US-China Trade War: How Tariffs Freeze Tech IPOs

Table of Contents

Direct Impact of Tariffs on Tech IPOs

Increased Costs and Reduced Profitability

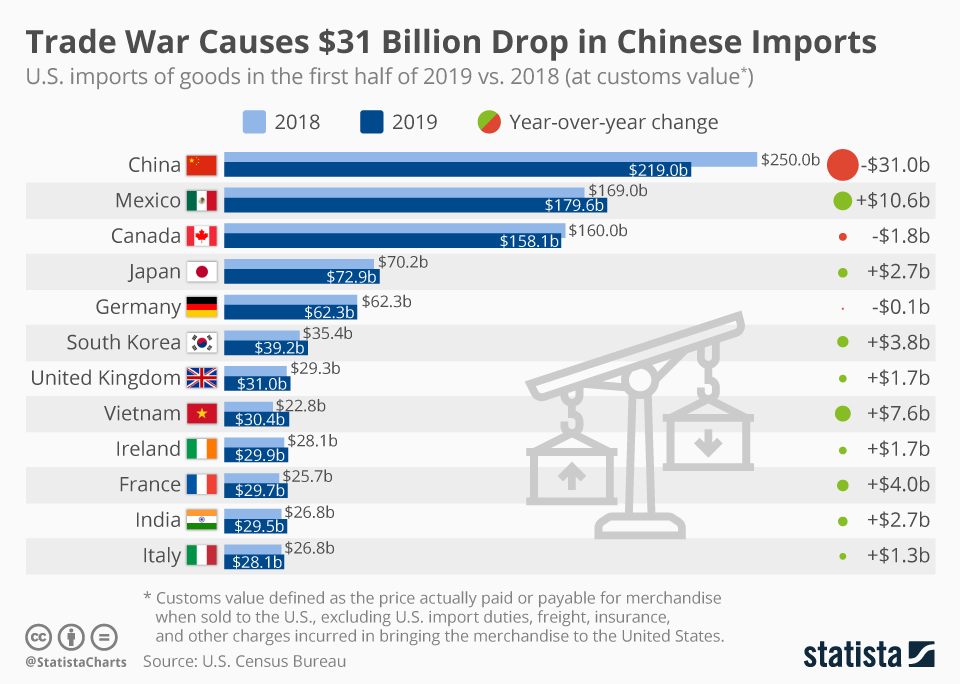

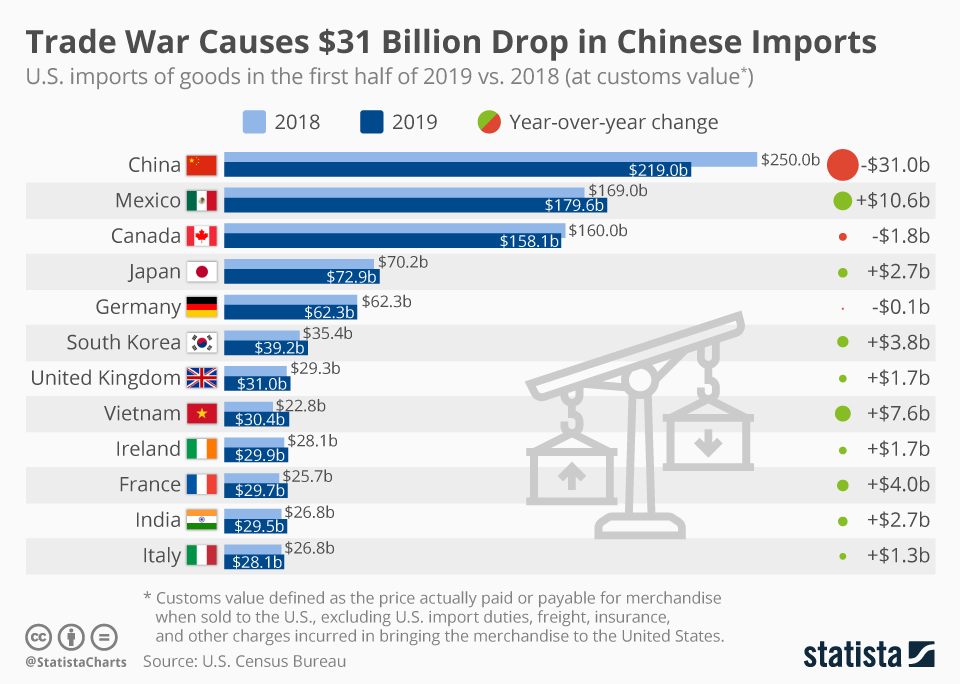

Tariffs directly increase the cost of goods, especially for tech companies with intricate global supply chains heavily reliant on Chinese manufacturing and components. This increase in manufacturing costs, coupled with higher import duties, significantly reduces profit margins. These reduced margins make companies less attractive to investors, leading to lower IPO valuations and potentially hindering the viability of the IPO itself.

- Increased manufacturing costs: Tariffs directly add to the price of raw materials and components sourced from China.

