US Downgrade: Dow Futures And Dollar React Negatively - Live Updates

Table of Contents

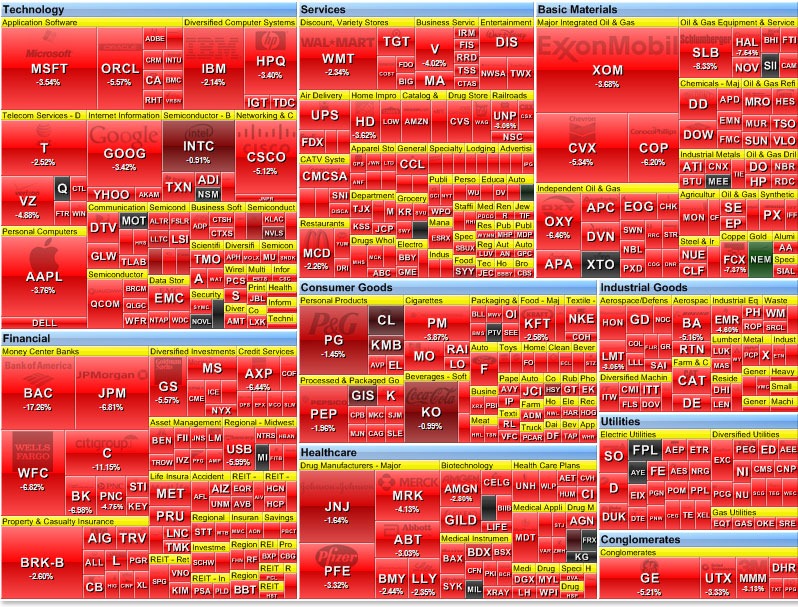

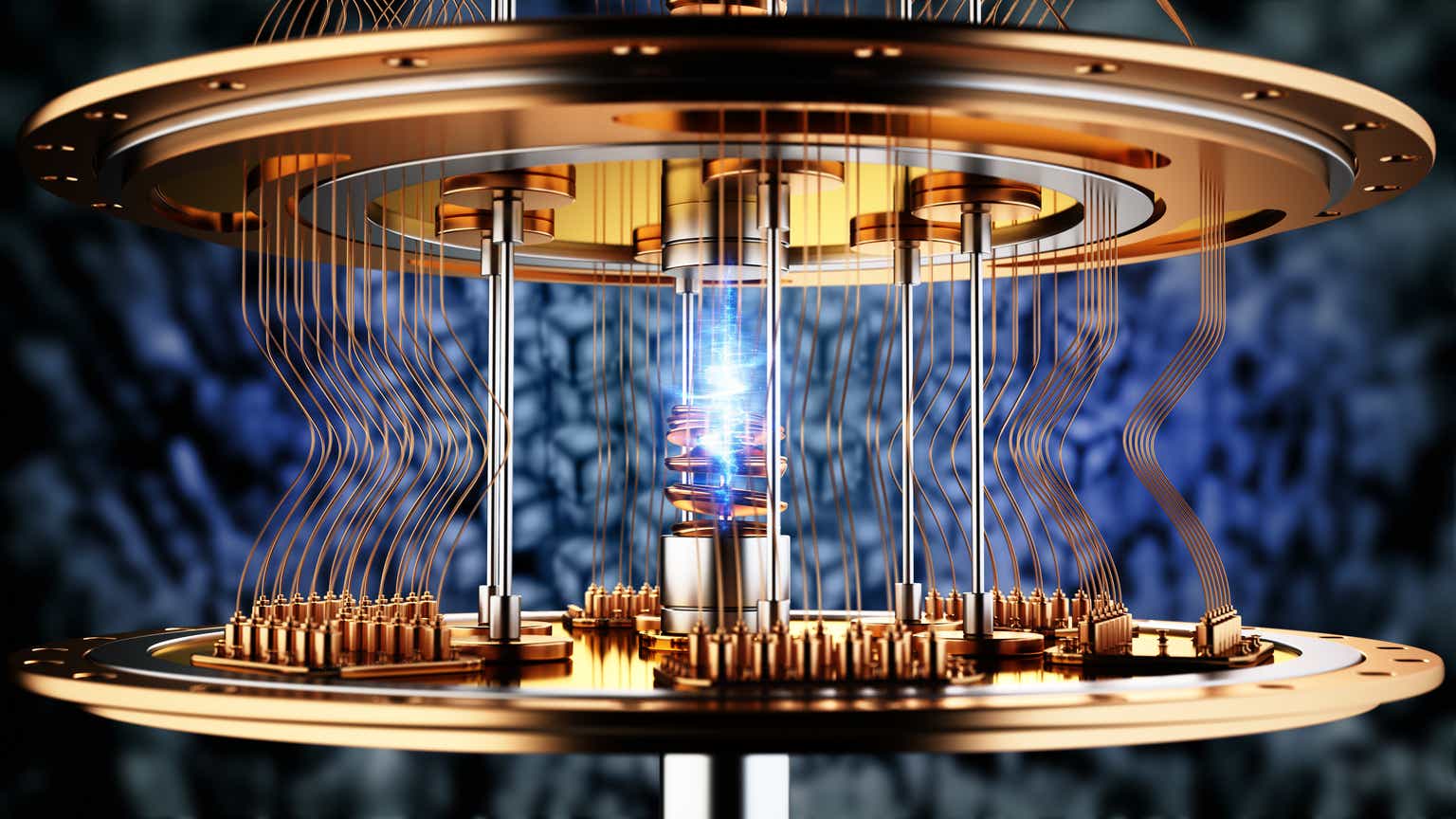

Immediate Market Reactions to the US Downgrade

The announcement of the US credit rating downgrade sparked a flurry of immediate market reactions, reflecting investor anxieties and uncertainty.

Dow Futures Plunge

Following the downgrade announcement, Dow Jones Industrial Average futures experienced a sharp and significant decline. Preliminary data indicates a drop of [Insert Specific Percentage and Point Drop Here], representing a substantial fall compared to recent trading days.

- Specific point drop in Dow Jones Industrial Average futures: [Insert precise number] points.

- Comparison to previous market volatility events: This drop is comparable to [mention comparable events, e.g., market reactions to other major economic news].

- Expert commentary on the severity of the drop: Analysts are citing [mention expert quotes or opinions on the significance of the Dow Futures drop and its implications]. Many believe this is a significant indicator of the market's reaction to the diminished creditworthiness of the US.

US Dollar Weakness

The US dollar weakened significantly against other major currencies following the downgrade announcement, signaling a loss of confidence in the US economy.

- Specific percentage changes against major currencies (e.g., EUR/USD, USD/JPY): The EUR/USD rose by [insert percentage], while the USD/JPY fell by [insert percentage]. [Add other relevant currency pairs and their changes].

- Analysis of safe-haven asset demand: We saw increased demand for safe-haven assets like gold and the Japanese Yen, reflecting investor anxieties.

