US Credit Downgrade: Live Updates On Dow Futures And Dollar

Table of Contents

Impact on Dow Futures

The US credit rating downgrade has a direct and demonstrable correlation with the movement of Dow futures. A downgrade signals increased risk in the US economy, prompting investors to reassess their portfolios. This often leads to a sell-off, driving Dow futures downwards.

At the time of writing, [Insert Current Dow Futures Price and Percentage Change Here]. This significant drop reflects investor concerns about the economic implications of the downgrade. Several factors contribute to this movement:

- Investor Sentiment: The downgrade has undoubtedly dampened investor confidence, leading to increased risk aversion and a preference for safer assets.

- Increased Uncertainty: The uncertainty surrounding the economic fallout from the downgrade contributes to market volatility and further price declines.

Key observations:

- Current Dow Futures Price: [Insert live data here]

- Percentage Change Since Downgrade: [Insert live data here]

- Short-Term Impact Prediction: [Insert analysis and prediction here]

- Long-Term Impact Prediction: [Insert analysis and prediction here]

- Most Affected Sectors: The banking and technology sectors are particularly vulnerable to the impacts of a credit downgrade, given their sensitivity to interest rate changes and investor confidence.

Dollar's Response to the Downgrade

The US dollar's response to the credit rating downgrade is complex. While a downgrade might be expected to weaken the dollar, its status as a safe-haven currency can lead to increased demand during times of uncertainty.

Currently, the US Dollar Index (DXY) is at [Insert Live DXY Value and Percentage Change Here]. This movement reflects the interplay between various factors:

- Safe-Haven Status: Despite the downgrade, the dollar may initially strengthen as investors seek safety in US assets.

- Investor Confidence: A decline in investor confidence can weaken the dollar as capital flows to perceived safer assets in other countries.

Key observations:

- Current US Dollar Index Value: [Insert live data here]

- Percentage Change Compared to Before Downgrade: [Insert live data here]

- Impact on Foreign Exchange Markets: The dollar's movement influences global exchange rates, affecting international trade and investment.

- Flight to Safety: The degree to which investors seek safety in the dollar will significantly impact its overall performance.

Global Market Reactions

The impact of the US credit rating downgrade extends far beyond US borders. Global markets are interconnected, and a major event in one country invariably affects others.

We are observing reactions across major international indices:

- FTSE 100: [Insert data and brief analysis]

- DAX: [Insert data and brief analysis]

- Nikkei 225: [Insert data and brief analysis]

Key observations:

- Key International Indices and Their Performance: [Summarize the performance of major indices worldwide]

- Impact on Emerging Markets: Emerging markets are particularly vulnerable to shifts in global investor sentiment.

- Analysis of Investor Behavior Globally: Risk aversion is likely to increase across global markets.

Economic Implications of the Downgrade

The long-term economic consequences of a US credit rating downgrade are potentially severe. Higher borrowing costs, reduced investor confidence, and slower economic growth are all possible outcomes.

- Increased Borrowing Costs: A downgrade may lead to higher interest rates, making it more expensive for the US government and businesses to borrow money.

- Reduced Investment: Uncertainty and reduced confidence may discourage both consumer spending and business investment.

Key observations:

- Potential Increase in Borrowing Costs: This will impact government spending, corporate investment, and consumer loans.

- Effects on Consumer Spending and Business Investment: Reduced confidence can lead to lower demand and slower economic activity.

- Long-Term Implications for Economic Stability: The downgrade poses significant risks to long-term economic stability and growth.

Conclusion: Understanding the US Credit Downgrade: Key Takeaways and Next Steps

The US credit downgrade has triggered significant volatility in Dow futures and the US dollar, with ripple effects felt across global markets. The immediate impact shows a decline in Dow futures, and the dollar's response is a complex interplay between its safe-haven status and investor confidence. The long-term economic consequences remain uncertain but pose significant risks to economic stability and growth. Staying informed about these developments is crucial.

Stay updated on the latest developments regarding the US credit downgrade and its impact on Dow futures and the dollar by checking back regularly for live updates. Bookmark this page and check frequently for the latest information on US credit ratings, Dow futures, and the dollar's performance.

