Universal Credit Hardship Payments: A Guide To Reclaiming Overpayments

Table of Contents

Understanding Universal Credit Overpayments

UC overpayments can arise from various reasons, including administrative errors by the Department for Work and Pensions (DWP), changes in your circumstances, or mistakes in the information provided during your application. Understanding the root cause is the first step to reclaiming your money.

- Changes in circumstances: Failing to report a change in income (such as starting a new job or receiving a bonus), employment status (becoming self-employed or changing jobs), or living situation (moving in with a partner or changing address) can lead to an overpayment. It’s crucial to report any changes to the DWP immediately.

- Administrative errors: The DWP, like any large organization, can make mistakes. These errors in calculating your Universal Credit entitlement can result in overpayments. These might involve incorrect calculation of housing costs, income thresholds, or other benefit-related factors.

- Incorrect information provided: Providing inaccurate details on your application form, either intentionally or unintentionally, can lead to an overpayment. Double-check all information before submitting your application.

- Fraud: Deliberately misrepresenting your circumstances to receive more benefits than you're entitled to is considered fraud and carries serious consequences. This is a separate issue and requires legal counsel.

Identifying if You Have an Overpayment

Regularly checking your Universal Credit statements is vital. This helps you catch potential overpayments early. Look for discrepancies between what you believe you're entitled to and the amount paid. Pay close attention to the details of each payment, comparing it with your reported income and circumstances.

- Check your UC statement: Access your online account regularly to review your payment history. Download statements for your records.

- Review your account balance: Monitor your account balance closely to identify any unexpected changes.

- Examine DWP correspondence: Keep all letters and emails from the DWP, as these may contain important information about your entitlement and potential overpayments. Any notices of overpayment should be reviewed carefully and promptly addressed.

Gathering Evidence for Your Claim

Strong evidence is vital for successfully appealing a Universal Credit overpayment. The more comprehensive your evidence, the stronger your case.

- Bank statements: These show your actual income and expenditure, helping to verify your claim.

- Payslips: Payslips provide irrefutable evidence of your earnings.

- Proof of rent payments or other expenses: Documenting rent, mortgage, or other significant living expenses provides a clearer picture of your financial situation.

- Correspondence with the DWP: Retain all communication with the DWP, including emails and letters, to support your claim.

How to Reclaim a Universal Credit Overpayment

Reclaiming an overpayment involves several steps. Act quickly and follow the correct procedures.

- Contacting the DWP: Explain your situation calmly and clearly. Provide all the supporting evidence you've gathered.

- Submitting a formal request: Use the official channels and forms provided by the DWP to challenge the overpayment. This often involves a mandatory reconsideration process. Ensure you understand the deadlines for submission.

- Understanding the appeal process: Be aware of potential next steps and deadlines. You may need to provide further evidence or attend a hearing. Seek legal advice if necessary.

Managing Universal Credit Debt

If an overpayment is confirmed, discuss repayment options with the DWP. They may offer different repayment plans tailored to your individual circumstances.

- Develop a repayment plan: Work with the DWP to create a manageable repayment schedule.

- Seek benefits advice: A benefits advisor can help you understand your rights and options, guiding you through the process.

- Explore hardship options: If you're struggling to repay, explore options for financial hardship support. This might involve reducing the repayment amount or adjusting your payment schedule.

Conclusion:

Reclaiming Universal Credit overpayments can be challenging, but understanding the process, gathering sufficient evidence, and seeking appropriate support significantly improves your chances of success. Remember to meticulously review your UC statements, keep accurate records, and act promptly if you suspect an overpayment. Don't hesitate to seek professional help from a benefits advisor or debt management agency if needed. Start the process of reclaiming your Universal Credit overpayment today!

Featured Posts

-

Andor Showrunner Hints At Rogue Ones Recut Version

May 08, 2025

Andor Showrunner Hints At Rogue Ones Recut Version

May 08, 2025 -

March 7th Nba Thunder Vs Trail Blazers How To Watch Online And On Tv

May 08, 2025

March 7th Nba Thunder Vs Trail Blazers How To Watch Online And On Tv

May 08, 2025 -

Xrp Price Prediction 2 Support Holds Bullish Reversal Or Bear Trap

May 08, 2025

Xrp Price Prediction 2 Support Holds Bullish Reversal Or Bear Trap

May 08, 2025 -

Aj Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Mnayy Jaye Gy

May 08, 2025

Aj Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Mnayy Jaye Gy

May 08, 2025 -

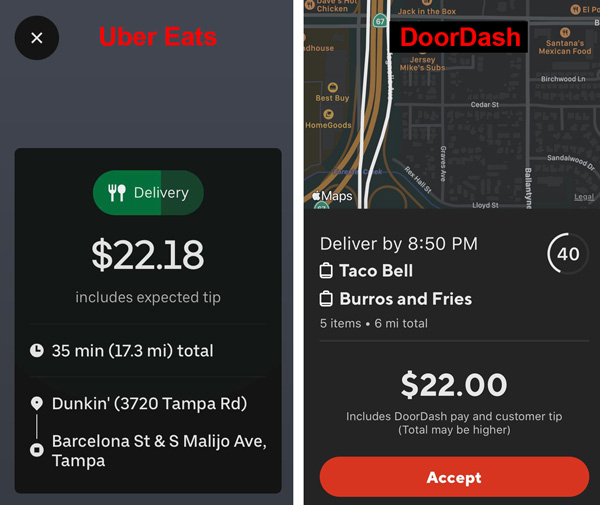

Uber Vs Door Dash A Legal Battle Over Food Delivery Dominance

May 08, 2025

Uber Vs Door Dash A Legal Battle Over Food Delivery Dominance

May 08, 2025