Wall Street Bets Assessment: The Aftermath Of Trump's Trade War.

Table of Contents

The Impact of Tariffs on Specific Sectors

Trump's trade war, characterized by significant tariffs on imported goods, heavily impacted various sectors popular among Wall Street Bets (WSB) investors. The resulting market volatility significantly altered investment strategies and portfolio compositions.

- Technology: The tech sector, a significant focus for many WSB users, experienced fluctuating growth as supply chains were disrupted and the cost of imported components increased. This led to price fluctuations in major tech stocks, impacting both long and short positions.

- Retail: Retailers faced increased costs due to tariffs on imported goods, leading to higher prices for consumers and squeezing profit margins. This negatively affected the performance of many retail stocks frequently discussed on WSB.

- Manufacturing: The manufacturing sector was directly targeted by many tariffs, leading to decreased production in some areas and job losses in others. This had a ripple effect throughout the economy, influencing the overall market sentiment and impacting the investment choices of WSB users.

Examples of affected stocks: While pinpointing the sole impact of tariffs on specific stocks is difficult, companies like Apple (AAPL), heavily reliant on global supply chains, and retailers like Target (TGT) and Walmart (WMT), facing increased import costs, clearly illustrate the trade war's effects on WSB portfolios. Market volatility surrounding these stocks reflected the uncertainty and risk associated with the trade war. Tracking these stocks on WSB during this period reveals a clear correlation between tariff announcements and price fluctuations.

Shifting Investment Strategies within Wall Street Bets

The trade war dramatically altered investment strategies within the Wall Street Bets community. The heightened uncertainty forced many to reassess their risk tolerance and diversify their holdings more strategically, though not always effectively.

- Increased Risk Aversion (Initially): The initial impact of the trade war led to increased risk aversion among some WSB members, with a shift towards more conservative investments.

- Short-Selling Opportunities: Others saw opportunities in short-selling stocks of companies heavily impacted by the tariffs, betting against their performance.

- Sector-Specific Focus: The trade war spurred a more sector-specific focus, as investors tried to identify industries that would either benefit or be less affected by the tariffs. This led to concentrated trading in specific sectors.

Pre-trade war WSB trends often favored high-growth, high-risk stocks. Post-trade war, a more nuanced approach emerged, though the community's inherent risk tolerance remained a defining factor, leading to periods of both cautiousness and aggressive shorting and trading in affected sectors.

The Role of Social Media and Information Dissemination

Social media, specifically Reddit's Wall Street Bets subreddit, played a significant role in shaping investment decisions during and after the trade war. The rapid spread of information, both accurate and inaccurate, contributed to market volatility.

- Meme Stocks and Sentiment: The heightened uncertainty fueled the popularity of "meme stocks," where social media sentiment heavily influenced stock prices, irrespective of fundamental analysis.

- Misinformation and Market Manipulation: The decentralized nature of WSB made it susceptible to misinformation and potentially manipulative trading strategies.

- Amplified Volatility: Social media sentiment acted as an amplifier of market fluctuations, causing rapid price swings based on online discussions and speculation.

The interconnectedness of social media and financial markets during the trade war highlighted the need for critical evaluation of information, particularly in high-volatility environments. WSB's role exemplifies the power – and potential peril – of social media in shaping investment trends.

Long-Term Economic Consequences and Future Predictions

The long-term economic consequences of Trump's trade war are still unfolding, but several lingering effects on investor behavior are already apparent. The increased uncertainty created a more volatile and unpredictable market, making long-term forecasting more challenging.

- Supply Chain Disruptions: The trade war's impact on global supply chains continues to affect businesses and investment decisions.

- Inflationary Pressures: Tariffs contributed to inflationary pressures, altering consumer behavior and impacting corporate earnings.

- Geopolitical Uncertainty: The trade war highlighted the interconnectedness of global economies and amplified geopolitical risk.

For Wall Street Bets, this means a continued need for adaptability and a thorough understanding of geopolitical and economic factors. Future predictions point towards a more cautious approach for some investors, while others may continue to exploit opportunities within a dynamic market landscape. The legacy of the trade war is likely to shape investment decisions within the WSB community for years to come.