Featured Posts

-

High Profile Office 365 Data Breach Results In Millions In Losses For Executives

May 21, 2025

High Profile Office 365 Data Breach Results In Millions In Losses For Executives

May 21, 2025 -

Screen Free Week Realistic Strategies For Success

May 21, 2025

Screen Free Week Realistic Strategies For Success

May 21, 2025 -

D Wave Quantum Inc Qbts Stock Plunge In 2025 Reasons And Analysis

May 21, 2025

D Wave Quantum Inc Qbts Stock Plunge In 2025 Reasons And Analysis

May 21, 2025 -

Eu Trade Macrons Plea For A Shift Away From Us Products

May 21, 2025

Eu Trade Macrons Plea For A Shift Away From Us Products

May 21, 2025 -

Prica S Reddita Postaje Film S Sydney Sweeney

May 21, 2025

Prica S Reddita Postaje Film S Sydney Sweeney

May 21, 2025

Latest Posts

-

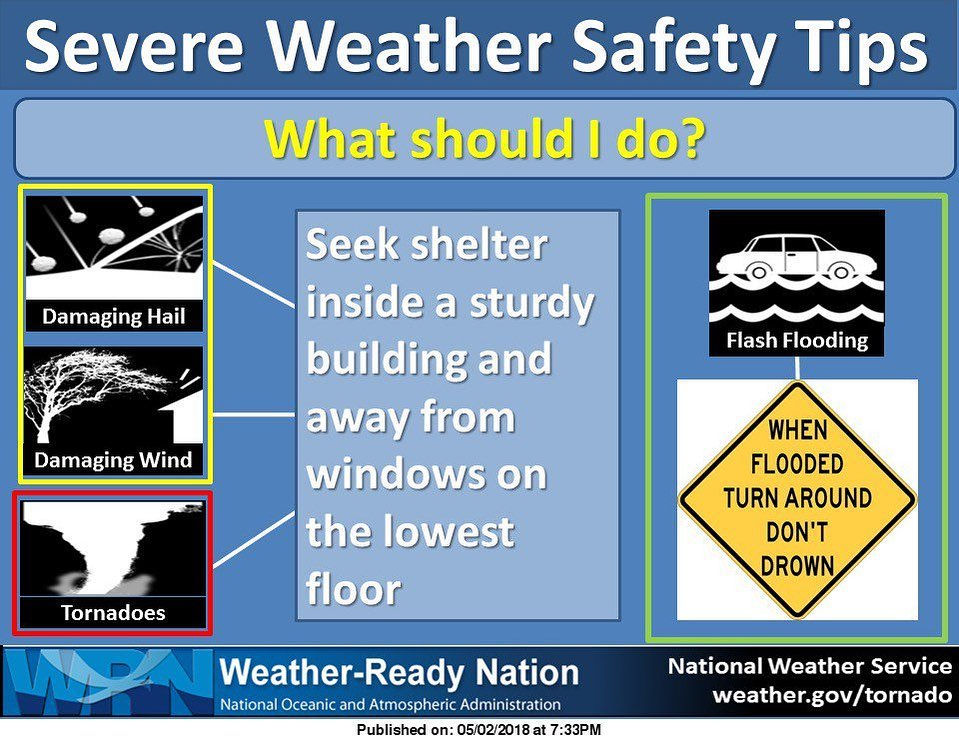

