Universal Credit Overpayments: Could You Be Owed A Refund?

Table of Contents

Many Universal Credit claimants have unknowingly received overpayments, leading to unexpected demands for repayment. This can be incredibly stressful, but it's important to know your rights. This guide explores how to identify potential Universal Credit overpayments, understand your entitlements, and claim a refund if you're eligible. We'll break down the process step-by-step to help you get back what you're owed.

Identifying a Universal Credit Overpayment

Signs of a Potential Overpayment:

Several indicators might suggest you've received a Universal Credit overpayment. It's crucial to be vigilant and check your statements regularly.

-

Unexpectedly High Payments: Have you received significantly larger payments than usual without explanation? This could be a sign of an overpayment. For example, if your usual monthly payment is £500 and you suddenly receive £800, investigate further.

-

Demands for Repayment: A letter from the Department for Work and Pensions (DWP) demanding repayment is a clear indication of an overpayment. Carefully read the letter to understand the reasons given and the amount owed.

-

Discrepancies Between Your Income and Payments: Compare your reported income with the Universal Credit payments you've received. Any significant differences should be investigated. If you reported a change in employment or income, ensure it’s accurately reflected in your payments.

-

Letters from the DWP Regarding Overpayment: The DWP will usually send you correspondence detailing any suspected overpayment, outlining the reasons and requesting repayment. Don't ignore these letters; respond promptly.

Keeping accurate records of your income and expenses is paramount. This includes payslips, bank statements, and any other documentation showing your financial situation. This will be invaluable if you need to challenge an overpayment.

Common Reasons for Universal Credit Overpayments:

Overpayments can occur due to various reasons, both on the claimant's and the DWP's side.

-

Failure to Report a Change in Circumstances: This is a very common cause. Changes such as starting a new job, a change in your living situation (moving in with someone), or a significant change in income must be reported to the DWP immediately. Failure to do so can lead to overpayments.

-

Administrative Errors by the DWP: Unfortunately, mistakes can happen. The DWP may incorrectly calculate your entitlement, leading to an overpayment. This could be due to incorrect data entry or misinterpretation of your circumstances.

-

Incorrect Calculation of Entitlement: The calculation of your Universal Credit is complex. Errors in this calculation, whether due to human error or a system glitch, can result in overpayments.

-

Delays in Reporting Changes: Even if you report a change, delays in processing the information by the DWP can sometimes lead to temporary overpayments until the correct calculation is made. Keep records of when you reported any changes.

For more information on reporting changes, visit the official government website: [Insert relevant Gov.uk link here]

How to Claim a Universal Credit Overpayment Refund

Gathering Necessary Documentation:

To successfully claim a refund, you'll need to compile the necessary supporting documentation.

-

Proof of Income: This includes payslips, bank statements, self-assessment tax returns (if applicable), and any other proof of income received during the period of the alleged overpayment.

-

Bank Statements: These show your income and expenditure, helping to verify your financial situation during the relevant period.

-

Rent Receipts: If you're claiming housing costs as part of your Universal Credit, rent receipts or statements from your landlord are essential.

-

Evidence of Changes in Circumstances: Any documentation supporting changes in your circumstances (e.g., a contract for a new job, a tenancy agreement) should be included.

-

Previous Universal Credit Award Letters: These letters detail your previous Universal Credit payments and can help to identify discrepancies.

Contacting the DWP:

You can contact the DWP via several channels:

- Phone: Call the Universal Credit helpline (number will be inserted here). Be prepared to provide your National Insurance number and other relevant information.

- Online: Use the online portal to report the issue and provide supporting documentation. [Insert relevant Gov.uk link here]

- Post: Write a letter explaining the situation and include all supporting documentation. Send it to the address provided in your correspondence from the DWP.

Steps to follow when contacting the DWP:

- Clearly state that you believe you've received an overpayment.

- Provide your National Insurance number and claim reference number.

- Explain the reasons why you believe you've been overpaid, referring to specific dates and amounts.

- Attach copies of all supporting documentation.

- Keep a record of all communications with the DWP.