- Impact on international trade and exchange rates: This weakening of the dollar could impact US exports (making them cheaper) and imports (making them more expensive), potentially influencing inflation and the trade balance. Further, fluctuations in exchange rates create uncertainty for multinational corporations.

Treasury Yields and Bond Market Response

The downgrade also triggered changes in US Treasury yields. Generally, a downgrade leads to increased yields as investors demand higher returns for holding riskier assets.

- Changes in 10-year and 30-year Treasury yields: The yield on 10-year Treasury notes [increased/decreased] by [insert percentage], and the 30-year Treasury bond yield [increased/decreased] by [insert percentage].

- Analysis of investor flight to safety: While some investors fled to safety, others might see opportunities in the increased yields of US Treasuries, potentially offsetting some of the initial negative impact.

- Impact on borrowing costs for the US government: Higher yields translate to increased borrowing costs for the US government, potentially exacerbating the fiscal challenges that led to the downgrade.

Factors Contributing to the US Downgrade

The US credit rating downgrade wasn't a sudden event; it reflects a confluence of long-term economic and political factors.

Mounting National Debt

The escalating US national debt played a significant role in the rating agency's decision.

- Current level of US national debt: The US national debt currently stands at [Insert Current National Debt Figure].

- Projected future debt trajectory: Projections indicate [mention projections and their implications].

- Comparison to debt levels of other major economies: Compared to other major economies, the US debt-to-GDP ratio is [higher/lower/comparable], highlighting the relative scale of the challenge.

Political Gridlock and Fiscal Irresponsibility

Persistent political gridlock and a lack of a cohesive long-term fiscal plan contributed significantly to the downgrade.

