, 2025 -

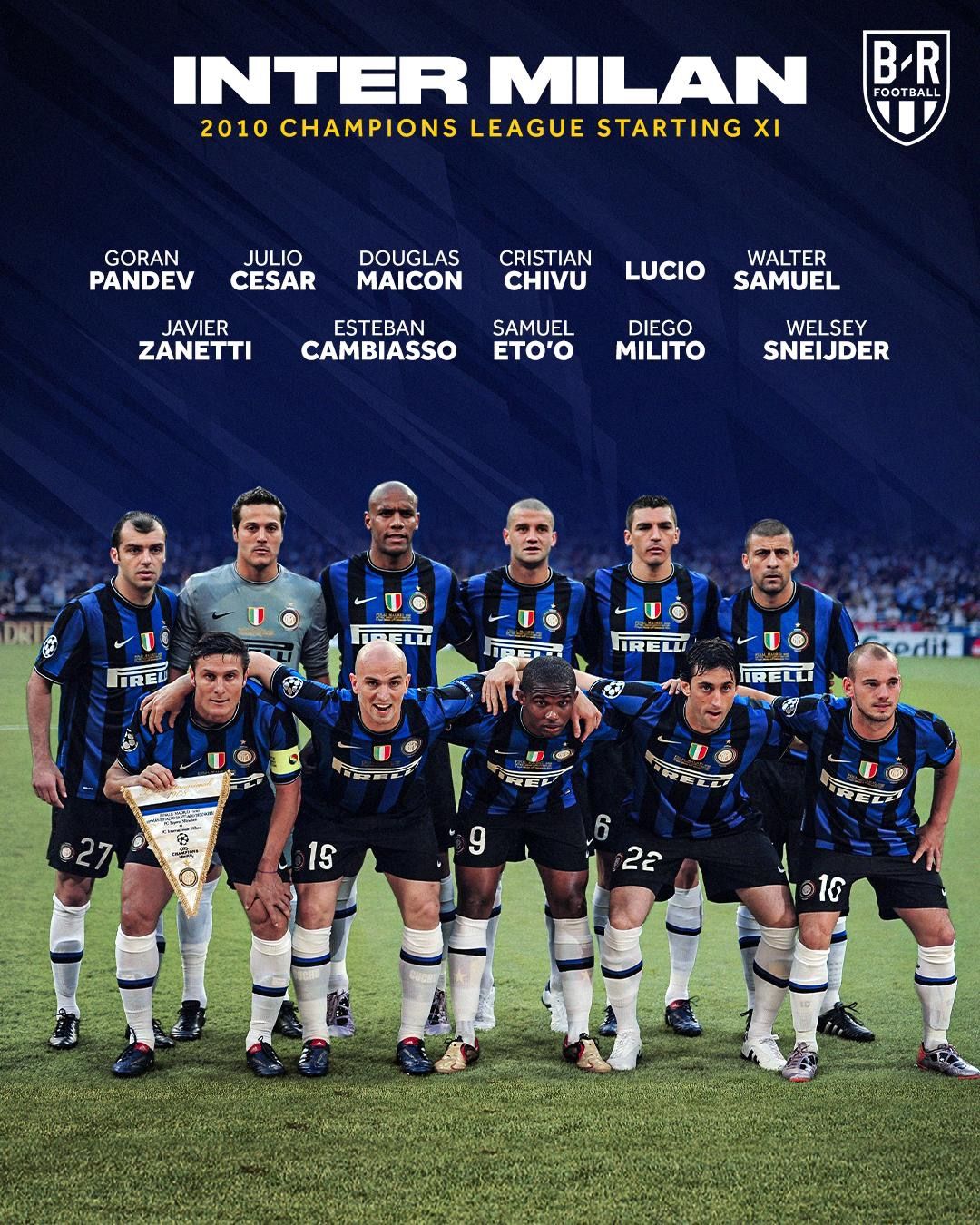

Champions League Inter Milans Shock Win Against Bayern Munich

May 08, 2025

Champions League Inter Milans Shock Win Against Bayern Munich

May 08, 2025 -

Indias Deepest Strikes Into Pakistan A 50 Year Reckoning

May 08, 2025

Indias Deepest Strikes Into Pakistan A 50 Year Reckoning

May 08, 2025 -

Affordable United Center Transportation New 5 Uber Shuttle

May 08, 2025

Affordable United Center Transportation New 5 Uber Shuttle

May 08, 2025