US-China Trade Deal Boosts S&P 500 By More Than 3%

Table of Contents

Immediate Market Reaction: Why the S&P 500 Jumped

The market's response to the US-China trade deal was swift and dramatic. The S&P 500 experienced a rapid and significant increase, outpacing previous reactions to similar trade news. This surge showcased a wave of investor confidence, reflecting a collective sigh of relief from businesses and investors alike. The speed and magnitude of the rally underscored the pent-up demand for certainty in the global economic landscape.

- Percentage Increase: The S&P 500's jump exceeded 3%, representing a substantial gain in market capitalization.

- Sector Performance: Several sectors significantly outperformed others. The technology sector, particularly companies reliant on global supply chains, witnessed substantial gains. Industrials also experienced a strong rally, reflecting the easing of trade restrictions.

- Investor Sentiment: Investor confidence soared, as evidenced by increased trading volume and a shift towards risk-on sentiment. Uncertainty, a major factor dampening investment for years, was visibly reduced.

This market rally demonstrated the profound impact of reduced trade uncertainty on investor behavior and overall stock market gains.

Underlying Factors Contributing to the S&P 500 Rise

Several underlying factors contributed to the S&P 500's significant rise following the US-China trade deal. These factors worked synergistically to create a powerful upward momentum in the market.

Reduced Uncertainty and Increased Investment

The deal significantly reduced uncertainty surrounding future trade relations between the US and China. This clarity fostered a more favorable business environment, encouraging businesses to increase investment and long-term planning.

- Investment Plans: Companies previously hesitant to invest due to tariff uncertainty now felt more comfortable committing capital to expansion, research and development, and hiring.

- Reduced Tariffs: Lower tariffs facilitated cheaper imports and exports, boosting profitability for many companies engaged in international trade.

- Improved Trade Relations: The deal signaled a potential thaw in US-China relations, improving the overall economic outlook and boosting investment confidence.

Positive Impact on Global Supply Chains

The US-China trade deal positively impacted global supply chains, easing logistical challenges and reducing production costs.

- American Businesses: American businesses sourcing goods from China benefited significantly from improved trade relations and reduced tariffs, leading to lower production costs and increased competitiveness.

- Global Trade: The deal’s positive effects rippled throughout the global economy, enhancing economic interconnectedness and fostering collaboration among nations.

- Supply Chain Resilience: The improved trade relationship enhanced the resilience of global supply chains, reducing vulnerability to future disruptions.

Stimulus Measures and Government Policies

While not directly part of the trade deal, the concurrent implementation of economic stimulus measures and supportive government policies likely contributed to the market's positive response. These synergistic effects amplified the benefits of the trade agreement.

- Fiscal Stimulus: Any concurrent fiscal stimulus packages further bolstered economic activity, creating a positive feedback loop with the trade deal.

- Monetary Policy: Supportive monetary policy from central banks around the world helped maintain liquidity and encourage investment.

Long-Term Implications for the S&P 500 and US Economy

While the immediate impact of the US-China trade deal on the S&P 500 was undeniably positive, the long-term implications require careful consideration.

- Long-Term Growth: The deal has the potential to foster long-term economic growth by reducing trade barriers and promoting greater economic cooperation.

- Economic Stability: However, the long-term economic stability remains contingent on the continued implementation and enforcement of the trade agreement.

- Geopolitical Risk: Geopolitical risks and unexpected shifts in US-China relations could still negatively impact the S&P 500.

- Future Market Outlook: The future market outlook depends on various factors, including the success of the trade deal in fostering sustainable economic growth and mitigating geopolitical risks.

Conclusion: The US-China Trade Deal and the Future of the S&P 500

The US-China trade deal’s impact on the S&P 500 was significant, resulting in an impressive increase of over 3%. This surge stemmed from reduced uncertainty, improved global supply chains, and potentially, synergistic effects with government policies. While the long-term effects remain to be seen, the deal holds the potential for sustained growth, contingent on continued cooperation and the mitigation of geopolitical risks. Stay informed on future developments in the US-China trade relationship and its impact on the S&P 500 and overall market trends by subscribing to our newsletter. Understanding the intricacies of US-China trade relations is crucial for effective investment strategies and navigating the complexities of the S&P 500 outlook.

Featured Posts

-

Springwatch In Japan A Guide To Cherry Blossom Viewing

May 13, 2025

Springwatch In Japan A Guide To Cherry Blossom Viewing

May 13, 2025 -

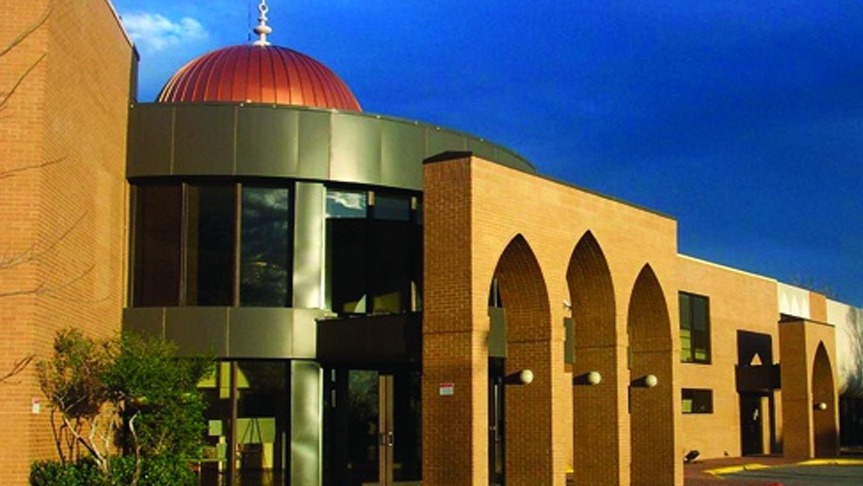

Planned Texas Islamic City Transparency And Addressing Community Concerns Regarding Sharia Law

May 13, 2025

Planned Texas Islamic City Transparency And Addressing Community Concerns Regarding Sharia Law

May 13, 2025 -

Palisades Fire Impact On Celebrities And Their Homes

May 13, 2025

Palisades Fire Impact On Celebrities And Their Homes

May 13, 2025 -

Sabalenka Triumphs Over Pegula At Miami Open

May 13, 2025

Sabalenka Triumphs Over Pegula At Miami Open

May 13, 2025 -

Chinas Byd Targets Brazils Ev Market As Fords Influence Wanes

May 13, 2025

Chinas Byd Targets Brazils Ev Market As Fords Influence Wanes

May 13, 2025

Latest Posts

-

E Bay And Section 230 A Ruling On Banned Chemical Listings

May 15, 2025

E Bay And Section 230 A Ruling On Banned Chemical Listings

May 15, 2025 -

Office365 Security Flaw Exploited Millions Of Dollars Stolen

May 15, 2025

Office365 Security Flaw Exploited Millions Of Dollars Stolen

May 15, 2025 -

Ohio Train Derailment Investigation Into Persistent Toxic Chemical Contamination

May 15, 2025

Ohio Train Derailment Investigation Into Persistent Toxic Chemical Contamination

May 15, 2025 -

Ev Mandate Opposition Car Dealers Push Back

May 15, 2025

Ev Mandate Opposition Car Dealers Push Back

May 15, 2025 -

Fbi Probes Millions In Losses From Executive Office365 Account Hacks

May 15, 2025

Fbi Probes Millions In Losses From Executive Office365 Account Hacks

May 15, 2025