- Examples of political gridlock hindering fiscal responsibility: [Cite specific examples of political battles hindering fiscal solutions].

- Analysis of the impact on investor confidence: The inability to address fiscal issues eroded investor confidence in the US government's ability to manage its finances.

- Potential solutions to address fiscal issues: [Suggest potential solutions, such as bipartisan cooperation on budget cuts, tax reform, or economic growth initiatives].

Rating Agency Rationale

The rating agency [Insert Rating Agency Name] cited several key factors in their rationale for the downgrade.

- Key factors cited by the rating agency in their decision: [Summarize the key reasons given by the rating agency].

- Comparison to previous rating actions: [Compare this downgrade to any previous rating actions on the US].

- Analysis of the credibility of the rating agency's assessment: [Discuss the credibility and potential biases involved in the rating agency's decision].

Potential Long-Term Implications of the US Downgrade

The US downgrade carries significant potential long-term consequences for the US and the global economy.

Increased Borrowing Costs

The downgrade is likely to lead to higher borrowing costs for the US government and businesses.

- Impact on interest rates for government bonds: Higher interest rates will increase the cost of servicing the national debt.

- Effect on corporate borrowing costs: Higher borrowing costs will impact businesses' investment plans and potentially hinder economic growth.

- Potential impact on economic growth: Increased borrowing costs can slow economic activity and reduce investment.

Inflationary Pressures

The downgrade could also contribute to inflationary pressures.

- Relationship between credit ratings, inflation and interest rates: A credit downgrade can increase inflation expectations, leading central banks to increase interest rates to combat inflation.

- Potential impact on consumer spending and prices: Higher interest rates can dampen consumer spending and contribute to higher prices.

- Government response strategies to mitigate inflationary pressures: [Discuss potential government strategies to manage inflation].

Geopolitical Ramifications

The US downgrade has global implications.

- Impact on the US dollar's role as the world's reserve currency: The downgrade could weaken the dollar's status as the world's primary reserve currency.

- Potential for increased global economic uncertainty: The downgrade increases global economic uncertainty, potentially impacting international trade and investment flows.

- Effects on international relations and alliances: The downgrade could affect the US's standing in international relations and potentially strain alliances.

Conclusion

The US downgrade represents a significant event with potentially far-reaching consequences for the US economy and global markets. The immediate negative reactions in Dow futures and the US dollar underscore the gravity of the situation. Understanding the factors contributing to the downgrade and its potential long-term implications is crucial for investors and policymakers alike. Stay informed about further developments and continue to monitor the impact of this US Downgrade on markets worldwide. Regularly check back for live updates on the evolving situation and to learn more about the ramifications of this significant US credit rating downgrade.

