Vodacom (VOD) Reports Better-Than-Expected Earnings And Payout

Table of Contents

Strong Revenue Growth Fuels Vodacom's (VOD) Earnings Beat

Vodacom's (VOD) earnings beat was primarily fueled by robust revenue growth across various service sectors. The company's strategic focus and effective execution have resulted in significant gains.

Breakdown of Revenue Sources

Several key areas contributed significantly to the impressive revenue increase in Vodacom's (VOD) earnings report.

- Mobile Data: This segment experienced a remarkable 15% year-on-year growth, driven by increasing data consumption and the expansion of 4G and 5G networks.

- Financial Services: Vodacom's (VOD) mobile money platform saw a substantial 20% surge in revenue, reflecting the growing adoption of mobile financial services in key markets.

- Enterprise Business: This sector showcased a healthy 10% growth, reflecting the success of Vodacom Business's strategic partnerships and innovative solutions for corporate clients.

Significant contributions were also observed in South Africa, along with strong growth in its international operations, specifically in Tanzania and the Democratic Republic of Congo. These regional successes significantly boosted overall Vodacom (VOD) earnings.

Market Share Gains and Competitive Advantage

Vodacom's (VOD) market share gains are a testament to its strategic approach. The company’s aggressive investment in network infrastructure, coupled with targeted marketing campaigns focused on superior customer service and innovative data packages, has solidified its competitive edge. This contrasts with competitors struggling to match the speed and reliability of Vodacom's network. Vodacom's (VOD) performance significantly outpaces competitors like MTN in several key market segments.

Increased Dividend Payout Reflects Vodacom's (VOD) Financial Strength

The improved Vodacom (VOD) earnings directly translated into a higher dividend payout, demonstrating the company's financial strength and commitment to rewarding shareholders.

Dividend Details and Impact on Shareholders

Vodacom (VOD) announced a dividend increase of 12%, amounting to [Insert Actual Dividend Amount]. This represents a significant boost for shareholders and reflects confidence in the company's future prospects. The ex-dividend date is [Insert Date] and the record date is [Insert Date]. This positive development is likely to further enhance investor confidence and attract additional investment.

Financial Health and Future Outlook

Vodacom's (VOD) strong financial health is evident in its healthy profit margins, low debt levels, and positive future projections. Key financial ratios, including [Insert Relevant Financial Ratios, e.g., Return on Equity, Debt-to-Equity Ratio], showcase the company's financial stability. While potential challenges such as regulatory changes and economic fluctuations exist, Vodacom’s (VOD) robust financial position positions it well to navigate these uncertainties.

Key Factors Contributing to Vodacom's (VOD) Success

Vodacom's (VOD) success is attributed to a combination of strategic initiatives and operational excellence.

Operational Efficiency and Cost Management

Vodacom (VOD) has consistently focused on improving operational efficiency and managing costs effectively. This includes streamlining internal processes, optimizing network infrastructure, and leveraging technological advancements to reduce operational expenditure. These efforts have directly contributed to improved profitability and stronger Vodacom (VOD) earnings.

Strategic Investments and Technological Advancements

Vodacom's (VOD) strategic investments in expanding its 4G and 5G networks, along with partnerships to offer innovative services like enhanced mobile financial solutions and IoT capabilities, have significantly impacted its growth trajectory. These investments have directly boosted Vodacom’s (VOD) earnings and market position.

Impact of Regulatory Changes

While regulatory changes can present challenges, Vodacom (VOD) has successfully navigated the evolving regulatory landscape, adapting its operations to comply with new regulations while still delivering strong financial results. The company has proactively engaged with regulators to ensure a positive and mutually beneficial relationship.

Conclusion: Vodacom (VOD) Earnings Signal Positive Future Growth

Vodacom's (VOD) better-than-expected earnings and increased dividend payout underscore the company's strong financial performance and promising future. The robust revenue growth across various sectors, coupled with strategic investments and operational efficiency, positions Vodacom (VOD) for sustained growth. The increased dividend payout is a testament to the company's commitment to shareholder value. This positive outlook strengthens investor confidence and suggests a bright future for Vodacom (VOD). Stay informed on Vodacom's (VOD) continued success by following our updates on their financial performance and future announcements. Learn more about investing in Vodacom (VOD) today!

