Vodacom (VOD) Reports Strong Payout, Improved Earnings

Table of Contents

Strong Earnings Growth Fueled by Increased Subscribers and Data Consumption

Vodacom's impressive earnings growth is primarily driven by a combination of increased subscribers and a surge in data consumption. This positive trend reflects the company's successful strategies in expanding its network coverage and catering to the growing demand for mobile data services across its operational areas.

-

Significant increase in the number of subscribers across various market segments: Vodacom reported a substantial increase in its subscriber base, exceeding expectations in both its prepaid and postpaid segments. This growth reflects the company’s successful marketing campaigns and targeted expansion into underserved areas. Specific figures from the report, detailing the percentage increase in subscribers, will be crucial in quantifying this success.

-

Substantial growth in data revenue driven by rising data consumption: Data revenue constitutes a significant portion of Vodacom’s overall revenue. The ongoing shift towards mobile data services, fuelled by increased smartphone penetration and the demand for high-speed internet access, has significantly boosted this revenue stream. The report should specify the percentage increase in data revenue.

-

Improved Average Revenue Per User (ARPU) indicating higher customer spending: The increase in ARPU indicates that not only are there more subscribers, but existing customers are also spending more on Vodacom's services. This reflects a successful strategy in upselling higher-value data plans and value-added services. Quantifying this ARPU growth is vital for assessing the financial health of the company.

-

Successful expansion of 5G network coverage leading to enhanced customer experience and higher data usage: Vodacom's ongoing investment in its 5G network infrastructure is a key driver of growth. The expansion of 5G coverage offers a superior user experience, driving higher data consumption and attracting new subscribers. Details on the geographical expansion of 5G coverage would further enhance this point.

-

Increased market share in key regions: Vodacom has been successful in expanding its market share across key regions within its operational footprint. This indicates the company's ability to compete effectively in a dynamic and competitive market. This success should be illustrated with specific data on market share gains.

Robust Dividend Payout Reflects Company Confidence and Investor Returns

The robust dividend payout announced by Vodacom reflects the company's confidence in its future performance and its commitment to rewarding its shareholders. This is a strong signal to investors, highlighting the company's financial stability and its potential for continued growth.

-

Higher dividend per share compared to the previous period: The increased dividend per share is a direct indicator of Vodacom’s improved financial health and profitability. The specific amount and the percentage increase compared to the previous period should be clearly stated.

-

Improved dividend yield attracting potential investors: A higher dividend yield makes Vodacom a more attractive investment proposition for income-seeking investors. Comparing the dividend yield to competitors within the telecommunications sector provides valuable context.

-

Demonstrates strong financial health and future growth prospects: The ability to increase the dividend payout suggests Vodacom possesses strong financial reserves and expects future growth to continue funding generous dividends.

-

Reinforces Vodacom's commitment to shareholder value: The dividend increase signals Vodacom’s dedication to maximizing returns for its shareholders, fostering investor confidence and long-term loyalty.

Future Outlook and Strategic Initiatives for Continued Growth

Vodacom's future growth will be driven by a combination of factors, including continued network expansion, technological advancements, and strategic initiatives to address competitive pressures and capitalize on emerging market trends.

-

Vodacom's plans for further network expansion and technological upgrades (e.g., 5G rollout, fiber optic infrastructure): Vodacom’s strategic investment in its infrastructure will support future growth. This includes continuing the 5G rollout and the expansion of fiber optic infrastructure, which provides the backbone for high-speed data services. The projected timeline and investment amounts should be discussed.

-

Strategies to address competitive pressures and maintain market leadership: The telecommunications industry is highly competitive. Vodacom's strategy for maintaining its market leadership should include proactive measures to address potential competition and retain its customer base.

-

Initiatives to capitalize on emerging trends in the telecommunications industry (e.g., IoT, cloud services): Vodacom is likely investing in and developing strategies to leverage emerging technologies such as IoT (Internet of Things) and cloud services to create new revenue streams and provide innovative services to its customers.

-

Projected growth forecasts and anticipated financial performance: The financial report should include Vodacom's projections for future growth, providing investors with an indication of the company’s anticipated financial performance.

