US-China Trade Surge: A Race Against The Clock Before Trade Deal Expiry

Table of Contents

The Current State of US-China Trade Relations

The relationship between the US and China, the world's two largest economies, is undeniably complex. Understanding the current state of their trade relations is crucial for navigating the challenges and opportunities ahead.

Increased Trade Volume

Recent data paints a picture of significantly increased bilateral trade volume between the US and China. This US-China trade growth is a double-edged sword, presenting both opportunities and risks.

- Specific import/export figures: While precise, up-to-the-minute figures fluctuate daily, overall trends show a substantial increase in both imports and exports between the two nations. For example, in [Insert Year - replace with most recent year with available data], imports from China to the US increased by [Insert Percentage - replace with accurate data]% compared to [Insert Previous Year]. Similarly, US exports to China saw a [Insert Percentage - replace with accurate data]% increase.

- Growth percentages compared to previous years: The growth in bilateral trade volume is significantly higher than the average growth seen in previous years, indicating a notable acceleration.

- Key sectors contributing to the surge: Several key sectors are driving this surge. Technology, including semiconductors and electronics, remains a major component, as does agriculture (soybeans, for example) and consumer goods. The US-China trade deficit, however, continues to be a significant factor influencing policy decisions.

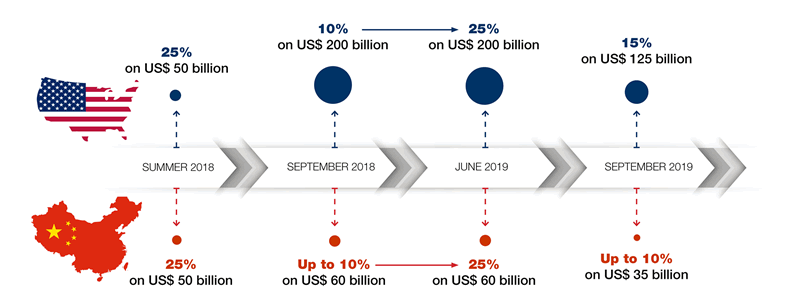

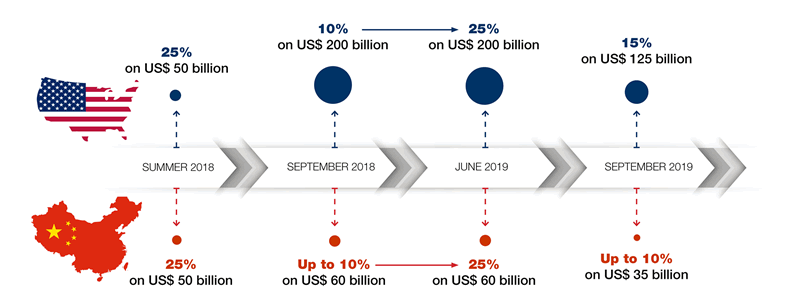

Uncertain Future of Existing Trade Agreements

The current surge in US-China trade volume occurs against a backdrop of uncertainty regarding the future of existing trade agreements. The expiration of these agreements, coupled with ongoing geopolitical tensions, creates a significant challenge for businesses.

- Specific trade agreements nearing expiration: Several key trade agreements between the US and China are approaching their expiration dates. [Insert Specific Agreements and Dates - replace with accurate information]. The lack of clarity surrounding their renewal creates significant uncertainty for businesses.

- Potential consequences of non-renewal: Failure to renew or replace these agreements could lead to increased tariffs, trade restrictions, and disruptions to supply chains, impacting both US and Chinese businesses.

- Ongoing negotiations: While negotiations are ongoing, the outcome remains unclear, adding to the sense of urgency for businesses to adapt to potential shifts in the trade landscape.

Factors Driving the Trade Surge

Several intertwined factors contribute to the current surge in US-China trade. Understanding these forces is essential for predicting future trends.

Global Supply Chain Dynamics

Global supply chain disruptions and ongoing efforts to diversify sourcing have played a significant role in shaping US-China trade.

- Impact of geopolitical instability: Geopolitical instability and the desire for supply chain resilience have forced many businesses to reconsider their reliance on China as a primary manufacturing hub. Diversifying supply chains is a significant ongoing process.

- Reliance on Chinese manufacturing: Despite diversification efforts, China still retains a substantial position in global manufacturing. Many companies remain heavily reliant on Chinese production for various goods.

- Efforts to diversify supply chains away from China: Numerous companies are actively seeking alternative sources for manufacturing, leading to increased trade with other countries, although completely eliminating dependence on China remains a significant challenge.

