US Fiscal Concerns Weigh On Stock Market, Leading To Sharp Decline

Table of Contents

The Debt Ceiling Debate and its Market Impact

The US debt ceiling is the legal limit on the amount of money the federal government can borrow to meet its existing obligations. Reaching this limit without raising it can lead to a government shutdown, impacting various sectors of the economy and creating significant market uncertainty. The ongoing debate surrounding the debt ceiling has created considerable unease among investors.

-

Potential government shutdown scenarios and their effect on market sentiment: A government shutdown would disrupt essential government services, impacting everything from national security to social programs. This uncertainty sends a chilling effect through the market, causing investors to react negatively.

-

Credit rating downgrades and their impact on borrowing costs: Failure to raise the debt ceiling could trigger a credit rating downgrade for the US government. This would increase borrowing costs for the government and potentially for businesses, dampening economic growth and negatively impacting stock valuations.

-

Uncertainty surrounding future government spending and its effect on investor confidence: The debt ceiling debate often highlights disagreements about future government spending levels. This uncertainty makes it difficult for businesses and investors to plan, further contributing to market volatility.

-

Examples of historical debt ceiling crises and their market consequences: Past debt ceiling crises have resulted in periods of increased market volatility and decreased investor confidence. Analyzing these past events provides valuable insight into the potential consequences of a similar scenario today. For instance, the 2011 debt ceiling crisis led to a significant stock market decline and a downgrade in the US credit rating.

The political implications of the debt ceiling debate are complex, with potential compromises and negotiations shaping the ultimate outcome. Market reactions during previous debt ceiling debates demonstrate the significant sensitivity of the stock market to this issue. Data from these periods clearly shows a correlation between heightened political uncertainty and market downturns.

Rising Government Spending and Inflationary Pressures

Increased government spending, especially when the economy is already operating near full capacity, can fuel inflationary pressures. This is because increased demand for goods and services can outpace supply, leading to rising prices.

-

Impact of increased inflation on corporate profits and stock valuations: High inflation erodes corporate profit margins as businesses struggle to absorb rising input costs without passing them on to consumers. This can lead to lower stock valuations.

-

Federal Reserve response to inflation and its effect on interest rates: To combat inflation, the Federal Reserve often raises interest rates. Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting stock prices.

-

Analysis of current inflation rates and their potential future trajectory: Analyzing current inflation rates and economic indicators helps investors assess the potential for future inflationary pressures and their impact on the market.

-

The effect of inflation on consumer spending and overall economic growth: High inflation can reduce consumer purchasing power, impacting consumer spending and overall economic growth. This decrease in consumer confidence can have a ripple effect throughout the economy and stock market.

Specific government spending programs, such as infrastructure initiatives or social welfare programs, can significantly contribute to inflationary pressures depending on the scale and timing of their implementation. Economists and financial analysts constantly assess the impact of these programs on the overall economic landscape. Analyzing relevant economic data, such as the Consumer Price Index (CPI) and Producer Price Index (PPI), is crucial in understanding the inflation outlook.

Economic Uncertainty and Investor Sentiment

Economic uncertainty, fueled by factors like the debt ceiling debate and rising inflation, significantly impacts investor behavior and market performance.

-

Increased volatility and its effect on risk-averse investors: Uncertainty leads to increased market volatility, making risk-averse investors more cautious and potentially prompting them to sell assets.

-

Shift in investor sentiment from bullish to bearish: Positive investor sentiment can quickly turn negative in response to economic uncertainty, leading to a market sell-off.

-

Impact on different market sectors (e.g., technology, energy): Different market sectors react differently to economic uncertainty. For example, cyclical sectors like technology might be more susceptible to downturns than defensive sectors like consumer staples.

-

Flight to safety and increased demand for safe-haven assets (e.g., gold, bonds): During periods of uncertainty, investors often seek safety by investing in safe-haven assets like gold and government bonds.

Strategies for Navigating Market Volatility

Navigating market volatility requires a proactive approach and sound investment strategies.

-

Importance of a well-diversified portfolio: Diversifying your investments across different asset classes and sectors helps mitigate risk.

-

Strategies for mitigating risk during market downturns: Employing strategies like dollar-cost averaging or having a portion of your portfolio in less volatile assets can help mitigate losses during market downturns.

-

Potential investment opportunities amidst the uncertainty: While risk is elevated, there are often opportunities for savvy investors to find undervalued assets. Thorough research and a long-term perspective are crucial.

-

Seeking professional financial advice: Consider seeking guidance from a qualified financial advisor to create a personalized investment strategy based on your risk tolerance and financial goals.

Conclusion

The sharp decline in the US stock market is largely attributed to the confluence of several critical factors: the ongoing debt ceiling debate, rising government spending contributing to inflationary pressures, and the resulting economic uncertainty. These factors have significantly impacted investor sentiment and heightened market volatility. Understanding the interplay between these US fiscal concerns and their impact on the market is key to navigating the current climate.

Staying informed about US fiscal concerns is crucial for navigating the current market volatility. Understanding the interplay between government policy, economic indicators, and market reactions will help investors make informed decisions and potentially mitigate losses. Continue to monitor developments related to US fiscal concerns and adjust your investment strategies accordingly. Learn more about effective investment strategies during times of economic uncertainty to protect your portfolio and position yourself for future opportunities.