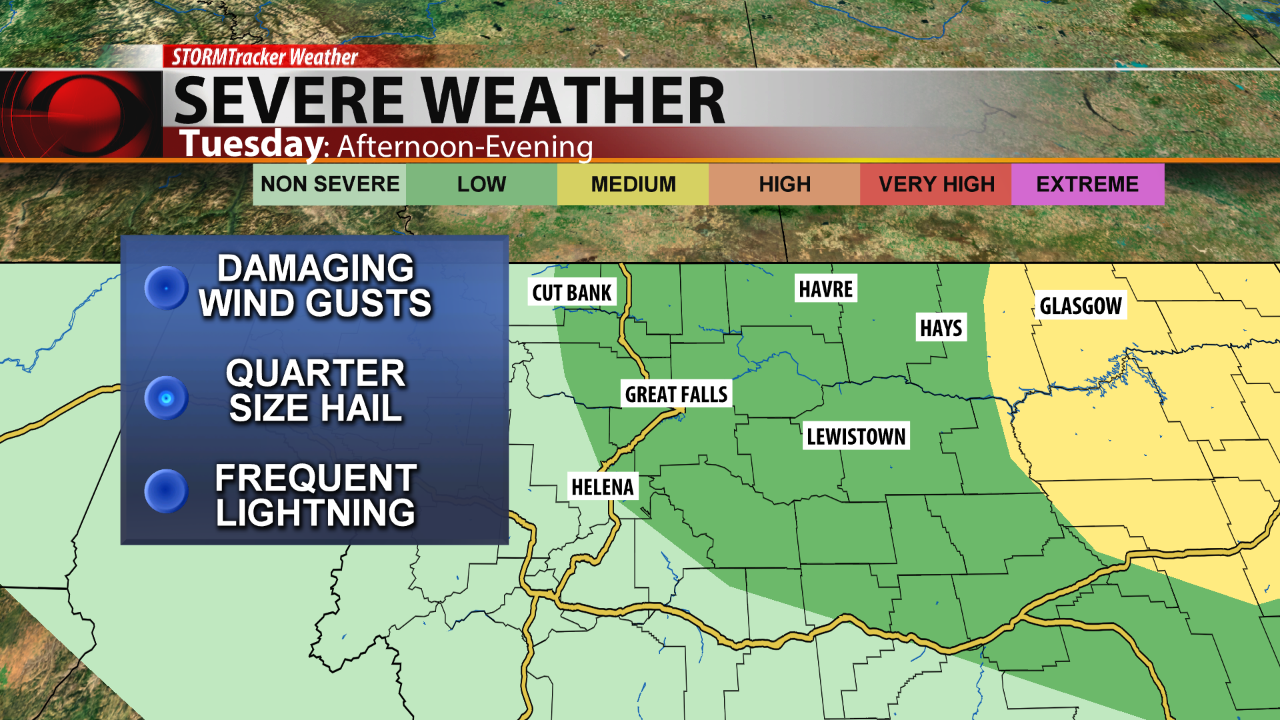

Increased Storm Chance Overnight Severe Weather Alert For Monday

May 21, 2025

Increased Storm Chance Overnight Severe Weather Alert For Monday

May 21, 2025 -

Enjoy Mild Temperatures And A Low Chance Of Rain This Week

May 21, 2025

Enjoy Mild Temperatures And A Low Chance Of Rain This Week

May 21, 2025 -

How To Dress For Breezy And Mild Conditions A Practical Guide

May 21, 2025

How To Dress For Breezy And Mild Conditions A Practical Guide

May 21, 2025 -

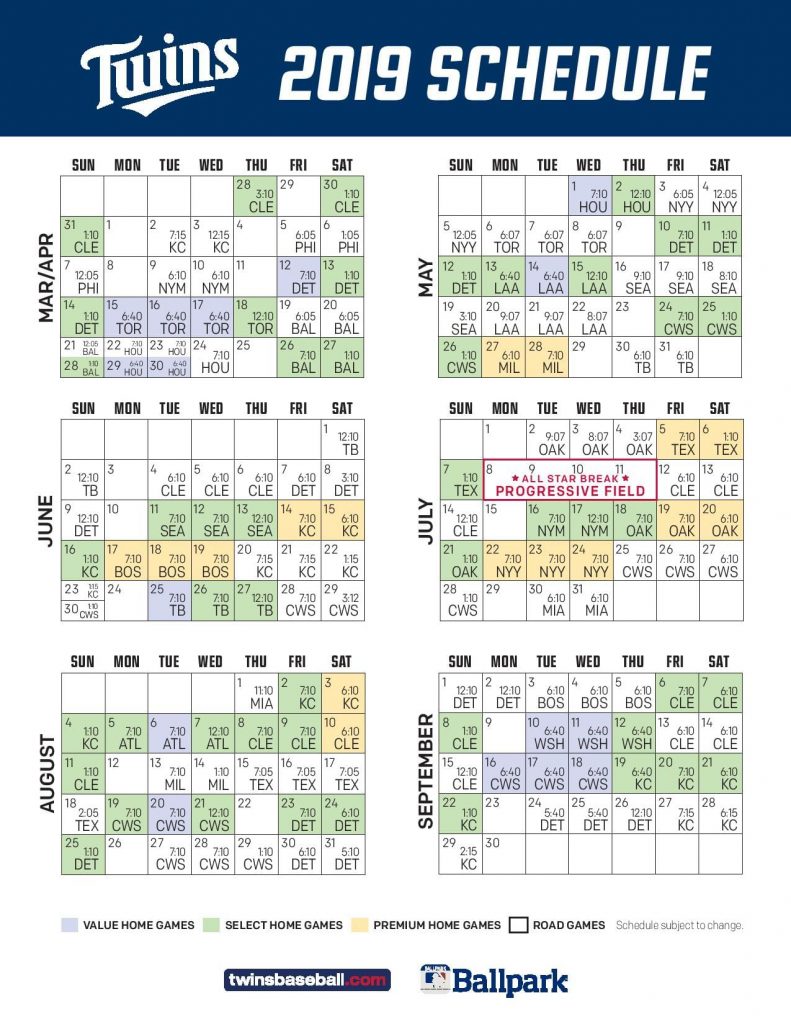

Minnesota Twins Baseball 10 Games On Kcrg Tv 9

May 21, 2025

Minnesota Twins Baseball 10 Games On Kcrg Tv 9

May 21, 2025 -

Severe Weather Possible Monday Overnight Storm Chances

May 21, 2025

Severe Weather Possible Monday Overnight Storm Chances

May 21, 2025