Consumer Demand and Inflation

Strong consumer demand, coupled with inflationary pressures in both the US and China, have also fueled the trade surge.

- Data on consumer spending: Robust consumer spending in the US has increased demand for imported goods, particularly from China, which remains a major supplier of consumer products.

- Inflation rates: Inflationary pressures in both countries are driving up the cost of goods, impacting import and export volumes and influencing trade balance calculations.

- Impact on import demand for both countries: Higher inflation impacts purchasing power, but consumer demand in the US continues to support imports from China, while Chinese consumers continue to import specific goods.

Potential Risks and Opportunities

The current environment presents both significant risks and opportunities for businesses operating in the US-China trade arena.

Geopolitical Tensions

Ongoing geopolitical tensions and trade disputes significantly impact the future trajectory of US-China trade relations.

- Areas of conflict: Areas of conflict, including issues related to Taiwan and technology transfer, continue to cast a shadow over trade relations.

- Potential for trade restrictions: The potential for new trade restrictions or tariffs remains a significant concern for businesses.

- Impact on business confidence: Geopolitical uncertainty negatively impacts business confidence, leading to hesitancy in investment and expansion plans.

Strategic Implications for Businesses

Businesses must proactively adapt to navigate the complex dynamics of the US-China trade surge.

- Risk mitigation strategies: Businesses need to develop robust risk mitigation strategies to account for potential trade disruptions and policy shifts. Supply chain diversification and alternative sourcing are crucial components.

- Opportunities for growth: While risks exist, opportunities remain for businesses that can successfully navigate the complexities of the US-China trade relationship and adapt to changing conditions. Strategic partnerships and innovative solutions are crucial.

- Importance of diversification: Diversifying supply chains and markets is paramount to mitigating risk and ensuring business continuity.

- Navigating trade policy uncertainty: Businesses need to stay informed about evolving trade policies and regulations to make informed decisions and adjust their strategies accordingly.

Conclusion

The current US-China trade surge presents a complex and dynamic environment with significant implications for businesses and global economies. The impending expiry of existing trade deals underscores the urgent need for businesses to strategically assess their exposure to this volatile relationship and develop robust contingency plans. Understanding the underlying factors driving this surge, the potential risks, and available opportunities will be crucial in navigating the coming months. Ignoring the potential consequences of inaction could be detrimental. Don't wait until it’s too late – proactively address the implications of the US-China trade surge and develop a strong strategy to mitigate risks and capitalize on opportunities before the trade deal expiry. Careful analysis of the US-China trade surge and proactive planning are vital for navigating this crucial period.

Featured Posts

-

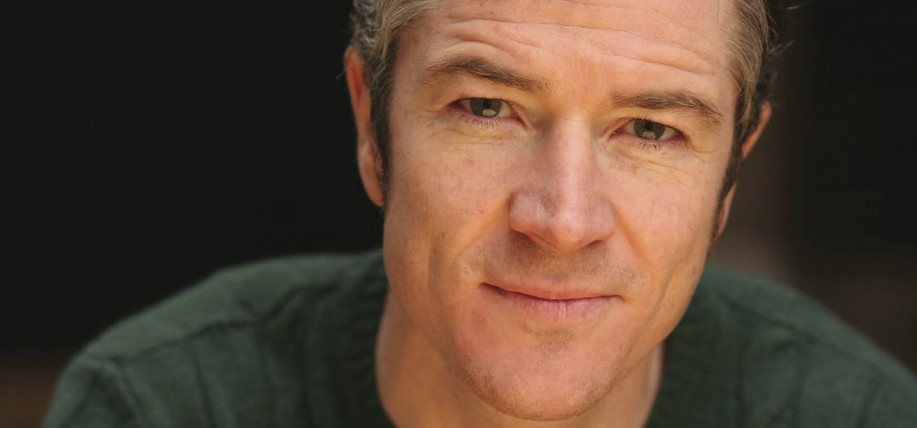

Barry Ward Interview The Irish Actor On Police Roles And Casting

May 22, 2025

Barry Ward Interview The Irish Actor On Police Roles And Casting

May 22, 2025 -

Tuerkiye Ve Italya Ya Ayni Goerev Nato Nun Yeni Plani

May 22, 2025

Tuerkiye Ve Italya Ya Ayni Goerev Nato Nun Yeni Plani

May 22, 2025 -

Chi Sprostit Vidmova Ukrayini U Chlenstvi Nato Plani Rosiyi Schodo Podalshoyi Agresiyi

