Upcoming Changes To SEC Crypto Broker Rules: What To Expect

Table of Contents

Expanded Definition of "Broker-Dealer" Under SEC Crypto Broker Rules

The proposed changes to SEC crypto broker rules signal a potential broadening of the definition of "broker-dealer," casting a wider net over crypto platforms. This expansion could encompass a larger segment of the industry, including smaller exchanges and even decentralized finance (DeFi) platforms, previously operating under less stringent regulatory oversight.

This shift has significant implications:

- Increased regulatory scrutiny for a wider range of crypto businesses: Many platforms currently operating in a less regulated environment will now face heightened scrutiny from the SEC. This includes thorough reviews of their operations, compliance procedures, and risk management strategies.

- Potential for higher compliance costs and operational burdens: Meeting the increased regulatory demands will necessitate significant investments in compliance infrastructure, legal expertise, and technological solutions. This can place a considerable financial strain, particularly on smaller entities.

- Greater legal clarity (or lack thereof) regarding the scope of the definition: The precise boundaries of the expanded definition remain somewhat unclear, creating a degree of legal ambiguity that could lead to uncertainty and potential disputes.

- Impact on innovation within the crypto space: The increased regulatory burden might stifle innovation, particularly in the DeFi sector, as platforms may struggle to navigate the complexities of compliance while maintaining agility and responsiveness to market demands.

Enhanced Custody Requirements for Crypto Assets Under SEC Crypto Broker Rules

The new SEC crypto broker rules will likely impose stricter requirements on how crypto assets are held and managed. This means heightened security measures and improved risk management practices are paramount. The focus will be on safeguarding customer assets and ensuring their protection against theft, loss, or unauthorized access.

These enhanced custody requirements could include:

- Higher capital requirements for broker-dealers holding crypto assets: Firms will need to maintain higher capital reserves to absorb potential losses and demonstrate financial stability.

- Stringent cybersecurity standards and protocols: Robust cybersecurity measures, including multi-factor authentication, intrusion detection systems, and regular security audits, will be essential.

- Increased insurance coverage to protect customer funds: Broker-dealers may be required to procure higher levels of insurance coverage to protect customer assets against various risks, including hacking and operational failures.

- Potential challenges for smaller firms in meeting these enhanced requirements: The cost of implementing these enhanced security and custody measures could be prohibitive for smaller crypto firms, potentially forcing consolidation or even market exit.

Increased Transparency and Reporting Requirements under SEC Crypto Broker Rules

Expect greater transparency and significantly increased reporting requirements under the revised SEC crypto broker rules. This will involve more frequent and detailed reporting on crypto transactions, holdings, and operational activities. This drive for increased transparency aims to enhance market oversight and investor protection.

However, this increased reporting also presents challenges:

- More frequent and detailed reporting to the SEC: Companies will need to invest in systems and personnel capable of handling the increased reporting burden.

- Enhanced record-keeping practices for compliance purposes: Meticulous record-keeping is crucial for demonstrating compliance with the new regulations.

- Potential implications for customer data privacy under new regulations: Balancing transparency with protecting customer data privacy will require careful consideration and robust data security measures.

- Challenges in balancing transparency with data security: Sharing detailed transactional data while safeguarding sensitive customer information requires advanced technology and security protocols.

Implications for Stablecoins and Other Crypto Assets under SEC Crypto Broker Rules

The new SEC crypto broker rules will likely have a differentiated impact on various types of crypto assets. Stablecoins, for instance, might face stricter scrutiny due to their potential systemic implications.

Here’s what we might expect:

- Different regulatory approaches for stablecoins versus other cryptocurrencies: Stablecoins, due to their peg to fiat currencies, may be subject to more stringent regulations compared to other cryptocurrencies.

- Potential impact on the use of stablecoins for payments and transactions: The new rules could influence the ease and accessibility of using stablecoins for everyday transactions.

- Scrutiny of algorithmic stablecoins and their associated risks: Algorithmic stablecoins, which maintain their peg through algorithmic mechanisms, will likely face closer examination due to the inherent risks involved.

- Potential limitations on the marketing and promotion of certain crypto assets: The SEC might impose restrictions on the marketing and promotion of certain crypto assets, particularly those perceived as high-risk or potentially misleading.

Preparing for the Changes: Strategies for Crypto Businesses

Proactive preparation is crucial for crypto businesses to navigate the upcoming changes in SEC crypto broker rules. This involves a multi-faceted approach encompassing legal review, technological upgrades, and strategic adaptation.

Here are some essential steps:

- Conduct a thorough review of existing compliance programs: Assess current compliance procedures and identify areas needing improvement to meet the heightened standards.

- Engage legal and compliance professionals to ensure regulatory adherence: Seeking expert legal advice is paramount to navigate the complexities of the new rules and ensure compliance.

- Invest in advanced security infrastructure and risk management systems: Upgrade security protocols and risk management systems to meet the enhanced custody and transparency requirements.

- Develop strategies for adapting to evolving regulatory landscapes: The regulatory environment is constantly evolving, so businesses must develop strategies for continuous adaptation and compliance.

Conclusion

The upcoming changes to SEC crypto broker rules will fundamentally reshape the cryptocurrency landscape. The expanded definition of "broker-dealer," enhanced custody requirements, increased transparency demands, and differentiated treatment of various crypto assets will necessitate significant adjustments from businesses operating in this sector. Understanding these changes and proactively implementing necessary adaptations is crucial for survival and success in this evolving industry. Don't wait; seek legal counsel, review your compliance programs, invest in robust security measures, and stay informed about future regulatory developments. Regularly revisit this article and other reputable sources for updates on SEC crypto broker rules as more information becomes available.