Featured Posts

-

The Impact Of Hamilton On Leclercs Ferrari Future

May 20, 2025

The Impact Of Hamilton On Leclercs Ferrari Future

May 20, 2025 -

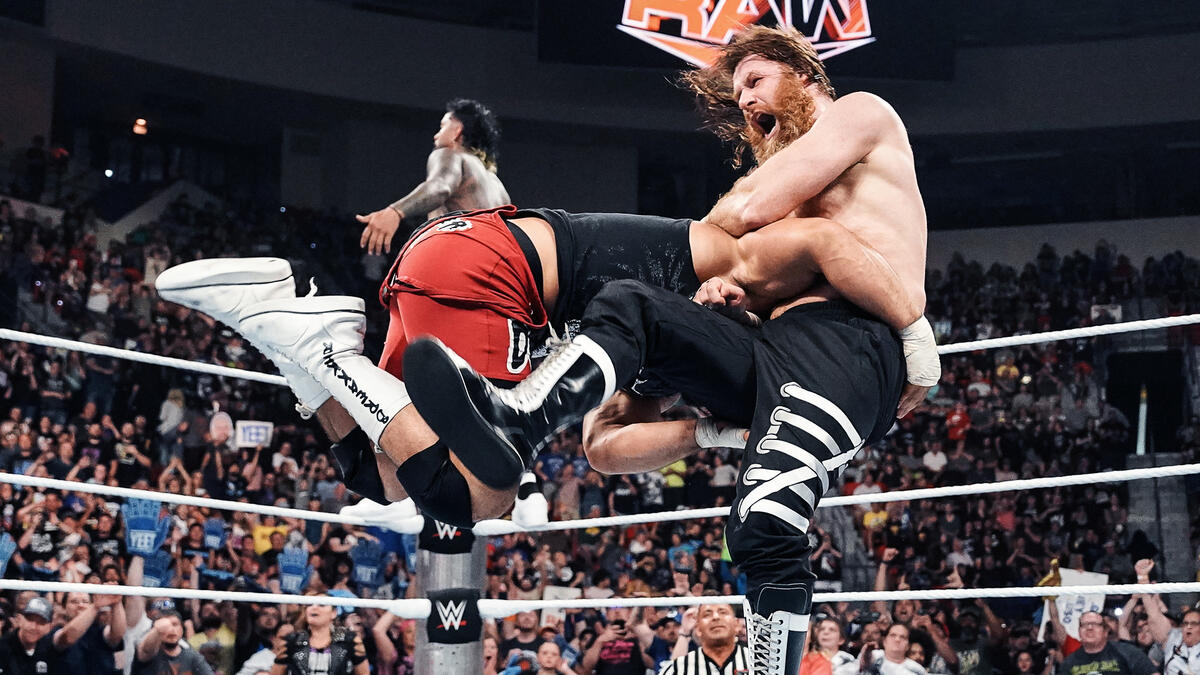

Wwe Raw Recap Rollins And Breakkers Assault On Sami Zayn

May 20, 2025

Wwe Raw Recap Rollins And Breakkers Assault On Sami Zayn

May 20, 2025 -

Viral Tik Tok Suki Waterhouses Unexpected Twinks Remark

May 20, 2025

Viral Tik Tok Suki Waterhouses Unexpected Twinks Remark

May 20, 2025 -

Hmrc Speeds Up Calls With Voice Recognition Technology

May 20, 2025

Hmrc Speeds Up Calls With Voice Recognition Technology

May 20, 2025 -

Drone Truck For Tomahawk Missiles A Usmc Army Collaboration

May 20, 2025

Drone Truck For Tomahawk Missiles A Usmc Army Collaboration

May 20, 2025

Latest Posts

-