Assessing the Legacy of Trump's Trade War on Wall Street Bets

This Wall Street Bets assessment has highlighted the significant impact of Trump's trade war on investment strategies within the WSB community. The analysis showed the effects of tariffs on specific sectors, the shift in investment strategies, the amplification of market volatility through social media, and the long-term economic consequences. The trade war created a period of heightened uncertainty, forcing WSB members to adapt their strategies and engage more critically with information. The legacy of this period will continue to shape the behaviors and decisions of investors within this dynamic online community.

Share your Wall Street Bets assessment of the Trump trade war's lasting effects in the comments below! Let's continue the conversation: What are your predictions for the future of Wall Street Bets in light of the trade war's aftermath?

Featured Posts

-

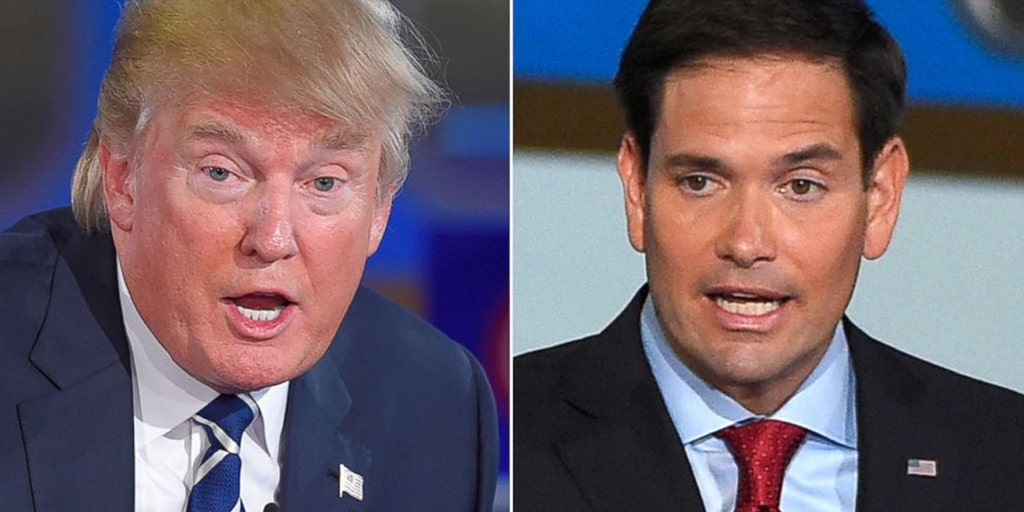

Analyzing Rubios European Envoy Role Under Trump

May 29, 2025

Analyzing Rubios European Envoy Role Under Trump

May 29, 2025 -

Trumps Pardon Attorney Ed Martin Targeting Biden Era Cases

May 29, 2025

Trumps Pardon Attorney Ed Martin Targeting Biden Era Cases

May 29, 2025 -

100 Forintos Erme Felmillios Vagyon A Zsebedben

May 29, 2025

100 Forintos Erme Felmillios Vagyon A Zsebedben

May 29, 2025 -

Support For Queensland Musician Following Pro Palestine Statement

May 29, 2025

Support For Queensland Musician Following Pro Palestine Statement

May 29, 2025 -

Polscy Prokuratorzy Pod Presja Blamaz W Polsce24

May 29, 2025

Polscy Prokuratorzy Pod Presja Blamaz W Polsce24

May 29, 2025

Latest Posts

-

The History And Folklore Of Rosemary And Thyme

May 31, 2025

The History And Folklore Of Rosemary And Thyme

May 31, 2025 -

Rosemary And Thyme Your Guide To Cultivating These Powerful Herbs

May 31, 2025

Rosemary And Thyme Your Guide To Cultivating These Powerful Herbs

May 31, 2025 -

A Guide To Combining Rosemary And Thyme For Maximum Flavor

May 31, 2025

A Guide To Combining Rosemary And Thyme For Maximum Flavor

May 31, 2025 -

Exploring The Differences Between Rosemary And Thyme Flavor Profiles And Uses

May 31, 2025

Exploring The Differences Between Rosemary And Thyme Flavor Profiles And Uses

May 31, 2025 -

Rosemary And Thyme Recipes Simple Dishes With Big Flavor

May 31, 2025

Rosemary And Thyme Recipes Simple Dishes With Big Flavor

May 31, 2025