Voice Recognition Technology Improves HMRC Call Centre Efficiency

Table of Contents

Reduced Call Handling Times

Voice recognition technology significantly accelerates call processing, leading to dramatically reduced call handling times. By automatically identifying the caller's needs through natural language processing, the system can efficiently route calls to the appropriate agent or department. This intelligent routing, based on keywords and phrases used by the caller, eliminates the need for lengthy initial questioning and ensures calls are directed to the most knowledgeable resource immediately.

- Faster call routing based on keywords and phrases: The system instantly analyzes the caller's speech to determine their query, eliminating the need for manual routing by call centre agents.

- Automated data entry, reducing agent workload: Voice recognition software automatically captures key information from the caller, eliminating the need for agents to manually enter data. This frees up valuable time for agents to focus on resolving customer issues.

- Self-service options through voice commands, deflecting calls from agents: Many inquiries can be resolved through interactive voice response (IVR) systems powered by voice recognition. Callers can access information and perform simple tasks like checking their tax refund status or updating their details without needing to speak to an agent. This significantly reduces the overall call volume handled by agents.

- Improved First Call Resolution (FCR) rates: By accurately identifying the caller’s needs and routing the call effectively, voice recognition contributes to higher first call resolution rates. This means more issues are resolved on the first contact, leading to increased customer satisfaction and efficiency.

Studies have shown that implementing voice recognition technology can reduce average call handling times by up to 30%, significantly improving overall call centre efficiency.

Enhanced Agent Productivity

Voice recognition technology isn't just about faster call handling; it's about empowering agents to be more productive and engaged. By automating routine tasks like data entry and call routing, voice recognition frees up agents to focus on more complex and nuanced issues. This shift allows agents to provide a higher level of customer service and handle a larger volume of calls effectively.

- Reduced time spent on manual data entry: Agents spend less time on repetitive data input, resulting in more time available for customer interaction and problem-solving.

- Focus on higher-value tasks, leading to better customer service: With automated tasks handled by the system, agents can dedicate their attention to resolving complex tax queries, providing in-depth explanations, and offering tailored advice.

- Improved agent morale through reduced call volume and stress: By streamlining the call handling process, voice recognition technology helps reduce stress and improve the overall working experience for agents. This contributes to better job satisfaction and retention rates.

- Increased capacity to handle a larger volume of calls: With increased efficiency and reduced call handling times, agents can handle a larger call volume without sacrificing the quality of service provided.

The increased agent productivity translates to significant cost savings for HMRC by optimising staffing levels and improving overall operational efficiency.

Improved Accuracy and Reduced Errors

Human error is inevitable, but voice recognition technology significantly minimizes the risk of mistakes during data entry and information processing. Accurate data capture is crucial for compliance and efficient tax processing.

- Minimized transcription errors: Voice recognition systems offer high levels of accuracy in transcribing spoken information, reducing the potential for errors compared to manual note-taking.

- Accurate data capture for faster processing: Accurate data from the beginning ensures smoother processing of taxpayer information, speeding up tax assessments and refunds.

- Improved data quality for better reporting and analysis: Accurate data leads to more reliable reporting and better informed decision-making within HMRC.

- Reduced risk of compliance issues due to inaccurate information: High-accuracy data entry helps reduce compliance risks and potential penalties associated with data errors.

The benefits of improved data accuracy extend to cost savings through reduced administrative errors and a lower risk of penalties due to compliance failures.

Enhanced Customer Experience

The ultimate benefit of implementing voice recognition technology is the enhanced customer experience it provides taxpayers. Faster resolution times, efficient service, and accurate information contribute to a more positive interaction with HMRC.

- Shorter wait times: Intelligent call routing and automated services reduce waiting times, ensuring taxpayers get through to an agent or the information they need more quickly.

- More efficient problem resolution: Accurate data capture and efficient call routing contribute to more efficient problem-solving.

- Improved overall satisfaction with HMRC services: Faster service, accurate information, and efficient problem-solving contribute to a significant improvement in overall taxpayer satisfaction.

- Potential for 24/7 availability of services: Voice recognition technology can enable 24/7 access to basic tax information and services, improving accessibility for taxpayers.

A better taxpayer experience translates to increased trust and confidence in HMRC services.

Conclusion

Investing in advanced voice recognition technology offers a multifaceted approach to modernising HMRC call centres. The key benefits include improved efficiency, increased agent productivity, enhanced accuracy in data handling, and a significantly better customer experience. This technology delivers positive outcomes for both HMRC staff and taxpayers alike, streamlining operations and improving service delivery. Investing in advanced voice recognition technology is a crucial step towards modernizing HMRC call centres and optimizing operational efficiency. Learn more about how voice recognition technology can transform your call centre operations and improve customer service.