Featured Posts

-

Swiss Village Faces Landslide Threat Livestock Evacuated By Hoof And Helicopter

May 23, 2025

Swiss Village Faces Landslide Threat Livestock Evacuated By Hoof And Helicopter

May 23, 2025 -

Emergency Airlift Saving Cows In A Remote Swiss Village

May 23, 2025

Emergency Airlift Saving Cows In A Remote Swiss Village

May 23, 2025 -

Royal Albert Hall To Host Grand Ole Oprys First Ever International Show

May 23, 2025

Royal Albert Hall To Host Grand Ole Oprys First Ever International Show

May 23, 2025 -

Big Rig Rock Report 3 12 Big 100 Analysis Of Top 100 Trucking Companies

May 23, 2025

Big Rig Rock Report 3 12 Big 100 Analysis Of Top 100 Trucking Companies

May 23, 2025 -

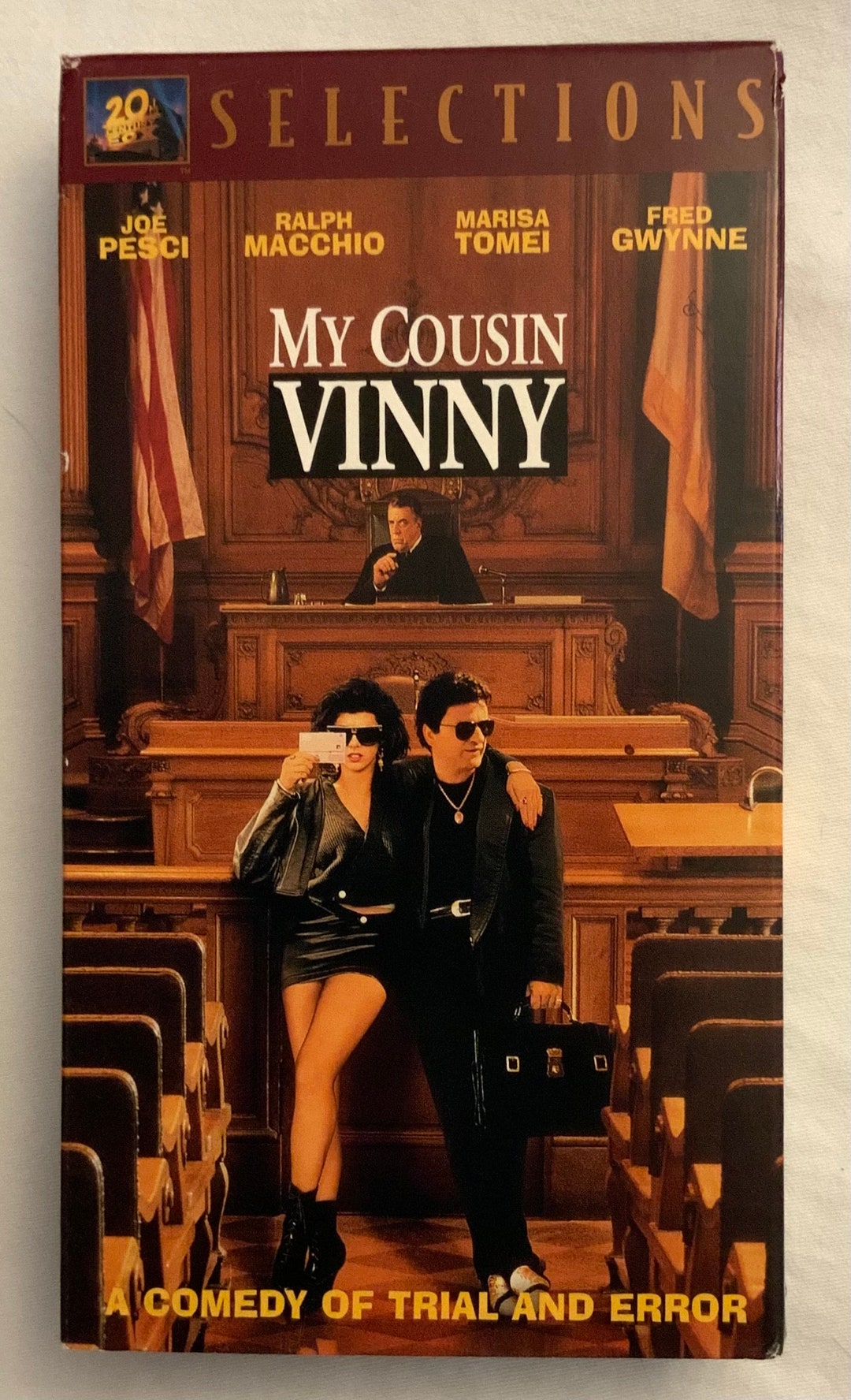

My Cousin Vinny Reboot Update From Ralph Macchio Joe Pescis Possible Return

May 23, 2025

My Cousin Vinny Reboot Update From Ralph Macchio Joe Pescis Possible Return

May 23, 2025

Latest Posts

-

Kartels Restrictions A Police Source Explains The Safety Measures

May 23, 2025

Kartels Restrictions A Police Source Explains The Safety Measures

May 23, 2025 -

Vybz Kartel Announces Nyc Barclay Center Show This April

May 23, 2025

Vybz Kartel Announces Nyc Barclay Center Show This April

May 23, 2025 -

Vybz Kartels Barclay Center Concert Nyc April 2024

May 23, 2025

Vybz Kartels Barclay Center Concert Nyc April 2024

May 23, 2025 -

Trinidad Govt Restrictions Vybz Kartels Response

May 23, 2025

Trinidad Govt Restrictions Vybz Kartels Response

May 23, 2025 -

T And T Government Restricts Vybz Kartels Freedom Of Movement

May 23, 2025

T And T Government Restricts Vybz Kartels Freedom Of Movement

May 23, 2025