- Higher import duties: Increased tariffs on finished goods or intermediate products raise the cost of bringing products to market.

- Supply chain disruptions: The trade war has disrupted established supply chains, leading to delays, shortages, and increased logistical costs.

- Reduced profit margins: Higher costs translate directly into lower profitability, making a company less appealing to potential investors.

- Decreased investor confidence: Reduced profitability and uncertainty surrounding future costs damage investor confidence in the company's long-term prospects.

Uncertainty and Volatility in the Market

The unpredictable nature of the US-China trade war creates a climate of profound uncertainty. This makes it exceedingly difficult for tech companies to accurately forecast future revenue and profitability, a critical element for attracting investors during an IPO. Market volatility, a direct consequence of trade tensions, deters investors from committing to IPOs; many prefer to wait for greater clarity and stability before investing their capital.

- Investor hesitancy: Uncertainty about future tariffs and trade policies makes investors hesitant to commit to long-term investments.

- Unpredictable market conditions: The fluctuating nature of tariffs makes it hard to predict future earnings and assess risk accurately.

- Postponement of IPOs: Many tech companies have delayed or postponed their IPOs due to the unpredictable market environment.

- Decreased investment capital: The uncertainty discourages investment, leading to a reduction in the overall pool of capital available for IPOs.

Indirect Impact of Tariffs on Tech IPOs

Geopolitical Risks and Investor Sentiment

Beyond the direct impact on costs and profitability, the US-China trade war introduces broader geopolitical risks that negatively affect investor sentiment towards technology companies. Concerns about escalating trade tensions and potential retaliatory measures create a more risk-averse investment climate. Investors often seek safer havens during times of geopolitical uncertainty, diverting capital away from potentially affected sectors.

- Negative investor sentiment: The trade war fuels negative sentiment, making investors more cautious about tech investments.

- Reduced risk appetite: Investors are less likely to take risks during times of geopolitical instability, impacting IPO valuations.

- Flight to safety: Investors often shift their investments towards safer assets, such as government bonds, during periods of uncertainty.

- Impact on global market confidence: The trade war's uncertainty affects global market confidence, creating a ripple effect across various sectors.

Difficulty in Securing Funding and Investment

The uncertainty surrounding tariffs makes it considerably harder for tech companies to secure the funding necessary for growth and expansion, a key prerequisite for a successful IPO. Venture capitalists and private equity firms may become hesitant to invest in companies facing tariff-related challenges, opting for less risky alternatives. This scarcity of capital can significantly delay or even prevent an IPO.

- Decreased access to capital: The uncertainty makes it harder to attract investors and secure loans.

- Higher cost of borrowing: Increased risk premiums may lead to higher interest rates for loans and financing.

- Reduced venture capital investment: Venture capitalists may be less inclined to invest in companies exposed to tariff risks.

- Difficulty in securing loans: Banks may be more reluctant to extend loans to companies operating in uncertain market conditions.

Case Studies of Frozen Tech IPOs

While specific examples require referencing constantly changing market conditions, several notable tech companies have either delayed or significantly altered their IPO plans in direct response to the uncertainties created by the US-China trade war. Research into specific instances throughout the period of heightened trade tensions will yield numerous examples of companies impacted. A search for news articles focused on “[Specific company name] IPO delay trade war” will help to uncover these instances and substantiate this point.

Conclusion

The US-China trade war's impact on tech IPOs is undeniable. Tariffs have created a climate of uncertainty, directly impacting profitability and indirectly influencing investor sentiment and access to funding. The increased costs, market volatility, and geopolitical risks associated with the trade war have collectively frozen many promising tech IPOs, highlighting the significant economic consequences of these trade disputes. The future of tech IPOs remains inextricably linked to the resolution of trade tensions between the US and China.

Call to Action: Understanding the impact of the US-China trade war on tech IPOs is crucial for investors and tech companies alike. Stay informed about trade developments and their effects on the market to make informed decisions regarding investment and IPO strategies. Further research into the evolving landscape of the US-China trade war and its implications on the tech sector is strongly recommended.

Featured Posts

-

Spanish Broadcaster Calls For Debate On Israels Eurovision Entry

May 14, 2025

Spanish Broadcaster Calls For Debate On Israels Eurovision Entry

May 14, 2025 -

Jose Mujica 1935 2024 Recordando Al Presidente Que Cambio Uruguay

May 14, 2025

Jose Mujica 1935 2024 Recordando Al Presidente Que Cambio Uruguay

May 14, 2025 -

When Will Captain America Brave New World Be On Disney Release Date Speculation

May 14, 2025

When Will Captain America Brave New World Be On Disney Release Date Speculation

May 14, 2025 -

Awoniyi Out Forest Strikers Injury And Surgery Confirmed

May 14, 2025

Awoniyi Out Forest Strikers Injury And Surgery Confirmed

May 14, 2025 -

Scotty Mc Creerys Sons Adorable George Strait Tribute Watch Now

May 14, 2025

Scotty Mc Creerys Sons Adorable George Strait Tribute Watch Now

May 14, 2025