Featured Posts

-

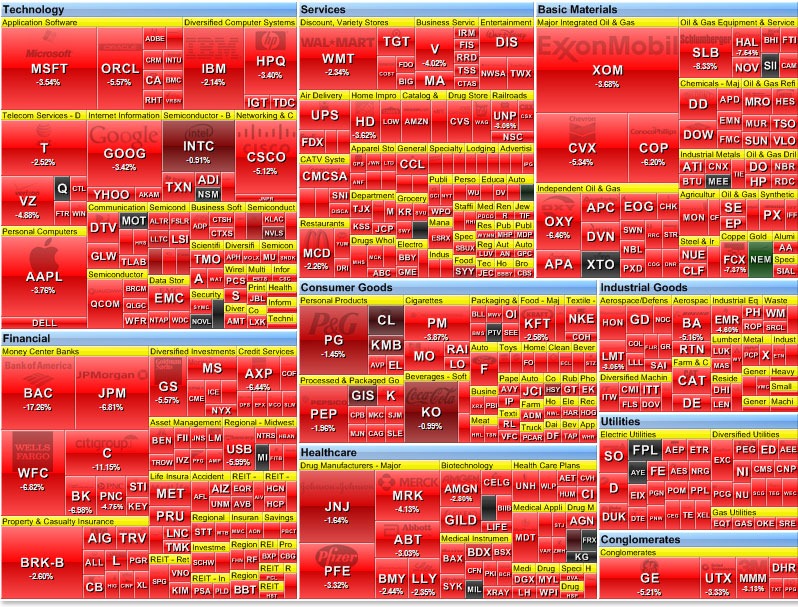

The Hollywood Strike Understanding The Actors And Writers Demands

May 20, 2025

The Hollywood Strike Understanding The Actors And Writers Demands

May 20, 2025 -

Unveiling Agatha Christies Family Secrets A Dispute Revealed In Private Letters

May 20, 2025

Unveiling Agatha Christies Family Secrets A Dispute Revealed In Private Letters

May 20, 2025 -

The Countrys Emerging Business Hubs A Geographic Analysis

May 20, 2025

The Countrys Emerging Business Hubs A Geographic Analysis

May 20, 2025 -

Nj Transit Averts Strike Engineers Union Reaches Tentative Agreement

May 20, 2025

Nj Transit Averts Strike Engineers Union Reaches Tentative Agreement

May 20, 2025 -

Matheus Cunha To Man United Journalist Shares Worrying Transfer Update

May 20, 2025

Matheus Cunha To Man United Journalist Shares Worrying Transfer Update

May 20, 2025

Latest Posts

-