Featured Posts

-

Cassie And Alex Fine Reveal Babys Sex On Fathers Birthday

May 13, 2025

Cassie And Alex Fine Reveal Babys Sex On Fathers Birthday

May 13, 2025 -

Delhi Heatwave Government Issues Advisory Warns Of Heatstroke

May 13, 2025

Delhi Heatwave Government Issues Advisory Warns Of Heatstroke

May 13, 2025 -

Tasman Council Road Closure A Truckies Realistic Perspective

May 13, 2025

Tasman Council Road Closure A Truckies Realistic Perspective

May 13, 2025 -

Crews Comeback Victory 2 1 Win Over Earthquakes

May 13, 2025

Crews Comeback Victory 2 1 Win Over Earthquakes

May 13, 2025 -

Where To Stream Eva Longorias Searching For Spain

May 13, 2025

Where To Stream Eva Longorias Searching For Spain

May 13, 2025

Latest Posts

-

Reverse The Wholesale Fibre Policy Bells Plea To The Federal Government

May 14, 2025

Reverse The Wholesale Fibre Policy Bells Plea To The Federal Government

May 14, 2025 -

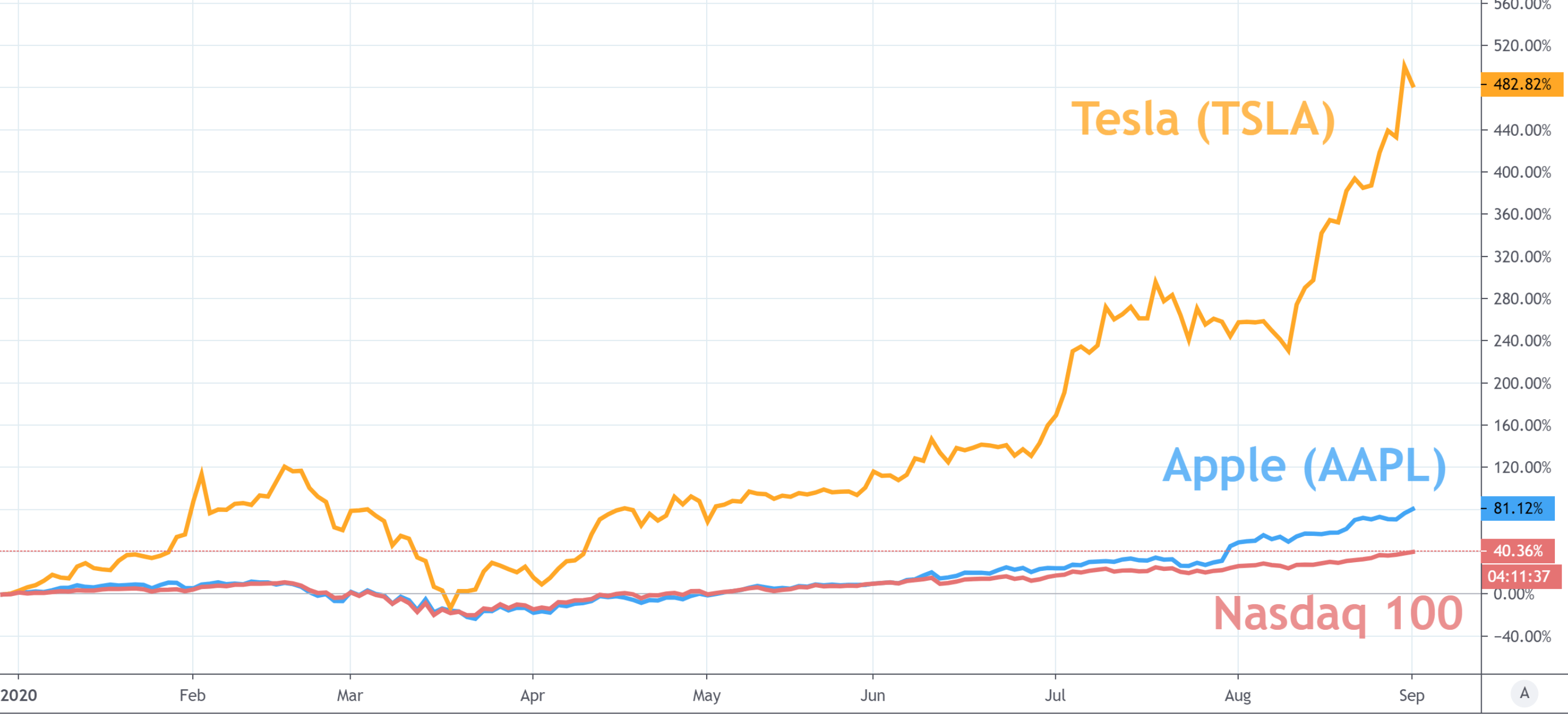

Shopify Stock Soars Nasdaq 100 Inclusion Fuels 14 Jump

May 14, 2025

Shopify Stock Soars Nasdaq 100 Inclusion Fuels 14 Jump

May 14, 2025 -

Global Risk Rally Driven By U S China Trade Deal Progress

May 14, 2025

Global Risk Rally Driven By U S China Trade Deal Progress

May 14, 2025 -

Canadas Expat Advantage Economic Gains From Us Dissatisfaction

May 14, 2025

Canadas Expat Advantage Economic Gains From Us Dissatisfaction

May 14, 2025 -

New Offer For Lion Electric Investors Revised Bid

May 14, 2025

New Offer For Lion Electric Investors Revised Bid

May 14, 2025