May 22, 2025

Chi Sprostit Vidmova Ukrayini U Chlenstvi Nato Plani Rosiyi Schodo Podalshoyi Agresiyi

May 22, 2025 -

Fortnite Back On I Phones In The United States

May 22, 2025

Fortnite Back On I Phones In The United States

May 22, 2025 -

Le Travail Des Cordistes Face Au Developpement Vertical De Nantes

May 22, 2025

Le Travail Des Cordistes Face Au Developpement Vertical De Nantes

May 22, 2025

Latest Posts

-

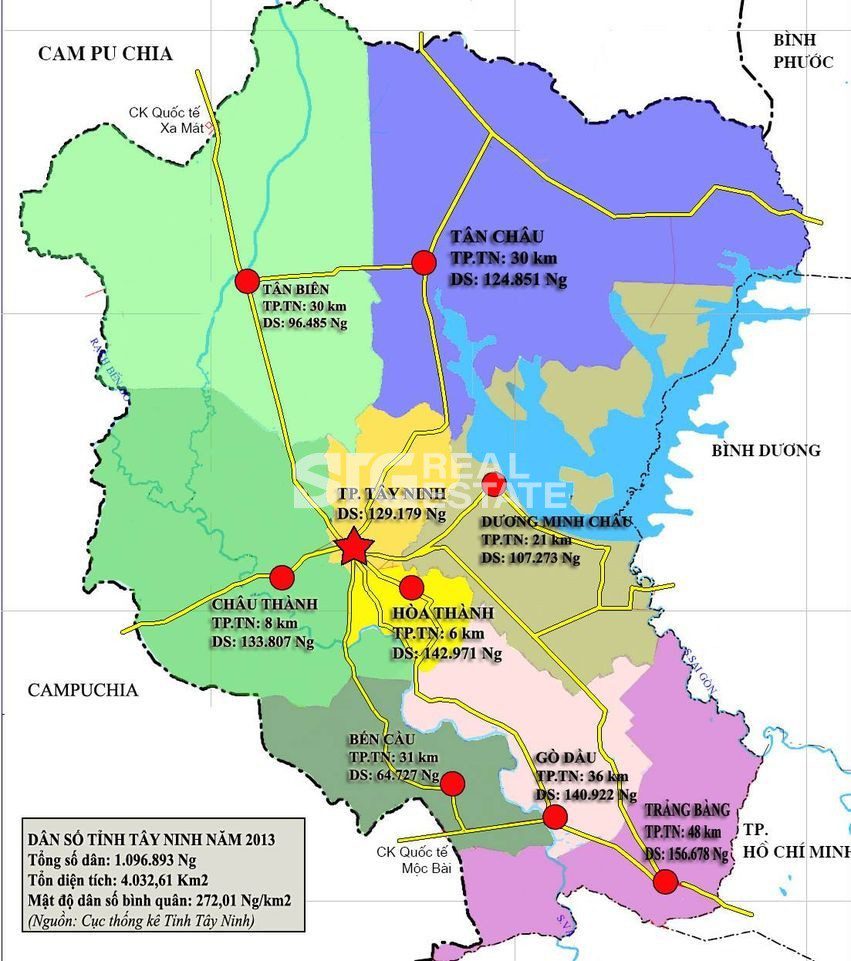

Cap Nhat Moi Nhat Ve Cau Va Duong Noi Binh Duong Tay Ninh

May 22, 2025

Cap Nhat Moi Nhat Ve Cau Va Duong Noi Binh Duong Tay Ninh

May 22, 2025 -

Tim Hieu Ve Cac Tuyen Duong Cau Noi Giua Binh Duong Va Tay Ninh

May 22, 2025

Tim Hieu Ve Cac Tuyen Duong Cau Noi Giua Binh Duong Va Tay Ninh

May 22, 2025 -

He Thong Giao Thong Lien Ket Binh Duong Tay Ninh Cau Va Duong

May 22, 2025

He Thong Giao Thong Lien Ket Binh Duong Tay Ninh Cau Va Duong

May 22, 2025 -

Cau Va Duong Cao Toc Binh Duong Tay Ninh Ban Do Va Huong Dan

May 22, 2025

Cau Va Duong Cao Toc Binh Duong Tay Ninh Ban Do Va Huong Dan

May 22, 2025 -

Cong Usb Va Hai Lo Vuong Bi An Muc Dich Va Cach Su Dung

May 22, 2025

Cong Usb Va Hai Lo Vuong Bi An Muc Dich Va Cach Su Dung

May 22, 2025