The Appeals Process:

If the DWP rejects your claim for a refund, you can appeal their decision.

-

Mandatory Reconsideration: This is the first stage of the appeal process. You need to formally request a reconsideration of the decision, providing any additional evidence you may have.

-

Independent Tribunal: If the mandatory reconsideration is unsuccessful, you can appeal to an independent tribunal. This is a formal hearing where your case will be reviewed by an independent panel.

Seeking help from a Citizens Advice Bureau or similar organization is highly recommended if you're struggling with the appeals process. They can provide valuable support and guidance.

Avoiding Future Universal Credit Overpayments

Regularly Reporting Changes:

Promptly reporting any changes in your circumstances is critical to avoiding future overpayments.

- Change of Address: Report any change of address immediately to avoid delays and ensure your payments are sent to the correct location.

- New Job: Report the start date, your earnings, and any other relevant employment details.

- Change in Household Composition: Report any changes to the people living in your household, such as someone moving in or out.

- Change in Income: Report any increases or decreases in your income, including self-employment income.

Keeping Accurate Records:

Maintaining organized financial records is essential for managing your Universal Credit and preventing future issues.

- Keep all payslips: These are crucial for verifying your income.

- Store bank statements safely: Keep at least a year's worth of statements.

- Record all correspondence with the DWP: This will be essential if you need to appeal a decision.

- Maintain a record of any changes in your circumstances: Keep copies of relevant documentation, such as contracts or tenancy agreements.

Conclusion

Identifying, claiming, and preventing Universal Credit overpayments involves understanding your entitlements, maintaining accurate records, and promptly reporting any changes in your circumstances. Remember, proactive record-keeping and communication with the DWP are key to avoiding future issues. If you suspect you've received a Universal Credit overpayment, don't hesitate to take action. Review your payments today and check for potential discrepancies. If you believe you're owed a refund, contact the DWP immediately and start your claim. Learn more about your rights and protect yourself from unnecessary debt. Don't let an overpayment go unclaimed!

Featured Posts

-

Carney Calls Trump Transformational In D C Meeting

May 08, 2025

Carney Calls Trump Transformational In D C Meeting

May 08, 2025 -

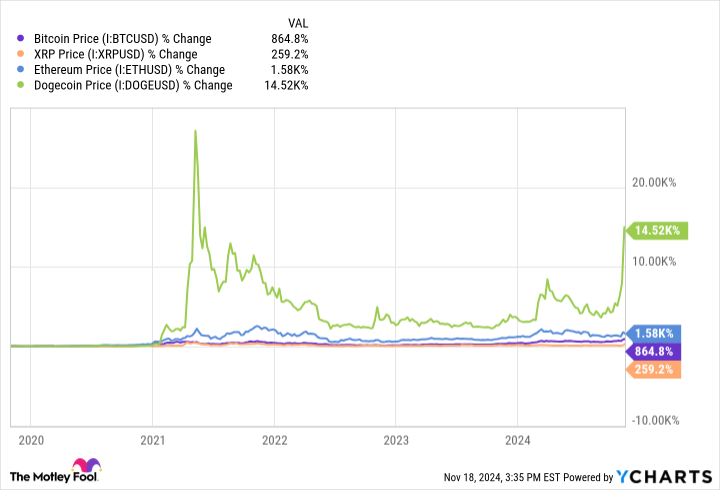

Analyst Spots Bitcoin Entering Rally Zone May 6th Chart Indicates Potential Uptrend

May 08, 2025

Analyst Spots Bitcoin Entering Rally Zone May 6th Chart Indicates Potential Uptrend

May 08, 2025 -

Lotto Results For Wednesday April 9th

May 08, 2025

Lotto Results For Wednesday April 9th

May 08, 2025 -

Is The Recent Bitcoin Rebound Sustainable

May 08, 2025

Is The Recent Bitcoin Rebound Sustainable

May 08, 2025 -

Xrp Poised For A Parabolic Move 3 Reasons To Watch

May 08, 2025

Xrp Poised For A Parabolic Move 3 Reasons To Watch

May 08, 2025