Conclusion

Vodacom's (VOD) recent financial report reveals a compelling story of strong earnings growth, robust dividend payouts, and promising future prospects. The company's success is attributed to increased subscriber numbers, higher data consumption, and strategic investments in network infrastructure. The impressive dividend payout reflects confidence in future performance and underlines Vodacom's commitment to shareholder value. The combination of strong current performance and a promising future outlook positions Vodacom favorably for continued success in the African telecommunications market.

Call to Action: Stay informed about Vodacom's (VOD) progress and future performance by regularly reviewing their financial reports and engaging with financial news outlets. Understanding Vodacom's financial health can help inform your investment strategies and decisions regarding this leading telecommunications company. Learn more about Vodacom's investment opportunities and financial reports [link to Vodacom investor relations].

Featured Posts

-

Ftc Appeals Activision Blizzard Acquisition Implications For The Gaming Industry

May 21, 2025

Ftc Appeals Activision Blizzard Acquisition Implications For The Gaming Industry

May 21, 2025 -

Abn Amro Ziet Occasionverkopen Flink Toenemen Analyse Van De Automarkt

May 21, 2025

Abn Amro Ziet Occasionverkopen Flink Toenemen Analyse Van De Automarkt

May 21, 2025 -

Le Hellfest Debarque Au Noumatrouff De Mulhouse

May 21, 2025

Le Hellfest Debarque Au Noumatrouff De Mulhouse

May 21, 2025 -

Finding A New Home Americans Seeking European Citizenship After Trump

May 21, 2025

Finding A New Home Americans Seeking European Citizenship After Trump

May 21, 2025 -

Chinas Space Based Supercomputer A New Era Of Computation

May 21, 2025

Chinas Space Based Supercomputer A New Era Of Computation

May 21, 2025

Latest Posts

-

Exploring The Themes In Gangsta Granny

May 21, 2025

Exploring The Themes In Gangsta Granny

May 21, 2025 -

Gangsta Granny Character Analysis And Plot Summary

May 21, 2025

Gangsta Granny Character Analysis And Plot Summary

May 21, 2025 -

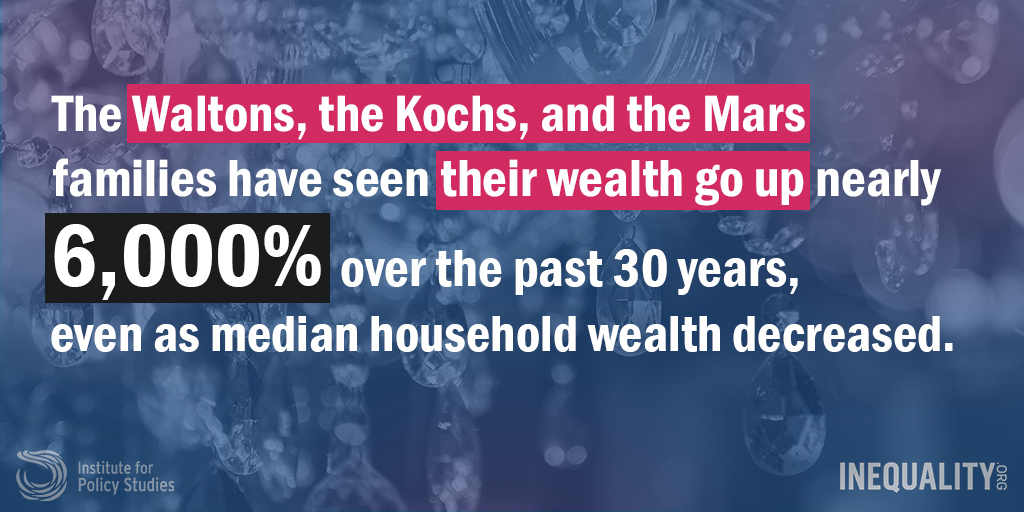

The Billionaire Boy Phenomenon A Sociological And Economic Analysis

May 21, 2025

The Billionaire Boy Phenomenon A Sociological And Economic Analysis

May 21, 2025 -

Billionaire Boy Challenges And Responsibilities Of Inherited Fortune

May 21, 2025

Billionaire Boy Challenges And Responsibilities Of Inherited Fortune

May 21, 2025 -

Understanding The Billionaire Boy Exploring The Dynamics Of Inherited Wealth

May 21, 2025

Understanding The Billionaire Boy Exploring The Dynamics Of Inherited Wealth

May 21, 2025