Featured Posts

-

Prima Nepoata A Lui Michael Schumacher S A Nascut

May 20, 2025

Prima Nepoata A Lui Michael Schumacher S A Nascut

May 20, 2025 -

Nyt Mini Crossword Solutions May 9

May 20, 2025

Nyt Mini Crossword Solutions May 9

May 20, 2025 -

Michael Schumacher Pogled Na Zivot Njegove Kceri Gina Marie

May 20, 2025

Michael Schumacher Pogled Na Zivot Njegove Kceri Gina Marie

May 20, 2025 -

Agatha Christies Poirot A Comprehensive Guide To The Master Detective

May 20, 2025

Agatha Christies Poirot A Comprehensive Guide To The Master Detective

May 20, 2025 -

L Intelligence Artificielle Au Service De L Ecriture La Methode Agatha Christie

May 20, 2025

L Intelligence Artificielle Au Service De L Ecriture La Methode Agatha Christie

May 20, 2025

Latest Posts

-

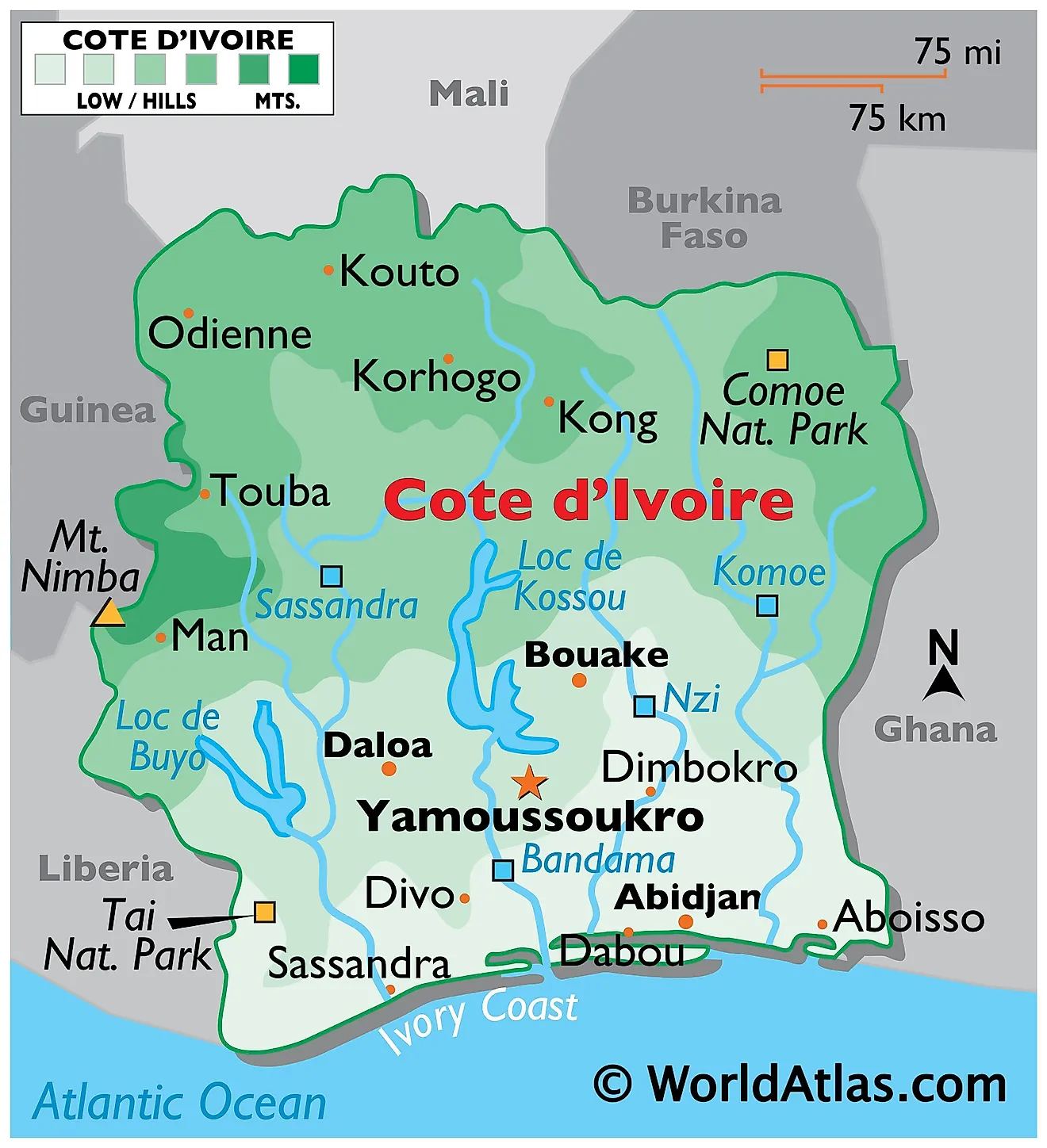

Focus Sur Le Mass Le Marche Africain Des Solutions Spatiales A Abidjan

May 20, 2025

Focus Sur Le Mass Le Marche Africain Des Solutions Spatiales A Abidjan

May 20, 2025 -

Presidence Ghaneenne Visite Officielle De John Dramani Mahama A Abidjan Pour Renforcer La Diplomatie

May 20, 2025

Presidence Ghaneenne Visite Officielle De John Dramani Mahama A Abidjan Pour Renforcer La Diplomatie

May 20, 2025 -

Marche Africain Des Solutions Spatiales Mass Abidjan Ouvre Ses Portes A L Innovation Spatiale

May 20, 2025

Marche Africain Des Solutions Spatiales Mass Abidjan Ouvre Ses Portes A L Innovation Spatiale

May 20, 2025 -

Le Ghana Et La Cote D Ivoire Diplomatie Et Cooperation Au C Ur De La Visite Du President Mahama

May 20, 2025

Le Ghana Et La Cote D Ivoire Diplomatie Et Cooperation Au C Ur De La Visite Du President Mahama

May 20, 2025 -

Premiere Edition Du Marche Africain Des Solutions Spatiales Mass Une Occasion Unique Pour L Innovation Spatiale En Afrique

May 20, 2025

Premiere Edition Du Marche Africain Des Solutions Spatiales Mass Une Occasion Unique Pour L Innovation Spatiale En Afrique

May 20, 2025