No Es El Arandano Descubre El Superalimento Que Combate Enfermedades Cronicas

May 21, 2025

No Es El Arandano Descubre El Superalimento Que Combate Enfermedades Cronicas

May 21, 2025 -

Peppa Pigs Family Expands Gender Reveal And Public Reaction

May 21, 2025

Peppa Pigs Family Expands Gender Reveal And Public Reaction

May 21, 2025 -

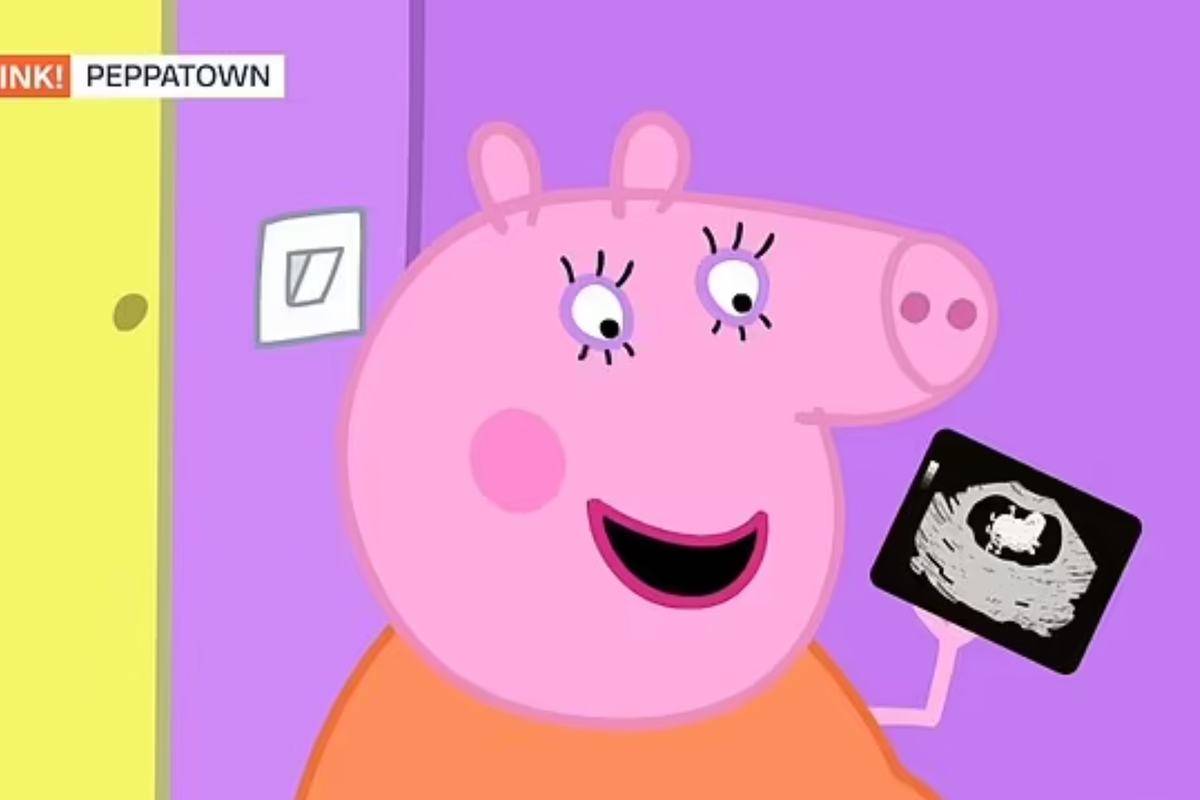

Peppa Pigs Mum Announces New Babys Sex Fans Share Their Thoughts

May 21, 2025

Peppa Pigs Mum Announces New Babys Sex Fans Share Their Thoughts

May 21, 2025 -

Meet Peppa Pigs New Baby Release Date And What To Expect

May 21, 2025

Meet Peppa Pigs New Baby Release Date And What To Expect

May 21, 2025 -

Peppa Pigs Mum Reveals Babys Gender The Internet Reacts

May 21, 2025

Peppa Pigs Mum Reveals Babys Gender The Internet Reacts

May 21, 2025