US Penny Circulation To End: Preparing For A Penniless Future

Table of Contents

The Economic Case for Eliminating the Penny

The argument for ending US penny circulation rests firmly on economic grounds. The sheer cost of producing these coins outweighs their value, making them an inefficient use of resources.

The High Cost of Production

Minting pennies is a surprisingly expensive undertaking. The cost of materials alone—a blend of copper and zinc—combined with manufacturing, and the transportation costs involved, far surpasses the penny's one-cent value.

- Materials: The fluctuating prices of copper and zinc significantly impact production costs.

- Manufacturing: The complex minting process requires specialized equipment and labor.

- Transportation: Shipping millions of pennies across the country adds to the overall expense.

According to the United States Mint, the cost to produce a penny often exceeds its face value by a significant margin. This inefficiency represents a considerable drain on taxpayer money.

Inefficiency in Transactions

Beyond production costs, pennies create significant inefficiencies in daily transactions. Their low value means businesses and individuals spend considerable time and resources handling them.

- Time Spent Counting: Employees waste valuable time counting and sorting pennies, impacting productivity.

- Increased Labor Costs: The extra effort involved in penny handling translates to higher labor costs for businesses.

- Storage Costs: Storing and securing large quantities of pennies requires additional space and security measures, adding to business expenses.

The Impact on Consumers

The elimination of the penny will undoubtedly impact consumers, primarily through changes in pricing and payment methods.

Rounding Up or Down

The most significant change consumers will likely experience is the rounding of prices to the nearest nickel. This could mean prices are rounded up or down, depending on the cent amount.

- Examples: A $1.97 purchase might round down to $1.95, while a $2.02 purchase could round up to $2.05.

- Potential Price Increases: While some transactions might result in savings, there's a potential for a slight overall increase in prices due to consistent rounding up.

Adjusting to a Cashless Society

The end of US penny circulation could accelerate the ongoing shift toward a cashless society. Many believe that the inconvenience of handling coins, particularly pennies, will further encourage the adoption of digital payment methods.

- Benefits of Cashless Transactions: Cashless payments are often faster, more convenient, and more secure.

- Increased Use of Digital Wallets: The prevalence of credit cards, debit cards, mobile payment apps (like Apple Pay and Google Pay), and digital wallets will likely increase.

Preparing for a Penniless Future

While the transition away from the penny will require adjustments, proactive planning can ease the process.

Managing Your Finances

Preparing for a world without pennies involves adapting financial habits and embracing digital solutions.

- Digital Payments: Prioritize the use of credit cards, debit cards, and mobile payment apps for daily transactions.

- Rounding Up Savings: Consider rounding up your savings to the nearest nickel to compensate for potential rounding discrepancies.

- Cash Transaction Strategies: Familiarize yourself with how retailers will handle cash transactions in the absence of pennies – rounding policies will vary.

The Future of Currency

The elimination of the penny raises questions about the future of US currency. It could spark innovation and lead to changes in other areas of our monetary system.

- Coin Redesign: The US Mint may consider redesigning other coins to improve efficiency and reduce production costs.

- Technological Advancements: Continued advancements in payment technology will likely further reduce the reliance on physical currency.

Conclusion

The impending end of US penny circulation presents both challenges and opportunities. The economic benefits of eliminating the penny—reducing production costs and streamlining transactions—are undeniable. While consumers will need to adjust to price rounding and potentially increased reliance on digital payments, preparing for this change is crucial. Prepare for the end of US penny circulation by adopting cashless payment methods, adjusting your spending habits, and staying informed about the ongoing debate regarding US coin circulation. Get ready for a cashless future and embrace the changes to US coin circulation.