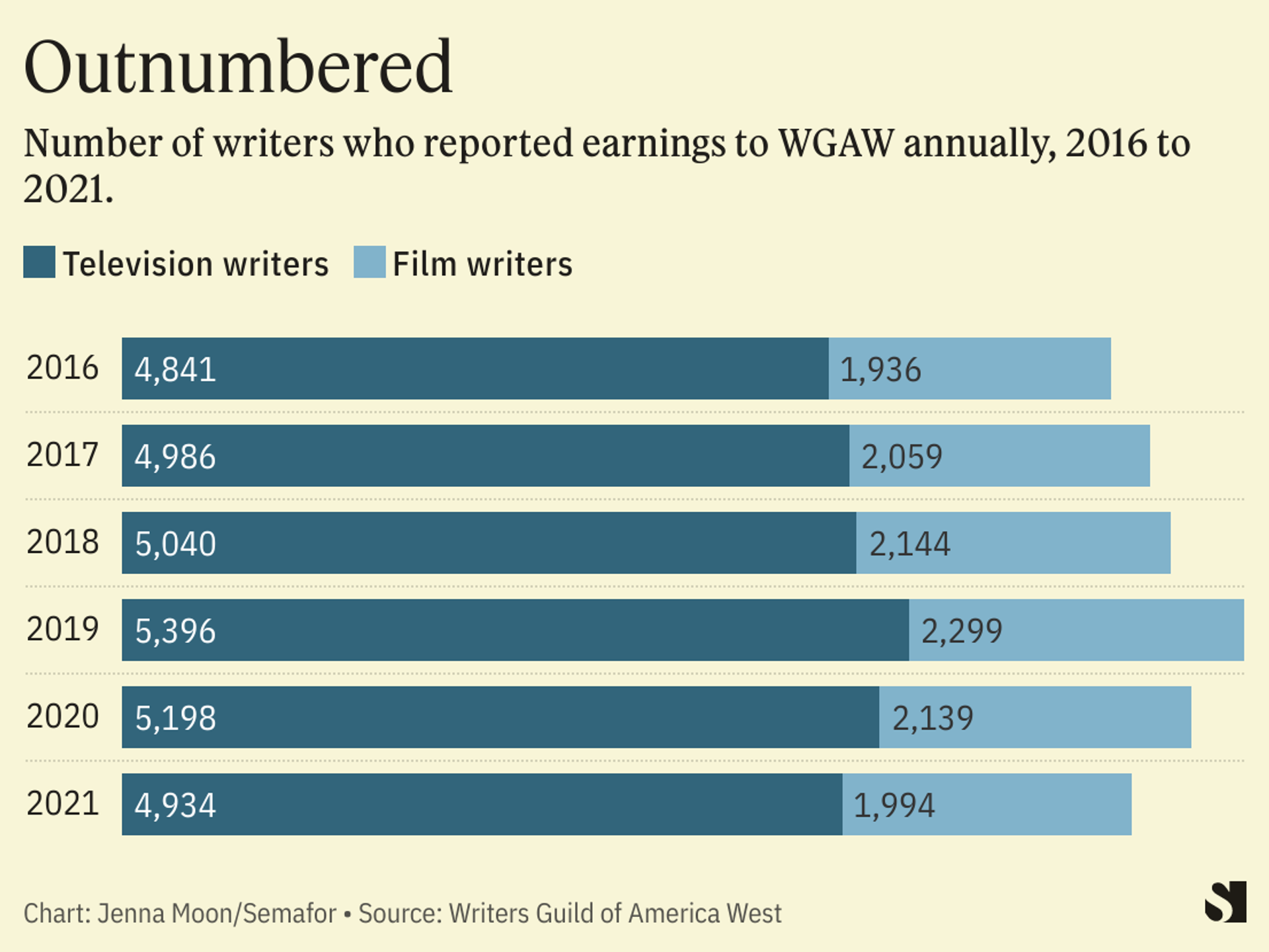

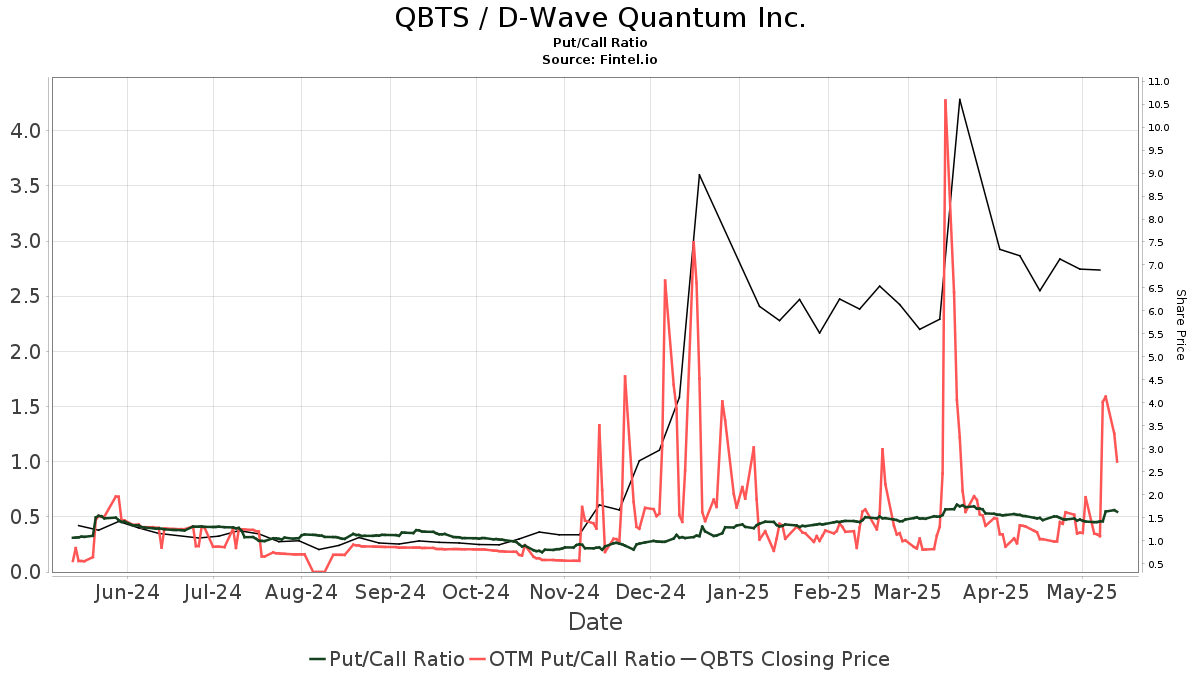

D Wave Quantum Qbts Stock Performance Impact Of Kerrisdale Capitals Report

May 20, 2025

D Wave Quantum Qbts Stock Performance Impact Of Kerrisdale Capitals Report

May 20, 2025 -

D Wave Quantum Inc Qbts A Quantum Computing Stock Investment Analysis

May 20, 2025

D Wave Quantum Inc Qbts A Quantum Computing Stock Investment Analysis

May 20, 2025 -

D Wave Quantum Qbts Stock Price Jump Analysis Of Fridays Increase

May 20, 2025

D Wave Quantum Qbts Stock Price Jump Analysis Of Fridays Increase

May 20, 2025 -

D Wave Quantum Qbts Explaining The Significant Stock Price Increase This Week

May 20, 2025

D Wave Quantum Qbts Explaining The Significant Stock Price Increase This Week

May 20, 2025 -

D Wave Quantum Nyse Qbts Stock Dip Analyzing Kerrisdale Capitals Critique

May 20, 2025

D Wave Quantum Nyse Qbts Stock Dip Analyzing Kerrisdale Capitals Critique

May 20, 2025