US-China Trade War: 80% Tariff Threat Shakes Stock Market

Table of Contents

The 80% Tariff Threat: A Closer Look

The proposed 80% tariff increase represents a dramatic escalation in the US-China trade war. While the specifics may fluctuate, the potential impact on various sectors is substantial. This steep increase targets a wide range of goods, significantly impacting import costs for businesses and ultimately consumers.

- Specific product categories affected: The proposed tariffs could affect numerous sectors, including consumer electronics (smartphones, laptops, etc.), agricultural products (soybeans, fruits, etc.), and manufactured goods. The exact list is subject to change, but the potential scope is vast.

- Potential impact on businesses importing these goods: Businesses reliant on imports from China face sharply increased costs, potentially squeezing profit margins and forcing price hikes for consumers. This could lead to reduced competitiveness and, in some cases, business closures.

- Analysis of the timing and potential motivations behind the announcement: The timing and reasoning behind such a drastic measure are complex and often debated. Analysts cite various factors, including ongoing trade negotiations, geopolitical strategies, and domestic political considerations. Understanding these underlying motivations is crucial for interpreting the long-term implications.

Keywords: 80% tariff, US-China trade war impact, import tariffs, affected goods, tariff increase

Impact on the Stock Market: Immediate and Long-Term Effects

The immediate market reaction to the 80% tariff threat was swift and negative. Stock market indices globally experienced significant drops, reflecting investor concerns about the economic consequences. The long-term effects, however, are potentially far-reaching and complex.

- Performance of major stock market indices (Dow Jones, S&P 500, Nasdaq) post-announcement: The announcement resulted in immediate volatility, with significant drops recorded across major indices. The extent of the impact varied across sectors.

- Impact on specific sectors (e.g., technology, retail, agriculture): Technology companies heavily reliant on Chinese manufacturing faced considerable pressure. Retail sectors braced for increased import costs, potentially leading to price increases for consumers. The agricultural sector, already impacted by previous tariffs, would likely face further significant challenges.

- Expert opinions on the long-term economic outlook: Economic experts largely agree that prolonged trade tensions could lead to reduced consumer spending, decreased global economic growth, and increased inflation. Supply chain disruptions are also a major concern.

Keywords: Stock market volatility, trade war impact on stocks, market indices, inflation, consumer spending, supply chain, economic outlook

Geopolitical Implications: Beyond Economic Concerns

The escalating US-China trade war extends far beyond simple economic considerations. The conflict has profound geopolitical implications, impacting international relations and global trade alliances.

- Impact on international trade agreements: The trade war raises questions about the stability and future of existing international trade agreements, potentially undermining the rules-based global trading system.

- Potential for increased protectionist policies globally: The conflict could embolden protectionist policies in other countries, leading to a more fragmented and less efficient global economy.

- Shift in global supply chains and manufacturing hubs: Companies may seek to diversify their supply chains, potentially shifting manufacturing away from China to other regions, reshaping global economic landscapes.

Keywords: Geopolitical risks, US-China relations, global trade, protectionism, retaliatory tariffs, international trade agreements

Strategies for Investors: Navigating Uncertainty

Navigating the turbulent market conditions created by the US-China trade war requires a cautious and adaptable approach. Investors should prioritize strategies that mitigate risk and capitalize on opportunities amidst the uncertainty.

- Diversification across asset classes: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) can reduce overall portfolio risk.

- Hedging strategies against market volatility: Investors may consider hedging strategies to protect against potential losses during periods of heightened market volatility.

- Seeking professional investment advice: Consulting with a qualified financial advisor can provide personalized guidance and strategies tailored to individual risk tolerance and investment goals.

Keywords: Investment strategies, risk management, portfolio diversification, market volatility, investment advice, financial advisor

Conclusion

The 80% tariff threat in the ongoing US-China trade war presents significant risks to the global economy and stock markets. The impact spans various sectors, triggering geopolitical consequences and creating considerable uncertainty for investors. Understanding these risks and adapting investment strategies is crucial for navigating this challenging economic climate.

Call to action: Stay informed about the evolving situation in the US-China trade war and its impact on the stock market. Continuously monitor market trends and consider consulting with a financial advisor to develop a robust investment strategy in this period of economic uncertainty. Proactive planning and informed decision-making are key to mitigating the risks associated with this escalating trade conflict. Keywords: US-China trade war, stock market outlook, investment strategy, financial advice, trade war impact.

Featured Posts

-

Royal Insider Alleges Prince Andrews Involvement With Underage Girl In Leaked Footage

May 11, 2025

Royal Insider Alleges Prince Andrews Involvement With Underage Girl In Leaked Footage

May 11, 2025 -

Will Thomas Mueller Leave Bayern Munich Fan And Expert Reactions

May 11, 2025

Will Thomas Mueller Leave Bayern Munich Fan And Expert Reactions

May 11, 2025 -

Perus Emergency Mining Ban 200 Million Hit To Gold Output

May 11, 2025

Perus Emergency Mining Ban 200 Million Hit To Gold Output

May 11, 2025 -

Aaron Judge And Babe Ruth A Yankees Record Breaking Comparison

May 11, 2025

Aaron Judge And Babe Ruth A Yankees Record Breaking Comparison

May 11, 2025 -

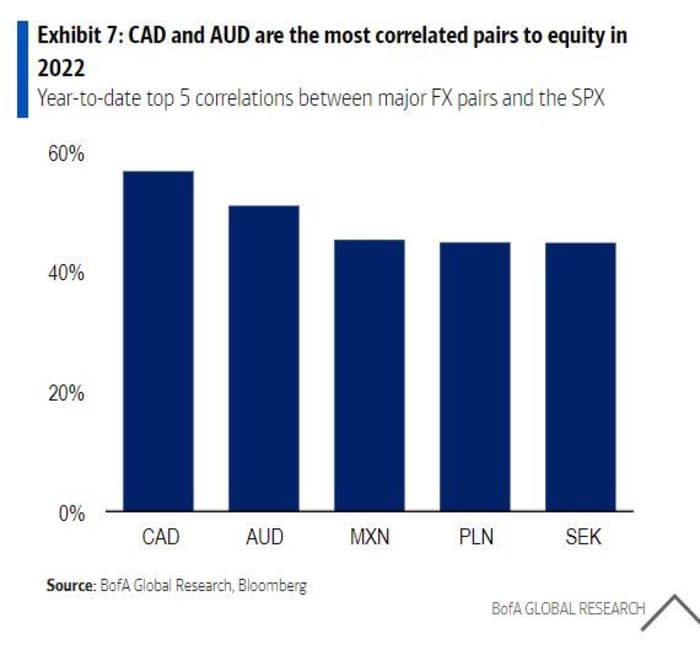

Are High Stock Market Valuations A Concern Bof A Says No Heres Why

May 11, 2025

Are High Stock Market Valuations A Concern Bof A Says No Heres Why

May 11, 2025