Featured Posts

-

The Big Rig Rock Report 3 12 X101 5 Explained

May 23, 2025

The Big Rig Rock Report 3 12 X101 5 Explained

May 23, 2025 -

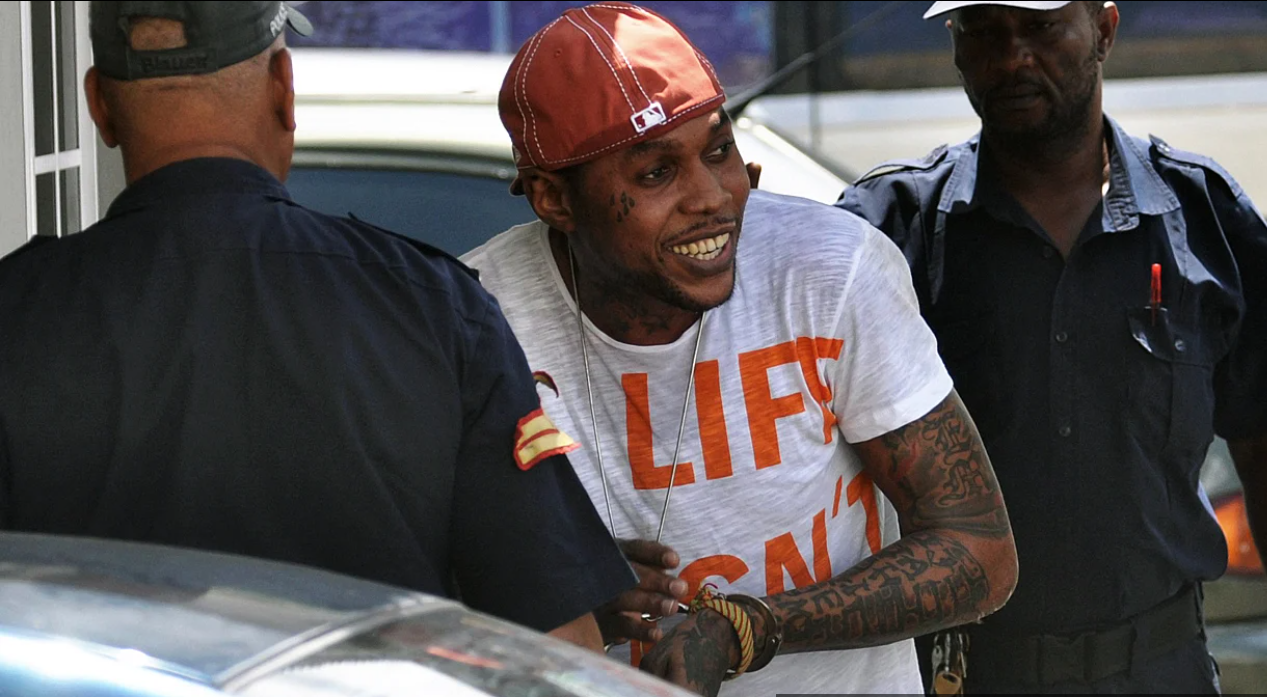

Vybz Kartel Breaks Silence Prison Family And Upcoming Music

May 23, 2025

Vybz Kartel Breaks Silence Prison Family And Upcoming Music

May 23, 2025 -

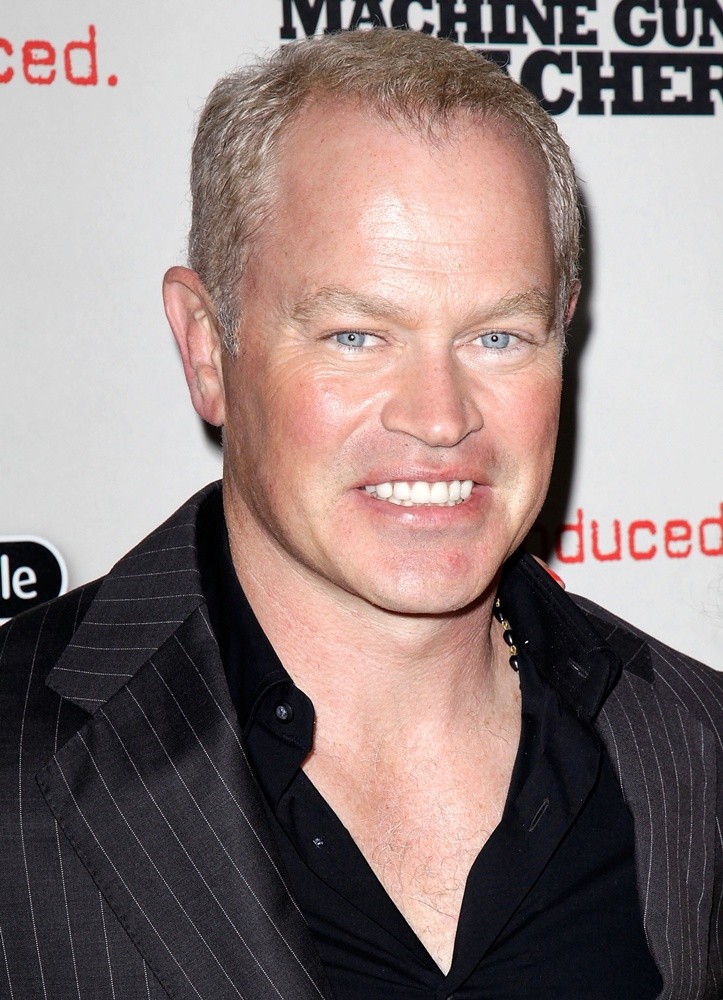

Neal Mc Donough A Commanding Presence In The Last Rodeo

May 23, 2025

Neal Mc Donough A Commanding Presence In The Last Rodeo

May 23, 2025 -

Kazakhstan Stuns Australia In Billie Jean King Cup Qualifying Tie

May 23, 2025

Kazakhstan Stuns Australia In Billie Jean King Cup Qualifying Tie

May 23, 2025 -

Netflix Serial Nou Cu O Distributie Ce Concura Pentru Oscar

May 23, 2025

Netflix Serial Nou Cu O Distributie Ce Concura Pentru Oscar

May 23, 2025

Latest Posts

-

Jonathan Groff And Just In Time A Tony Awards Prediction

May 23, 2025

Jonathan Groff And Just In Time A Tony Awards Prediction

May 23, 2025 -

Jonathan Groff Could Just In Time Make Tony Awards History

May 23, 2025

Jonathan Groff Could Just In Time Make Tony Awards History

May 23, 2025 -

Jonathan Groffs Just In Time Performance A Tony Awards Prediction

May 23, 2025

Jonathan Groffs Just In Time Performance A Tony Awards Prediction

May 23, 2025 -

Jonathan Groffs Potential Tony Awards History With Just In Time

May 23, 2025

Jonathan Groffs Potential Tony Awards History With Just In Time

May 23, 2025 -

Could Jonathan Groff Win A Tony For Just In Time Analyzing His Chances

May 23, 2025

Could Jonathan Groff Win A Tony For Just In Time Analyzing His Chances

May 23, 2025